Aussie sees biggest fall since March

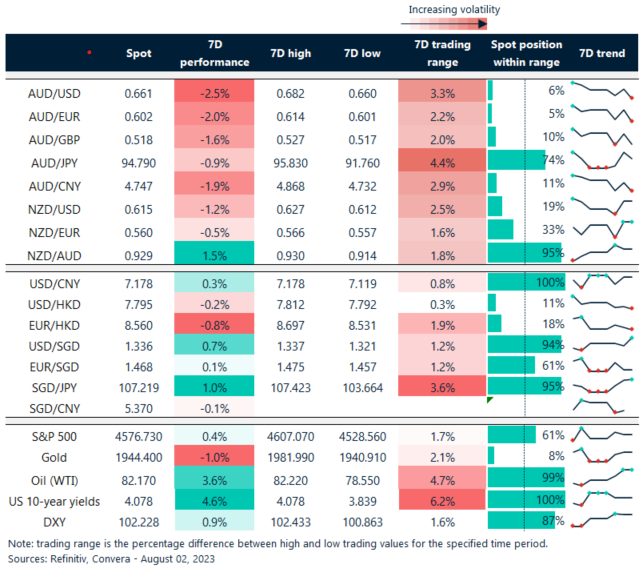

The Australian dollar was down sharply yesterday, with the AUD/USD falling 1.6%, after the Reserve Bank of Australia decided to keep interest rates on hold at 4.10%.

Importantly, markets and a number of economists now believe the RBA has likely reached the end of its rate-hiking cycle, with no more full interest rate hikes priced into to Australian money markets. The market now has only a maximum of 22 basis points of hikes priced in.

The decision saw a large sell-off in the AUD market.

The AUD/USD suffered its largest one-day loss since 7 March – in the middle of the US’s Silicon Valley Bank crisis.

USD extends comeback

Otherwise, the US dollar continued its recovery overnight, with recent strong data driving the greenback’s outperformance.

The USD index climbed 0.3% as it reached the highest level since 10 July.

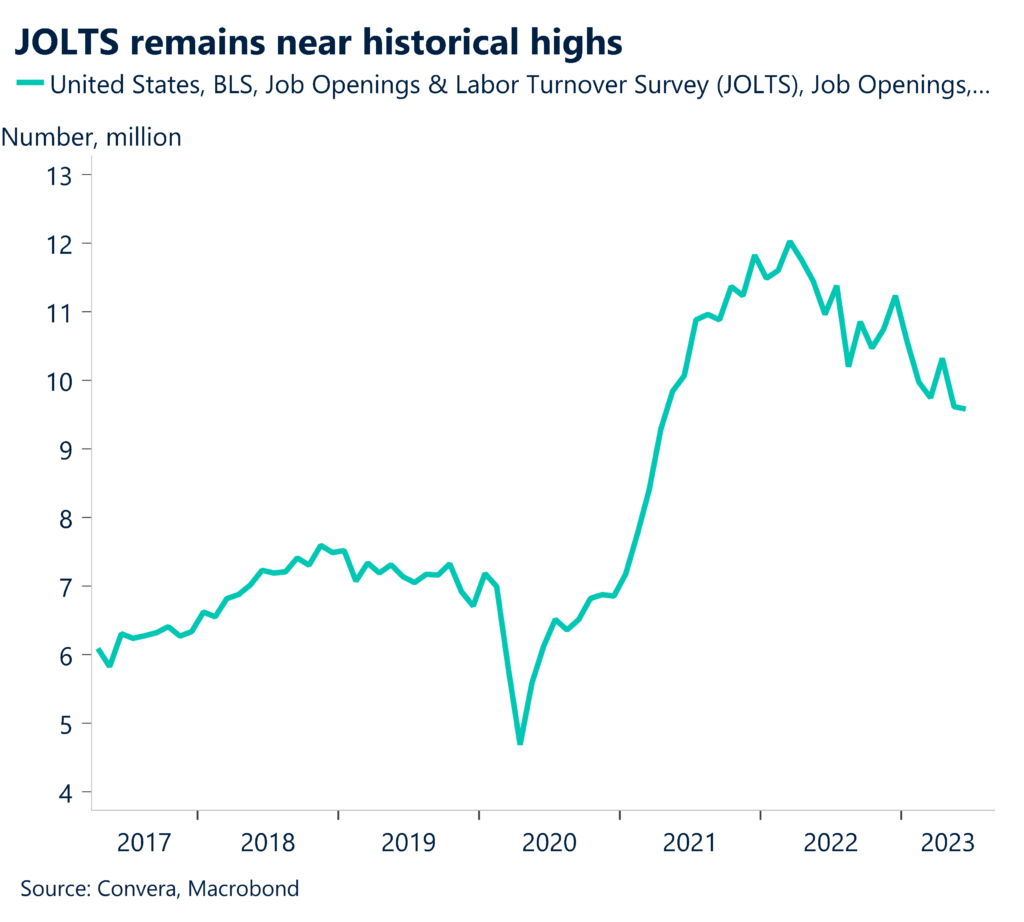

Overnight, the monthly job openings and labor turnover series (JOLTS) remained at a historically high 9.6 million in June, another sign of ongoing strength in the US employment markets. Tonight, ADP job numbers are due, with the non-farm payrolls released on Friday.

