USD surges on safe havens flows, strong data

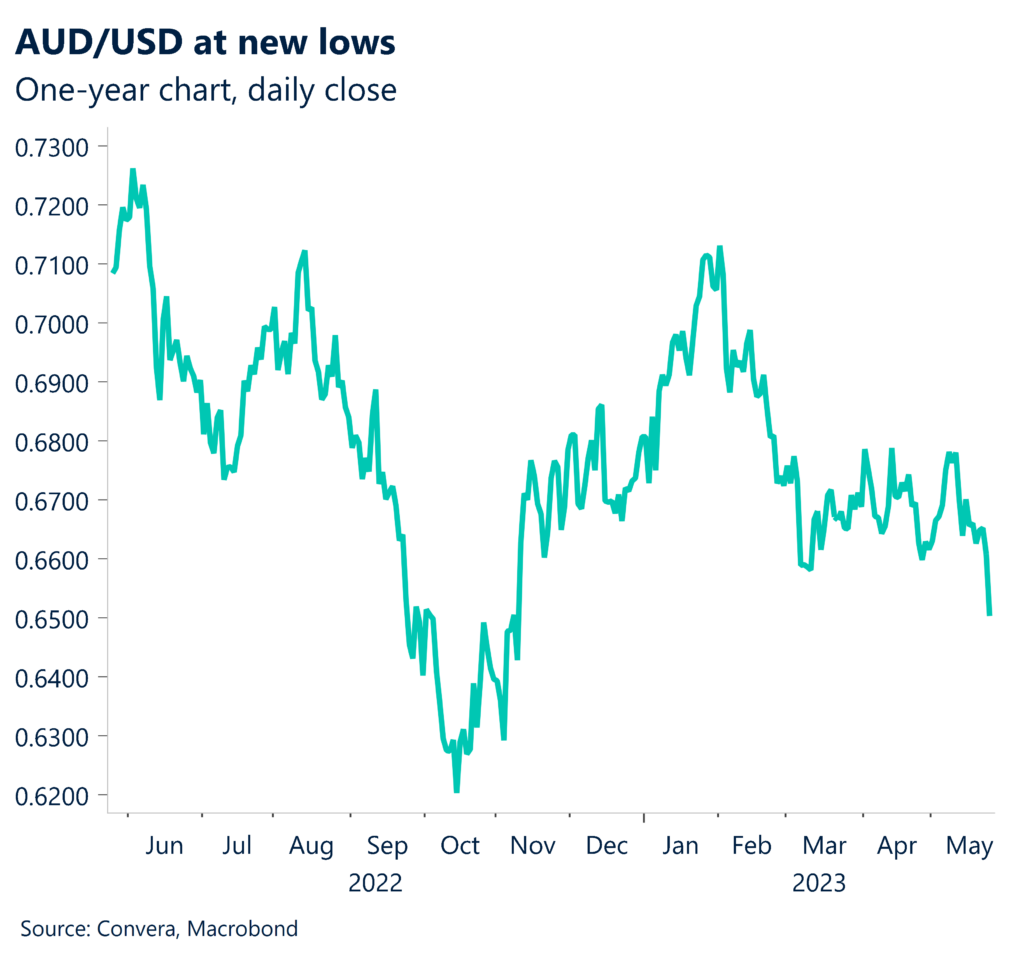

The Australian and New Zealand dollars both hit new lows for the year overnight as the US dollar’s recent strong run continued.

The greenback has benefited from safe-haven flows as worries swirl around the US debt ceiling, but stronger economic data has also boosted the USD.

Overnight, the preliminary March-quarter GDP reading beat expectations, up an annualised 1.3% versus 1.1% expected, while the weekly unemployment claims also stayed near historic lows.

The greenback strengthened with the USD index at the highest level since mid-March.

The AUD/USD fell 0.6% as it hit the lowest level since 10 November.

The NZD/USD fell 0.8% as it underperformed after this week’s Reserve Bank of New Zealand decision suggested the central bank was likely now on hold.

