Written by Steven Dooley and Shier Lee Lim

Market-wide rally continues

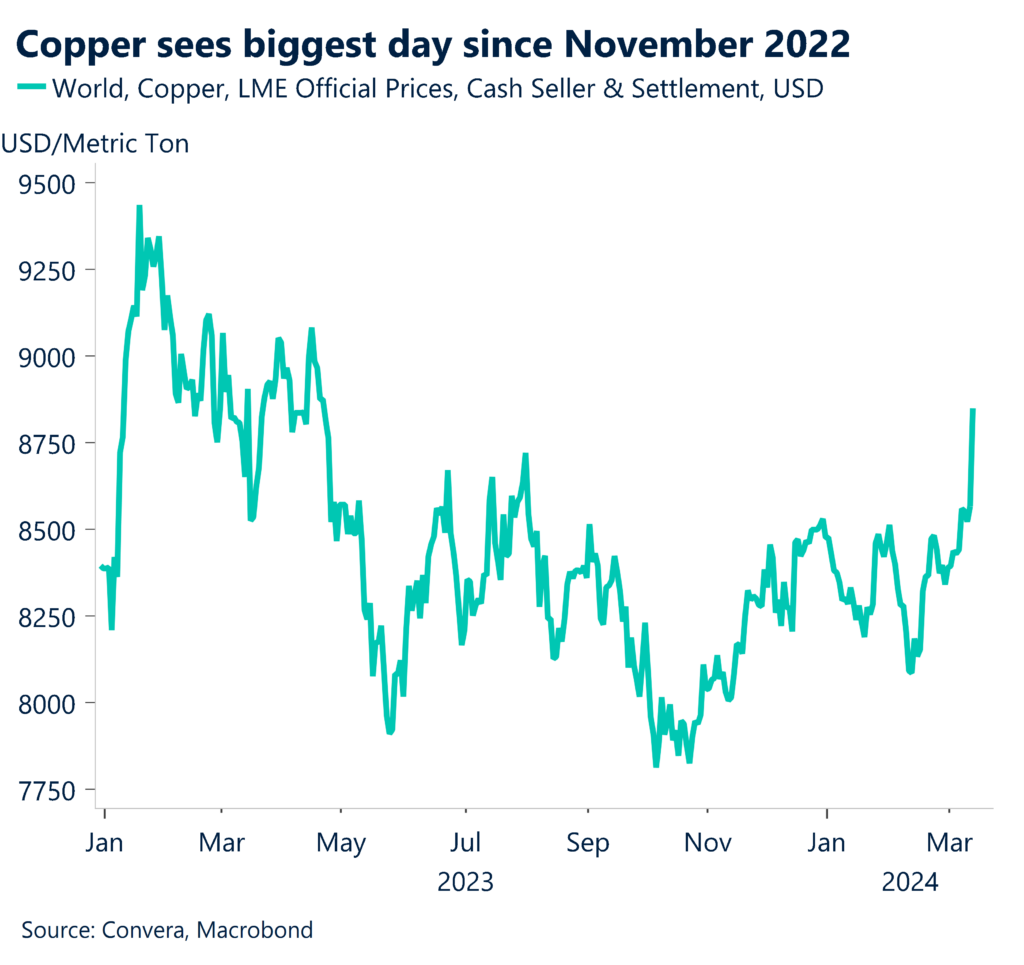

Copper – supposedly the only metal with a PhD in Economics – led the charge overnight as hopes for lower interest rates continued to drive assets as diverse as US shares, gold and Bitcoin higher.

The US’s Dow Jones climbed 0.1% as it neared all-time highs while gold gained 0.8% and silver jumped 3.6%. Bitcoin gained 3.2% as it also neared all-time highs. (Other US sharemarket indexes eased, however.)

Copper, traditionally seen as sensitive to the economic cycle due to its use in a wide range of applications, jumped 3.3% in its best day since November 2022.

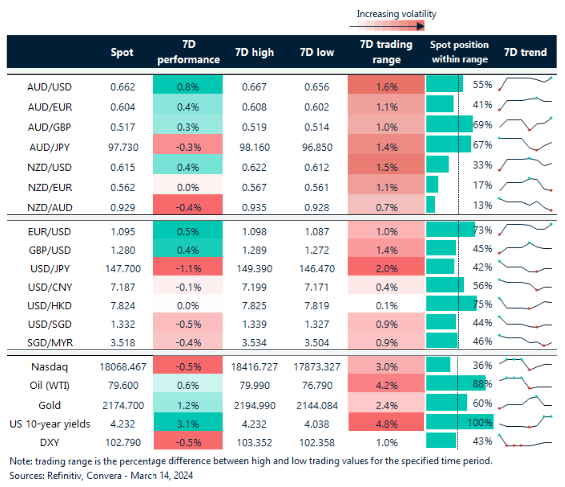

In FX markets, the USD eased lower. The Aussie and the euro were the best performers. The AUD/USD and EUR/USD both gained 0.2%.

