Written by Convera’s Market Insights team

US debt auctions matter again

Boris Kovacevic – Global Macro Strategist

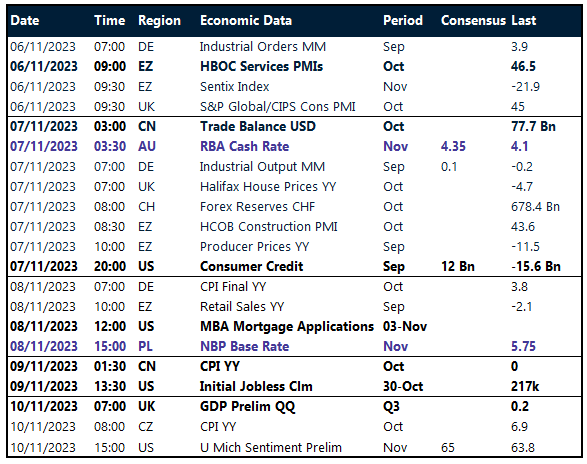

Two weeks full of interest rate decisions and a plethora of top tier macro data out of the US, UK and Eurozone has left us with few economic releases to look forward to this week. The US macro front has therefore been quiet and will remain so for the rest of the week. With yesterday’s non-market moving speech from Jerome Powell out of the way, investors continued their capital rotation into bonds and stocks. The S&P500 recorded its longest daily winning streak (7) in two years with the US 10-year falling to a six-week low below 4.5%. Market driving events remain centered around Asia and Europe. However, the Treasury auction on Thursday will be carefully watched as the fixed income space continues to be the biggest theme shaping the broader market narrative.

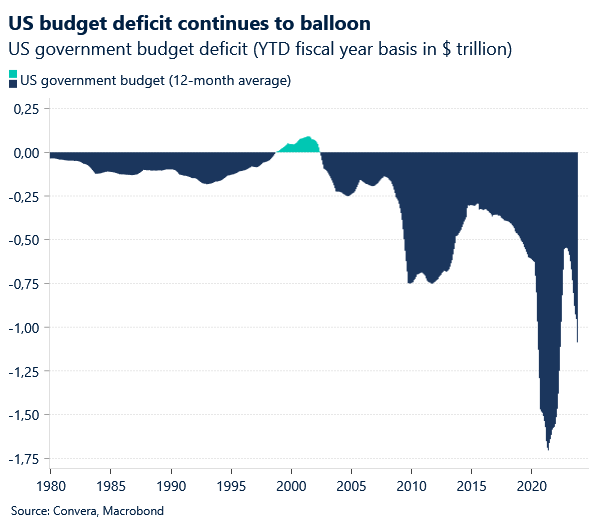

Investors have mostly priced out any remaining bets of the Federal Reserve raising interest rates much further and are currently expecting rate cuts worth 100 basis points for 2024. However, the recent fall in government bond yields and easing of financial conditions could be seen as unwarranted and unwelcomed by the Fed, effectively increasing the risk of another surprise hike. Investors will continue to keep an eye on yields. In this context, the US Treasury’s $24 billion auction sale of 30-year debt on Thursday will most likely be the highlight of the week as the government’s annualized interest payments on debt rose past the $1 trillion mark.

Days with Treasury auctions have been exceptionally volatile since 2022 with price swings of US equities averaging around one percent. The US dollar (DXY) has defined its short-term one-month range between 104.80 and 107.40 (2.4%) and is currently trading mostly sideways. The S&P 500 index has risen by around 6.8% since its October low and is now 5% away from its all-time high. Tensions in APAC-FX remain high as both USD/JPY and USD/CNY remain near intervention levels at 151.00¥ and 7.28¥ respectively.

Bailey’s efforts to rescue Sterling fall short

Ruta Prieskienyte – FX Strategist

The pound has endured three consecutive days of losses against the US dollar, falling to a fresh weekly low of $1.2241 yesterday as market sentiment soured. Part of the move has been a result of the US dollar bouncing back after recent losses, but sterling was also a touch softer against the euro, closing the day down by 0.2% and falling to an 8-day low as conflicting Bank of England (BoE) forward guidance left the pound vulnerable.

