Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

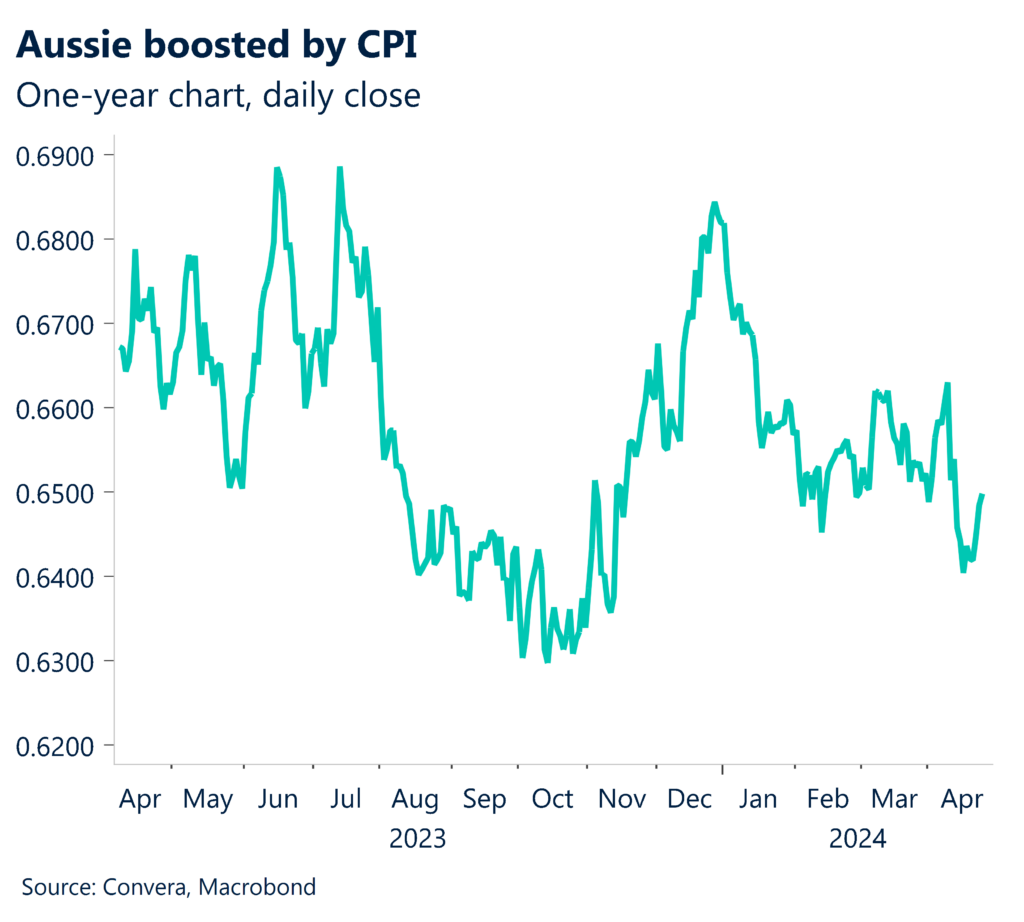

Aussie at two-week high after inflation jump

The Australian dollar pushed up to new two-week highs on Thursday after this week’s hotter than expected inflation number boosted the currency.

The Australian public holiday didn’t dimmish the AUD buying with the AUD/USD up 0.5%.

Wednesday’s CPI reading was hotter across the board but the acceleration over the quarter was likely to be most concerning for the Reserve Bank of Australia.

In annual terms, headline inflation was reported at 3.6% (versus 3.5% expected) while the RBA’s preferred measure, the trimmed mean, came in at 4.0% (forecast at 3.8%).

On a quarterly basis, headline jumped 1.0%, above the 0.8% forecast, while the trimmed mean was also at 1.0% versus the 0.8% expected.

Australian money markets now don’t see a full 25-basis point rate cut until August 2025.

