Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

CAD lower after BoC cut

The Bank of Canada extended this year’s theme of rate cuts as it joined the Swiss National Bank and Swedish Riksbank by cutting interest rates overnight.

The BoC cut rates by 25bps to 4.75%.

The BoC’s move had little impact on FX markets with the USD/CAD up only 0.1%.

The AUD/USD was flat while USD/CNH gained 0.2%.

Tonight, all eyes are on the European Central Bank, expected to also cut rates by 25bps.

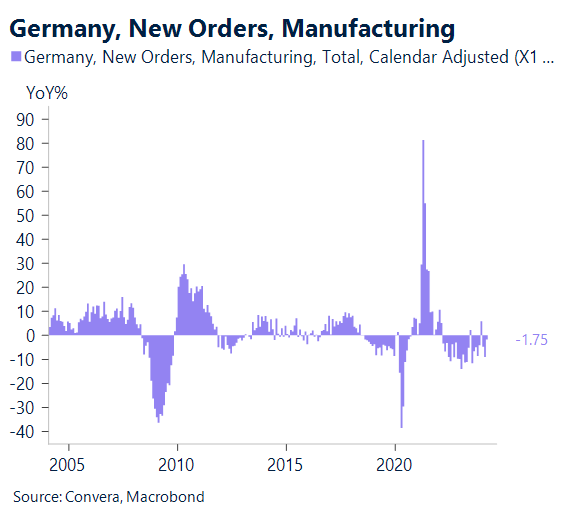

German factory orders decline pauses recovery

Europe will remain in focus with factory orders due. A significant drop in new orders was reported for April in many factory surveys.

Thus, we project a 3.1% m-o-m reduction in German manufacturing orders, marking the fourth consecutive month of decline.

The recovery in EUR/USD from the 1.0597 Oct 78.6% retrace pauses below the important resistance pocket of 1.0792-1.0886.

TWD pressures

Because of the base impact, we anticipate inflation to slightly increase to 2.1% y-o-y in May from 2.0% in April for Taiwan inflation. May’s headline inflation rate is predicted to remain steady at 0.1% m-o-m, sa, indicating no downward pressure on prices.

As a result of seasonal demand, we anticipate that the price inflation of entertainment services would rise, while the price inflation of dining out should decrease, maintaining service price inflation at 2.5% y-o-y in May.

Additionally, we anticipate that core inflation would be steady at 1.8% year over year, which would be in line with the decision to maintain the policy rate at the CBC meeting on June 13.

Aussie still trapped under 0.6700

Table: seven-day rolling currency trends and trading ranges

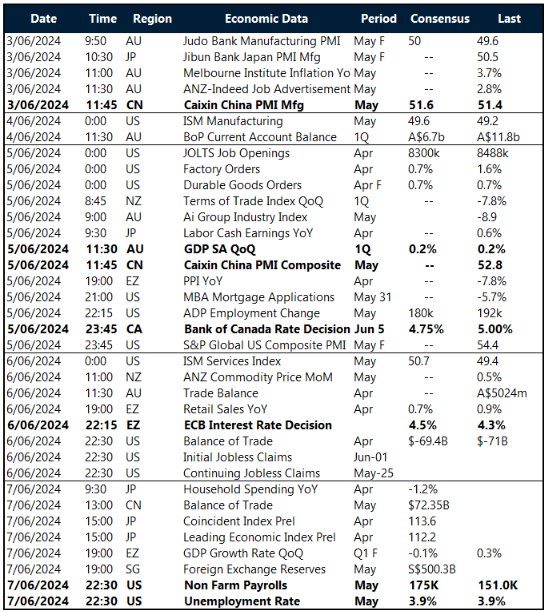

Key global risk events

Calendar: 3 – 7 June

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]