Written by Convera’s Market Insights team

Slight pushback on easing financial conditions

Boris Kovacevic – Global Macro Strategist

The last economic data patch out of the US before today’s thanksgiving holiday helped the US dollar bounce back slightly from its 2 ½ month low set on Tuesday. While investors have already committed to pricing out any potential rate hikes for this year, incoming data continues to play a role regarding the markets expectation of how much the Federal Reserve will need to ease monetary policy in 2024. Yesterday’s upside surprise in US consumer inflation expectations and lower than expected initial jobless claims with the very stretched overbought position of the Greenback going into the week gave investors some ground to buy the dollar again.

The year-ahead inflation expectation from US consumers jumped by 30 basis points to 4.5% in November, reaching the highest level in 7-months. While consumer price growth continues to moderate, the worsening inflation outlook from households was largely driven by the increase in expected gas prices. Longer-term inflation expectations remained steady at 3.2%, the highest level since 2011. Meanwhile, another report highlighted the tightness of the US labor market with the number of Americans filling for unemployment benefits falling by 24 thousand to 209 thousand on the week ending November 18th. Seasonality issues have been a challenge for the Labor Department in recent times, which makes it difficult to place too much importance on individual data points. Given other signs of a cooling labor market in the form of weaker jobs growth and falling job openings, a rising trend in the jobless claims cannot be ruled out in the next months.

Investors have taken the opportunity of the recent easing of financial conditions to reallocate capital into risk assets like the euro, pound, and equities. The 10-year real yield has fallen by 40 basis points from its 16-year high reached at the end of October and the US term premium has slipped back into negative territory. The 30-year fixed mortgage rate has pushed lower for four consecutive months now, coming in at 7.29%. However, conditions overall remain tight and dollar bears will need to hope for continued weakness in US economic data to justify their positioning.

Sterling stutters after UK budget update

George Vessey – Lead FX Strategist

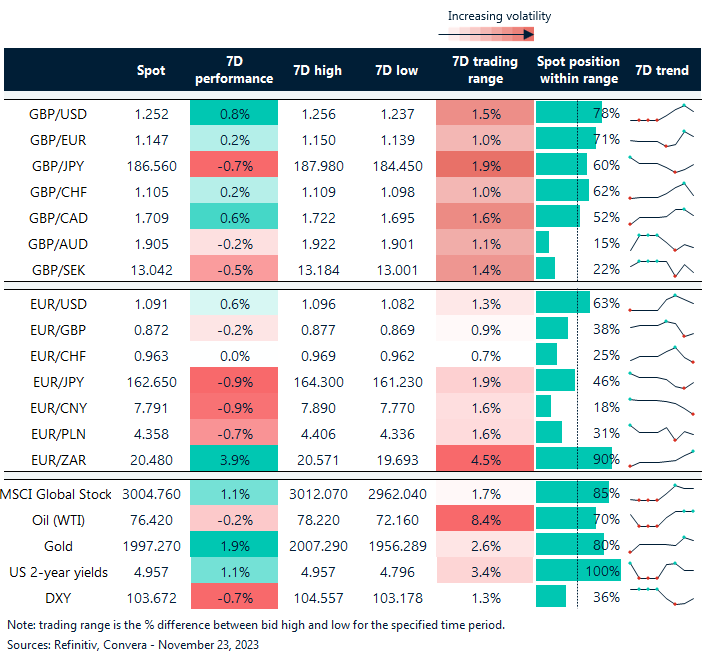

UK stocks, bonds and the British pound slumped, albeit modestly, after UK Chancellor, Jeremy Hunt’s, fiscal update in the Autumn Statement yesterday. GBP/USD surrendered the $1.25 handle and GBP/EUR inched south of €1.15, but GBP/JPY extended towards ¥187 as investors continue to digest the notion that global monetary policy will likely stay restrictive for some time.

