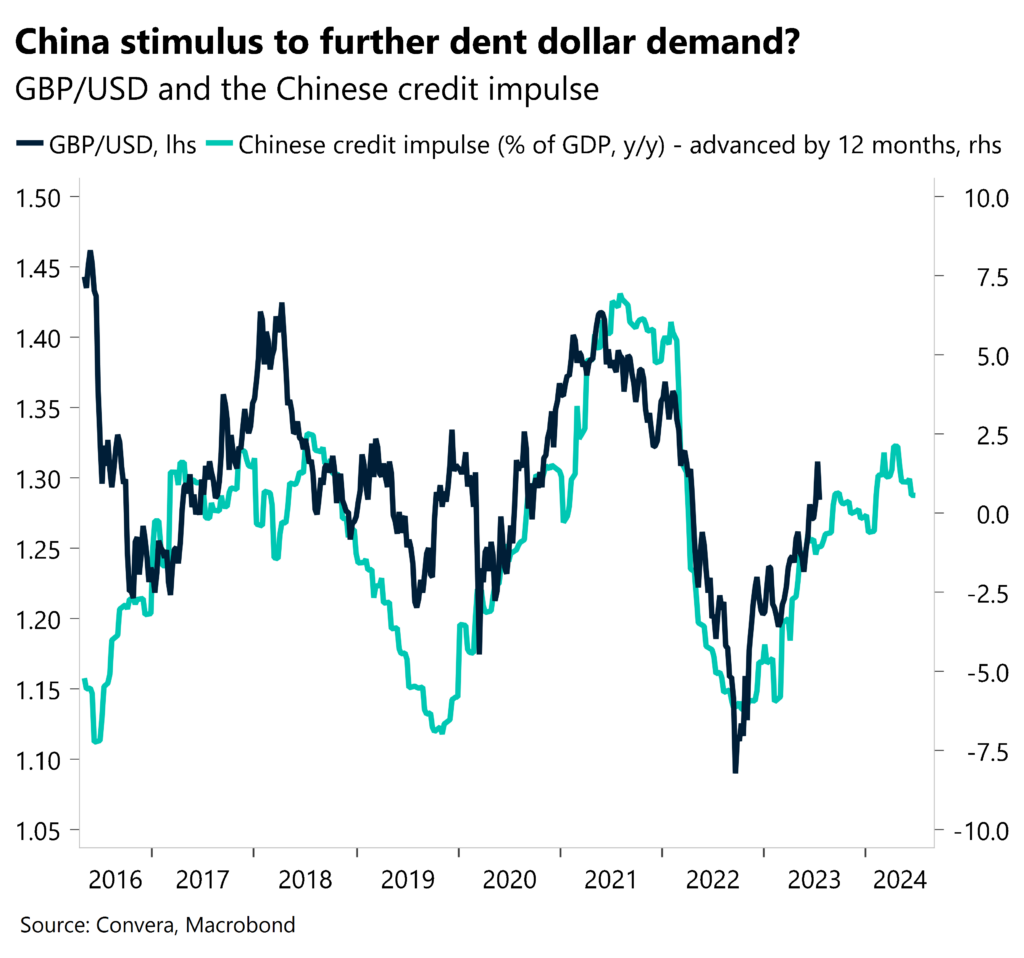

Dollar softens as China stimulates

Ahead of the US Federal Reserve’s (Fed) key policy decision tomorrow, attention shifted to China following the closely watched Politburo meeting where China’s top leaders vowed to provide more stimulus for the country’s wavering economy. China’s yuan and the Australian dollar, often a liquid proxy for the yuan, jumped with improved global risk appetite, whilst the US dollar softened after four successive daily gains.

The optimism coming out of China and for the global growth outlook is being tempered by the pessimism coming out of Europe though. Furthermore, most major central banks are keeping their feet firmly on the monetary breaks – keeping policy tighter for longer in an aim to slow the rate of inflation back towards their 2% targets. Amid tighter financial conditions, we’re finally starting to witness the lagged impact on the real economy. In the US, the latest PMI readings indicated the softest pace of expansion in private sector business activity since February, with service activity growth easing to a five-month low, and manufacturing output levels remaining relatively unchanged. Still, the US economy seems to be more robust than its European peers, which in theory should be constructive for the US dollar so long as rate differentials don’t drastically change.

