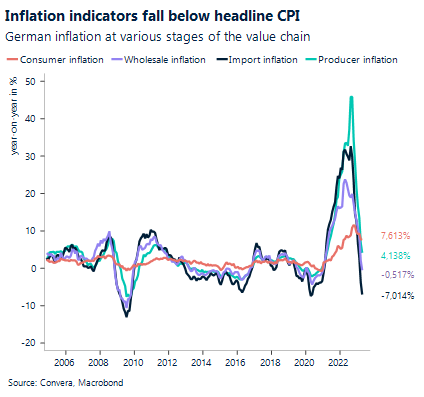

Disinflation is coming to Europe

The first day of a holiday shortened week began with some encouraging news out of Spain, where inflation has fallen to the lowest level in almost two years in May. Consumer prices increased by only 2.9% during the last twelve months, less than in the previous month and what economists had expected. This downside surprise has been followed by Italian producer prices falling 3.5% on the year, cementing the narrative, that the disinflationary forces are starting to play out.

The overall price trend in recent weeks has been one of falling prices. However, core inflation rates across the developed world continue to be elevated and with around 80% of countries globally still struggling with inflation above 4% – 44% with inflation above 8% – central banks will be cautious about turning dovish too soon. We do expect lower headline inflation to impact core rates with a lag, but getting back to target will take some time. Central banks have accepted that monetary policy works with long and varies lags. Given the ECB’s statement, that most of the impact of tighter monetary policy on the real economy will only be felt in 2024, policymakers will become more cautious in continuing to raise interest rates.

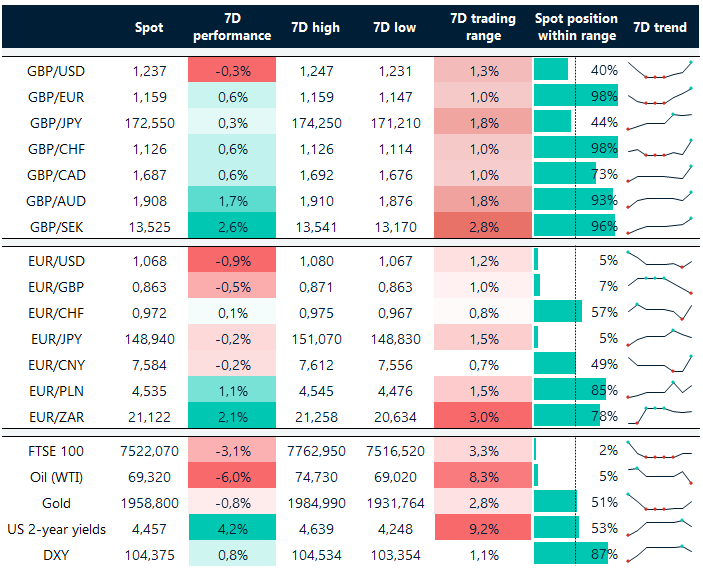

Especially against the backdrop of weaker lending standards. Total deposit outflows in the Eurozone fell in seven out of the last eight months. Bank lending to households grew just 2.5% year-on-year, marking the slowest extension of credit to consumers since 2017. While the ECB is expected to raise interest rates in June and July, it will become increasingly harder to justify tightening policy in an environment of weakening credit growth and falling inflation rates. Investors took notice and pushed GBP/EUR up for the fourth day in a row. The currency pair is trading at around €1.1580 and is on track to record the seventh consecutive weekly appreciation.

US yields tumble after 12-day streak

A series of disappointing macro data out of the Eurozone had dragged the Euro to 2-month lows at the beginning of this week. The common currency caught a breather in yesterday’s session, even against the background of drastically falling inflation expectations in Europe. As has been common in recent weeks, US events turned out more market moving, overshadowing European data releases.

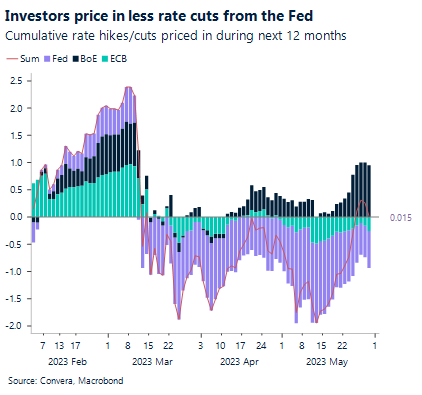

The yield on short-dated two-year US government bonds fell in yesterday’s trading, after interest rates had risen twelve days in a row. The prospect of the agreed US debt limit extension passing the house and congress forced investors to price out some of the short-term political risks, that had been putting upward pressure on yields. Market participants and speculators took that opportunity to take some profits on the recent dollar rally as well, which saw the US Dollar Index rise by 3.7% since April.

Yesterday’s drawback might lack meaningful strength in the short-term as sticky inflation and continued US data surprises are putting pressure on the Federal Reserve to raise interest rates in June as well. Markets now see a two in three chance of a 25 basis point hike by US policy makers in two weeks. These speculations will be put to the test on Thursday and Friday with the release of the US purchasing manager index for the manufacturing sector and labor market report. With the deteriorating sentiment and global business cycle, the Euro has lost one of its main driving forces. EUR/USD could still rally into the second half of the year if market bets on Fed rate cuts start picking up again. But for that to happen, the US economy would have to continue weakening from here on. The currency pair already came under some pressure this morning with French consumer prices falling more than expected, putting the spotlight on German (today) and Eurozone (tomorrow) inflation again.

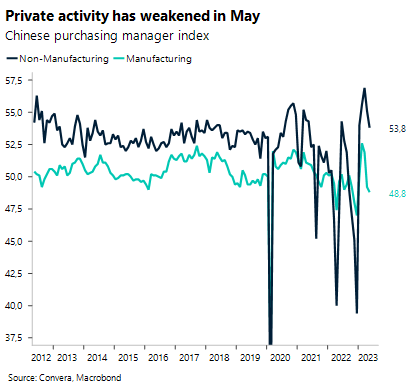

Chinese data pressures global equities

Europe has not been the only region facing global and regional headwinds. Economic data out of China has spurred growth concerns, after the long awaited reopening of the world’s second largest economy disappointed expectations. The countries manufacturing sector continued to weaken in May, according to the official purchasing manager index, which fell to 48.8. As was the case with the PMI’s for the Eurozone and US, the Chinese services sector remains robust and well above the important 50 mark, indicating a monthly expansion.

Financial markets in Asia have reacted negatively to the data disappointments and have underperformed European and US peers. The Chinese Hang Seng stock index is already down around 20% since its yearly high reached at the end of January. The Chinese yuan has been affected by the uncertainties surrounding the economic recovery as well. USD/CNY is trading above the important ¥7.00 mark, after the currency pair rose by 3.4% in just seven weeks.

Global equity benchmarks are beginning the day on weaker footing following the Chinese and European data disappointments. Today, focus will shift to German inflation numbers, which will set the tone for the broader Eurozone consumer prices released tomorrow.

GBP/EUR trending higher on weak Eurozone data

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: May 29- June 02

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.