Written by the Market Insights Team

Trump switches targets

Boris Kovacevic – Global Macro Strategist

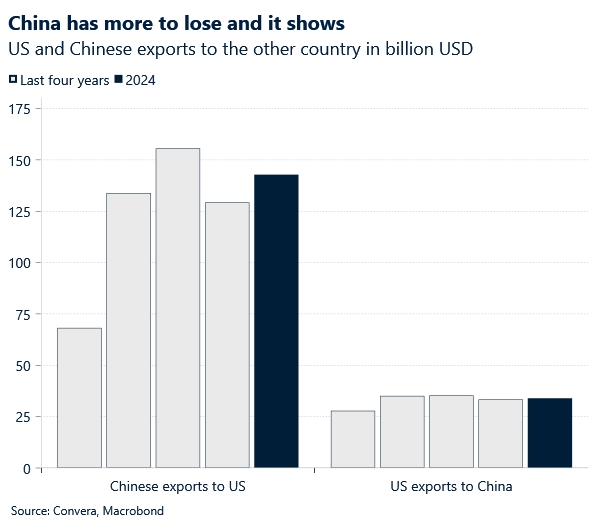

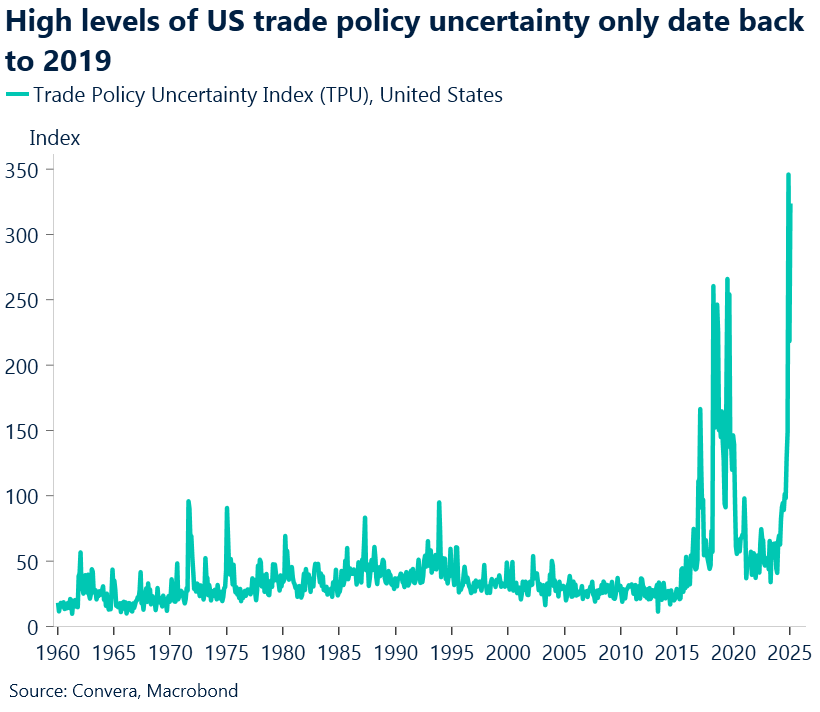

The tariff escalation is not over—only delayed. The one-month extension for negotiations between the U.S., Mexico, and Canada has eased some immediate market tension, but the damage in terms of prolonged policy uncertainty is already done. This is underscored by reports that a highly anticipated call between Xi and Trump, scheduled for Tuesday, did not take place. As a result, the Trump administration proceeded with a 10% tariff on China, prompting Beijing to retaliate with additional levies on roughly 80 products, set to take effect on February 10th.

While this sounds like a drastic measure, the targeted volumes of exports remain minimal. China has more to lose than the US and it shows. Meanwhile, Europe remains at risk of further tariff hikes. The market’s back-and-forth pricing this week underscores one key takeaway: in today’s macro environment, uncertainty is the only constant, and volatility remains elevated. Inflation expectations have also been trending higher since bottoming in September, reinforcing the view that Fed rate cuts are unlikely over the next two meetings.

