Written by Convera’s Market Insights team

Sigh of relief after US inflation report

Boris Kovacevic – Global Macro Strategist

Although the Federal Reserve’s (Fed) preferred inflation gauge (core PCE) started the year on stronger footing, rising by 0.4% in January, the data was in line with expectations and didn’t come in hot like the CPI numbers a few weeks ago. Hence, markets maintain their bets that the Fed should deliver its first interest rate cut in June. US yields turned lower, and the US dollar index erased two days of gains.

US stocks reacted favourably to the inflation report, with the S&P500 and Nasdaq rising 0.5% and 0.8% respectively on hopes the Fed will begin cutting rates this summer. The risk rally was also fuelled by outstanding unemployment claims rising to their highest in three months, pointing to some labour-market softening in the US. Delving deeper into the PCE report though, the largest monthly rise in more than a year overshadowed the base-effects driven fall of the annual core inflation rate from 2.9% to 2.8%. One metric of particular interest to Fed chair Jerome Powell, the services inflation excluding housing and energy, even rose by 0.6% from a month ago, the most in 22-months. However, the highly anticipated report has not been able to move the needle much when it comes to market’s pricing of future Fed policy. While the trifecta of rebounding inflation prints in the form of the CPI, PPI and PCE reports has now been completed for January, it seems that investors took comfort in the fact that inflation did not exceed economists’ expectations. January is also seen as being plagued by multiple one-off factors as companies adjust prices at the beginning of the year, which means that investors continue to patiently await new data to strengthen their conviction trades.

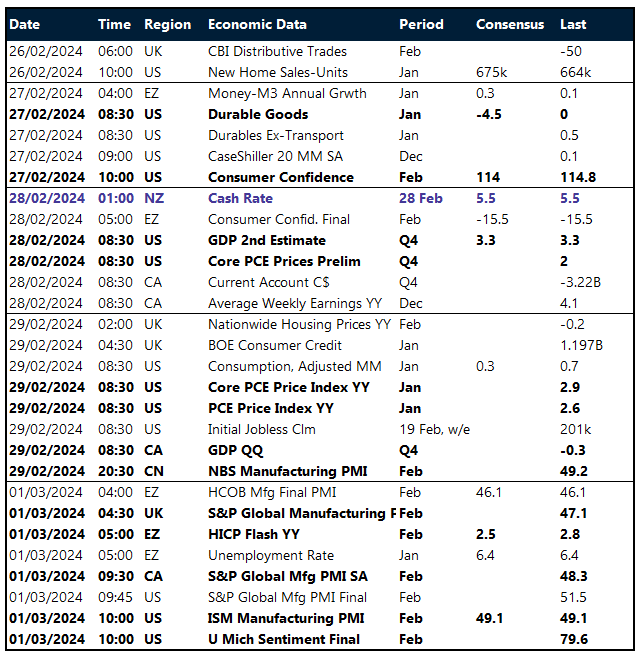

The big three upcoming macro releases that could act as volatility catalysts will be today’s ISM manufacturing PMI, the non-farm payrolls report on the 8th and CPI report on the 12th of March. Upside surprises could keep dollar selling at bay, but over the medium-term, we think because it’s a case of “when” not “if” the Fed cuts rates this year, the dollar should weaken against its major peers, and we may have already seen its 2024 peak.

Sterling rangebound as UK Budget beckons

George Vessey – Lead FX Strategist

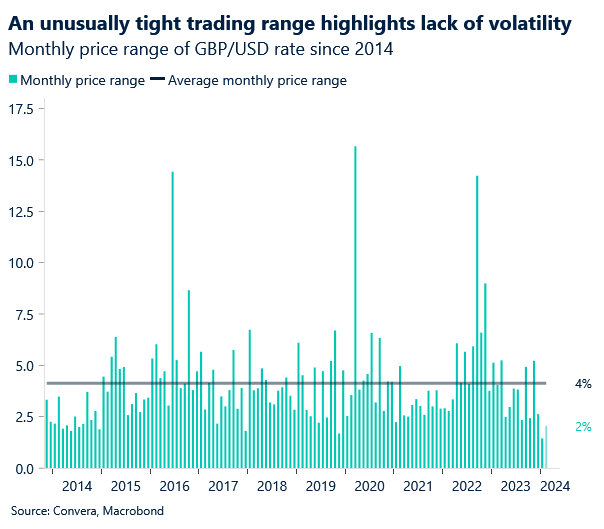

The eagerly awaited US inflation report yesterday did little to buck the trend of market inertia. GBP/USD swung in a measly 0.4% range yesterday and ended the day lower, but still in the middle of its 3-month trading range. Whilst realised volatility is historically low, market implied volatility in GBP crosses is also at multi-year lows, suggesting traders aren’t expecting things to liven up any time soon either.

Even as the UK Spring Budget next Tuesday looms, markets are relaxed ahead of the event, a far cry from the conditions that prevailed during the Liz Truss fiasco in October 2022, which saw implied volatility spike to levels comparable to the Brexit vote and Covid shock. This contributed to GBP/USD hitting a record low under $1.05. We’ve since seen the pound recover to above $1.30 (July 2023), fall back to $1.20 (October 2023) and stabilise between $1.25-$1.28 over the past three months. This quiet period is highly unusual, but it also supports the pound given its high-yield appeal when it comes to carry trades. Will the UK fiscal event shake things up next week though? Most of the time, the pound barely bats an eye lid, but with a UK election on the horizon, the Chancellor could bring forward a relatively significant package of tax cuts despite limitations of increasingly tight fiscal forecasts.