Today, a decent tick-up in the US consumer confidence reading for July is expected amid a growing sense that consumers have so far been able to handle the pain of higher interest rates. But investors remain braced for the Fed’s decision tomorrow and more importantly its accompanying communication.

Waning resilience of UK economy

The pound clocked seven straight days of losses against the US dollar, its longest losing streak since the onset of the pandemic in 2020. Monday’s decline was a result of flash PMI surveys showing Britain’s private sector growing at its slowest pace in six months in July. GBP/USD fell to a two-week low sub-$1.28 briefly, but has fund support on improved global risk appetite following Beijing’s vow to bolster China’s economy.

Britain’s economy held up better than expected in the first half of 2023, avoiding a recession that many, including the Bank of England (BoE), had predicted. However, signs of stalling economic resilience are emerging, suggesting that the surge in interest rates is starting to bite. The UK’s preliminary composite PMI reading for July came in at 50.7, down from 52.8 in June in the biggest month-on-month drop in 11 months. Although above the 50-level that separates growth from contraction, it was the weakest reading since January. Moreover, forward-looking indicators, including flatlining new orders and lower business optimism over the future, point to growth weakening in the near-term. There was slightly better news on the inflation front though as manufacturers reported an outright fall in input costs for the third consecutive month. But services firms again reported that strong pay growth was driving up input costs. This is one reason why services inflation is likely to remain sticky.

Rate expectations in the UK have fluctuated wildly recently, taking the pound on a volatile ride this month. Since the below-forecast UK inflation print last week, BoE terminal rate expectations have dropped from around 6.2% to 5.7%, erasing the UK-US 2-year yield premium and contributing to the pound’s 2.5% depreciation from its 15-month peak above $1.31.