On the macro front, the latest data suggests a cooling labor market. Job openings dropped from 8.16 million to 7.6 million, with the openings rate falling from 4.9% to 4.5%. Factory orders declined for the second consecutive month in December, falling 0.9% m/m. Meanwhile, the Economic Optimism Index marginally missed expectations. However, despite this weaker data, markets remain more focused on political developments. For now, the U.S. exceptionalism narrative remains intact, but if economic data continues to deteriorate, investors may begin to reassess.

The U.S. dollar weakened in yesterday’s session on hopes of a temporary reprieve on the trade front. However, at $1.0380 against the euro and $1.2480 against the pound, the Greenback remains resilient.

Old-fashioned rhetoric?

Kevin Ford – FX & Macro Strategist

On Monday, Trump posted on his Truth Social account, regarding the initial agreement with Prime Minister Trudeau, that “the tariffs announced on Saturday will be paused for a 30-day period to see whether or not a final Economic deal with Canada can be structured.” As mentioned in previous Daily Market Updates, the tariff threats, and their further imposition, were likely bargaining tools to bring Mexico and Canada to the table to renegotiate the CUSMA/USMCA deal, ASAP.

Uncertainty still lingers but hopes for the start of the renegotiation process are at season highs, which, for now, has helped dissipate fears of a long-lasting trade war. However, as we approach the 30-day mark in March, if there aren’t any advancements on the diplomatic front, we will find ourselves back where we were last week. Again, we’ll wait and see.

The question remains whether Trump was also forced to pause the tariffs due to the global market reaction and lobbying from relevant sectors. Also, some might say that the unpopularity of his trade policy among economists and capital markets professionals persuaded him. However, it’s hard to imagine that he’d change his stance on tariffs. For some, his old-fashioned vision of trade and global economics dates back to the 80’s; ‘I believe very strongly in tariffs,’ said Mr. Trump, then a Manhattan real estate developer. Criticizing the trade practices of Japan, West Germany, and South Korea, he asserted; ‘America is being ripped off. We’re a debtor nation and we have to tax, we have to tariff, we have to protect this country’. Same rhetoric, same ideas on protectionism, with very little logic or rationale in today’s context, given the region’s trade interconnection.

For now, while trade uncertainty remains, we’re back to fundamentals, with the Loonie trading around the 1.432 level, as this week’s focus shifts to jobs data in the US and Canada.

Euro stronger but risks remain

Boris Kovacevic – Global Macro Strategist

The imposition of a 10% tariff by the US on Chinese imports, coupled with China’s measured retaliatory tariffs, has heightened global trade tensions. The Eurozone faces potential economic repercussions from these developments, given its significant trade links with both the US and China and is somewhat stuck in the middle between these two great powers.

However, the tariff delay for Mexico and Canada was enough for the euro buyers to step in again, leading EUR/USD beyond the $1.0350 mark. The currency pair is now marginally higher year-to-date but is still trading around 3.5% and 7.3% lower versus 12 months and 5 months ago.

Economic data is scares but today’s above consensus inflation print for the Eurozone does strengthen our case that markets might have gone overboard when it comes to pricing in rate cuts from the ECB this year. Inflation accelerated for a fourth consecutive month, coming in at 2.5% in the first month of 2025. Core inflation beat expectations as well and remained at 2.7%.

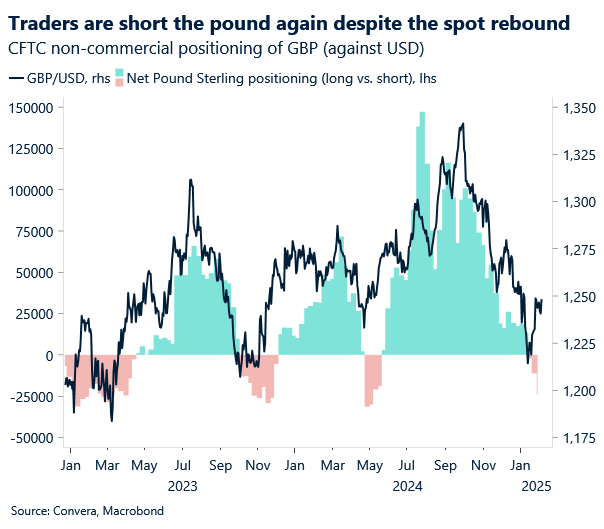

Some relief for pound bulls

Boris Kovacevic – Global Macro Strategist

The British pound remains under pressure as a combination of weak economic data, persistent inflation concerns, and shifting Bank of England (BoE) expectations continue to weigh on sentiment. While the BoE has maintained a cautiously dovish stance, markets are increasingly pricing in rate cuts later this year as growth prospects dim. The latest data releases have done little to support sterling, reinforcing the view that the UK economy is struggling to gain momentum.

