USD extends slide

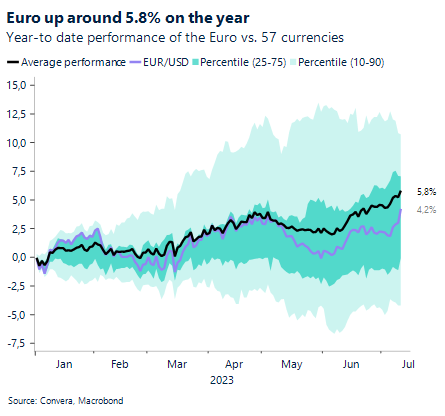

The stampede out of the U.S. dollar continued overnight as the greenback collapsed to 15- and 16-month lows against the UK pound and euro, respectively. The U.S. currency’s slide knocked it to five- and 10-month lows against rivals from New Zealand and Canada, while it tumbled to four-week lows versus the Australian dollar. Elsewhere, the Swiss franc and Mexican peso both notched 8-year peaks against their U.S. counterpart. The U.S. dollar index has shed more than 2% this week, putting it on track for its worst weekly performance of the year. The exodus from the dollar follows underwhelming news on U.S. hiring and inflation over the past week that, taken together, suggest the Federal Reserve may be down to its final rate hike of its most aggressive tightening cycle since the 1980s. Markets are betting that after July the Fed could move to the sidelines if U.S. inflation maintains its downward momentum toward central bankers’ 2% goal.

Aussie scales 4-week peak

Australia’s dollar continued its upward charge against its battered U.S. rival. The glide higher has propelled the Aussie above recent resistance at 0.6700 and 0.6800 with AUD/USD currently taking aim at 0.6900. But having fallen so far over a short period of time, the greenback could steady as the week draws to a close which is on track to be the U.S. currency’s worst so far this year.

