Global overview

Across the board gains lifted the U.S. dollar to multiweek highs. The greenback firmed against the Canadian dollar and rose to its highest in three and six weeks versus sterling and the euro, respectively. The dollar has gained altitude over the past week as it’s served as a safe harbor from rising concerns about the outlook for global growth. Signs of a resilient U.S. economy, meanwhile, have pushed off the table prospects of the Federal Reserve slashing borrowing rates anytime soon. The dollar started to bounce higher last week after data once again revealed that U.S. inflation remains stubbornly elevated. A gauge of longer-term prices pressures ticked up to 3.2% in May, the highest level since 2011. The dollar has sustained its higher ground for now thanks to news this week of a resilient American consumer as retail sales bounced back in April despite the headwinds of high inflation and higher lending rates. The Fed next meets in mid-June with markets no longer pricing in the risk of a rate cut compared to a roughly 17% likelihood a month ago.

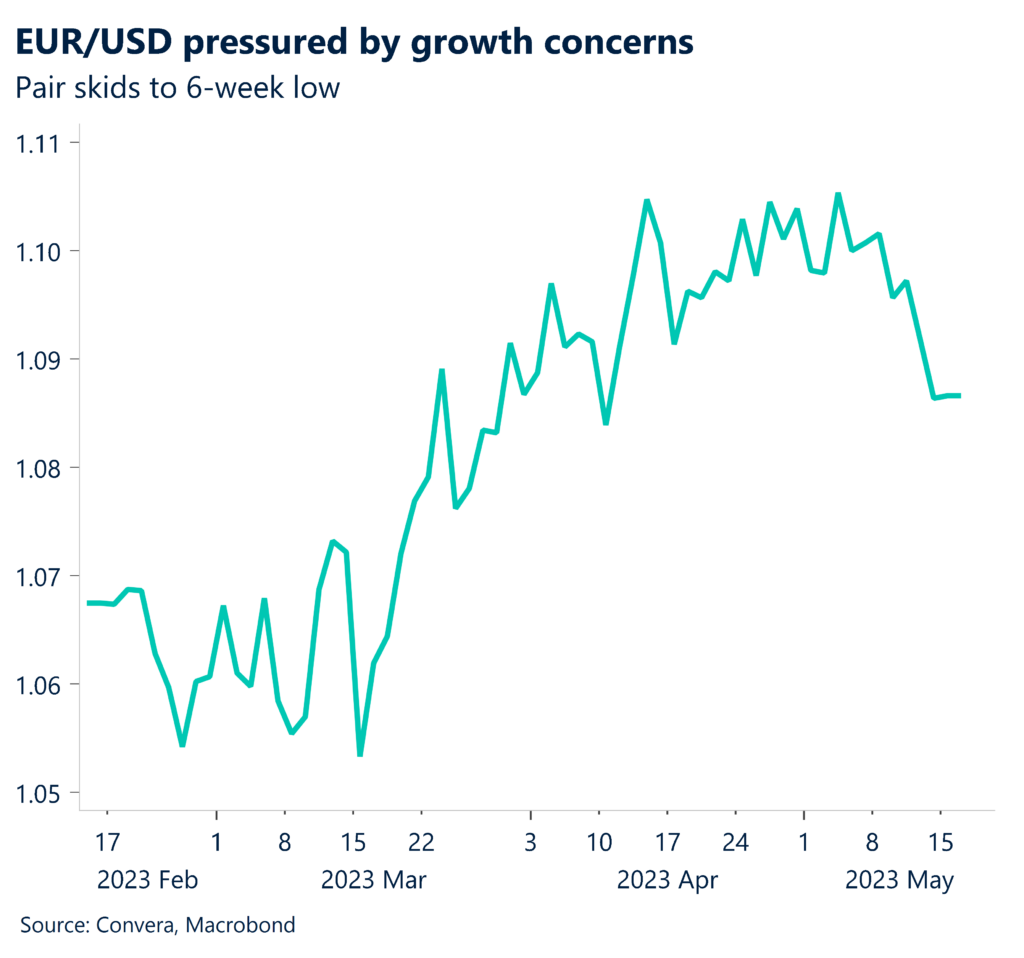

Euro sinks to 6-week low

Another leg lower knocked the euro to its lowest level in weeks versus its firmer U.S. rival. Mounting concerns about the health of Europe’s largest economy continued to gnaw at the euro, pushing it to six-week lows. The latest blow came from news that German investor confidence weakened for a third straight month in May, when it printed below zero for the first time this year. Growth concerns suggest less scope for the European Central Bank to raise interest rates to fight elevated inflation.

Sterling hits a 3-week bottom

A more than two-cent drop over the past week has knocked sterling from one-year highs to three-week lows verses the U.S. dollar. The pound has been dogged by the notion that the Bank of England may be closer to the finish line for raising borrowing rates than previously thought. The BOE raised rates last week but was a bit tight-lipped about how much further it would have to increase them amid its multiyear fight against inflation. Meanwhile, a surprise uptick in UK unemployment added to renewed growth concerns that have weighed on sterling.