On the macro front, UK GDP growth remains tepid, with leading indicators suggesting that underlying demand is softening. The S&P Global/CIPS UK Services PMI edged up to 51.2 in January from 51.1 in December, slightly surpassing market expectations of 50.9. This indicates a marginal expansion in service sector activity. However, new orders declined for the first time in 15 months, signaling potential headwinds ahead.

The British pound has regained some lost ground today following the U.S. decision to postpone tariffs on Canada and Mexico, easing broader trade concerns. Unlike other major economies, the UK is less directly exposed to U.S. tariff risks due to its lower volume of goods exports to the U.S. relative to services. This has provided some relief to sterling, which had been under pressure amid global risk aversion. GBP/EUR is pushing higher for a third consecutive day and is trading above €1.20 again while GBP/USD is struggling to keep its head above the $1.25 mark.

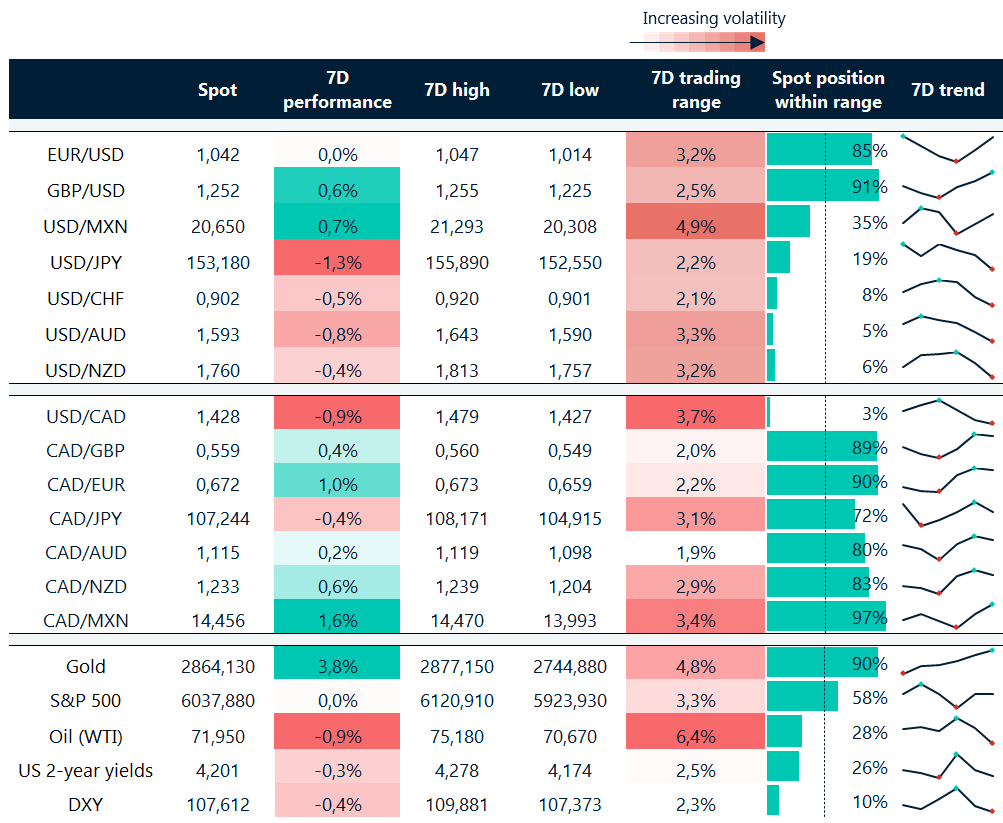

USD falls in line with trade de-escalation

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: February 3 -7

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.