Global overview

FX markets were quieter than usual thanks to holidays in the US and Canada. The USD remains well supported after last Friday’s stronger jobs report. Today, all eyes are on Reserve Bank of Australia governor Philip Lowe as he overseas his final interest rate decision.

USD remains supported after Friday’s jobs report

Global markets were broadly quiet overnight with the US and Canada both closed for national holidays.

In Europe, equity markets drifted lower, as they continued to react to last week’s stronger than expected US jobs report that kept live the possibility of further rate hikes from the US Federal Reserve.

The threat of further hikes — although still remote — provided support to the US dollar which rose to three-month highs after Friday’s job report.

The USD/JPY extended recent gains to near the highest level since November.

The USD/CNH and USD/SGD were also higher.

Euro rebounds from recent lows

European currencies recovered overnight after the heavy selling seen last week.

A stronger than expected Eurozone inflation reading initially boosted the euro but cautious commentary from European Central Bank board member Isabel Schnabel, who warned of a growth slowdown, saw the euro lower.

The British pound was also pressured as the GBP/USD dropped back to three-month lows.

The recent weakness in the euro and British pound saw the currencies fall versus other major markets, with the AUD/EUR at one-month highs and AUD/GBP at three-week highs overnight.

Lowe’s final decision due

The AUD/USD and NZD/USD were initially higher in yesterday’s trading but fell overnight to close broadly flat.

The Australian dollar is in focus today with the Reserve Bank of Australia decision due at 2:30pm AEST. The market sees less than a 1.0% probably of a hike according to market pricing from Refinitiv.

The meeting is the final decision overseen by governor Philip Lowe who took over in September 2016.

While Lowe had requested an extension in line with the previous two governors, he was denied, the first RBA chief not to be granted an extension since Bernie Fraser in 1996.

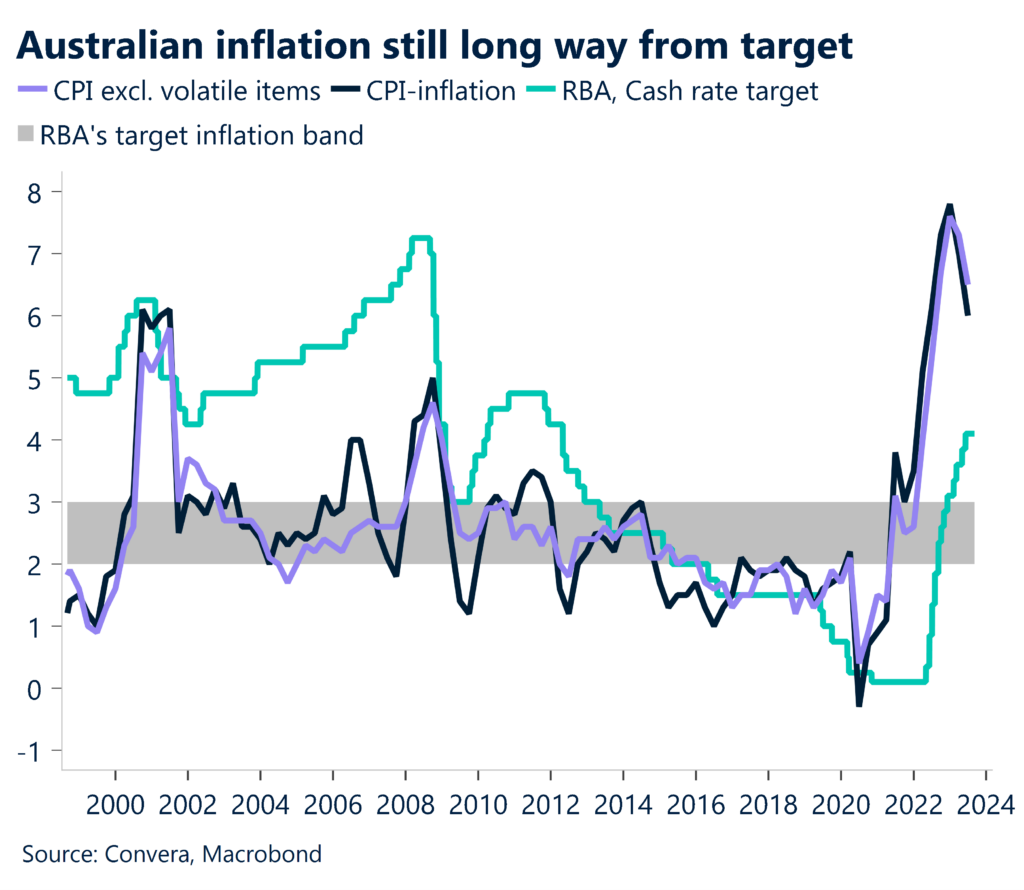

Lowe’s March 2021 forecast that the cash rate was likely to remain at 0.1% until “at least 2024” — and then hiking rates by 400bps over the next two years — made his position untenable.

Euro rebounds in quiet session

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 4 – 8 September

All times AEST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.