Making sense of dollar resilience

Boris Kovacevic – Global Macro Strategist

Last week was a big one to unpack with some asset classes recording their largest price swings so far in 2024. A cocktail of political turmoil in Europe, downside inflation surprises in the US and hawkish signals from the Fed and ECB led investors into safe-havens like government bonds, the Swiss franc, and US dollar. The narrative of the US disinflation continues to gain credibility among market participants as both the consumer, producer, and import price indices for the month of May surprised to the downside last week.

Incorporating the newest data into a simple regression model on the Fed’s preferred price gauge (core PCE) gives us a monthly growth rate of 0.1%, which is something investors have started pricing into markets. The US 10-year Treasury yield recorded its biggest weekly decline this year and the probability of a Fed cut in September has risen to 62%. This has pushed US equity benchmarks to record highs. Surprisingly enough, the dollar did not suffer the consequences of this disinflation driven re-pricing of expected monetary policy. The Greenback had its best week in ten and gained against the euro, pound, and yen. This development is even more surprising given the weaker than expected macro data coming out of the US last week. Initial jobless claims drifted higher and consumer sentiment fell to the lowest level this year.

The Federal Reserves upward revision of its dot-plot could have something to do with the dollar’s resilience, as policy makers now only see one, instead of three rate cuts as their base case. However, this cannot explain the entire story. Investors already seem to interpret the Fed’s rate projection as priced in and almost outdated given the inflation prints for May. Safe haven flows and rising risk premia in Europe are therefore the best explanatory factors in explaining why EUR/USD has fallen from its weekly peak at $1.0860 to $1.0650.

French politics a drag on the euro

Boris Kovacevic – Global Macro Strategist

Governing Council members of the European Central Bank have had plenty of opportunities to push back against too aggressive policy easing expectations for this year. President Christine Lagarde began the week by saying that rates won’t be on a linear declining path. A plethora of her colleagues joined in on the chorus, strengthening the consensus around skipping the July meeting and focusing on a potential rate cut in September. Governing Council members Nagel, Simkus, Rehn and Villeroy sounded surprisingly conform, stating that the ECB (1) must not rush nor dally after decisions to cut, (2) wont pre-commit to any path and (3) can’t declare victory over inflation yet.

Policy maker Centeno urged prudence on rates as inflation rebounded in May. Given the expected fall of price pressures until the September meeting, we continue to see the end of Q3 as the likely timing for another 25 basis point rate cut. Partially due to the election in France being out of the way as well. This is still a topic that the ECB is watching, even though officials have stated that there is still no cause for alarm over the market turmoil in Europe’s second-largest economy. The French risk premium – defined as the difference between 10-year bond yields in France and Germany – widened by the most on record last week as investors rotated capital from France to Germany.

This largely explains why the euro was not able to profit from the US disinflation story and was pushed to sub $1.07 levels. The common currency weakened against the dollar, pound, and franc with the latter already on track to record its best week against the euro so far this year. EUR/GBP fell for four consecutive weeks now as is trading below 0.85 at close to two-year lows. Looking ahead, politics will continue to play a role in determining the euro’s short-term value. On the macro front, German sentiment and flash PMI’s are expected to show continued improvement of economic momentum.

Will the BoE lean into rate cuts?