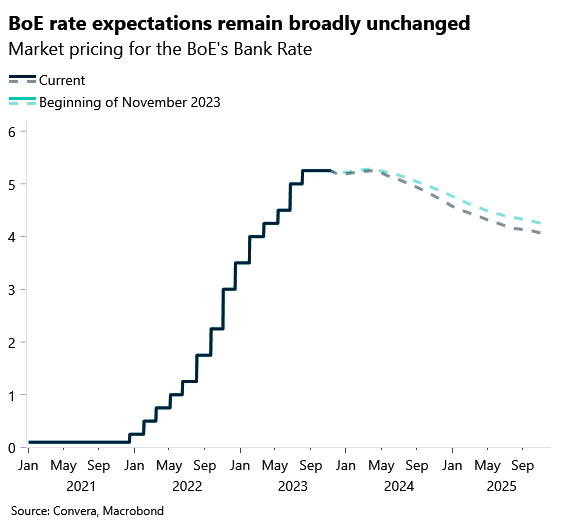

During a speech on Wednesday BoE’s Governor Andrew Bailey rejected remarks made by the chief Economist Huw Pill earlier this week, who said “interest rate cuts could come around the middle of 2024”, insisting it is too early to talk about interest rate cuts. The contradicting messaging did little to change market expectations though as traders fully price in a rate cut by the August meeting, which looks rather modest compared to the over 50bps priced in for the Fed and the ECB at this point. Also in the mix was an industry survey that showed pay growth slowed in October and rising redundancies led to an increase in the number of job-seekers. Wage growth is one of the BoE’s considerations when assessing the stickiness of inflation in Britain, and its rate policy. Going forward, the BoE’s Monetary Policy Committee will be placing more weight than usual on the report on jobs survey, following the temporary suspension of the Labour Force Survey due to low response rate causing data reliability issues. An overall softness in the market could back up the dovish narrative on BOE rates.

Overall, pound enters the final stretch of the week on a weak footing. The 50-day moving average at about $1.2280 appears to be acting as a moderate support for the pound in the immediate term, but with tomorrow’s GDP data expected to show third quarter growth marginally negative, there might be room for further dovish repricing in BoE expectations and further pound weakness.

Euro in wait-and-see mode

Ruta Prieskienyte – FX Strategist

The euro held its ground against the US dollar, closing the day above $1.07 for the third time this month and trading close to two-month highs. EUR/CAD hit a fresh 2-month high as the sell-off in the oil markets continued amid demand worries. Given a quiet calendar from a domestic perspective, the common currency remains in a guarded position, awaiting US jobs data later today.

German’s final CPI print for October released yesterday confirmed inflation fell to the lowest level in over 2 years at 3.8% y/y, matching the initial estimate and consensus. Inflation in services dipped a tick to 4.6% y/y, pointing to a persistent stickiness in domestic non-tradable inflation sectors. Having said that, most of the decline was due to base effects in energy, which are about to flip. To further complicate matters, median consumer expectations for Eurozone inflation over the next 12 months increased sharply to 4.0% in September, reaching the highest level since April as revealed by data released by the ECB Consumer Expectations Survey. Simultaneously, expectations for inflation three years ahead remained unchanged at 2.5%. This supports ECB’s Nagel call warning that difficulty may still be ahead as it could take much longer to get from 3% to 2%, than to get to the current level from over 10%.

While ECB policymakers continue to push back against rate cut expectations, markets remain unconvinced, pricing in 92bps of cumulative cuts for 2024 as evidence of an economic slowdown mounts. September’s Eurozone retail sales registered a third straight monthly decline, and sunk to -2.9% y/y as households’ real incomes continue to be squeezed and consumer demand remains subdued.

Oil prices plunge 6% in a week

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: November 06-10

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.