Written by Steven Dooley and Shier Lee Lim

Financial markets recover after inflation sell-off

Financial markets mostly recovered overnight on Wednesday after steep losses were seen on Tuesday following a hotter-than-expected US inflation reading.

US headline annualised inflation was reported at 3.1% — above forecasts for 2.9% — and likely ending hopes for a rate cut at the Federal Reserve’s March meeting.

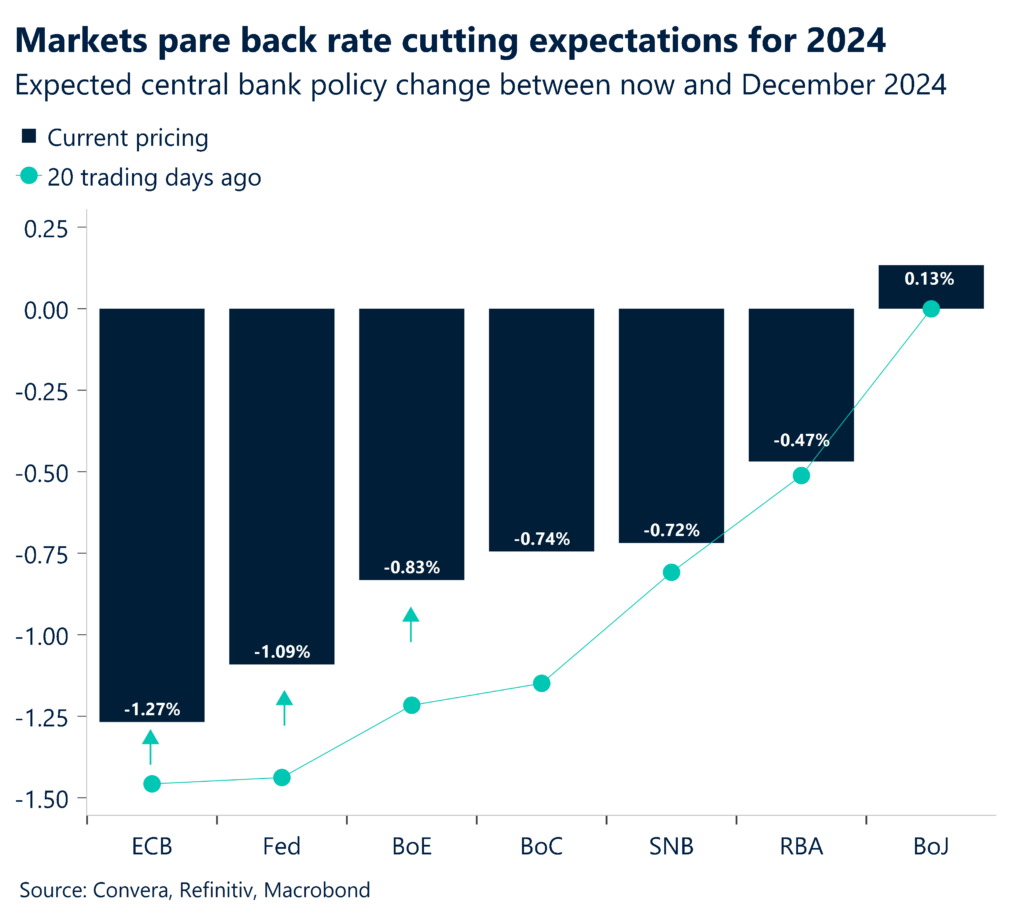

The hot US CPI, along with some tough talk from Fed chair Jerome Powell, has seen money markets reduce expectations for Fed cuts in 2024 from around 150bps of cuts to 109bps currently.

However, markets recovered overnight, with the S&P500 up 1.0% and Nasdaq up 1.2%.

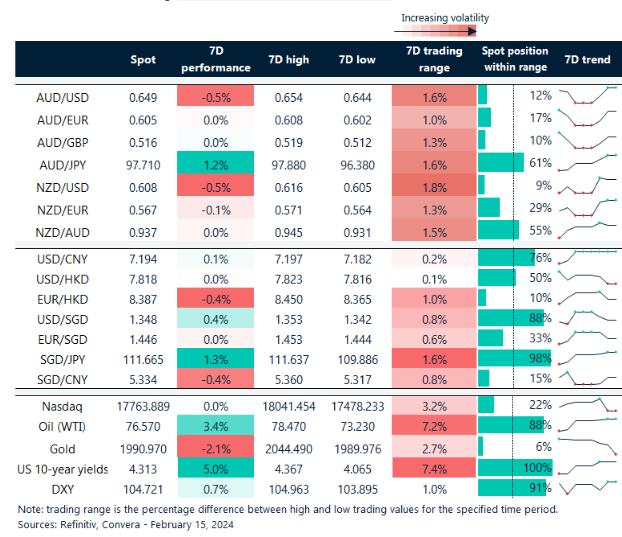

In FX markets, risk-sensitive currencies like the Australian and NZ dollars outperformed, with the Aussie stronger ahead of today’s job report due at 11.30am AEDT.

The AUD/USD gained 0.6% while NZD/USD climbed 0.4%.

The euro and Japanese yen were moderately higher while the British pound slipped after UK January inflation came in below expectations.

Australian jobs due

Looking to Australian jobs, we project an increase in employment of about 15,000 in January. With a stable population and labour force growth, we estimate that the unemployment rate increased by an additional 0.1 percentage points to 4.0%.

Leading labor market indicators have become less optimistic, and our growth forecast for Australia is still below average. In the upcoming months, we anticipate that trend job growth will stall even further, and by the end of the year, the unemployment rate will have increased to about 5%.

The AUD/USD remains in a downtrend with key moving average pointing lower. If the pair is unable to break above the resistance zone of 0.664-0.6657, this sets up a potential move to the larger range of support at 0.6170–0.6296.

Philippines policy decision could support PHP

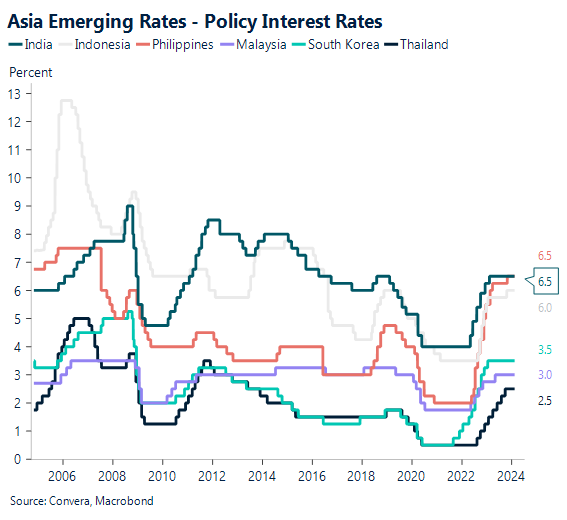

In the Philippines, the Q4 GDP growth was robust, which confirms our belief that the Bangko Sentral ng Pilipinas (BSP) would be patient in its policy shift despite the recent decrease in headline inflation.

As a result, we expect the BSP to maintain its policy rate at 6.50%.

Although the January CPI data release indicated a decline year over year to 2.8% from 3.9% in December, the BSP warned that headline inflation might still surpass the goal in Q2.

As a result, we believe that the policy statement’s tone will probably be somewhat harsh, with BSP emphasizing the necessity of maintaining “sufficiently tight” policy settings.

Aussie recovers ahead of jobs

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 12 – 17 February

All times AEDT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.