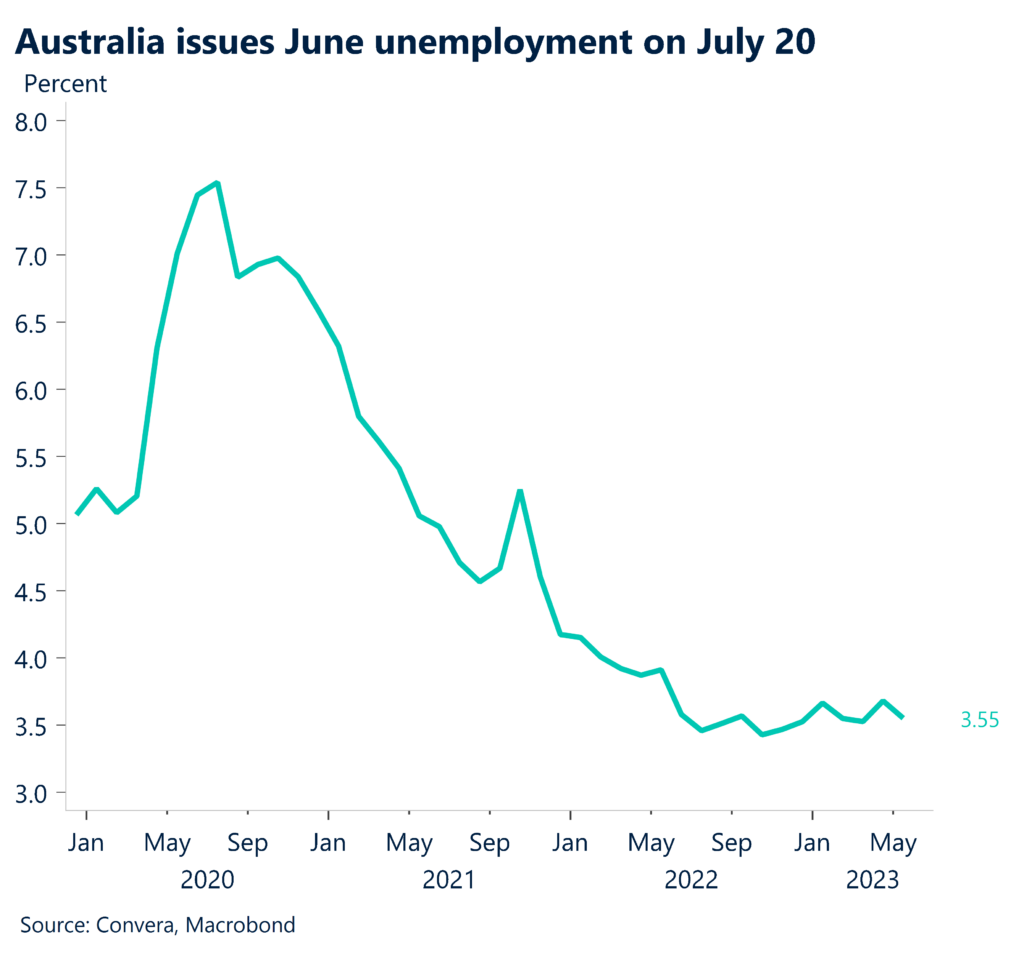

Aussie gains will be tested next week by consumer inflation and the June jobs report.

AUD/USD jumped 1.4% overnight and climbed as high as 0.6894, its strongest level since mid-June.

