Written by Convera’s Market Insights team

Dollar poised for worst month of 2024

George Vessey – Lead FX Strategist

The US dollar is on the verge of its first monthly decline in 2024 as the mood across financial markets remains upbeat, boosting riskier assets like equities and pro-cyclical currencies. Despite markets scaling back Federal Reserve (Fed) easing bets for 2024, US dollar strength has significantly cooled this month, with the world’s reserve currency appreciating against just 14% of its global peers in May.

The extent of USD weakness is a bit surprising given US inflation is still anything but soft and the growth convergence story seems to be losing steam too, evidenced by the strong S&P PMIs for the US last week. Moreover, Minneapolis Fed President Kaskhari was the latest to underscore that the US central bank will not cut rates until there is clear evidence of sustained disinflation, echoing hawkish signals from other Fed officials and minutes from the US central bank’s last policy meeting. Elsewhere on the data front, the S&P CoreLogic Case-Shiller 20-city home price index in the US surged by 7.4% y/y in March, the most since October 2022, and to new all-time highs. It marks the ninth consecutive month of increases in home prices. We’ve witnessed records repeatedly break in both stock and housing markets over the past year in the US despite interest rates remaining elevated and easing bets being severely trimmed since the turn of 2024.

Although there is obvious preference to look for dollar weakness amongst investors, the US currency retains a high growth and high yield appeal, so we cannot rule out dollar demand returning, especially if the important PCE inflation data this Friday comes in hotter than expected.

Pound extends gains as Labour majority eyed

George Vessey – Lead FX Strategist

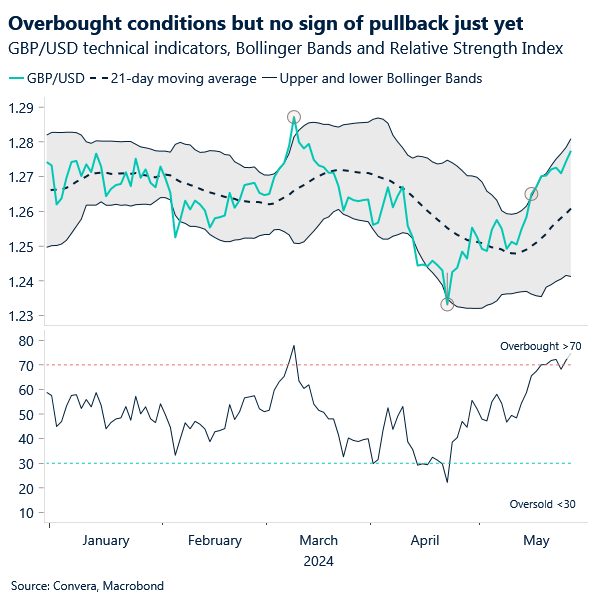

Sterling’s strength gained traction yesterday as the odds of a Labour Party victory in the UK general election on July 4 rose from 70% to 90% according to the latest odds by bookies. GBP/USD punched through $1.28 for the first time in nine-and-a-half weeks, GBP/EUR scaled 9-month highs nearer €1.18, whist GBP/JPY held firm above ¥200.00 – close to 2008 highs.

The opposition Labour Party is more than 20 points ahead of the ruling Tory Party in the polls. Markets usually prefer continuity over change, but Labour’s shift to a more pro-business, centre-ground position is seen as favourable for the pound as the Labour Party continues to stress that economic stability will be prioritised. This election campaign might be much less volatile than previous instances, but sizable tail risks should never be ruled out – a hung parliament being the biggest downside risk to sterling, as witnessed in 2010 and 2017 when GBP/USD dropped around 3% in a week. We believe any volatility will most likely be “noise” though and the direction of the pound over the course of 2024 is more likely to be determined by monetary policy paths/divergences of major central banks.

This is another reason for the pound’s recent rally though, given a June rate cut has been priced out by markets after the UK inflation report last week, leading to UK gilt yields rising to 1-month highs. Whilst traders eye GBP/USD’s 200-week moving average, daily momentum and the daily Relative Strength Index are in overbought territory, so further upside from here could be limited in the short term.

ECB’s Knot hints at four cuts in 2024

Ruta Prieskienyte – FX Strategist

The euro is up for a third consecutive trading day, nearing a 2-month seen earlier in the month, as the US dollar extends its downside even after hawkish comments from Fed’s Kashkari. Bunds remained little changed alongside rate-cut wagers on the back of speeches from ECB’s Centeno and Knot and a survey of inflation expectations. Money markets bet on 23bps of cuts next week, 26bps by July and 61bps by year-end.

Across the macro space, ECB’s inflation expectations edged lower in April, reaching its lowest since September 2021. Prices are seen advancing 2.9% over the next 12 months, down from 3% in March, and the gauge for three years also fell to 2.4% from 2.5%, having been at that level for four months, further reinforcing bets that ECB will start reducing rates next week. With a first cut in borrowing costs on June 6 looking like a done deal, some officials are starting to discuss the pace of possible subsequent moves. On Monday, France’s Villeroy said the ECB shouldn’t exclude cutting rates in both June and July, pushing back against fellow monetary officials who are uncomfortable with the idea of consecutive cuts as they remain wary of lingering upside risks. Although not commenting on the timing of further easing, ECB’s Knot said Brussels’ most-recent forecasts merit either three or four interest rate cuts this year, marginally more than the latest market pricing.

Investors now look ahead to the preliminary German inflation data for May, due mid this afternoon. Two-week volatility in EUR/USD that envelopes ECB-meeting risk stands at 5.14%, compares to year-to-date average of 5.81%. The relative premium on the tenor comes at 62 basis points in favor of implied, as realised volatility continues to mull around May lows. The latest CFTC positioning is the most euro bullish in 2-months as investors reversed their bearish bets from a month ago. Given the imminent divergence in the timing of ECB and Fed rate cuts, EUR/USD is under the influence of an overarching downward bias, confirmed by the option market risk sentiment, with 2-week risk reversals in the pair positioned marginally bearish. For now, previous May high near $1.09 remains the immediate resistance barrier.

Oil up over 3% from a week ago

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: May 27-31

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.