With the USD stronger, the EUR/USD fell 0.2%, GBP/USD lost 0.5%, while USD/JPY gained 0.7%.

Across Asia, the NZD/USD fell 1.0% while USD/SGD jumped 0.5% to three-week highs.

NZ jobs due

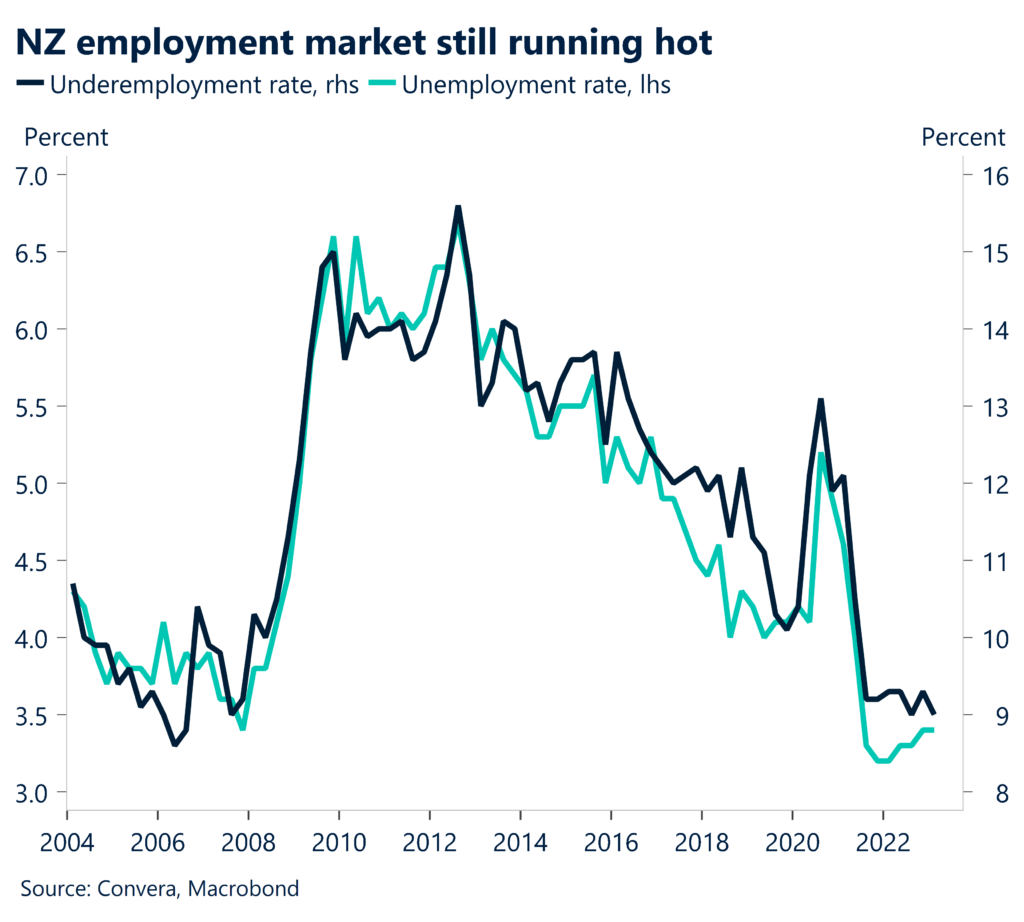

The New Zealand employment market is in focus today with June-quarter figures released at 8.45am AEST.

The market is looking for the employment market to grow by 0.6% – slower than the 0.8% seen in the March quarter – with the unemployment rate forecast at 3.5%.

Aussie hit after RBA

Table: seven-day rolling currency trends and trading ranges

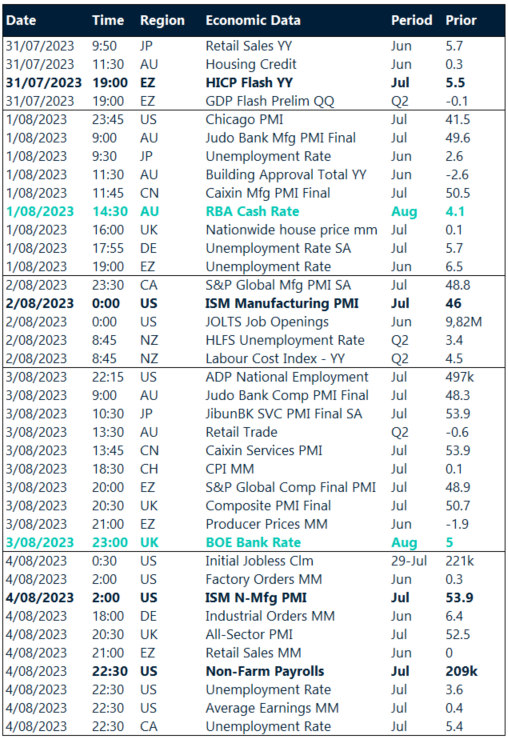

Key global risk events

Calendar: 31 July – 4 August

All times AEST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.