Global overview

With a rally to new highs Wednesday, the U.S. dollar index was on its way to only its second monthly gain of the year. The stronger buck flirted with one-month highs versus the Canadian dollar and climbed to new 10-week peaks against the euro. A weaker UK pound was on pace to snap a two-month winning streak against its U.S. rival. The dollar’s latest lift came from downbeat factory data from China that added to recent signs of economic malaise in the world’s No. 2 economy. Meanwhile, a sharper than expected cooling in European inflation suggested fewer euro-positive interest rate hikes on the European Central Bank’s table. The greenback partly owes its May turnaround to global economic indicators that have painted a more resilient picture of growth on U.S. shores than many places abroad. Hotter U.S. data and Washington reaching a deal to raise the debt ceiling have markets girding for the Federal Reserve to raise interest rates again with markets pricing about a 65% likelihood of a quarter-point hike in two weeks. Up about 2.8% in May, the dollar index was on track for its first monthly gain since February.

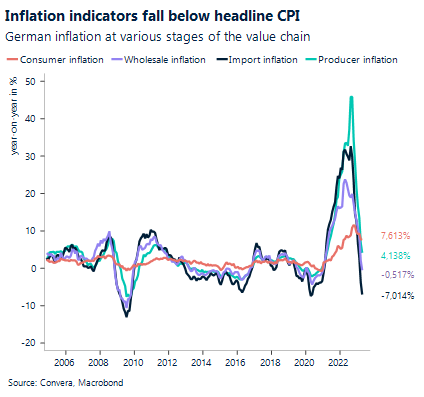

Data suggests less hawkish outlook for ECB policy

The euro’s May swoon gathered pace as Europe’s single currency fell to new 10-week lows. Inflation in France, the bloc’s No. 2 economy, posted a sharper than expected cooling to a 5.1% annual rate in May, below forecasts of 5.5% from 5.9% in April. The data offered evidence of the ECB’s 375 basis points in interest rate hikes since mid-2022 having the intended effect on inflation and suggested fewer rate increases on the table going forward. A slide of roughly 3% in May pushed EUR/USD into negative territory for the year.

Sterling poised for 1st monthly fall since February

Sterling tilted toward recent early April lows against the U.S. dollar as weaker data from China along with shakier global stocks weighed in risk-sensitive currencies like the pound. For the month, GBP/USD has fallen more than 1.5%, putting it on pace for its first monthly decline since February. China’s official factory purchasing managers index unexpectedly contracted at a faster pace of 48.8 in May, the latest in a lengthening string of underwhelming data that’s raised concerns about the health of the world’s second-largest economy.

