US shares boosted by debt deal, jobs report

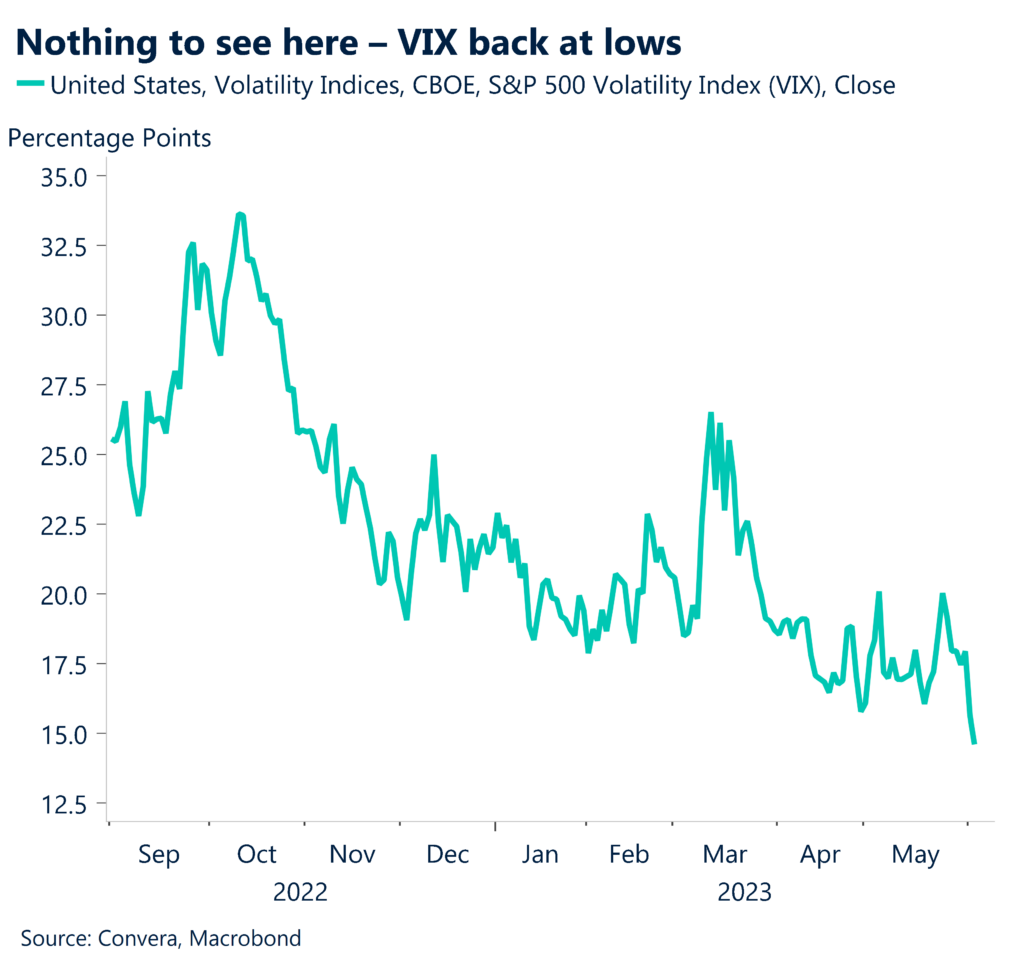

Financial markets closed strongly last week with investors reacting to news the US Senate had passed the deal that ends the US debt ceiling crisis – for now.

The US’s Dow Jones index gained 2.1% in its best one-day gain since January.

US shares were also boosted by a stronger than expected jobs report. The May non-farm employment report found 339k jobs were added to the US labour market, well above the 193k forecasts, and the best reading since the January report.