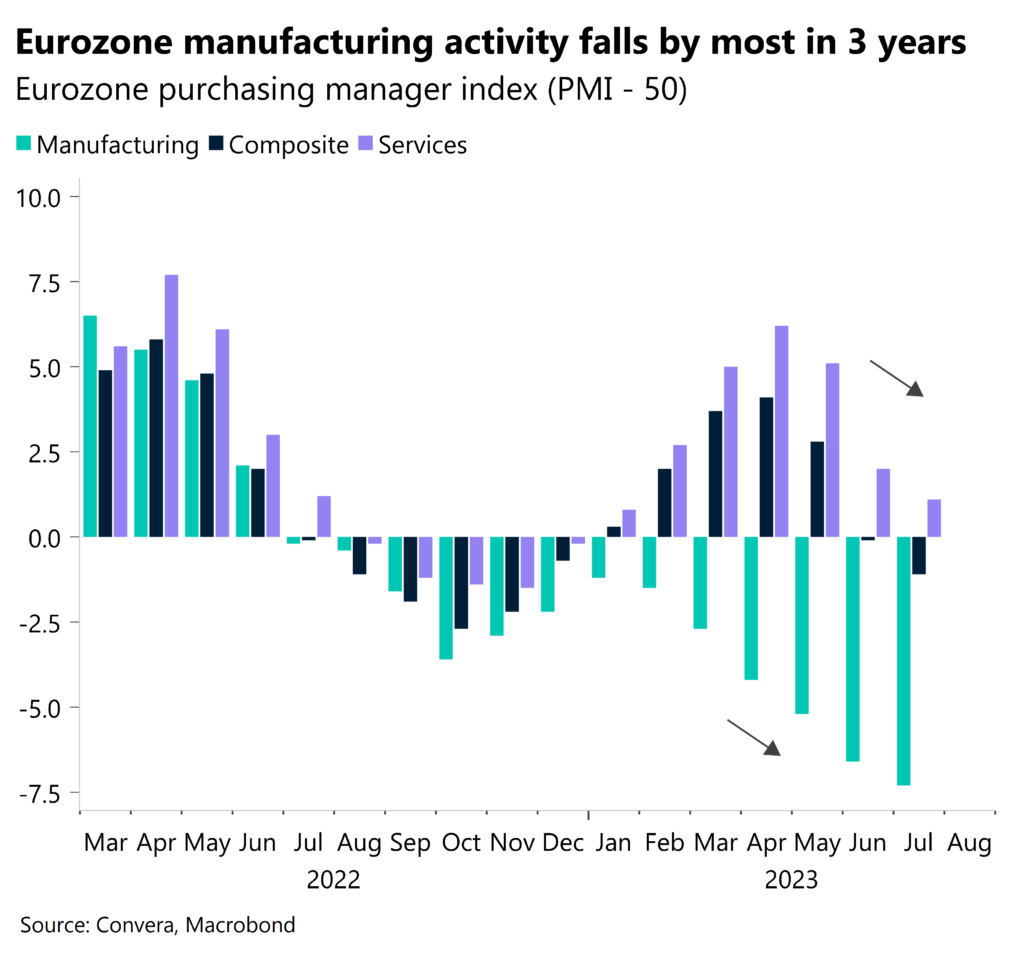

Recession warnings flash in Europe

The euro declined more than 0.5% versus the US dollar yesterday after a sharp decline in European PMI gauges reignited recession fears. Preliminary PMI data showed business activity contracted in France and Germany in July, with Germany suffering the steepest pace of deterioration in the manufacturing sector since the aftermath of the pandemic in May 2020.

The private sector of Europe’s economic powerhouse fell into contraction territory for the first time since January. The overall Eurozone economy also contracted more than anticipated, with order inflows and output expectations pointing to the downturn deepening in the coming months. Manufacturing continues to be the Achilles heel across Europe, and while the services sector remains in expansion, growth has slowed for three months running. The European Central Bank (ECB) will likely deliver another 25-basis points rate hike this Thursday, bringing borrowing costs to multi-year highs, but signs of cooling inflation and particularly weak economic data might prompt the ECB to revise its inflation forecasts in September, potentially scaling back rate hike expectations and weakening the euro.

Currently, markets see the ECB cutting rates by circa 75 basis points over the course of 2024, so the challenge for the ECB this week will be to convince markets of a tighter for longer rate regime to tame inflation despite the obviously weakening economic outlook. Overnight, the common currency has been supported by China’s stimulus pledges, but the path of least resistance, in our view, is to the downside until we receive more details from the upcoming central bank meetings.

Rallying oil prices boost CAD

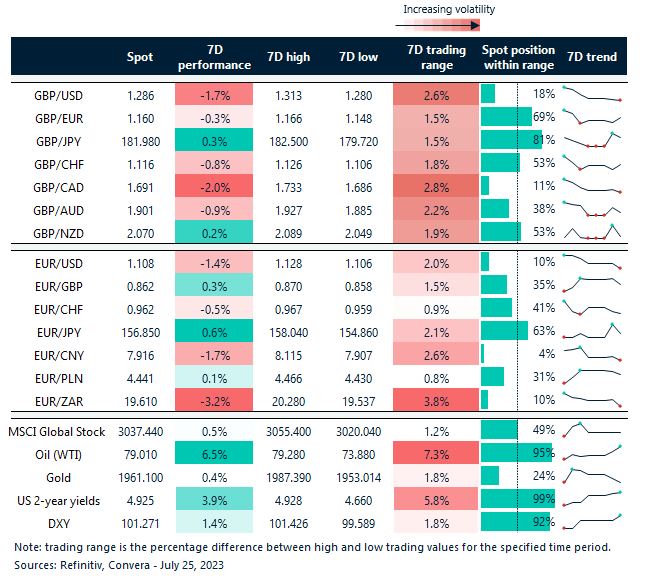

Table: 7-day currency trends and trading ranges

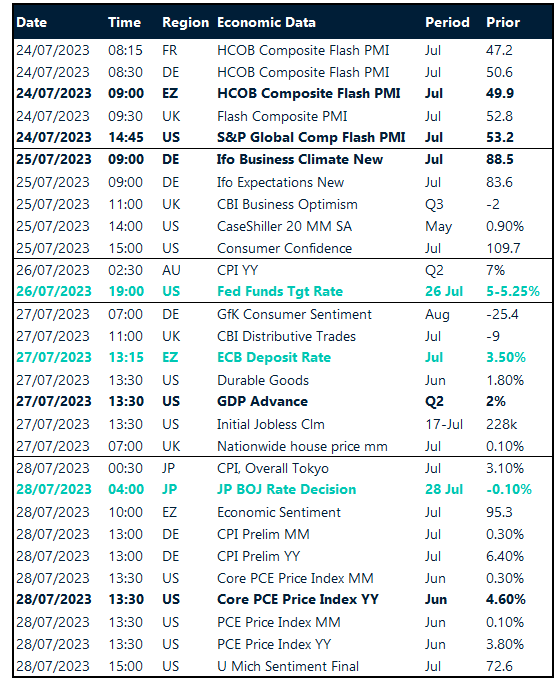

Key global risk events

Calendar: July 24-28

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.