Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

Fed cut hopes weigh on greenback

Global stocks were mainly higher last week as markets shook off worries about tariffs, poor US data and the removal of the head of the US’s Bureau of Labor Statistics, and instead focused on the hopes for US rate cuts.

The US’s benchmark S&P 500 gained 2.4% last week and returned to levels close to all-time highs.

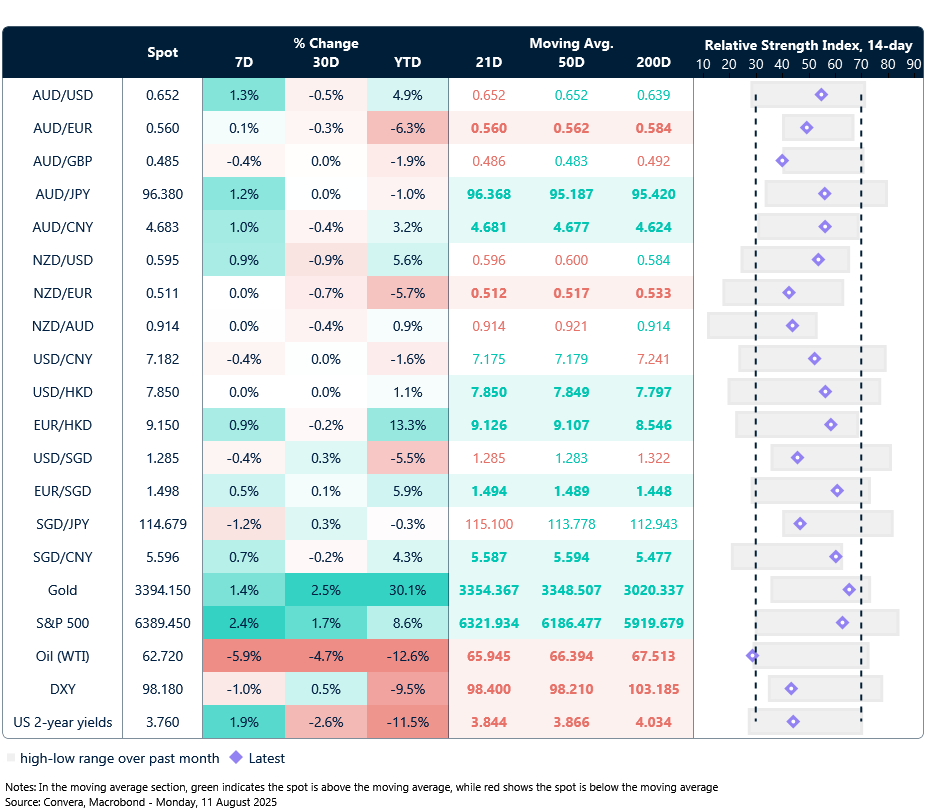

The Aussie benefited from the rebound in sentiment with the AUD/USD up 0.8% over the week.

The Aussie’s best gains were against the Japanese yen with the AUD/JPY up 1.3% last week. The Aussie was steady versus the euro but fell against the British pound.

The kiwi was also stronger last week with the NZD/USD up 0.8% and NZD/JPY up 1.2%.

In Asia, the Singapore dollar mostly fell last week, but the SGD did gain versus the US dollar with USD/SGD down 0.2%.

The Chinese yuan was weaker across markets last week with the USD/CNH up 0.1%.

