Written by the Market Insights Team

US President Trump’s initial days in office have eased concerns about tariffs, particularly trade with China. This has led to “tariff relief” in FX markets, with the US dollar coming under selling pressure. EUR/USD rallied to its highest level in over a month around $1.05 and GBP/USD extended its recovery from a 1-year low, whilst FX volatility in general decreased substantially. However, it is not prudent to assume Trump’s slow start does marks the beginning of the end of protectionist policies. Rather, it points to a more protracted timeline for their implementation. Away from politics, three big central bank decisions are due this week with rate cuts expected from the European Central Bank and the Bank of Canada while the US Federal Reserve is expected to hold rates steady.

Soft Trump bad for the dollar

Boris Kovacevic – Global Macro Strategist

Looking back at Donald Trump’s first presidential term, the US dollar weakened in 2017 during Trump’s first year in office, following a strong rally in 2016. His first week back as president signals that history could repeat itself. The Greenback recorded the worst week in five months, with selling pressure increasing after Trump suggested he would rather avoid imposing tariffs on China and called for the Federal Reserve to cut interest rates.

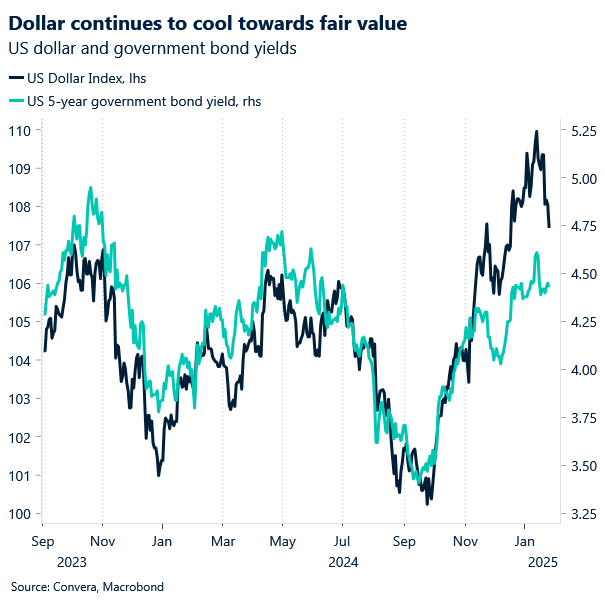

While interest rate differentials typically support the dollar, shifting market sentiment and short squeezes could outweigh this effect. Hedge funds and large speculators currently hold their biggest long-dollar positions since 2019. Additionally, the dollar appears historically overvalued—when adjusted for inflation differentials, it has returned to 1985 levels. Given this, Trump may seek ways to pressure trading partners into strengthening their currencies, potentially using tariffs as leverage. For now, the US economy continues to stand out, the threat of tariffs remains a key risk, and the Fed is unlikely to drive the dollar significantly lower in its next meeting. This was confirmed by Friday’s stronger than expected PMI data showing that the manufacturing sector expanded for the first time since July 2024.

This upcoming week will therefore be driven by multiple themes such as inflation, trade politics, and central banks. The FOMC decision on Wednesday will set the tone for currency markets before the PCE data on Friday concludes the week. Inflation is expected to have accelerated from the previous month in December (m/m).

Is Europe bottoming?

Boris Kovacevic – Global Macro Strategist

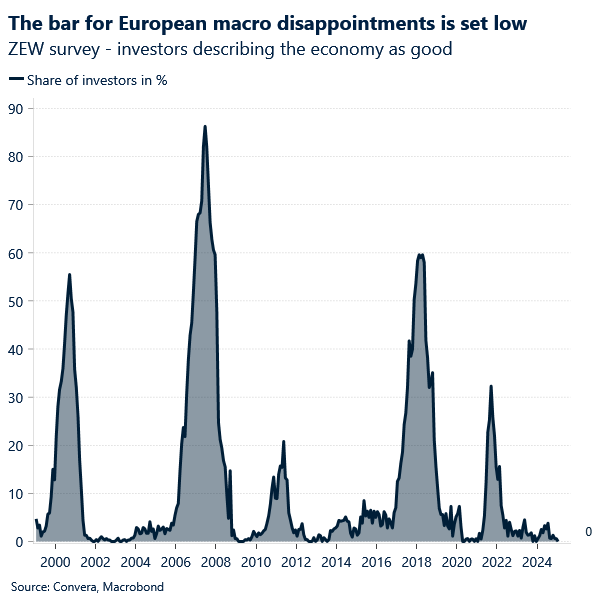

Investor sentiment toward the European economy has been largely negative, with concerns over recession risks, weak growth, and ongoing geopolitical tensions dominating the narrative. However, much of this pessimism is already reflected in asset prices, setting an exceptionally low bar for positive surprises. As a result, any unexpected improvement in economic data could trigger a disproportionately strong market reaction this year.