Boris Kovacevic – Global Macro Strategist

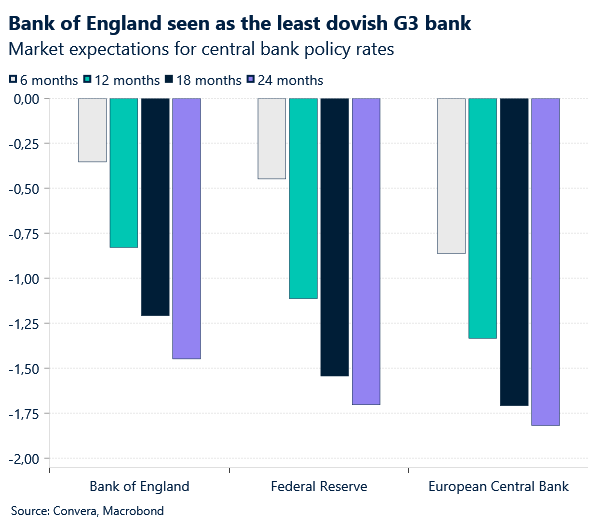

Markets don’t expect any change in policy from the Bank of England this week, mainly due to the recent string of higher-than-expected inflation prints and the upcoming election in July. Still, policy makers are likely to take the opportunity to prepare markets for a potential easing at the meeting in August. Markets see the start of the easing cycle more likely in November with a potential December cut in the cards. We will keep an eye on the number of officials voting for a cut this week (likely two) and if Governor Bailey continues to push back against markets pricing in minor policy easing for this year.

The meeting is held against the backdrop of the UK economy having stalled in April, recording zero growth for the first time this year. The services sector remains robust, but production and construction pushed GDP into negative territory on the month. The unemployment rate hit a two-and-a-half year high in the same month just weeks before the general election. The economic weakness could be one reason for policy makers to start easing rates earlier than markets currently expect.

We see the meeting and potential downside surprise on UK CPI next week as potentially negative for the pound. This doesn’t mean that GBP/USD and GBP/EUR are destined to fall in the coming sessions. Domestic macro and monetary policy drivers in the UK will be important but can’t be seen in isolation. Economic data from the United States in form of the retail sales and industrial production report will be key volatility catalysts as well and European politics is expected to remain the biggest driver of GBP/EUR in the coming week.

Euro down as politics bites

Table: 7-day currency trends and trading ranges

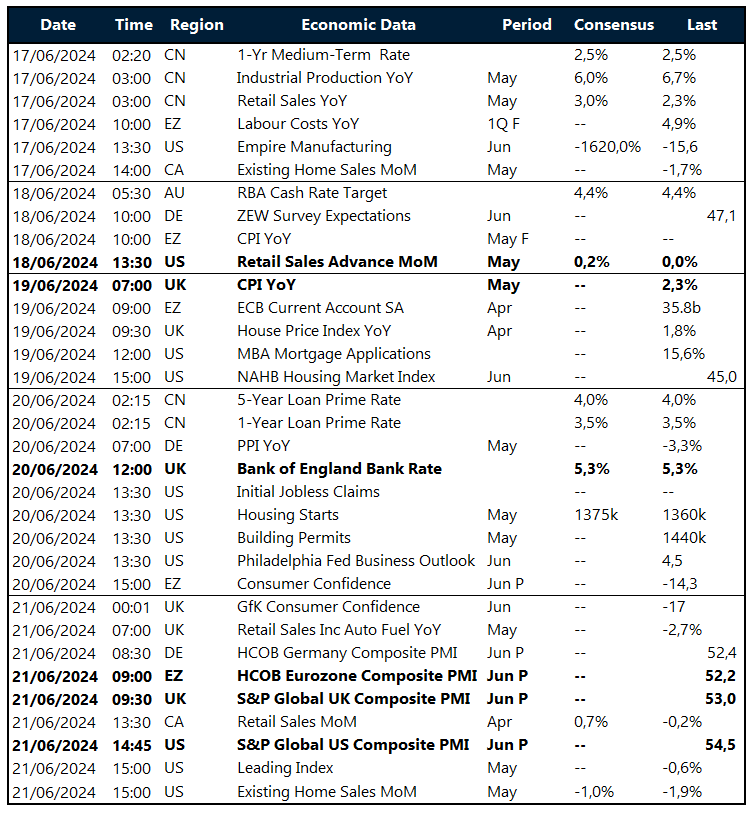

Key global risk events

Calendar: June 10-14

All times are GMT+1 time zone.

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.