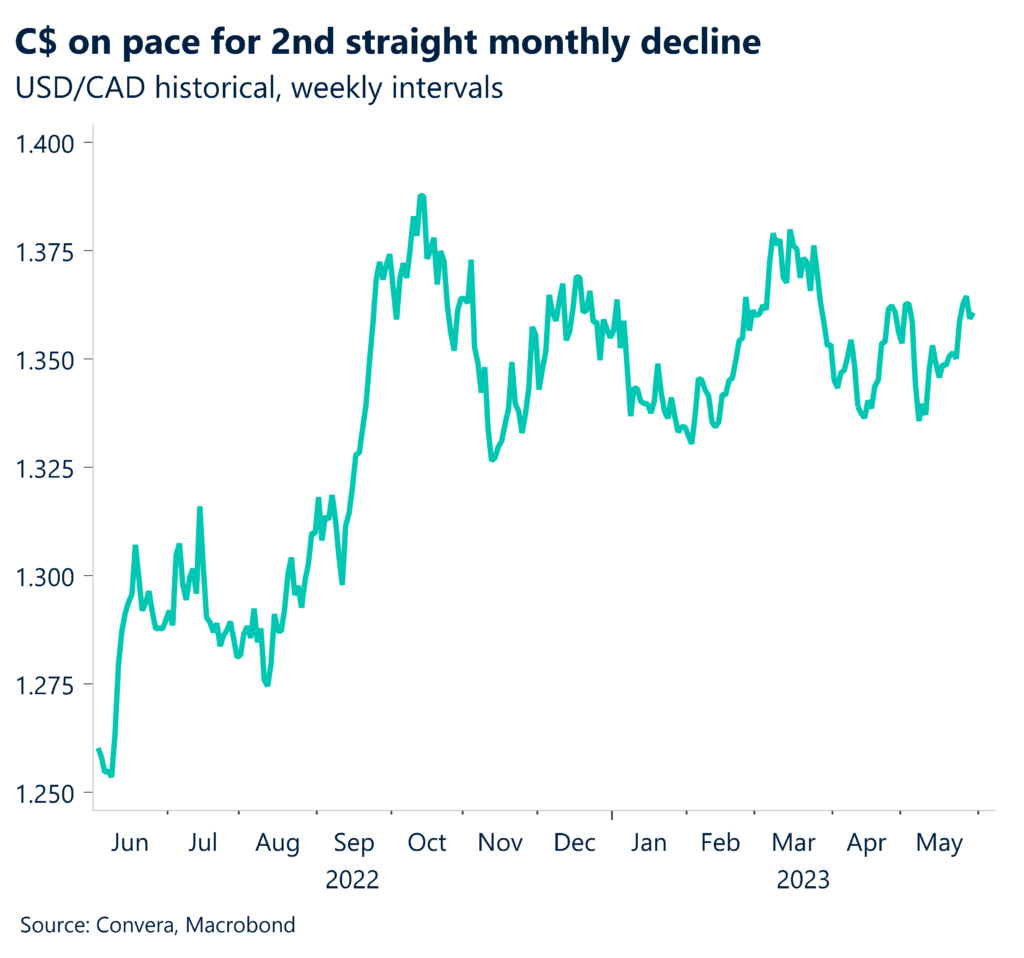

C$ cuts losses after Canada posts solid 3.1% Q1 GDP

Canada’s dollar hovered near one-month lows against its stronger U.S. counterpart which benefited from safety flows on worries about Chinese economic weakness. Oil added to its losses after it plunged 4.4% Tuesday and closed below $70. The loonie pared declines after Canada’s economy fared better than expected last quarter when it grew at a faster than expected 3.1% annual rate. While growth stalled in March with a zero reading, that was better than forecasts of a mild contraction. While the outlook still calls for low growth, the economy’s resilience is keeping the door cracked for the Bank of Canada to raise interest rates which is positive for the loonie’s yield appeal. Odds still favor Ottawa holding rates at 4.50% when it meets on June 7.

