Written by Convera’s Market Insights team

Check out our latest Converge Market Update Podcast which looks at how recent economic data has called into question the timing of rate cuts and triggered some significant volatility across financial markets. Could this become more frequent as central banks begin policy easing this year? Join Lead FX Strategist George Vessey as he breaks down the latest in the global macroeconomic and FX landscapes.

Dollar steadies as Fed minutes eyed

George Vessey – Lead FX Strategist

The US dollar fell across the board yesterday with the dollar index touching a 2-week low as it tracked a decline in global yields. USD/JPY briefly lost its grip on the ¥150 handle giving the Japanese yen some breathing space having been pinned near a 3-month low. A decline in the Philly Fed services sector index hurt the dollar, but it seems Canada’s inflation print caused the most volatility across financial markets yesterday spurring a decline in yields and sending the Loonie and buck lower.

Canadian consumer prices rose 2.9% in January from a year ago, following a 3.4% increase in December. That was slower than the consensus forecast of 3.3% and marks the first time since June that the headline rate fell to within the central bank’s control range. The disinflation progress looks to be resuming after price pressures reversed course at the end of last year. This gives the Bank of Canada more room to start considering rate cuts in the coming months, which led to jump in demand for bonds, sending yields lower. The yield on benchmark two-year debt plunged to just below 4.17% in its biggest daily drop of 2024 and sent the Canadian dollar tumbling against most peers.

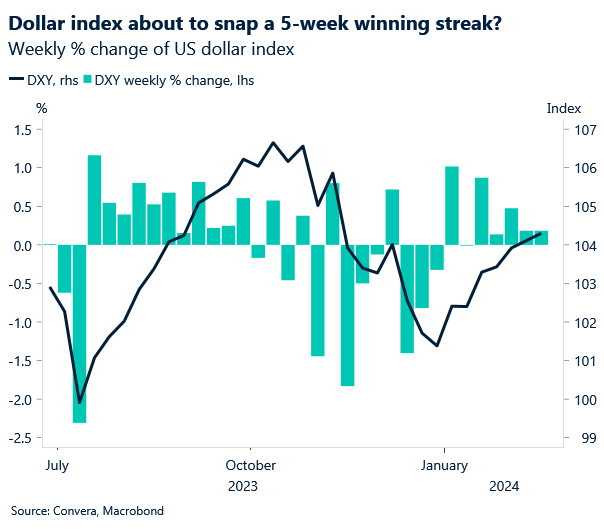

The data ramped up expectations for rate cuts by global central banks this year though and this weighed heavily on the US dollar as well. Today, all eyes will be on the Federal Reserve’s meeting minutes to provide further clarity on the outlook for US rates as the dollar index looks poised to clock its firstly weekly fall in six.

Sterling jumps and slumps

George Vessey – Lead FX Strategist

The British pound jumped versus the US dollar yesterday to score its best day in four, largely driven some mildly soft US data but it was the downside surprise in Canadian inflation, sending yields across the pond lower, which weighed on USD as well as the CAD. At the same time, the pound slumped against the euro though, breaking south of €1.17, as demand for the common currency rose following Eurozone wage data.

In the UK, Bank of England (BoE) Governor Andrew Bailey told UK lawmakers that bets on interest rate cuts this year were not unreasonable if wage growth and services inflation continue to ease. Data last week showed the UK fell into a technical recession at the end of 2023, but with a sharp fall in inflation set to support real incomes and drive a recovery in activity, the BoE is focusing on signs of an upturn in Britain’s economy. Business survey data has also strengthened, with the UK’s composite PMI reaching an 8-month high in January and is expected to remain in expansion territory when February’s figures are released this Thursday. We agree that the sharp fall in inflation will provide strong support to real household incomes and economic activity, although the pace of the upturn will be limited by the lagged impact of monetary tightening. Easing is on the horizon though and we expect the BoE to start cutting from June and deliver a total of three 25 basis point rate cuts by year-end.

Sterling will likely retain a yield advantage, supporting it in the second half of the year, but as we warned yesterday, there are some headwinds to be wary of in the short-term. GBP/USD bumped into resistance at its 50-day moving average near the $1.2670 area and reversed back towards $1.26. Meanwhile, sterling slipped to its lowest level against the euro in around a month and has fallen for six days on the trot now.

Euro breaks back above $1.08

George Vessey – Lead FX Strategist

EUR/USD managed to break above the psychological level of $1.08, which has acted as a short-term resistance barrier over the last week or so. The world’s most traded currency pair is now testing its 200-day moving average just above this level as a decline in US Treasury yields puts downward pressure on the US dollar.

