Global overview

The U.S. dollar started the new week on its front foot, buoyed by last week’s strong American jobs report. Broad gains gave the dollar a leg up versus rivals from Europe and Canada. Data Friday showed the world’s largest economy added 339,000 jobs last month, though unemployment rose to 3.7% from 3.4% and wage growth moderated. The data was considered mixed enough for the Federal Reserve to skip an interest rate hike next week. Still, fresh signs of U.S. economic resilience and outperformance have put new wind in the dollar’s sails, keeping it broadly supported. While the Fed may postpone its next rate increase, the economy’s underlying strength allows cover for the central bank to continue hiking. At the same time, markets have started to throw in the towel on the notion of the Fed having to pivot to rate cuts by the end of the year. A lighter week of U.S. economic data will see the spotlight shift to Canada which issues a midweek central bank decision and late week jobs numbers.

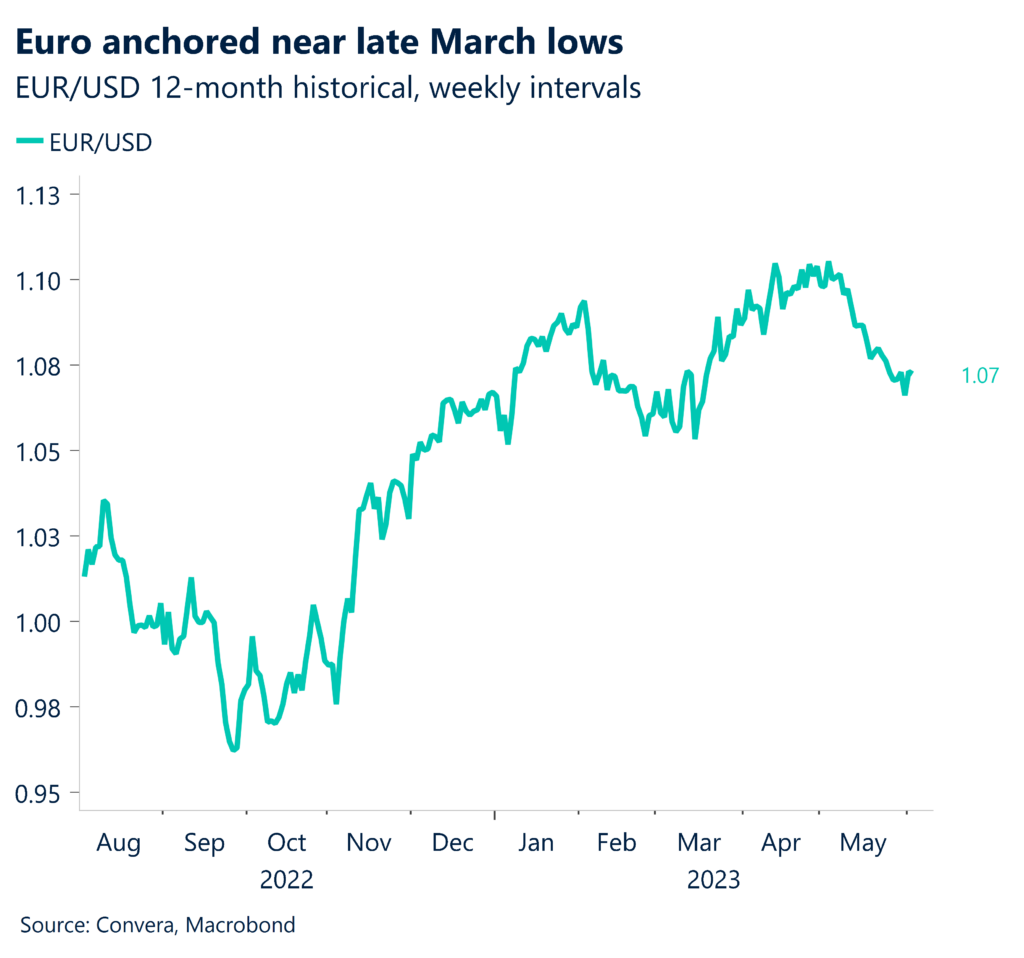

Euro weighed down by data

The euro remained on the defensive after it fell for the fourth straight week against the greenback. The euro favored its back foot after data showing a larger than expected cooling in euro area inflation suggested reduced pressure on the European Central Bank to extend rate increases deep into the second half of the year. Euro zone producer prices cooled sharply to a 1% annual rate in April, compared to forecasts of 1.4% from a downgraded 5.5% in March. After raising rates to 3.25% in May, the highest level in nearly 15 years, the ECB may only have a couple more rate increases on the table.