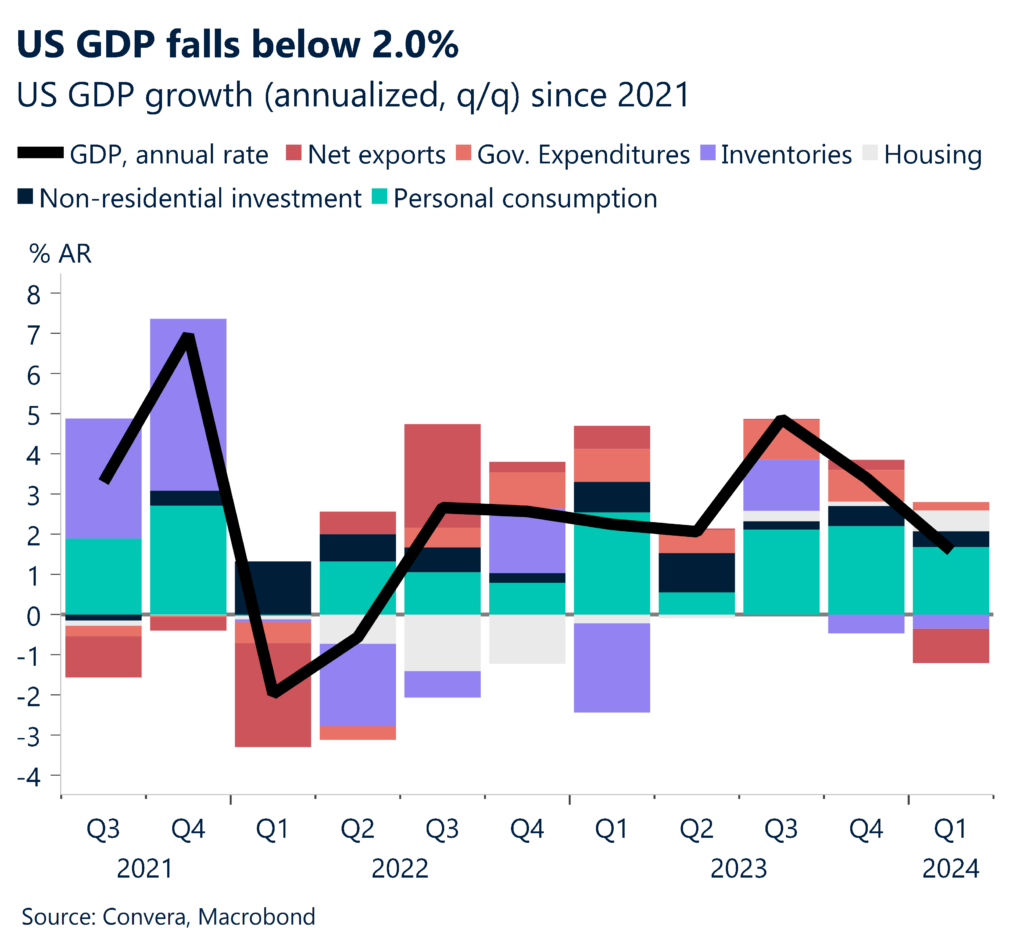

“Reverse Goldilocks” as US growth slows, but inflation accelerates

In other markets, the US dollar was weaker after a disappointing March-quarter US GDP reading saw growth slow but inflation accelerate – a rare occurrence that raises the spectre of stagflation.

US GDP was reported at 1.6% in annualised terms versus the 2.4% expected.

On the other hand, core personal consumption and expenditure inflation was 3.7% versus the 3.4% expected. We receive full PCE data tonight. The USD index is now down 1.0% from its 16 April high.