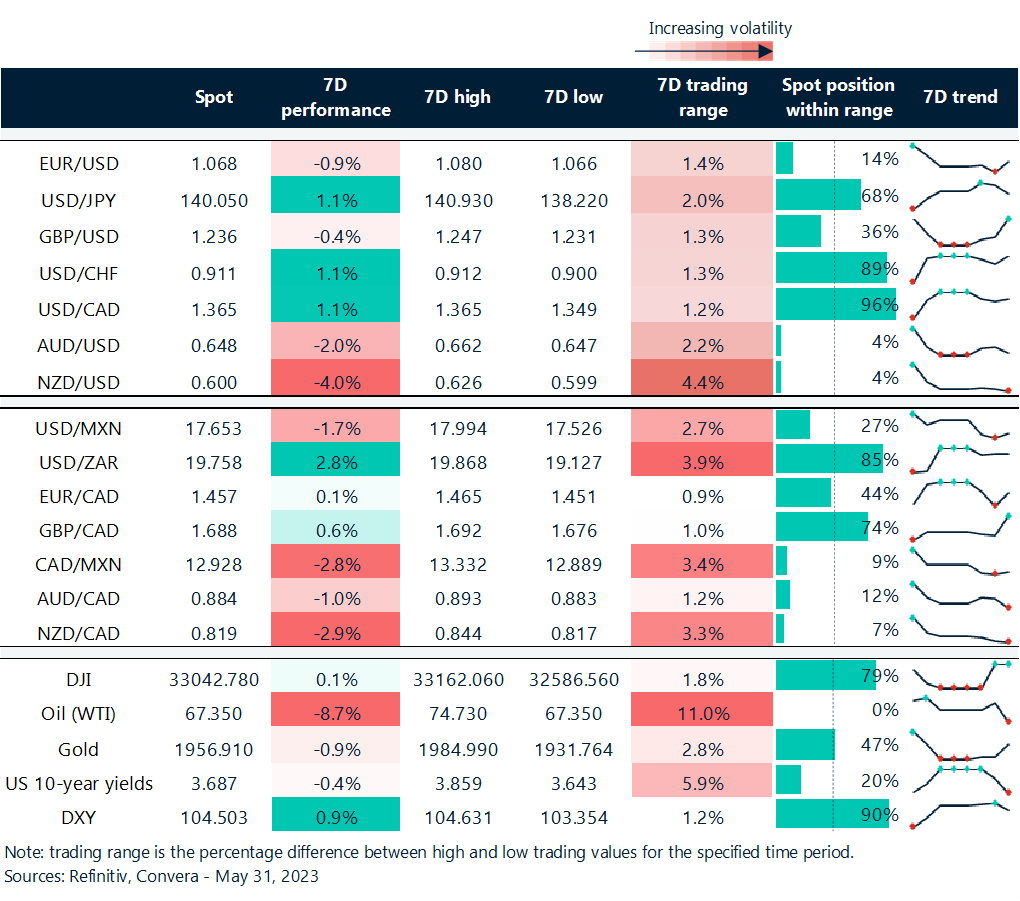

Dollar sticks to top of recent ranges

Table: rolling 7-day currency trends and trading ranges

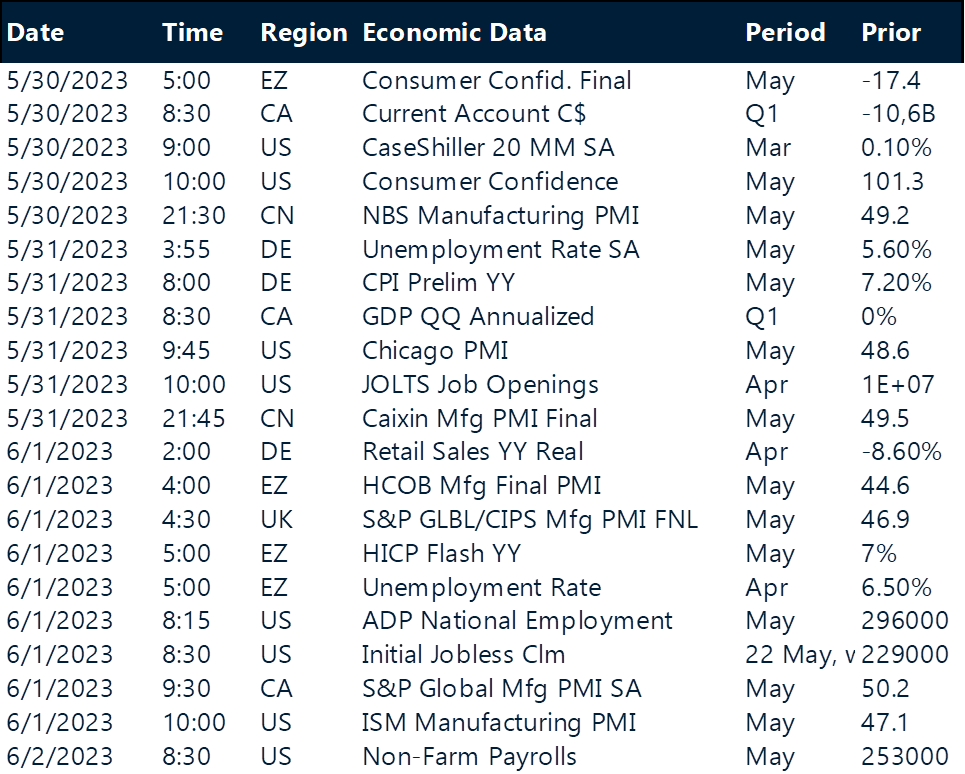

Key global risk events

Calendar: May 29-Jun 2

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.