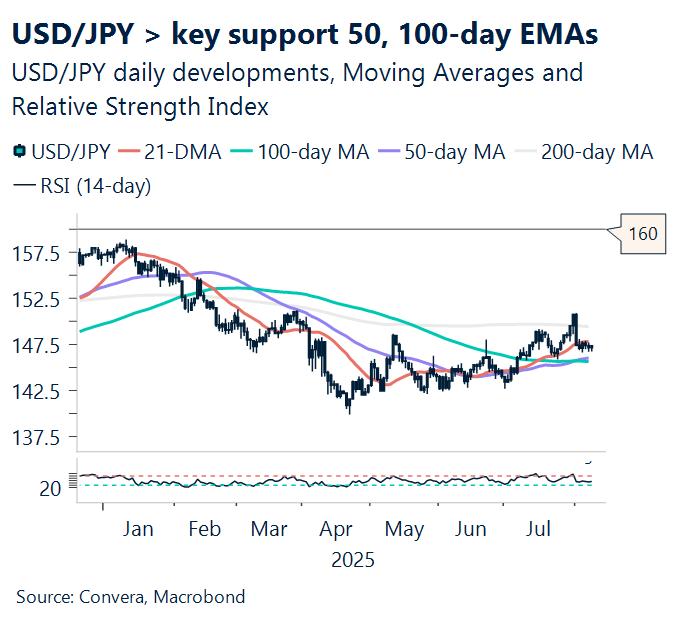

USD/JPY bucks the trend as BOJ signals cautious optimism

Japan’s central bank is striking a cautiously upbeat tone, and markets are listening. With TOPIX breaking the 3000 mark for the first time, investors seem to welcome the Bank of Japan’s latest Summary of Opinions from its July meeting.

Policymakers suggest Japan’s economy is making a modest comeback, helped by easing trade tensions following a recent agreement with the US. Still, they acknowledge that global trade dynamics could shift, depending on how other deals play out.

Inflation remains sluggish, but the BoJ expects it to gradually align with its forecasts. While the bank plans to maintain its supportive stance for now, it’s ready to raise rates if its outlook on prices and growth holds steady.

In currency markets, USD/JPY is defying the crowd. While most major currencies gained vs USD, USD/JPY edged up 0.2% for the past week, standing out among its G10 peers.

The pair is holding firm above key support levels, specifically the 50-day EMA of 146.668 and 100-day EMA of 146.78. Traders are now eyeing the next resistance at the 21-day EMA of 147.46.

Currencies on edge as global data storm hits

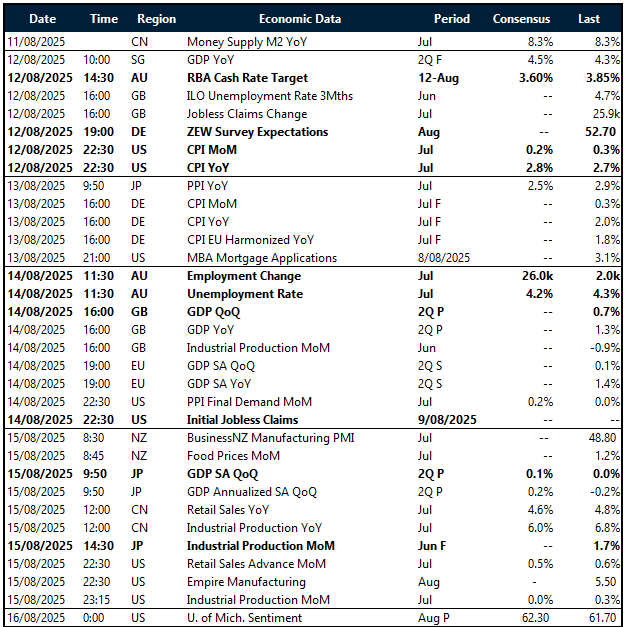

The coming week brings a packed economic calendar with critical data across major economies, likely to drive FX volatility. US inflation will be closely watched, with July CPI released Tuesday and PPI on Thursday.

Consensus points to still-moderate price pressures (CPI YoY 2.8% vs 2.7% prior), which will be key for recalibrating Fed expectations. Europe’s inflation story continues Wednesday and Thursday with final July CPIs from Germany and France, and GDP prints for both the UK and Eurozone offering timely insight into growth momentum. China’s July activity data (Friday) will be watched for clues on the recovery’s durability, with retail sales and industrial output expected to ease from June’s pace.

The Reserve Bank of Australia announces its rate decision Tuesday. Consensus expects a 25bp cut to 3.60% (from 3.85%), as inflation moderates and growth slows. With the Australian dollar already under pressure, any deviation from this script could spark volatility. Thursday’s July jobs report (consensus +26k) will further inform RBA trajectory and AUD direction .

Japan’s Q2 GDP (Friday) is forecast to show only marginal growth (+0.1% q/q), as exports and domestic demand remain subdued. UK data releases are clustered Thursday, with GDP, industrial and manufacturing output all due. Eurozone Q2 GDP (Thursday) will be parsed for signs of resilience amid ongoing headwinds.

Beyond inflation, US data will test consumer resilience with July retail sales (Friday, +0.5% m/m expected) and University of Michigan sentiment (Saturday). Initial jobless claims on Thursday will be monitored for any softening in labor markets. These data will be key for the dollar, especially if inflation surprises on either side.

Aussie rebounds and nears nine-month highs

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 11 – 16 August

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.