Written by Convera’s Market Insights team

Euro slips on a political deadlock

Ruta Prieskienyte – Lead FX Strategist

The euro slipped to as low as $1.080 in early Asia hours before recouping some losses, weighed down by a potential political deadlock in France after exit polls suggested that no party will likely win a clear majority in the parliamentary elections. The leftist alliance is projected to win up to 198 seats, Macron’s centrists will likely win up to 169 seats and Marine Le Pen’s far-right National Rally is set to come in third with up to 143 seats. The results raised concerns about further political uncertainty and market volatility, while the prospect of a left-wing government will trigger fiscal risks.

The surprise result came just as the euro had its best weekly performance since mid-November. The broad-based Euro index, which tracks the euro’s performance against a basket of leading global currencies, clocked an impressive gain of 0.6%, primarily driven by the unwinding of safe-haven demand, with significant gains reported against the yen and the Swiss franc. A series of disappointing economic data releases in the US resulted in narrowing spreads in the front-end of the DE-US benchmark sovereign bond yield curve to a three-week low, thus handing the euro its best weekly performance against the Greenback thus far in 2024. Going forward, EUR/USD is likely to be more influenced by UST-Bund spreads once again. With several GC members implicitly endorsing the current ECB money market pricing (40bps), these expectations are likely to remain stable throughout upcoming weeks, with a potential for additional easing priced in for September. This suggests that the Fed’s actions will be a major driver for EUR/USD.

This week’s domestic calendar looks sparce with the most notable data release being the final German CPI print due on Thursday, which is unlikely to be market moving. Consequentially the US centric developments and will continue to dictate the short term directional and volatility trends in EUR/USD. Meanwhile, French induced political uncertainty will remain elevated for some time, which could weigh on the Eurozone’s soft economic data that had shown signs of improvement.

Dollar awaits Powell, CPI

Boris Kovacevic – Global Macro Strategist

A relatively strong job report did little to nothing to dispel the mounting signs that the world’s largest economy is starting to weaken. A string of disappointing macro data over the past two weeks has put the US exceptionalism thesis to the test. The services PMI unexpectedly contracted in June with the subcomponents for employment, new orders and production falling into negative territory. The number of Americans claiming unemployment benefits has been on the rise since May and job openings have been on the decline for two years now.

Hiring remains robust, looking at the non-farm payrolls report from the Bureau of Labor Statistics published on Friday. Job growth came in at 206k in June, slightly above the 190k – 200k print expected by economists. However, the 2023 average of 222k falls short of the previous two years (251k, 377k) and the unemployment rate has already risen from its pandemic low at 3.5% to 4.1% last month. Long-term unemployment picked up from 0.8% to 0.9% as well and is at the highest level since the beginning of 2022.

The totality of data continues to support the Fed’s easing bias and points to a high likelihood of the first rate cut occurring in September. Markets currently price in five rate cuts over the course of the next nine FOMC meetings with two of them happening this year. This is subject to the incoming data, that continues to display a large disconnect between the hard (lagging) and soft (leading) data. The next release of interest will come in the form of the US CPI report published on Thursday, which will follow a two-day congressional testimony from FOMC Chair Powell. A potentially benign July print (0.1% expected m/m) could be seen as risk positive.

US equities advanced to record highs last week, unfazed by political developments and supported by falling yields. The S&P 500 index is approaching the $5600 mark after having risen in 9 out of the last 11 weeks and is now up 17% in 2024. The 2-year Treasury yield fell to 4.6%, setting a 3-month low. This led to the US Dollar Index falling by the most in nine weeks and erasing its gains from the previous three weeks.

BoE back in focus for pound

George Vessey – Lead FX Strategist

Now that the dust has settled after the UK election, attention pivots back to monetary policy as Bank of England (BoE) policymakers will start hitting the wires again, providing us with more guidance on the rates outlook. Our view remains that the first cut will come in August, and will be followed by potentially two more in 2024, which could keep the pound pinned under $1.30 versus the US dollar for longer.