Sterling slips anew

Sterling backpedaled from recent two-week highs against the firmer U.S. dollar. The pound’s sensitivity to shifts in the outlook for global lending rates has exposed a vulnerability. The market scaling back expectations for the Fed to cut borrowing rates as soon as this year has buoyed the dollar at the pound’s expense. Moreover, last week’s U.S. jobs report, while mixed, served as a reminder of U.S. economic resilience compared to Europe, a dollar-positive theme. Sterling had its fall slowed by news that UK services growth enjoyed a modest upgrade in May to 55.2 from 55.1 where the PMI was forecast to remain.

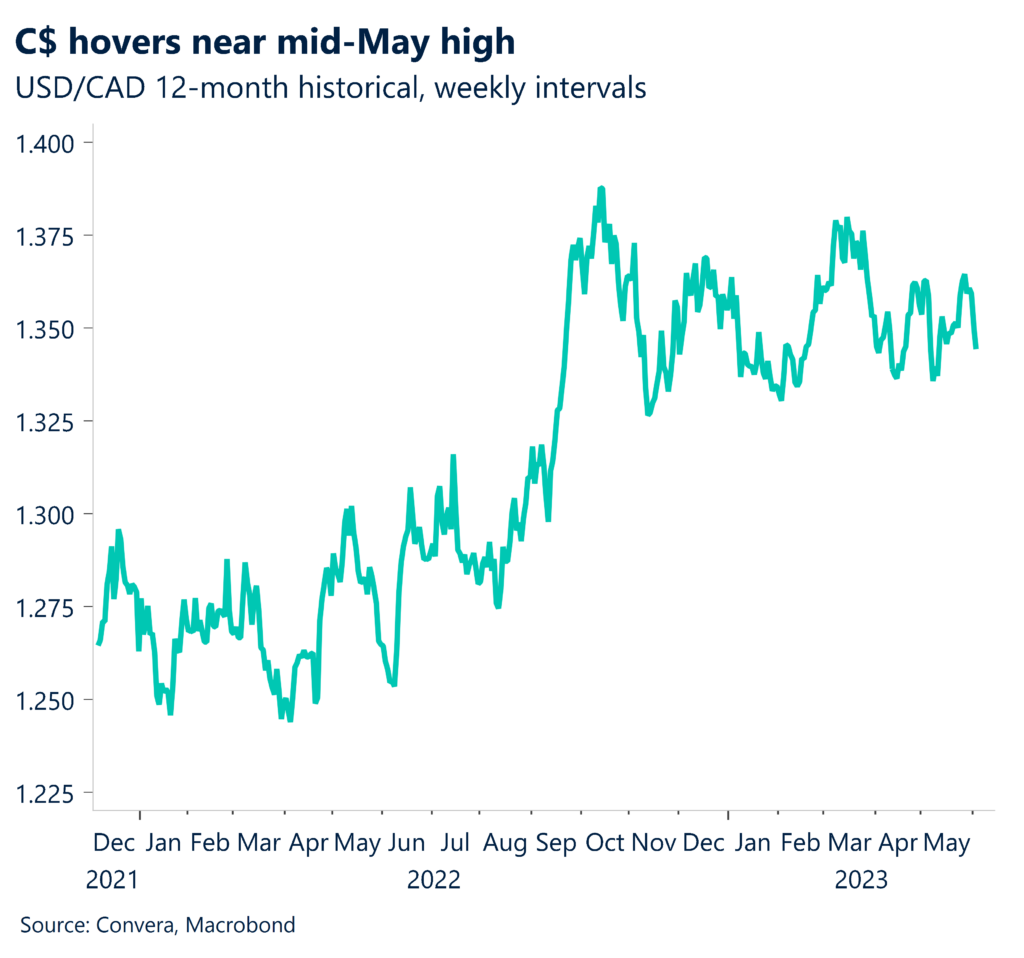

C$ near highs ahead of midweek BOC decision

