Greenback remains strong despite debt deal

FX markets have seen little impact over the weekend despite hopes for a deal on the US debt ceiling.

US president Joe Biden and Republican House of Representatives leader Kevin McCarthy reached an in-principle deal on Friday but the agreement still needs approval from Congress.

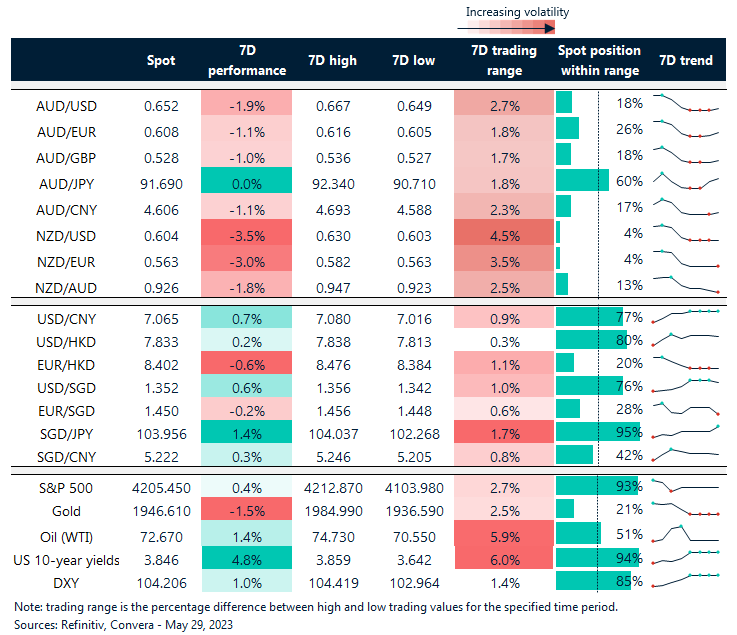

While US equity markets gained on Friday – the S&P 500 climbed 1.3% while the tech-focused Nasdaq jumped 2.6% – FX markets were more cautious.

The US dollar index remains steady near two-month highs as US bond yields pressed higher.

The AUD/USD climbed 0.2% while the NZD/USD fell 0.2%.

The kiwi continued to fall following the aftershocks from last week’s Reserve Bank of New Zealand decision, which signaled a potential end in the RBNZ’s rate hiking cycle.