Labour’s victory was expected, as was the muted market reaction last week, but the long-term trajectory for sterling could be favourable if closer trade relations with the EU are established, thereby reducing the currency’s Brexit premium (GBP/USD is still down 15% from when the UK voted to leave the EU). But the hard-right Reform UK’s success could arguably curb the enthusiasm around this narrative. In the short-term though, the interest rate story will ultimately determine the direction of the pound and this depends largely on inflation and wage growth data. This week though, figures from the ONS are expected to show a 0.2% GDP growth in May, and manufacturing production is set to increase following a 1.4% drop, the largest since 2020. The UK’s trade deficit in goods is anticipated to shrink from a 22-month high.

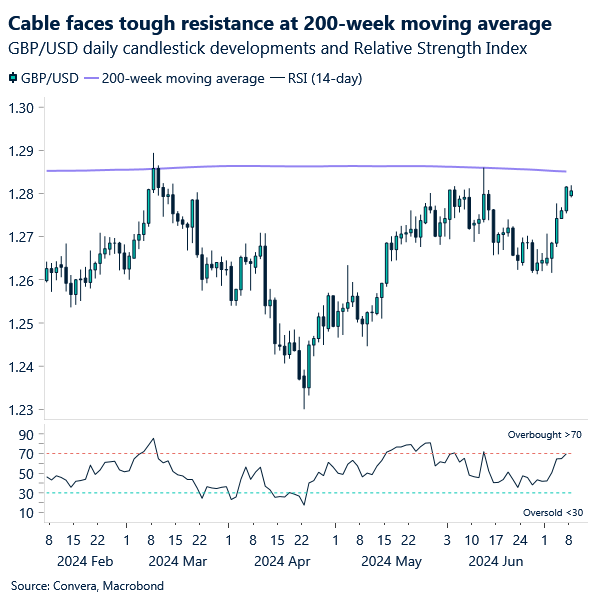

From a technical perspective, GBP/USD will have to break north of its 200-week moving average, located at $1.2848, if it’s to have a better chance of breaking above $1.30 – a key level it’s been below for 251 consecutive days. GBP/EUR remains atop €1.18, and given the ongoing political uncertainties in Europe, a stretch towards €1.19 again could be on the cards this week.