Canada’s dollar was camped near its highest level in more than two weeks against the U.S. dollar ahead of a big week for the domestic economy. It’s considered a close call whether the Bank of Canada Wednesday will raise interest rates from 15-year highs of 4.50% after data last week showed the economy was firing on more cylinders than expected over the opening quarter of the year. Canada Friday issues its May jobs report with hiring forecast to cool to an increase of 20,800 jobs, about half the 41,400 it added in April. Unemployment is forecast to inch up to a still low 5.1% from 5.0%. No rate increase this week but a firm signal of a tightening bias could see the loonie take flight.

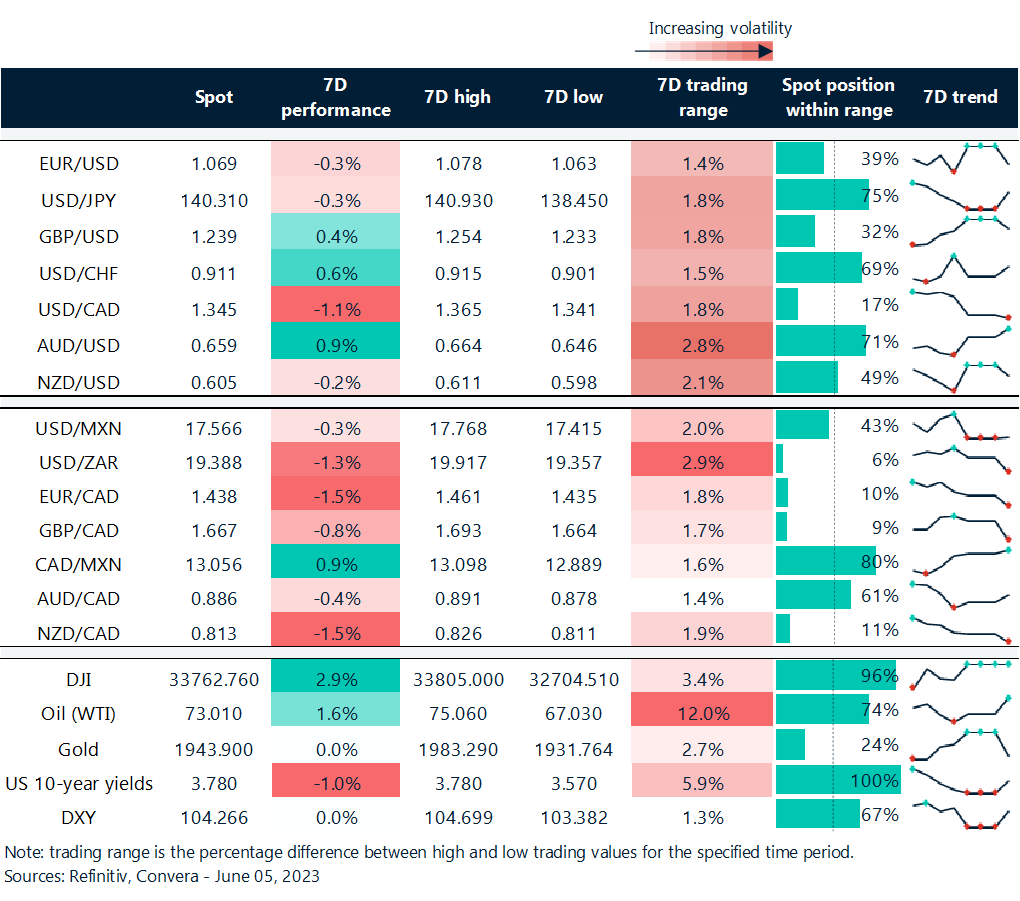

Dollar hovers near top of range

Table: rolling 7-day currency trends and trading ranges

Key global risk events

Calendar: Jun 5-9

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.