Euro falls with interest rate at all-time high

The European Central Bank (ECB) raised its policy rates by 25 basis points, pushing the deposit rate to a new all-time high of 4.00%. The tenth interest rate increase in a row by the ECB is a testimony on how volatile and unpredictable monetary policy can be around regime changes. While the logic behind the hike itself can be debated from a policy and macro perspective, it has to be said that no one expected the ECB to tighten policy by 450 basis points at the beginning of the cycle.

The focus now shifts to policymakers managing expectations about premature easing, which have already crept into market pricing. The sharp fall of the euro below $1.07 following the rate decision can be interpreted as the markets believe 1. the ECB is going too far in its fight against inflation given weak underlying growth and 2. that the overtightening in the short term will have to be compensated by more easing in the medium term.

A stronger euro from here on is conditioned on economic activity picking up, as it would ease the need for the ECB to cut rates in the first half of 2024. This reaction function is highlighted by the euro’s positive reaction to the better-than-expected data out of China today. Both factory output and retail sales grew faster than expected in August, supporting the thesis that the worse of the crisis could be behind the world’s second largest economy. Today’s 0.25% rebound will not be enough to get EUR/USD into green territory and the currency pair will most likely record the ninth weekly depreciation in a row.

Fed to shy away from calling the top on rates

Forecasting a recession in the US has consequently been a failed cause for the past six months. Strong consumer spending and a resilient labor market have pushed out recession calls for the US and have put the possibility of a soft landing back into some investment outlooks for 2024. The labour market in particular remains the beacon of hope for proponents of this scenario. However, with short-term interest rates at 20-year highs starting to work their way through the economy, some loss of economic momentum is to be expected.

The past few weeks have been characterised by a bottoming of the manufacturing sector and the weakening of the services sector. This development has been visible in the latest inflation data as well, which showed the goods deflation ease and services – especially rent inflation – starting to come down. For the Federal Reserve (Fed), whether to hike again or not will boil down to one simple question. Will services inflation come down fast enough to compensate for bottoming energy and goods prices or not? It is likely that US policymakers will shy away from calling an interest rate peak like the ECB did yesterday.

This view has supported being cyclically bullish on the US dollar. We do think that we are coming closer to the bottoming of the global business cycle with China rebounding and Europe having front-loaded its recession. This could mean that the Greenback loses one of its positive drivers going into next year. However, the second FX driver, monetary policy divergences, still favour the Fed vs. the ECB going into Q4 2023. We are getting the final patch of data for the week in the form of US industrial production and the Michigan Consumer Sentiment Index. Before the Fed meets next Wednesday, investors will focus on housing data on Monday and Tuesday.

GBP downside risk mounts before BoE

The British pound briefly dipped under $1.24 versus the US dollar yesterday and importantly closed below its 200-day moving average, which opens the door to further downside risk. A corrective pullback is under way this morning, but we don’t expect it to be sustained and instead negative momentum towards $1.23 can’t be ruled out ahead of more key central bank meetings next week.

GBP/USD dropped to its lowest in four months, pressured by further strength in the dollar as new data consolidated evidence of resilience in the US economy and added leeway for the US central bank to keep interest rates higher for longer. Conversely, concerning domestic data and plunging demand for mortgages might limit the room for the Bank of England (BoE) to remain hawkish. Both the Fed and BoE meet next week, and money markets currently expect the former to keep interest rates unchanged and the latter to raise by 25 basis points. However, the dovish tilt by the ECB yesterday likely added fuel to the ongoing dovish re-pricing of BoE rate expectations, and markets are no longer pricing another full BoE hike after next week. That means a potential peak Bank Rate of 5.5%, which is a far cry from the 6.5% priced just a couple of months back.

No wonder GBP/USD has dropped over 5% in two months. The currency pair remains almost 2% above its 1-year average, but this incorporates the all-time low under $1.04 last September. Compared to its 2-year and 5-year averages, GBP/USD is over 1% and 3% lower respectively.

Commodity currencies buoyant as oil prices surge

Table: 7-day currency trends and trading ranges

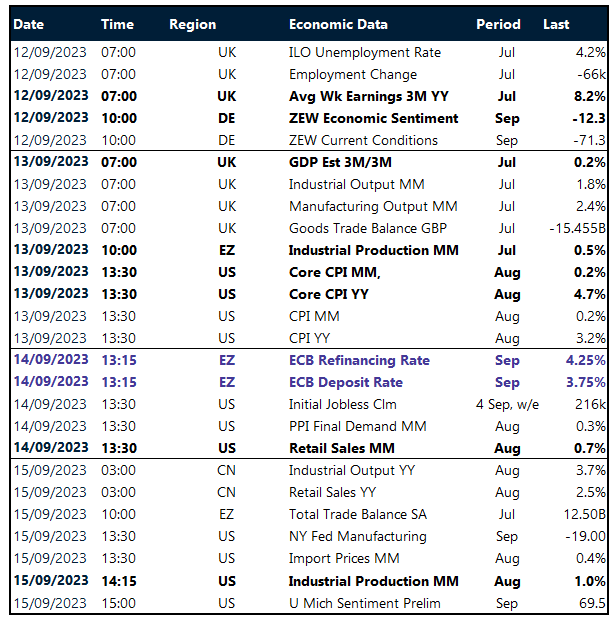

Key global risk events

Calendar: September 11-15

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.