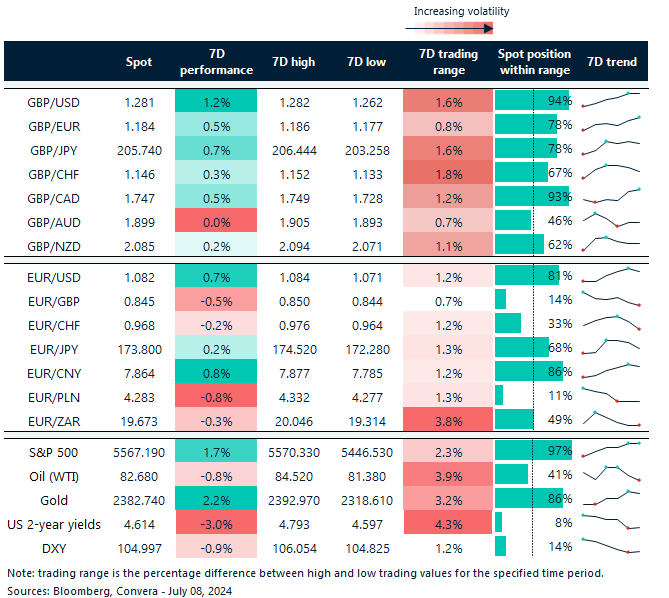

Dollar rocked by falling yields

Table: 7-day currency trends and trading ranges

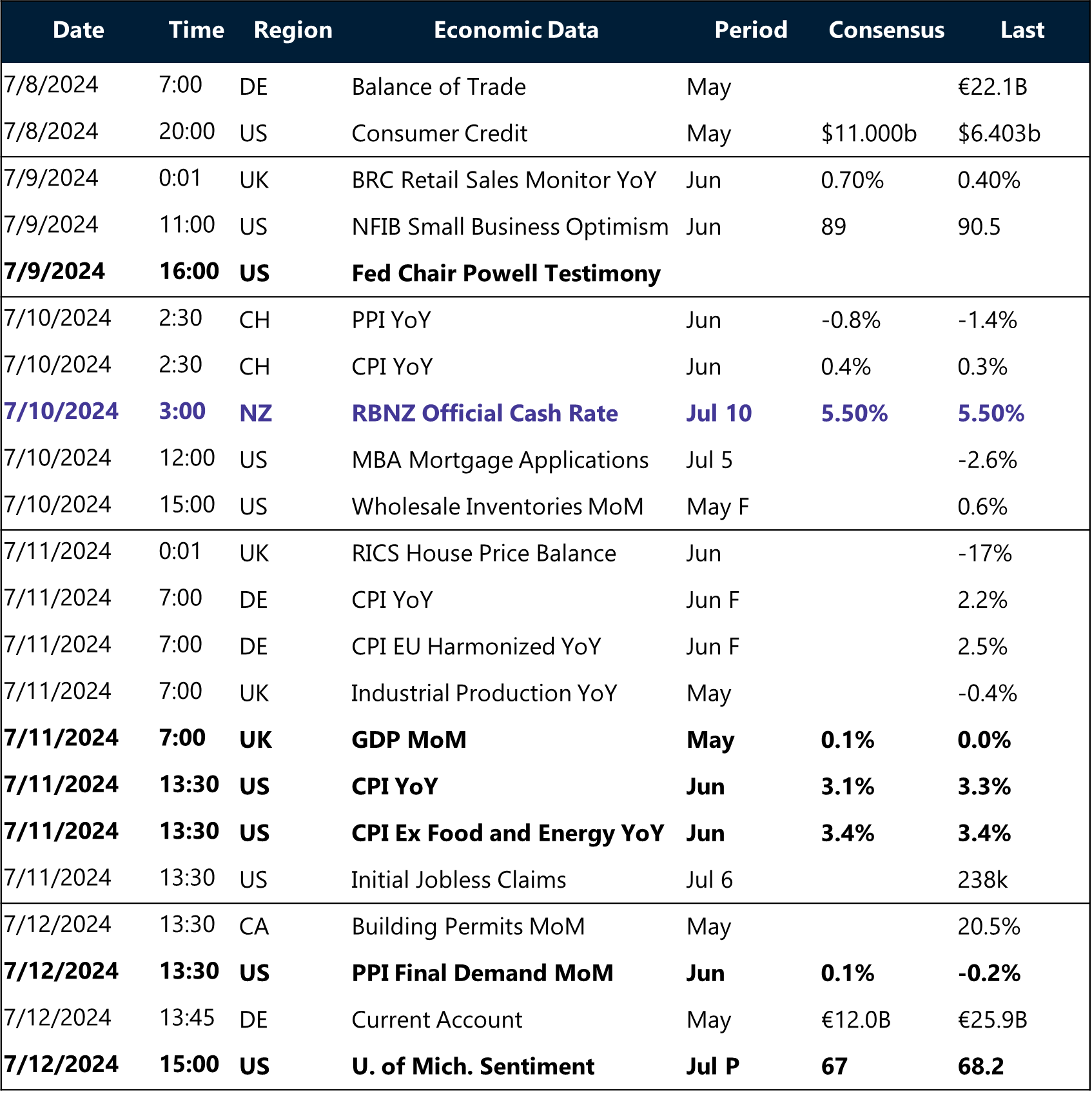

Key global risk events

Calendar: July 08-12

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.