Written by Convera’s Market Insights team

Dollar steadies as Fed guidance in focus

George Vessey – Lead FX Strategist

The US dollar index is extending gains from the previous session following one of its worst weeks of the year so far. Last week, the dollar lost ground to pro-cyclical peers – those currencies that perform better on hopes of improving global economic growth. The reason why these hopes have increased is because of rising expectations of interest rate cuts to support economies.

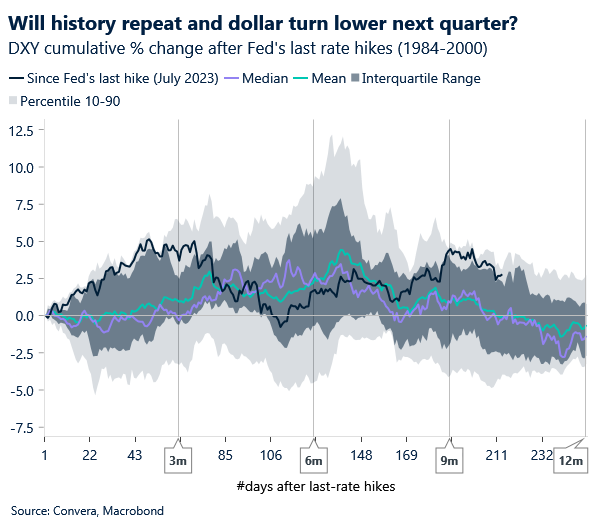

Nevertheless, the global risk rally has fizzled out somewhat as Atlanta Fed President Raphael Bostic said that it will take time before the central bank is confident that inflation will return to 2%, reiterating that only one rate cut will be necessary this year. In the short-term, we think a low volatility environment should offer the dollar some more reprieve given its high yield appeal in the carry trade strategy. But as we move into the second half of the year, it seems more plausible for the dollar to weaken amid the moderating US growth outlook and if the disinflation trend resumes. Looking back at what has historically happened to the dollar after the Fed’s last rate hike, we see the US currency is currently in the 90th percentile of its historical performances. However, if history repeats, we should see the dollar’s strength subside.

With little on the US economic data calendar this week to guide the direction of currency moves in the very near term, focus remains on a slew of Fed speakers for clues on the US rate outlook and how soon an easing cycle could begin.

Climbing ahead of inflation data

George Vessey – Lead FX Strategist

Sterling remains afloat the $1.27 handle versus the US dollar, just 1.4% away from its 2024 high near $1.29. The 100-day moving average appears to have flipped from a short-term resistance level to an area of support, though this could be tested following tomorrow’s UK inflation report. GBP/EUR has also climbed back above €1.17 to a fresh 2-week high.

Unlike the US, UK inflation in recent quarters has undershot the central bank’s expectations and is likely to return to target in the next month or two. The headline CPI print on Wednesday is forecast to fall from 3.2% to 2.1%, which could raise the prospect of a Bank of England (BoE) interest rate cut as soon as June. However, the BoE is more focused on services inflation – giving it more prominence in the monetary policy decision-making process given recent volatility in the wage figures. If it comes in hotter than anticipated odds of a June cut will likely be slashed, helping the pound stretch towards $1.28.

On the flip side, a sharp deceleration in services inflation will raise the probability of a June start and potentially even a consecutive August cut. Such a scenario could heavily weigh on the pound and drag GBP/USD back under its key moving averages and into the lower $1.20s.

CAD under mild selling pressure ahead of inflation report

Ruta Prieskienyte – FX Strategist

The Canadian dollar weakened along with its G-10 peers against the greenback amid selling pressure stemming from various Fed policymakers putting a damper on hopes for the first rate cut occurring in September. The Loonie has also ignored the further advance in commodity, which typically help support the currency. USD/CAD overnight implied volatility jumped to a 2 ½ week high at 7.61%, as investors look ahead to the release of Canada’s inflation data later today.

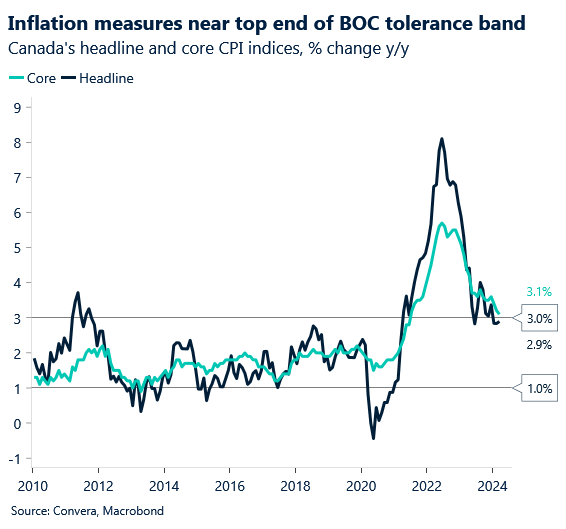

The headline CPI has persistently surprised to the downside this year, and output growth is losing momentum. While there is a risk that April’s estimate comes in above the seasonal norm, the boost will come largely from shelter and gasoline — two sources that the BoC is likely to look past. What the markets, and the central bank, will pay attention is the diffusion of the disinflation process. Given the recent trend, we expect that, for the first time since early-2021, April’s CPI report will show the share of spending categories experiencing annual deflation (annual inflation rate below 0%) exceed those experiencing inflation above 3.0%. Markets expect Canada headline CPI to come in at 0.5% m/m in April, down from 0.6% previously, and 2.7% on year-on-year terms, down from 2.9%. Another downside surprise would bolster expectation of a July rate cut by the Bank of Canada. Swap implied probability currently stands at 62% in June, with 57bps easing priced in by year end, only 6bps more than what’s currently priced in for the Fed.

From a positioning perspective, the latest CFTC data shows that hedge funds upped short bets on the Loonie to their highest since 2017. Meanwhile, short term market sentiment remains CAD bearish, with both 1-week and 1-month USD/CAD risk reversals edging marginally higher ahead of the data print. Looking at technicals, for now USD/CAD is bounded by the 50-day SMA at $1.3638, but volatility expectations for today’s session at multiweek highs, signs of further easing in price pressures could see the pair break higher past this level and surge towards $1.37 level.

Gold up over 2% in a week

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: May 20-24

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.