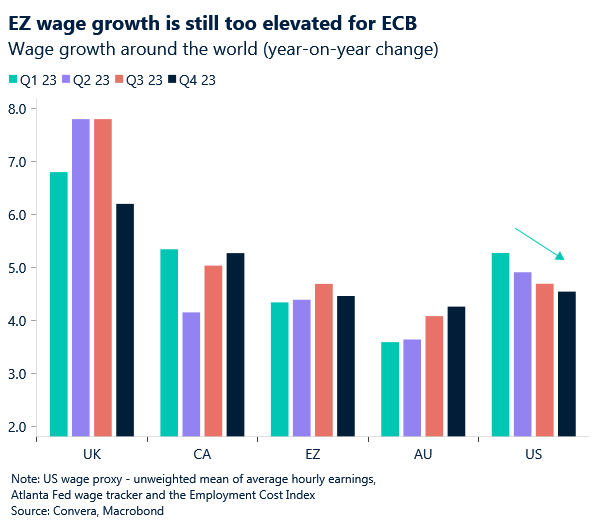

The European Central Bank (ECB) also released a report that revealed wages in the Eurozone remain elevated despite the modest fall in the fourth quarter last year. Negotiated wage growth fell from 4.7% to 4.5% y/y in Q4, which validates expectations that wage growth is no longer accelerating. Other measures of wage growth were already moving down before this data release, but negotiated wages make up the bulk of wage developments in the Eurozone. How much strong wage growth matters for services inflation rests on how easily higher wage costs can be passed onto consumers. The flash services PMI for January saw the index remain below the neutral 50 mark for the sixth consecutive month, so with the overall outlook for services still weak, higher wages are doubtful. The ECB will welcome the news on wages, but given it was only a small decline, it is likely the ECB will adjust monetary policy cautiously in 2024.

Money markets are currently pricing in over a 50% chance of a rate cut in April and another three before year-end, which we see as too dovish. This means we think the euro may have room to run higher against the dollar if we see a hawkish repricing in ECB rate expectations.

USD & CAD track yields lower

Table: 7-day currency trends and trading ranges

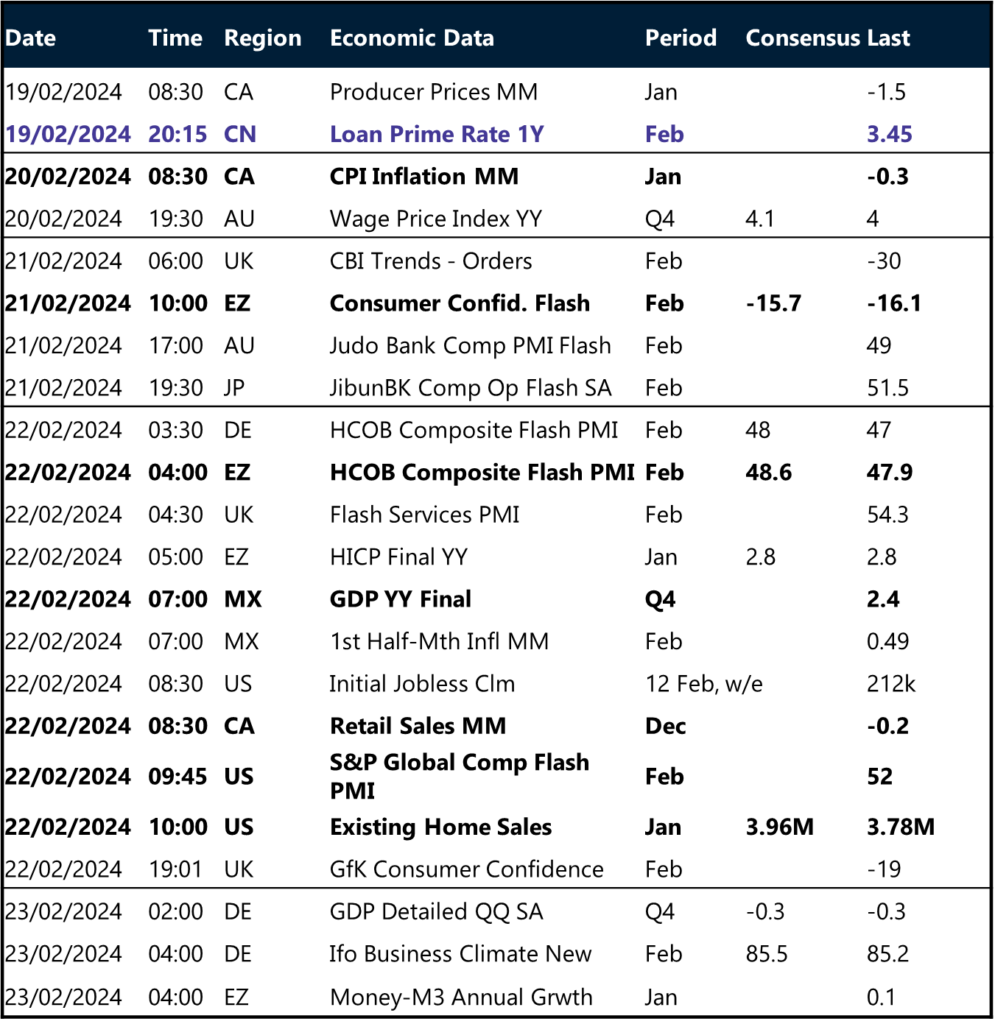

Key global risk events

Calendar: February 19-23

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.