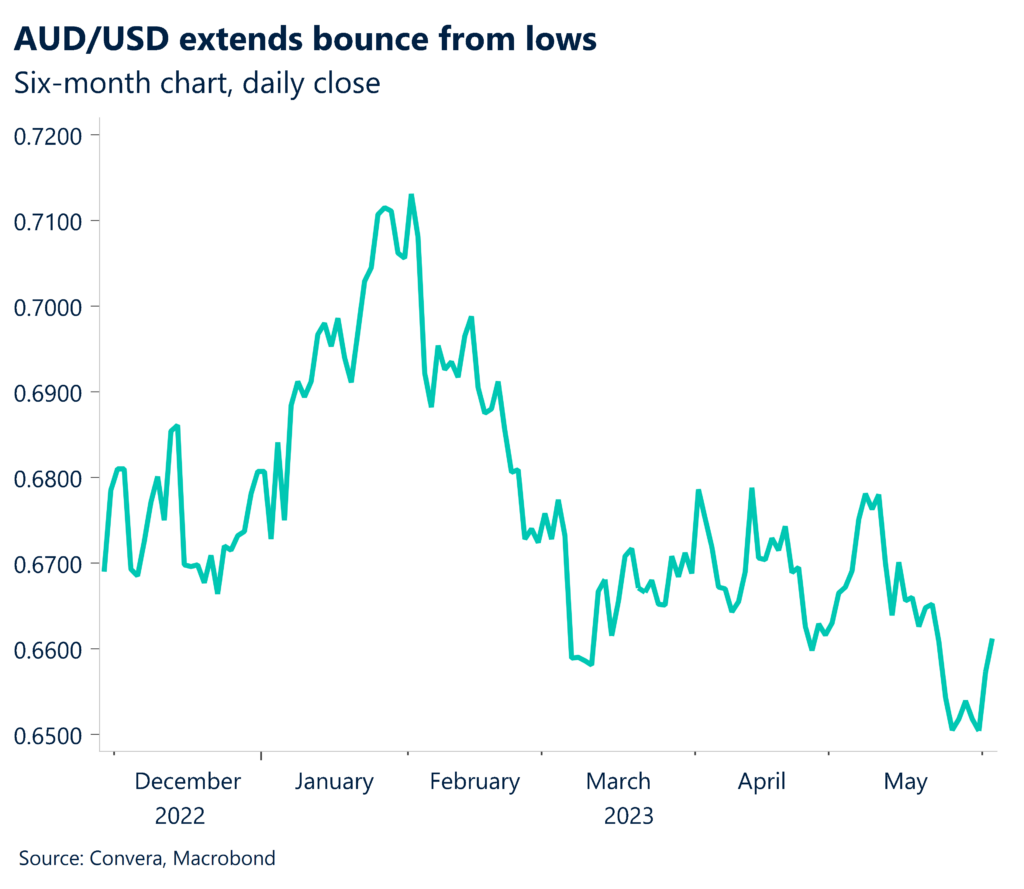

Aussie at two-week highs

The Australian dollar was the clear outperformer as it benefited in line with global equity markets.

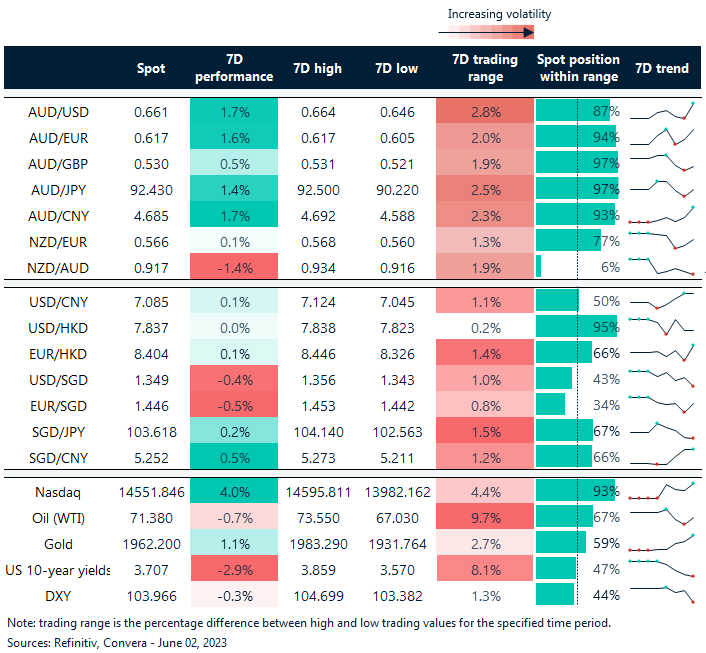

The AUD/USD gained 0.6%.

The US dollar was stronger in other markets, however.

The NZ dollar was weaker with the NZD/USD down 0.1%.

The USD/SGD and USD/CNH gained 0.1%.

China data watched as manufacturing marks global recession

The main focus this week is the all-important Reserve Bank of Australia decision due on Tuesday.

Australian March-quarter GDP is due on Wednesday.

From China, the Caixin services PMI is due today.