How will rates and FX traders react to fiscal loosening when the Bank of England is also expected to cut interest rates this year? Could we see a further hawkish repricing in rates, pushing out the date of the first rate cut and will this strengthen the pound as it should or weaken it like we saw in 2022? January was dry, February was a flop, could March be messy for sterling?

Lower German inflation renews ECB rate cut bets

Ruta Prieskienyte – FX Strategist

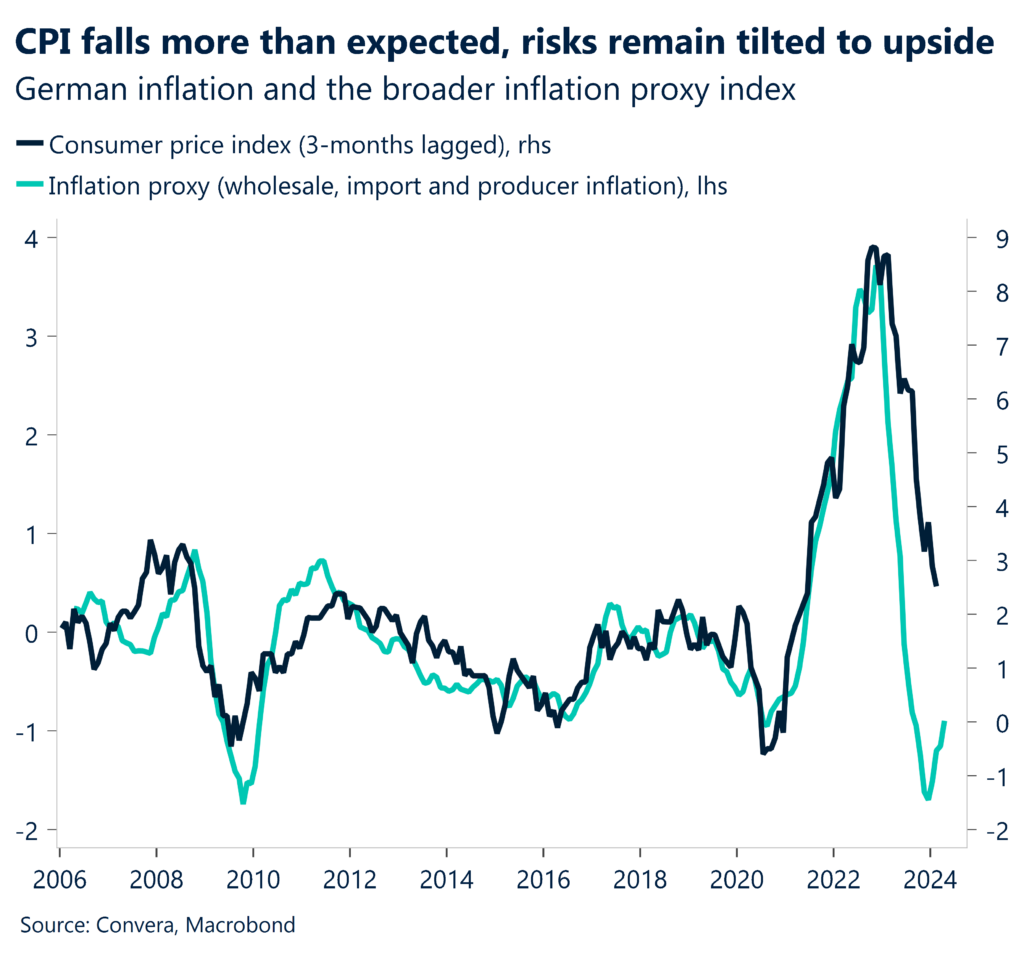

The euro held above the $1.08 threshold as US PCE price figures weighed on the US dollar and weaker-than-expected German inflation data provided room for the European Central Bank (ECB) to start cutting interest rates as soon as June.

Preliminary CPI reports from Europe’s largest economies indicated Germany’s inflation rate declined to 2.5% in February, more than market expectations of 2.6% and reaching the lowest level since mid-2021. Similarly, the French inflation rate also eased to 2.9% in February, marking the lowest level since January 2022, and Spain’s rate dropped to a six-month low of 2.8%, with both readings slightly above market expectations of 2.7%. Despite some recent positive inflation surprises recently, the ECB remains vigilant urging markets not to get ahead of themselves by prematurely declaring victory against inflation. On Monday, ECB President Lagarde emphasized the need for further evidence indicating that price growth is converging towards their target before starting to loosen monetary policy. A number of Governing Council members are waiting for clearer wage growth data before supporting a policy rate cut move. Having said that, investors have upwardly revised their ECB rate cut expectations, increasing the probability of a June cut to 79%, up from 73% beginning of the week. Overall, money markets expect 91bps cumulative rate cuts by year-end.

February’s extra ‘leap year’ day was not enough for the euro to remedy its lackluster start to the year against the US dollar, with EUR/USD depreciating for the second consecutive month in February. On an annual basis, the pair is down by 2.1% – the worst YTD performance since 2021 and is likely to feel further downside pressure with wider Eurozone inflation print due shortly this morning. Meanwhile, euro continues to outperform other G10 currencies, gaining 1.7% and 2.2% YTD against safe haven currencies of JPY and CHF respectively.

US 2-year yields down by close to 2% in a week

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: February 26 – March 1

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Join us for Convera Live! A series of in-person events discussing the future of global payments.