Dollar dips despite surging yields

The US dollar index is on track for its third daily decline in a row but is holding just above its 200-day moving average ahead of flash purchasing manager indices (PMIs) due tomorrow and the Jackson Hole Symposium later this week. Meanwhile, the yield on the 10-year Treasury note advanced past the 4.3% mark on Monday, the highest since November 2007.

Investors remains cautious about the hawkish outlook for the Federal Reserve (Fed) and higher bond supply from the US Treasury. The US bond market resumed its selloff, driving yields to 16-year highs in a sign that bondholders are bracing for the risk that monetary policy will remain tight. However, risk aversion took a breather yesterday as the S&P 500 finally ended its longest losing streak since February. The tech-heavy Nasdaq also rebounded over 1.5%. Although the dollar remains close to its 10-week peak, thanks to the bullish impulse from surging long-term yields, its gains can be seen mainly against the low-yielding Japanese yen and Chinese yuan. Both the euro and pound, meanwhile, continue to recover against the US currency, in line with equities rebounding and hence dragging the dollar index lower overall.

The focus today remains on yields ahead of Friday’s speech from Fed Chair Jerome Powell at the Jackson Hole symposium. But today we’ll also be monitoring existing home sales data in the US, which have fallen just shy of 40% since the pandemic. The Richmond Fed manufacturing index is also expected to record its eighth consecutive result in negative territory.

Pound eyes 200-day moving average

After advancing for the first week in five, GBP/USD has continued its recovery and looks poised to test the $1.28 handle, which is where its 10-day moving average resides. Its 200-day moving average is located 10 pips shy of $1.29 and is seen as the next crucial upside target to overcome for the pound to extend back above $1.30.

The expectations of weaker flash PMIs from the UK on Wednesday might scupper the pound’s rally though. We expect to see a continuation of the manufacturing downturn and mounting stagnation in the services sector, although the composite PMI should hold above the critical 50 mark which separates expansion from contraction. The resilience of the services sector so far this year has helped the UK economy defy expectations of recession but has also pressured the Bank of England (BoE) to keep raising interest rates to combat sticky services inflation. Money markets have recently repriced the BoE’s terminal rate to reach 6% following strong wage growth and core/services inflation last week. This has also strengthened the pound’s fortunes of late.

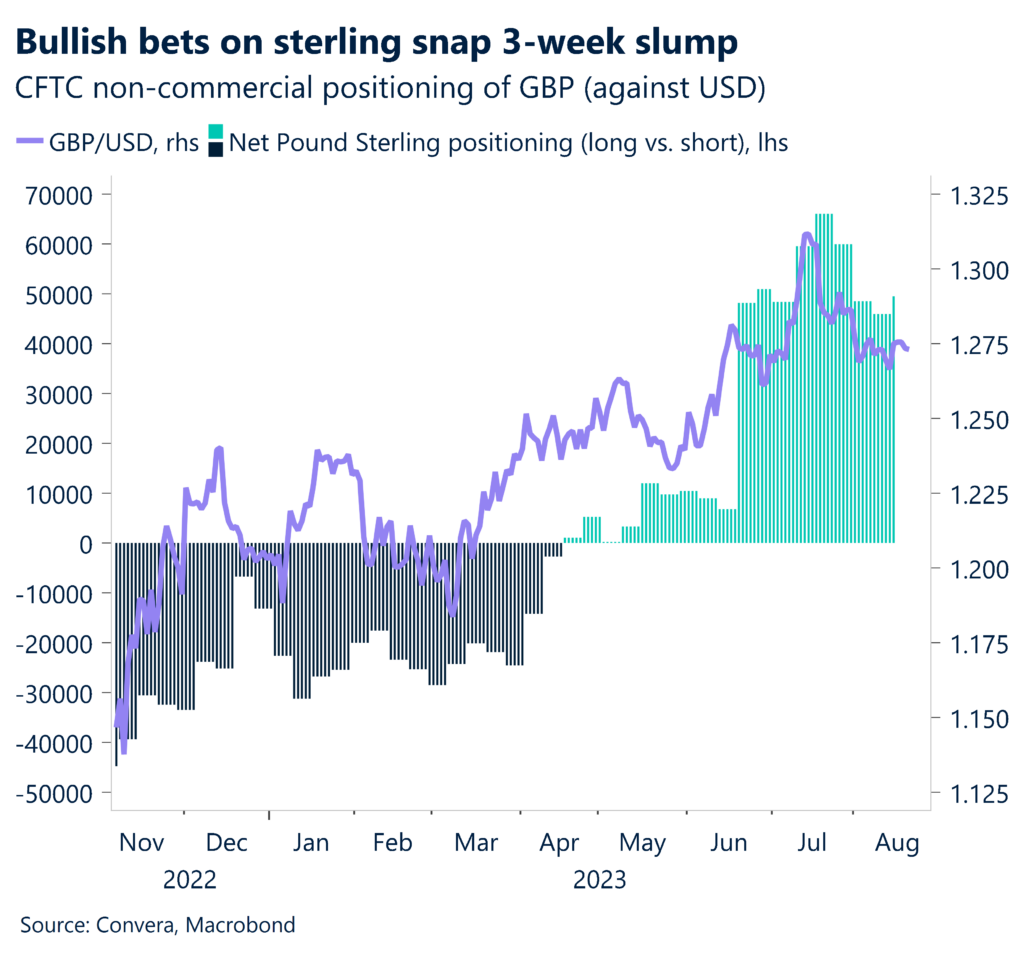

In terms of FX positioning, speculative traders have been bullish on the British pound since mid-April, and net long contracts rose to 50,988 last week from 47,020 the week before, snapping a 3-week slide from the highest level in 16 years.

Euro above $1.09 despite global turmoil

The euro is following global equities higher this morning, with investors taking comfort from the fact that no important economic data is scheduled to be released today. The pessimism surrounding risk assets has seen stocks and currencies like the euro suffer in recent weeks with the US 10-year yield rising to the highest level since 2007.

The marginal improvement of the euro versus the dollar should not be overinterpreted as the outlook for Europe and China remains bleak in the short-term. According to the Ifo institute, the downtrend in Germany’s residential construction sector does not seem to be at an end. Around 40% of companies have reported a lack of demand for housing in July, up from 10% two months ago. While wages in Europe’s largest economy have only slightly trailed inflation since 2020, housing and food prices have outstripped people’s pay by a lot. As the latest data suggests, food prices are still 18% more expensive than before the pandemic, after adjusting them by wage growth.

Investors will continue to focus on the yield rise and developments in China. The PMIs will be market moving tomorrow, with economists expecting the manufacturing contraction to continue in Europe. EUR/USD is once again above $1.09 and is looking to secure its first positive week in seven.

Chinese yuan is on thin ice

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: August 21-25

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.