NZD/USD climbs 5-month high

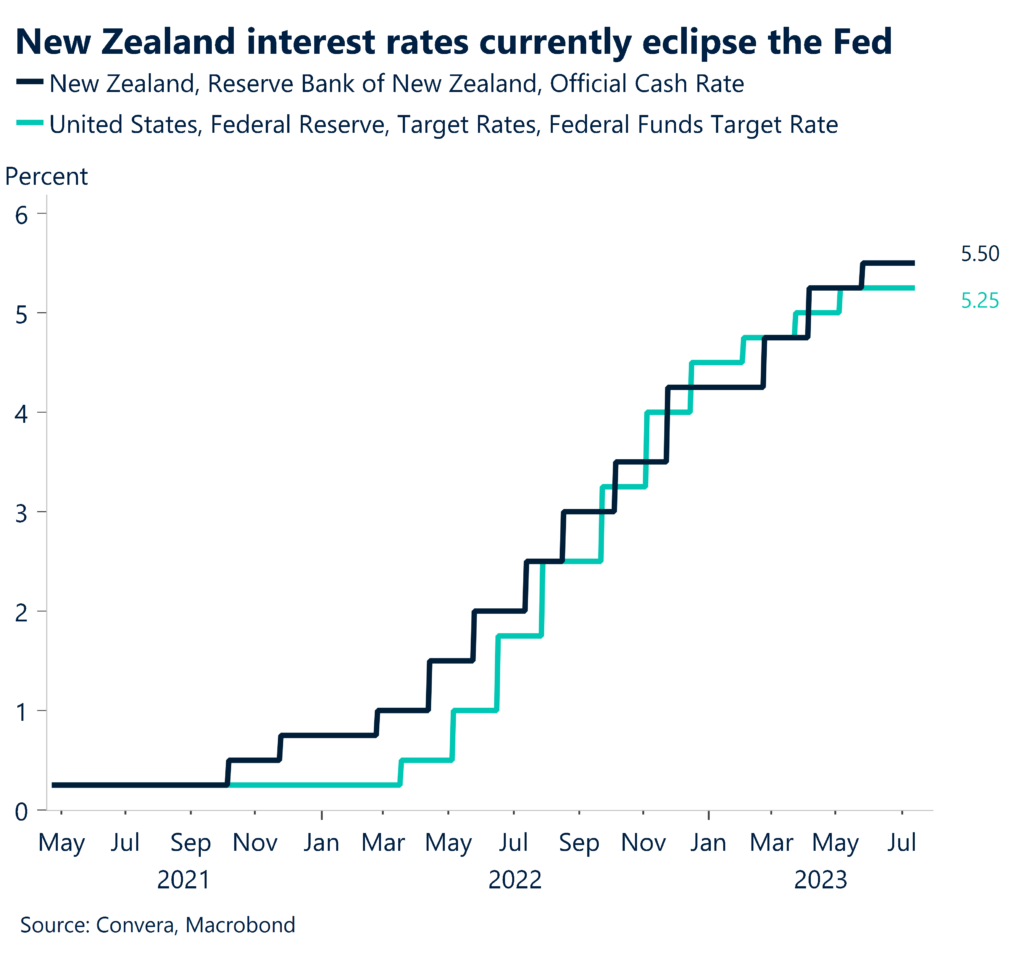

The sinking greenback kept New Zealand’s dollar biased higher as NZD/USD flirted with 0.6400. The pair overnight rose as high as 0.6394, its strongest level in more than 5 months. Greenback bulls continued to run for the exits on the notion that the Fed may only have one more rate hike on the table. Mounting signs of easing inflation show the Fed making significant progress toward lowering inflation back to its 2% goal. The Fed in June signaled an intention to raise rates two more times by year-end.

For a gauge of how tightly a hold the kiwi has on its gains, markets will parse New Zealand’s second quarter inflation report on July 19 that’s forecast to show annual price growth moderated to 5.9% from 6.7% in Q1.

NZD/USD powered 1.4% higher overnight.

AUD/NZD steadied around 1.0780.

USD extends slide, hits 15-month lows

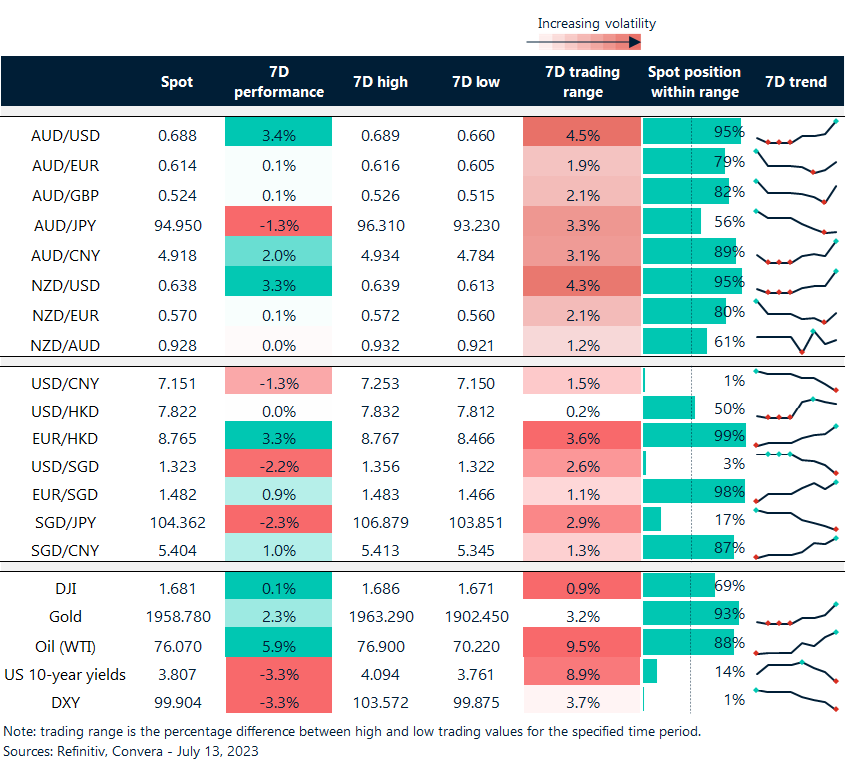

Table: seven-day rolling currency trends and trading ranges

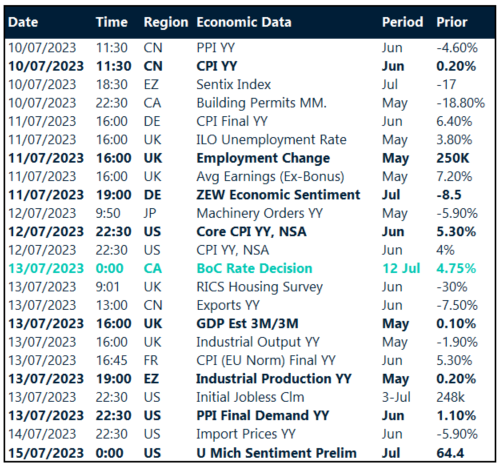

Key global risk events

Calendar: 10 – 15 July

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.