US jobless claims due

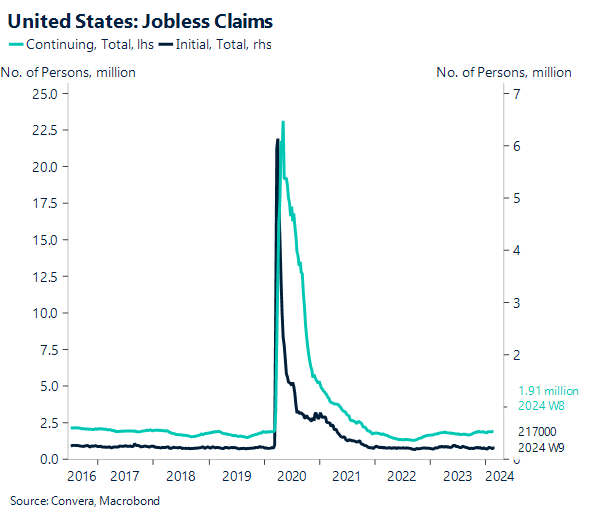

For the US dollar, the next big event is tonight’s US jobless claims.

While ongoing claims increased gradually last week, initial claims were sideways with positive adjustments for both.

This week’s claims statistics showed a notable geographical variance, and new data may provide further light on the same. We anticipate that claims will progressively rise in the upcoming months from their current lows as the labour market gradually moderates.

March has seen the dollar crawl into the month after giving up over half of its YTD gains against the G10 since mid-February.

UK housing in focus

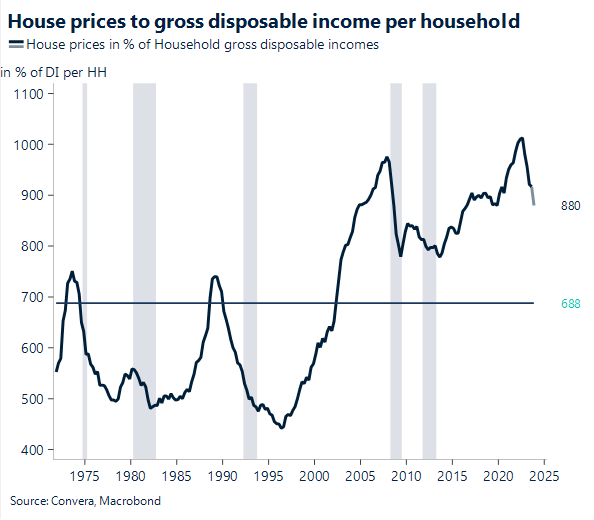

Also due today, UK house prices. The price balance of this poll increased to -18 in January, which is still negative but significantly different from the -60 it was publishing only three months prior, indicating that the UK housing market is still recovering.

The balances tracking activity, including stocks, sales, agreed-upon sales, predicted sales, directions to sell, and inquiries from potential buyers, are improving in addition to the price balance. In the upcoming months, the housing market may continue to be supported by reduced mortgage rates, a strong labour market, and a strengthening economy.

The UK entered a technical recession in H2-23, as was confirmed this month, while growth surveys with a longer time horizon, like PMIs, have shown greater resilience.

Euro, Aussie benefit most from USD weakness

Table: seven-day rolling currency trends and trading ranges

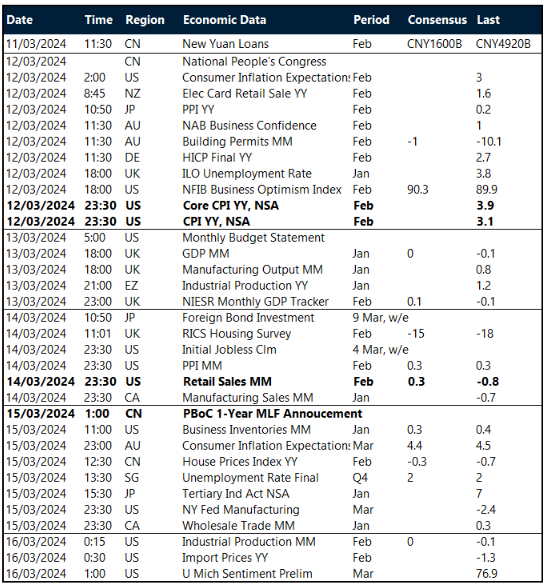

Key global risk events

Calendar: 11 – 16 March

All times AEDT

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]

Take a deep dive into the trends shaping cross-border payments with our podcast, Converge.