In his address, Mr Hunt unveiled cuts to personal and business taxes in a bid to boost growth, and the Conservative party’s electoral chances. There was bad news from a macro-economic perspective though as UK growth is forecast to reach 0.7% in 2024, according to the latest projections from the Office for Budget Responsibility (OBR), far below a forecast in March for an expansion of 1.8% next year. A decrease in inflation to 2.8% by the end of 2024 was also forecast, again a stark contrast to March’s estimate of 0.9%. So, with growth forecasts downgraded and inflation forecasts upgraded, it keeps the BoE’s balancing act intact, but we still lean towards rate cuts as the next policy move, perhaps by summer of 2024. Although demand for UK assets eased after the budget update, the market reaction was rather muted overall, a far cry from the turmoil witnessed when UK tax cuts were last unveiled by Liz Truss’ government a little over a year ago.

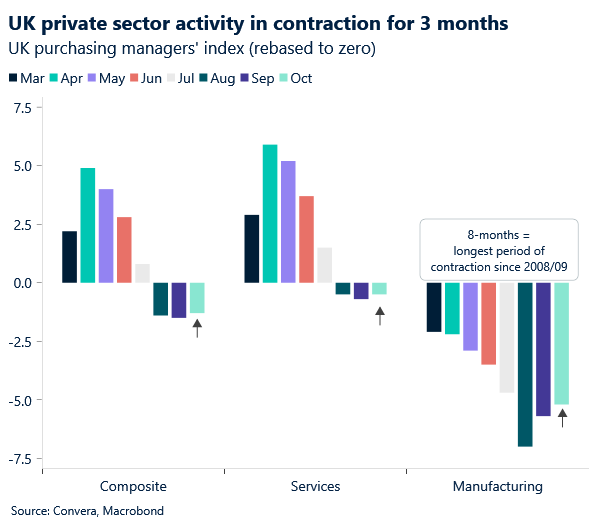

Today, the pound is back on the offensive against the dollar and trading above its 100-day moving average once again, having found support at its 200-day moving average yesterday. Flash industry PMIs are the main focus this morning, to discover whether Britain’s key sectors remain in contraction territory.

Eurozone consumer morale improves to 3-month high

Ruta Prieskienyte – FX Strategist

The euro fell under $1.09 against the USD briefly yesterday, after the latest FOMC meeting minutes showed that the US Fed policymakers unanimously favored a cautious approach towards future interest rate adjustments and based any future moves on progress toward their inflation goal. Still, the common currency remains close to its 3-month high. The STOXX 50 closed at over 3-month highs while bond markets remained relatively stable as central bank officials offered little to dissuade investors from expecting a potential future decrease in interest rates.