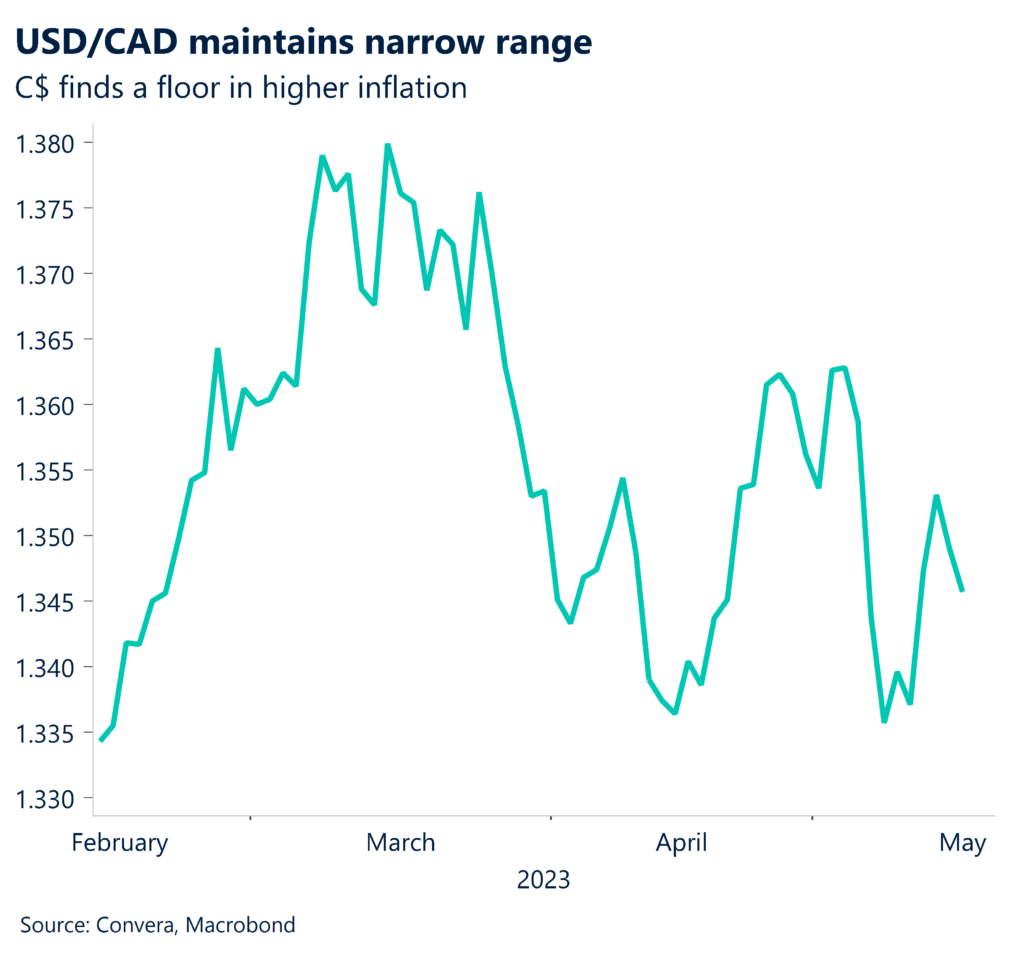

C$ buoyed by hotter inflation

While little changed early Wednesday, the Canadian dollar maintained a weekly gain against the greenback after hotter than expected domestic inflation depicted a still open door for the Bank of Canada to lift borrowing costs. Canadian inflation ticked up to a 4.4% annual rate in April, compared to forecasts to cool to 4.1% from 4.3% in March, the lowest level in 1 ½ years. While Ottawa is not expected to raise rates when it meets on June 7, the odds of a quarter-point hike to 4.75% from 4.50% have edged up to about 20% from roughly 10% before this week’s inflation report.

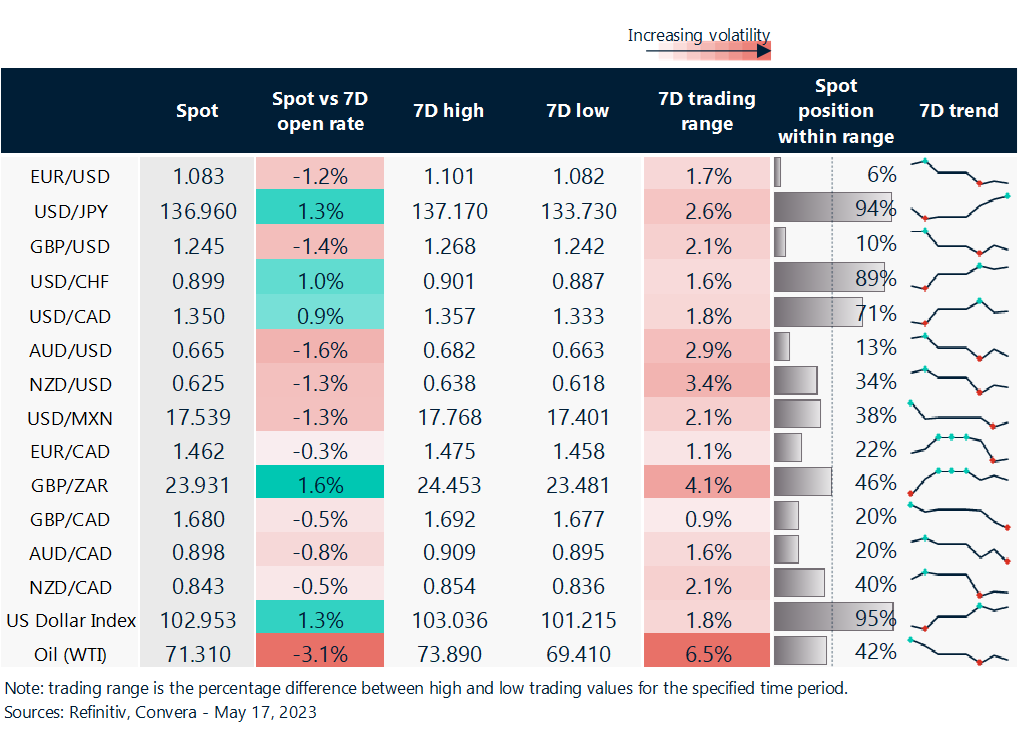

European currencies hit multiweek lows

Table: rolling 7-day currency trends and trading ranges

Key global risk events

Calendar: May 15-19

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.