Written by Convera’s Market Insights team

Watch out for hawk talk

George Vessey – Lead FX Strategist

The US Federal Reserve’s (Fed) Open Market Committee meeting today is one of the main risk events today, following a batch of important US data releases. No change in rates is widely expected, but the probability of the Fed being hawkish, at least rhetorically, has increased significantly. The US dollar recorded is fourth monthly rise in a row in April thanks to US yields surging to fresh 5-month highs on the higher-for-longer Fed narrative.

The Fed’s data dependence increases the uncertainty in the forecast for the path of monetary policy as any deviation, particularly in inflation, from the central bank’s expectation could give it pause. Indeed, with the 3-month average jobs growth running at 244 thousand and 3-month annualised core inflation at 4.5%, Fed officials will most likely hold rates unchanged for several meetings. Even yesterday we saw the employment cost index, the Fed’s preferred measure of labour costs, accelerated by 1.2% during the first quarter, the most in one year and firmly above expectations of 1% to underscore persistent wage pressures that can magnify the impact of stubborn inflation in the US economy. This provides further ammunition to justify a hawkish Fed shift today. Recall, Fed Chair Jerome Powell dropped the reference that interest rate cuts “will likely be appropriate” at some point this year at the Fed’s last meeting. This time around, there could be some questions about whether the Fed would consider raising interest rates and investors will be listening closely to how Powell responds. Market expectations for cuts have been severely dialled back already over recent months though, pricing less than two cuts for 2024, a marked change from six priced at the start of the year. There is now even a 25% chance the Fed doesn’t cut rates at all this year.

Ahead of the Fed’s decision, the ISM manufacturing PMI survey and JOLTS job openings data will be published which could trigger more volatility today. From last month’s ISM prints we put forth three critical theses: (1) The manufacturing sector is bottoming, while the services sector has peaked. (2) The US dollar continues to be data driven and sensitive to the macro environment. (3) Hard data is moving the dollar more than soft data.

Pound fails to break above descending trendline

George Vessey – Lead FX Strategist

After GBP/USD rebounded over two cents in a week from around $1.23, it has so far failed to close above its 200-day and 50-week moving averages, pouring cold water over its recovery attempts. The currency pair remains trapped in a descending trend channel that’s been in place since early March as traders await further directional clues from the Fed and US data today.

The daily chart patterns don’t bode well for the pound, with 14-day momentum readings being negative for over a month and the minimum correction (23.6%) of the $1.23 to $1.2570 climb being met this week. In the short-term, risks appear skewed to the downside for now, especially if the US-UK rate outlook continues to diverge. Sterling also broke a 5-day rising streak against the euro yesterday, but GBP/EUR remains afloat the €1.17 handle and is still up 1.5% year-to-date as investors believe the BoE is likely keep rates higher for longer than the ECB. GBP/EUR remains one of the most stable currency pairs in the FX space due to UK-EZ economic similarities. However, the pound continues to find decent support at its key 100-month moving average just below €1.16.

Markets are currently pricing in an 65% chance of a first move by the BoE in August while discounting around 40 basis points of cuts by year-end, implying a 60% chance of a second cut in 2024.

Euro sags despite region exiting recession

Ruta Prieskienyte – FX Strategist

Yesterday’s macro packed day created plenty of buzz across the markets, delivering plentiful of surprises. EUR/USD initially rose above $1.072 as Eurozone GDP surprised to the upside, but the pair soon pared winnings as the dollar extended gains in month-end trading after a hotter-than-expected reading of employment costs drove Treasury yields higher.

Headline Eurozone inflation for April remained steady at 2.4% y/y, in line with market expectations, while the core, a crucial underlying measure that filters out volatile food and energy prices, further cooled to 2.7% y/y, down from 2.9 y/y in the previous month, confirming the disinflationary narrative. We also learnt that the bloc expanded by 0.3% in Q1 2024, the fastest growth rate since the third quarter of 2022, and substantially above market expectations (+0.1%). The data gave the ECB an additional reason not to rush cutting rates to a larger extent this year, especially should inflationary pressures prove to be more stubborn going forward. Near term pricing on the overnight index swaps remained largely unchanged, with money markets pricing 21bps of easing in June (≈90% probability), but year-end expectations were scaled back to 65bps (-6bps d/d).

Month end portfolio rebalancing saw choppy trading with 1-day EUR/USD realised volatility rising to 6.8% – above the 1-year average. Overall, the euro closed April on a positive note, having appreciated on average by 0.7% against its G10 peers. EUR gained the most against JPY (+3.4% m/m), while recording the largest losses against AUD (-0.5% m/m). EUR/USD closed 0.3% lower on the month. Ahead of the FOMC, technicals point to a range bound environment with near-term support at $1.0629 (100-week SMA) and resistance at $1.0724 (21-day SMA). Overnight EUR/USD risk reversals further skewed in favour of puts, meaning market participants are worried about further potential downside risk during the Fed meeting later today. Speaking of, on a typical FOMC day, we tend to observe EUR/USD appreciate by an average of 0.14% d/d on a close-close basis, but this time could be different due to the risk of a hawkish Fed further supporting dollar demand and dragging EUR/USD to the low $1.06s yet again.

JPY still at mercy of broad selloff

Table: 7-day currency trends and trading ranges

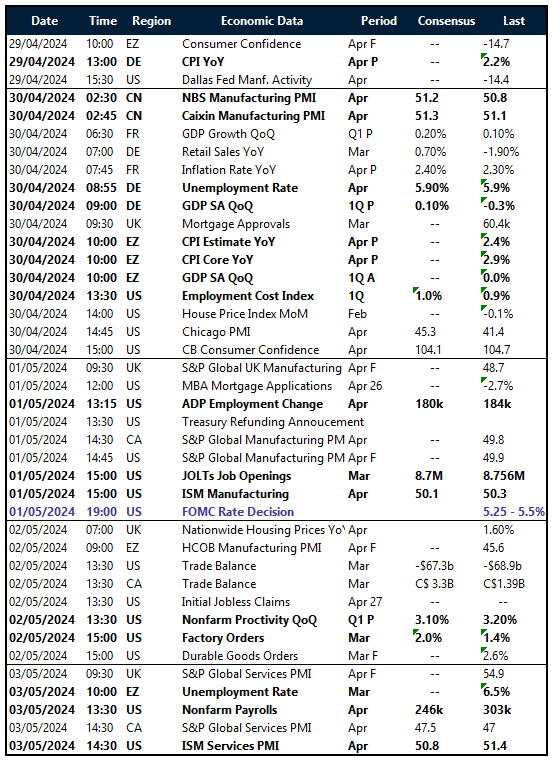

Key global risk events

Calendar: April 29 – May 3

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.