Global overview

The U.S. dollar followed up last week’s gain with more as market players readied from a trio of central bank meetings this week. The firmer greenback hovered near one-week highs versus the Canadian dollar while it was at or near two-week peaks against the euro and sterling. European currencies slid after weaker than expected factory surveys stoked worries about growth after a barrage of interest rate hikes. Markets are on edge as central banks in the U.S., Europe, and Japan issue much anticipated monetary policy decisions. Many suspect that a quarter-point rate hike from about 5.1% by the Fed Wednesday could be the finale of its most aggressive tightening cycle in decades. The ECB follows the Fed with a Thursday decision, followed by Japan on Friday. The ECB is widely expected to hike rates by 25 basis points to 3.75% while Japan could tweak its stance with a potential adjustment to its yield curve control program. A Fed that hikes this week and maintains a tightening bias could help the dollar extend its recovery from recent 15-month lows.

Euro flirts with 2-week low

The euro fell to 12-day lows against its U.S. rival after downbeat European data spelled a more uncertain outlook for higher lending rates beyond this month. Germany’s manufacturing PMI unexpectedly tumbled to 38.8 in July, compared to forecasts to improve to 41.0 from 40.6. Disappointing data offered evidence of the bloc’s largest economy continuing to sputter after it slipped into recession in the first quarter. The ECB is all but certain to hike rates to 3.75% from 3.50% Thursday but central bankers could be tightlipped about what happens at their next meeting on Sept 14.

Growth worries weigh on sterling

Sterling fell to two-week lows against the U.S. dollar after fresh data on the British economy added to expectations for the Bank of England to slow the pace of further tightening. Britain’s factory PMI for July weakened more than expected to 45.0 in July, compared to forecasts of 46.1 from 46.5 in June. Following cooler than expected UK inflation last week, the data backed the case for UK interest rates to potentially peak at lower levels below 6%.

C$ bounces after falling last week

The Canadian dollar steadied after a data-induced fall last week as it found support from ongoing risk appetite and oil maintaining elevated levels above $77. The loonie underperformed last week after data set a higher bar for the Bank of Canada to raise rates from 5%. Consumer inflation cooled below 3% to the lowest level 27 months, while the highest borrowing rates in 22 years contributed to weaker retail sales – all of which pointed to a moderating Canadian economy. Canada’s marquee event lands with a Friday survey on monthly growth that’s forecast to increase by 0.4% in May after it stalled in April.

Dollar rises to ceiling of weekly range

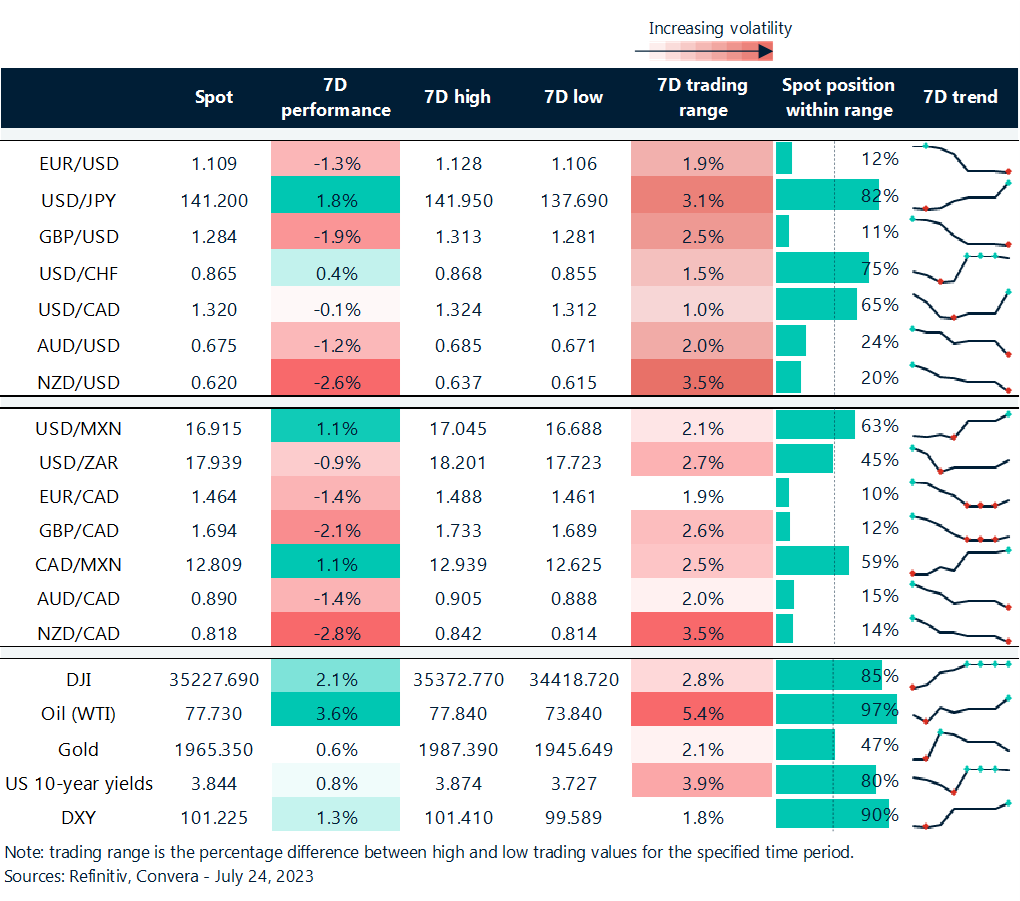

Table: rolling 7-day currency trends and trading ranges

Key global risk events

Calendar: July 24-28

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.