Recent data supports this view—the Eurozone composite PMI rose from 49.6 to 50.2, surpassing expectations, while the UK’s PMI climbed to 50.9 versus a forecast of 50.1, marking two consecutive years of monthly growth in private sector activity. These signs suggest that economic momentum in Europe may have reached its low point.

As a result, calls for EUR/USD to reach parity are fading. The euro has benefited from a wave of positive developments over the past week, including Trump’s softer stance on tariffs and an unexpected expansion in Eurozone private-sector activity. This has reduced the risk premium priced into the currency. However, lingering uncertainty over Trump’s trade policy toward the EU could limit further gains.

Despite this recent strength, structural pressures—such as slowing growth and monetary policy shifts—could weigh on the euro in the weeks ahead. The $1.02 level appears to be a strong support. Meanwhile, the European Central Bank is expected to cut rates in the coming week, with at least three additional cuts anticipated by year-end.

GBP/EUR rebounds from 5-month low

George Vessey – Lead FX & Macro Strategist

Sterling stabilized against the US dollar and euro last week, with the latter rebounding from a 5-month low. Improved global risk appetite on softer tariff talk from President Trump, a rally in global fixed income markets, and somewhat better demand-side data locally (including flash PMIs and certain CBI surveys) looks to have stalled sterling’s recent downtrend. GBP/USD rose around 2% higher last week, but remains nearly four cents below its 100- and 200-day moving averages.

The pound has pounced on broad-based dollar weakness, but better than expected leading indicators is also a reminder not to completely write off the UK economy – or sterling. GBP/USD is trading about 7.5% below its 10-year average near $1.32, but we need to see more US data coming in on the weaker side and UK data coming in on the stronger side for this recovery to gain traction. The declining economic surprise differential between the UK-US has weighed on the pair, although UK-US rate differentials suggest the pair should be trading higher. On a broader note, the pound is still the worst performer in the G10 space year-to-date – plagued by the weak UK economic growth outlook, stubborn inflation concerns, as well as a lack of confidence in UK fiscal sustainability with gilt yields still elevated – thus government borrowing costs are still concerning. As a result, the UK’s slower growth trajectory could further sway traders to ramp up expectations of more Bank of England (BoE) rate cuts. As a reminder, markets are only pricing in roughly 65 basis points of BoE cuts by year-end, so the pound remains vulnerable, as weaker growth prospects and rising expectations of policy easing weigh on sentiment.

However, the pound is well placed to benefit (particularly against the euro) from the likely improvement in FX risk sentiment due to the softer tariff start by President Trump, while also enjoying greater resilience to direct tariff risks than the Eurozone. GBP/EUR looks a bit cheap to front-end rate differentials, which has helped the pair bounce off the €1.18 support handle of late.

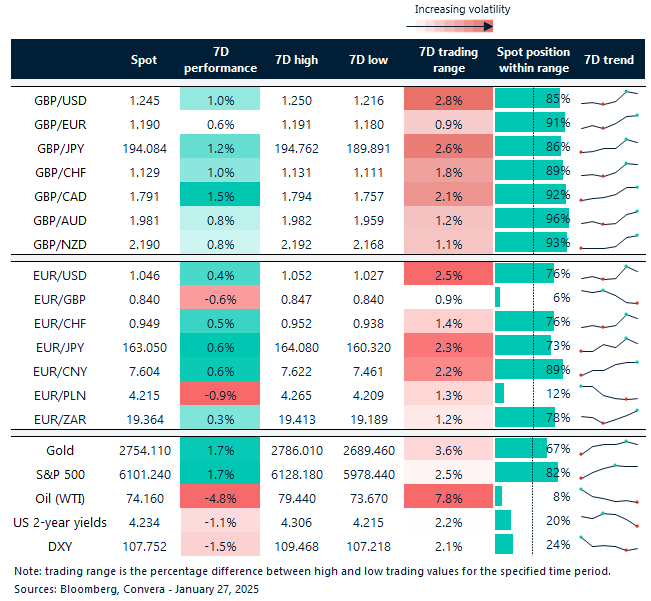

Sterling recovers across the board

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: January 27-31

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.