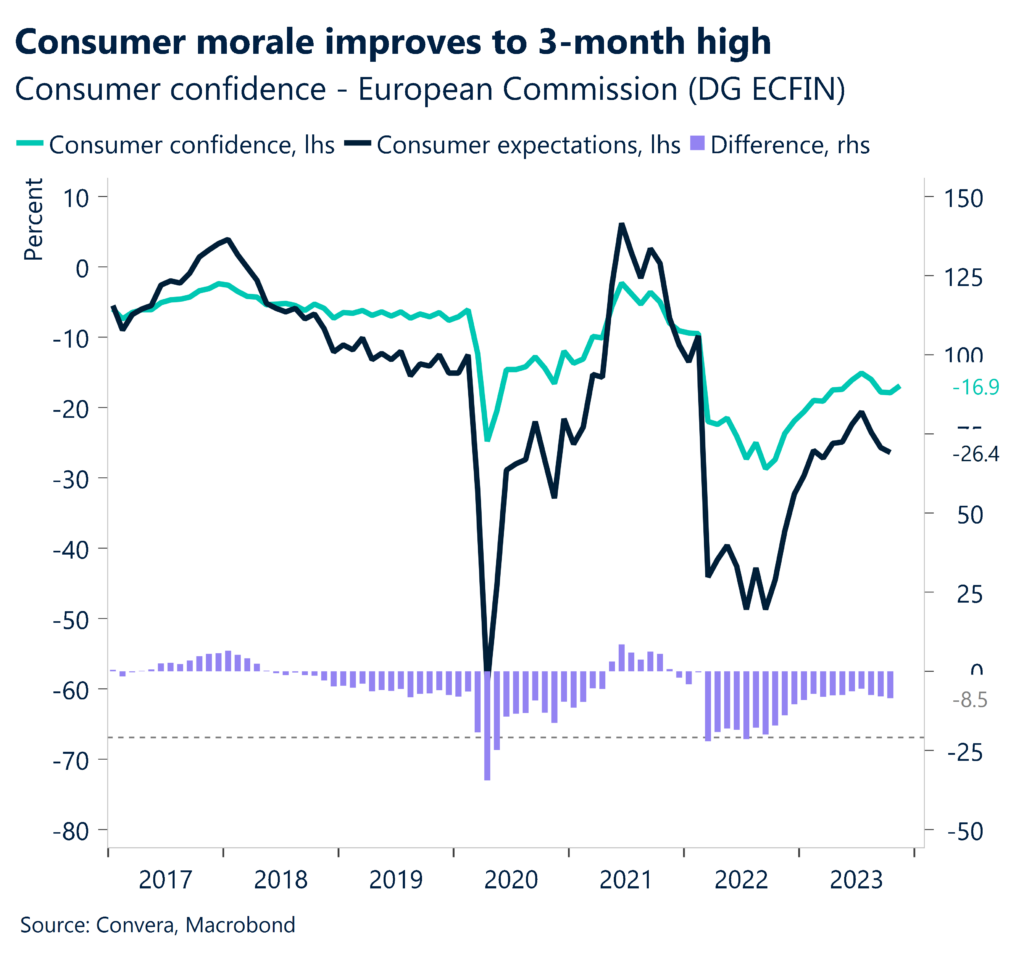

The Eurozone consumer confidence indicator rose by 0.9pts to -16.9 in November, the highest in three months and above market expectations. Expectations for the financial situation over the next 12 months continued to bounce back as consumers are growing more optimistic that interest rates will not go up further and might start going down as inflation continues to cool. Having said that, optimism over the current economic situation hit an 8-month low, in a stark contrast to improving investor morale. Overall, still-subdued EZ consumer confidence suggests that households will continue to hold back spending over the coming months, delaying the economic rebound. While a further improvement in sentiment is likely now that inflation of frequent-out-of-pocket purchases is declining sharply, the trend will not be linear. Consumer spending is likely to remain depressed in Q4 ahead of the holiday spending season.

The November purchasing manager indices are due shortly this morning, in what is likely to be a highly watched and market moving event. Last month the EZ composite PMI sank to a new cyclical low, while services PMI touched a fresh three and a half year low. Markets are expecting a rebound and will be vigilant for signs signaling the bottoming of the Eurozone economy. A slight miss to the downside would be euro negative and could pull EUR/USD back under $1.09.

JPY and CNY battling back

Table: 7-day currency trends and trading ranges

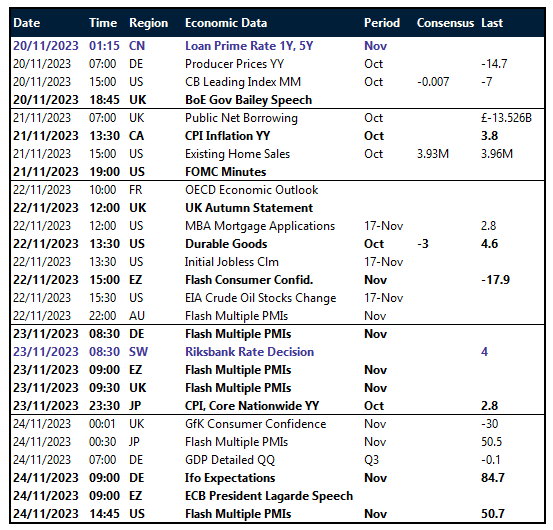

Key global risk events

Calendar: November 20-24

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.