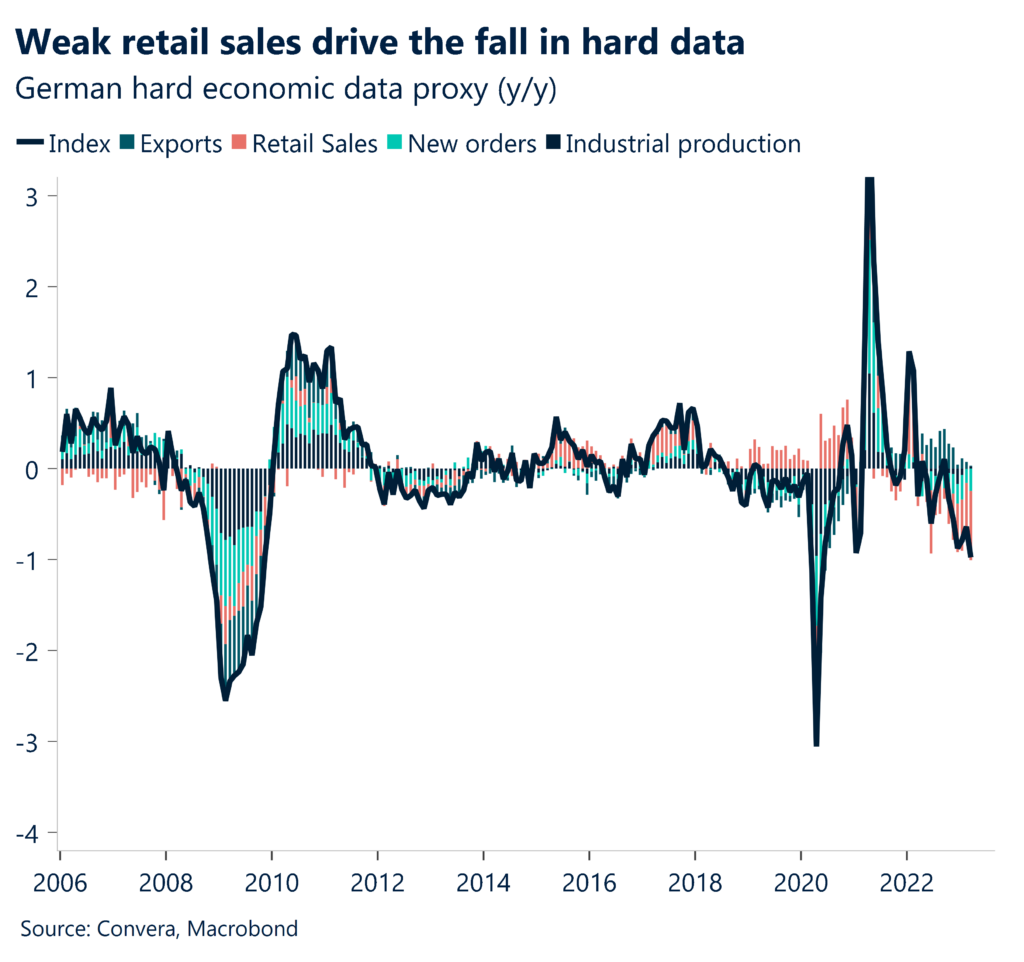

Euro hit as Germany falls into recession

The USD also benefited on a relative basis as poor European data hit the euro.

Most notably, Germany was confirmed as having fallen into a technical recession, as March-quarter GDP fell 0.3%, following a 0.5% contraction in the December quarter.

The EUR/USD fell 0.3% as it dopped to the lowest level since mid-March.

However, the EUR held up better versus the Australian and New Zealand dollars, with the AUD/EUR down 0.3% and the NZD/EUR falling 0.5%.

Debt ceiling talks key

The US debt ceiling talks will continue to dominate markets in the near term.

On Wednesday, the latest data due, the US Treasury’s cash balance dropped to USD49bln from USD76bln on Tuesday.

The Treasury has said the US government might run out of money as soon as next Thursday.

Otherwise, US personal consumption and expenditure numbers are released tonight – a key measure of inflation. The market expects the core PCE annual rate to remain steady at 4.6%.

Aussie, kiwi crunched by perfect storm

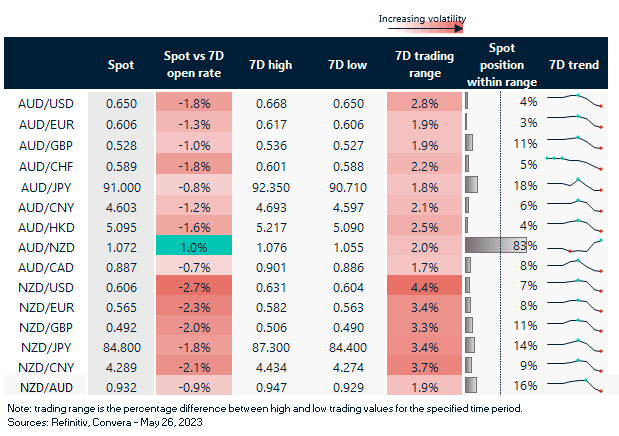

Table: seven-day rolling currency trends and trading ranges

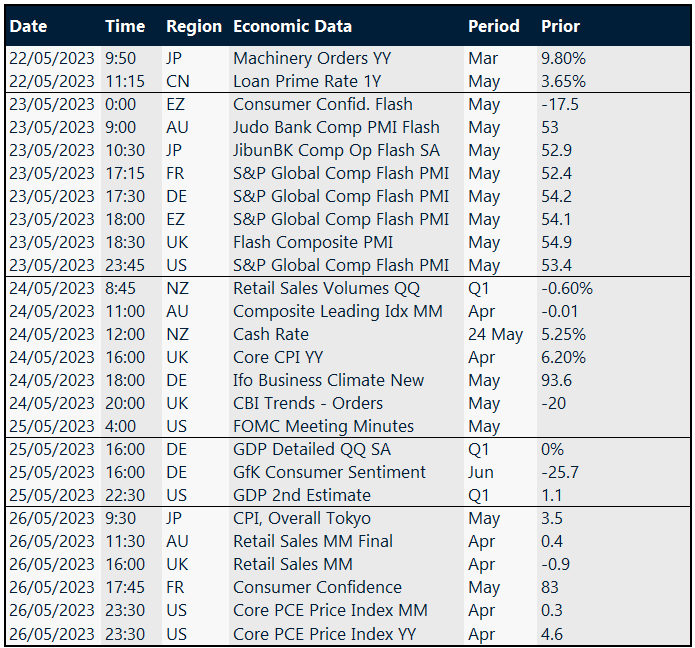

Key global risk events

Calendar: 22 – 26 May

All times AEST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.