US inflation and Fed in focus

George Vessey – Lead FX Strategist

The US dollar index has risen for three days straight, holding firm above the 105 handle ahead of US inflation data and the Federal Reserve’s (Fed) monetary policy meeting later today. The fixed-income market has started to rally (yields falling) as has been the typical trend pre-Fed meetings. Therefore, the dollar’s strength is likely more a result of safe haven demand amidst the ongoing European political woes.

The strength of the US labour market is providing the Fed cover to wait for better news on inflation before signalling a rate cut, but the central bank cannot take that strength for granted, or as a given. The labour market should be more on the Fed’s radar because if it waits for cracks to form, it will be behind the curve. All eyes are on US CPI today though, with economists expecting a benign inflation report. The headline rate coming in at 0.1% m/m, means the annual growth rate would therefore remain unchanged at 3.4%, with core inflation expected to fall from 3.6% in April to 3.5% in May. Such data is unlikely to sway the Fed’s decision. No change to policy is expected today, but the so-called dot plot is expected to show one fewer rate cut than in March. That is, the Fed might signal two cuts instead of three in 2024. Ultimately, the Fed does not know when it will be appropriate to start easing policy and its data-dependent guidance puts the emphasis on the incoming data. A rate cut this summer is off the table, and although the Fed will need to eventually plant the seeds that a rate cut could be coming, it probably won’t happen today.

Interestingly, despite the renewed political risks, coupled with the scaling back of Fed rate cut expectations of late, equities are holding up well. Although both the S&P500 and Nasdaq slipped modestly yesterday, they closed at all-time highs on Monday. The US dollar and US stocks continue to outperform globally, and until the US economy starts weakening more convincingly, or inflation begins to cool more rapidly, these trends will likely persist.

ECB’s hawkish consensus shift to be tested

Boris Kovacevic – Global Macro Strategist

The aftershock of President Emmanuel Macron calling for a snap election continues to work its way through markets. FX options are pricing in higher volatility and a stronger bias against the common currency following the surprise result on Sunday. The one-week risk reversal widened by 50 basis points and reached a two-month low, showing a negative option skew against the euro vs. the US dollar.

The one-year volatility on EUR/USD surged to the highest level in six weeks as options traders incorporate the French election at the end of the month. However, the fixed income space has been the most sensitive to the recent political developments with the 10-year spread between French and German government bond yields rising to their widest since March 2020. Equity markets couldn’t escape the risk premium investors are putting on European assets either with the Stoxx 600 recording its worst day (-0.9%) in two months. While still an ongoing topic, investors will focus on the Fed decision and US CPI report today as both events continue to set the tone for global markets.

On the monetary policy front, European policy makers are cautioning speculators against expecting too many interest rate cuts this year just a week after the central bank eased its monetary policy for the first time in five years. President Christine Lagarde began the week by saying that rates won’t be on a linear declining path. A plethora of her colleagues joined in on the chorus, strengthening the consensus around skipping the July meeting and focusing on a potential rate cut in September. Governing Council members Nagel, Simkus, Rehn and Villeroy sounded surprisingly conform, stating that the ECB (1) must not rush nor dally after decisions to cut, (2) wont pre-commit to any path and (3) can’t declare victory over inflation yet.

All this comes against the backdrop of inflation reaccelerating in May. We do see the potential for inflation to pick up around the end of Q3 in what we describe as a two-step process. However, the first step is a likely continuation of the disinflation process, which could see the headline inflation in the Eurozone and Germany fall below the 2% in the months ahead. It will be interesting to see if the ECB can maintain its hawkishness against such a backdrop as well.

Pound near 2-year high versus euro

George Vessey – Lead FX Strategist

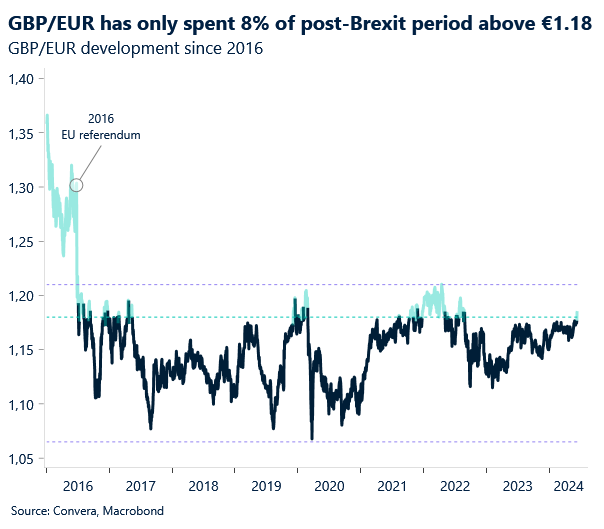

The British pound recorded its highest level versus the euro (€1.1880) since August 2022 amidst the ongoing political jitters across Europe. Over the past eight years, since the EU referendum in 2016, GBP/EUR has traded above €1.18 for only 8% of the time. But, while political risk will continue to dominate the pair in the short-term, central bank dynamics will regain control as the key catalyst for the pair over the longer-term and this leaves sterling vulnerable.

Financial markets are pricing just a 5% probability of a rate cut by next week and only 40% for August’s meeting. However, we think markets are under-pricing the risk of a summer rate cut given the data on Tuesday showing the UK unemployment unexpectedly rose to a 2½-year high, and the vacancy-to-unemployment ratio is now back down to pre-Covid levels. The slowdown in UK private sector pay growth will please the BoE too, but it’s the path of services inflation that’s set to prove more decisive in determining the timing and scale of policy easing this year. That data is due next week. Any evidence that UK inflation is cooling, and a summer rate cut is coming, could see GBP/EUR lose its grip on €1.18 once again.

This morning, UK GDP came in line with expectations as the British economy stagnated in the month of April. The 3-month average came in at 0.7% despite construction output falling more than expected (-3.3% vs. -1.8%). The industrial and manufacturing production figured fell more than economists had anticipated as well.

CAD/MXN up almost 7% in seven days

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: June 10 – 14 (all times in BST)

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.