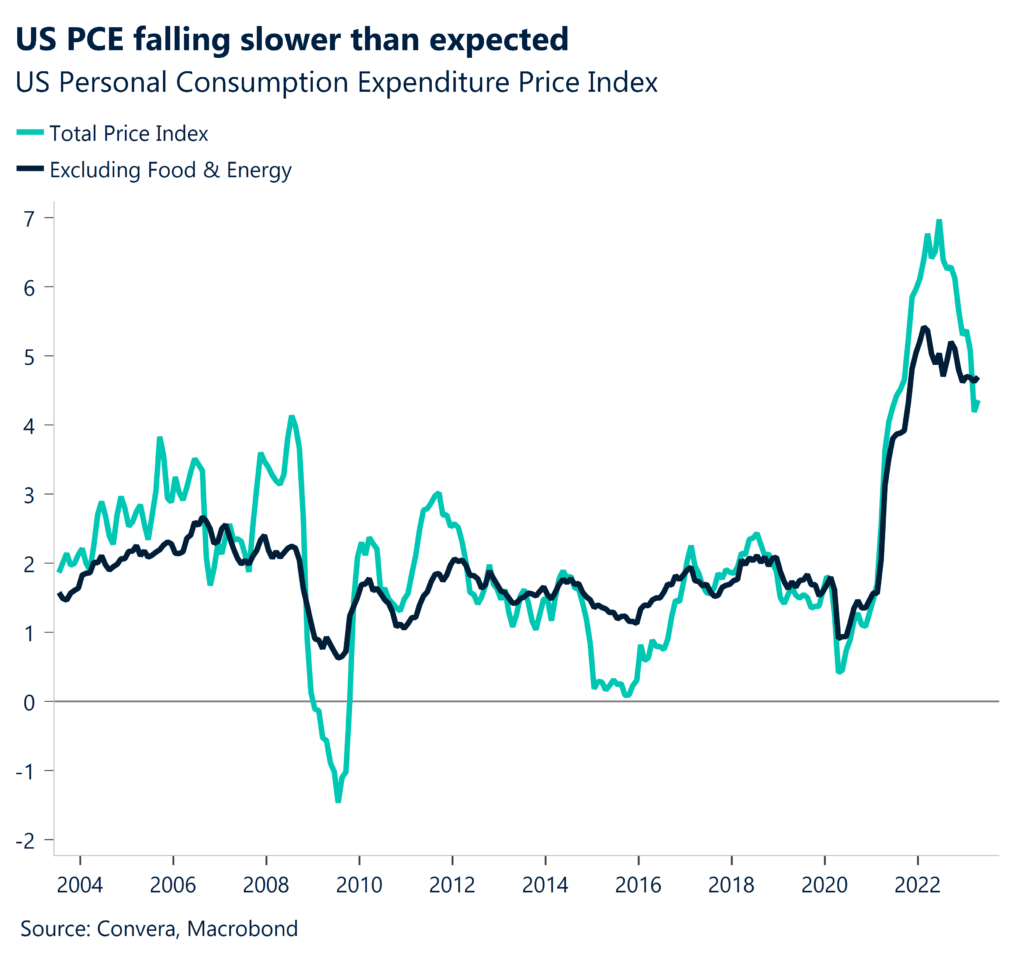

PCE drives Fed fears

Instead, FX markets are growing more nervous about another potential rate hike from the US Federal Reserve when it next meets on 15 June.

On Friday, US personal consumption and expenditure inflation came in at a higher-than-expected annualised core rate of 4.7%.

The inflation news saw expectations for a Fed rate hike grow – financial market pricing now sees a 70% chance for a 25-basis point hike at the Fed’s next meeting.

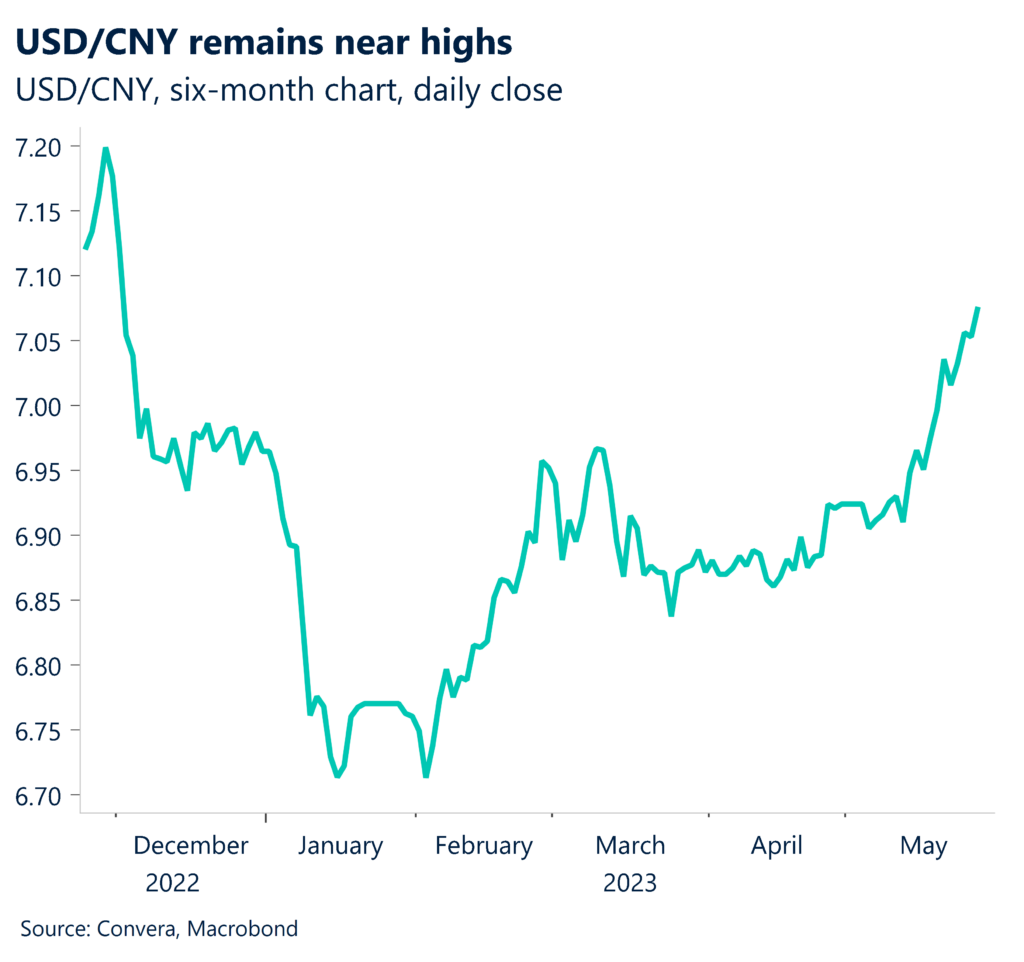

Chinese yuan weak ahead of key data

The US dollar eased lower in Asia on Friday, but key pairs remain near recent highs.

The USD/CNH fell from 2023 highs, down 0.3%, while the USD/SGD dropped 0.2%.

The Chinese yuan could see more volatility with key manufacturing data due on both Tuesday and Thursday this week.

Later in the week, the US non-farm payrolls will be the major release ahead of next month’s US Federal Reserve meeting.

USD remains elevated despite debt deal hopes

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 29 May – 2 June

All times AEST

Have a question?[email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.