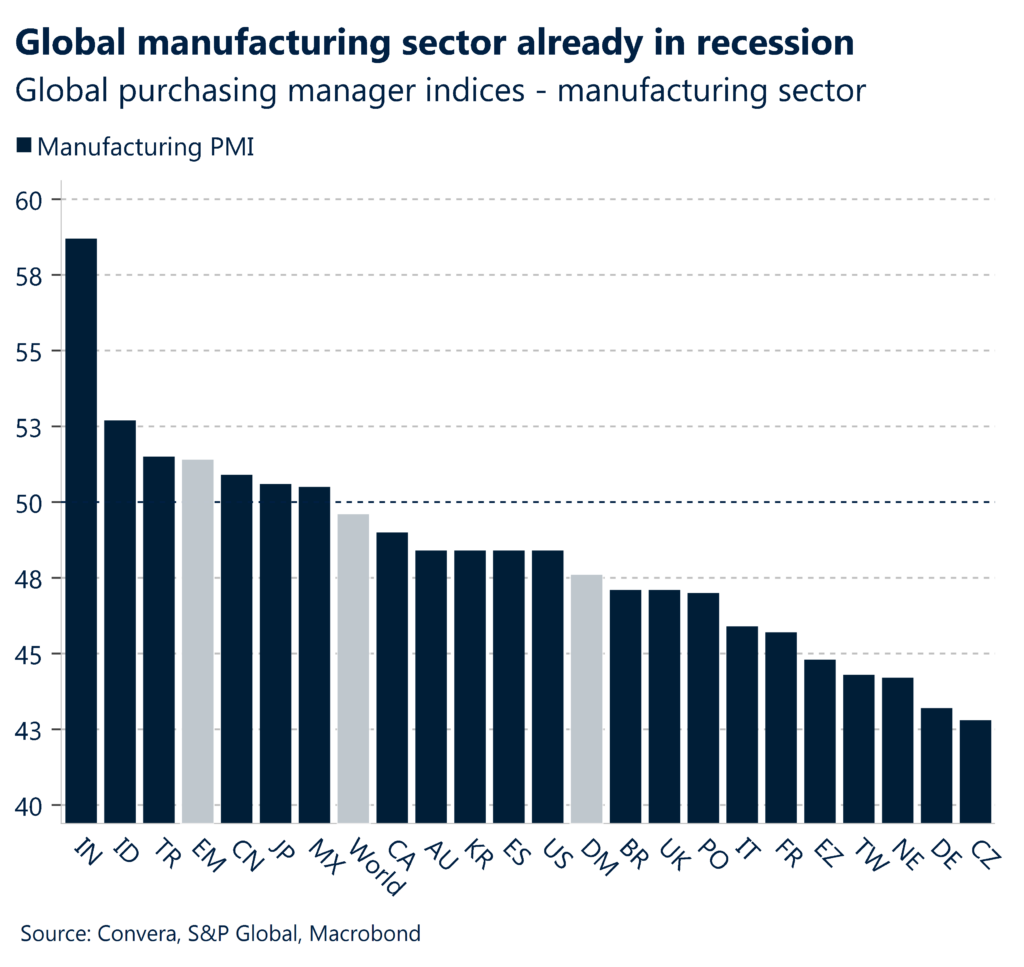

Last week’s manufacturing PMI from China showed a further slowdown and, globally, the manufacturing sector has now fallen into recession.

On Wednesday, Chinese trade numbers will also be key, also likely to be impacted by the global manufacturing slowdown.

Aussie outperforms ahead of RBA

Table: seven-day rolling currency trends and trading ranges

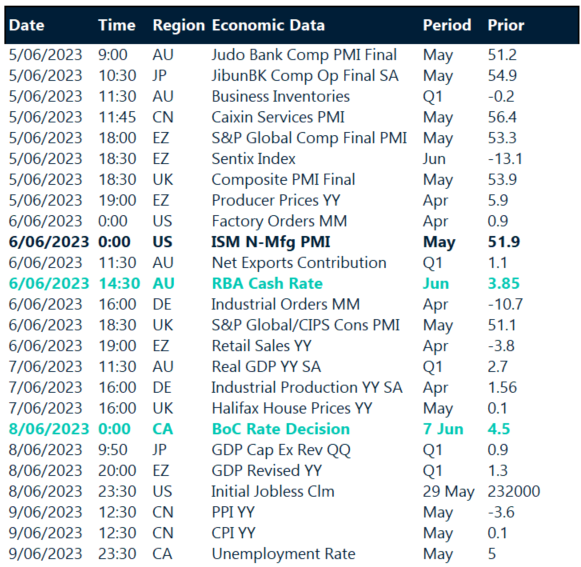

Key global risk events

Calendar: 5 – 9 June

All times AEST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.