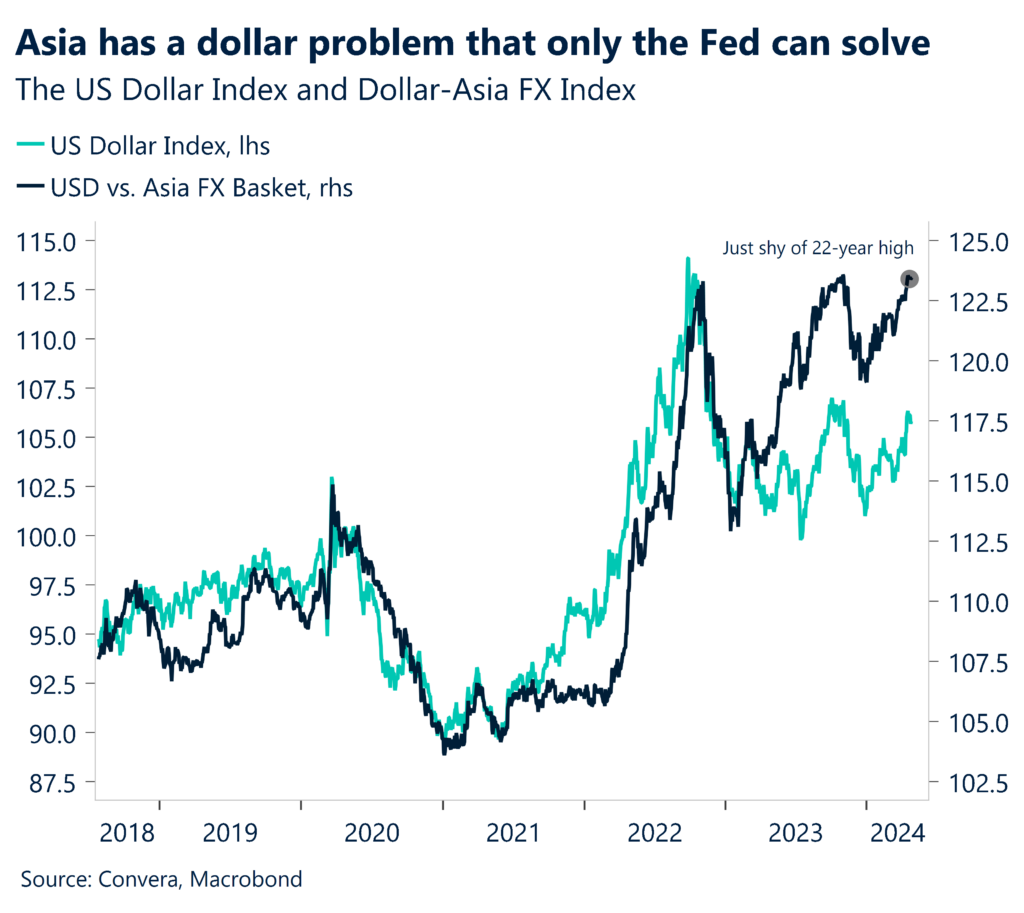

USD/JPY in focus with BoJ, USC PCE due

Looking forward, two big releases are due in the next 24 hours that could have a seismic effect on FX markets – particularly the USD/JPY pair.

First, the Bank of Japan policy decision is due today. The BoJ is not expected to alter interest rates after raising rates in March, but a move to reduce bond purchases – an alternative way of tightening policy – is a possibility.

One unknown is how much the JPY’s recent weakness will play into the BoJ decision – but tightening policy could be one way of providing support to the weaker yen.

Later tonight, the US PCE inflation reading is due – potentially one of the biggest economic releases of the year.

A significantly higher number could almost eliminate the chance of a US rate cut in 2024 – at least for now.

Aussie at two-week highs

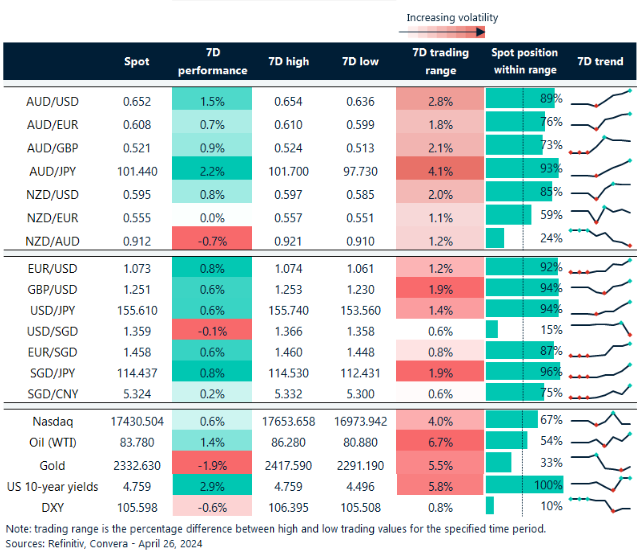

Table: seven-day rolling currency trends and trading ranges

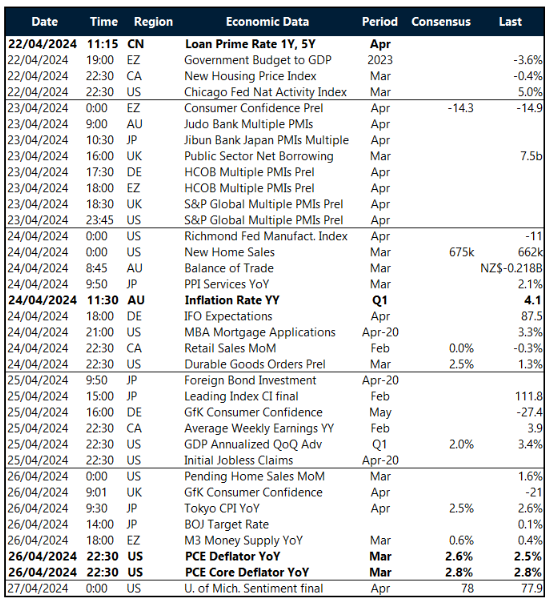

Key global risk events

Calendar: 22 – 27 April

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]