US ISM reading in focus today

The US dollar ended July lower against a basket of currencies, adding to June’s decline and marking its 8th monthly drop out of the last ten months since peaking in September last year. The start of the dollar’s downturn coincided with the bottoming of the equity market slump and the peak of inflation in many advanced economies. The dollar index remains afloat the key $100 mark though and has alleviated last year’s “overbought” conditions.

The resilient US economy and upgrade to the global growth outlook by several forecasters have led to improved global risk appetite, supporting demand for riskier assets and allowing both the Dow Jones and the S&P 500 to surge over 3% last month. The tech-heavy Nasdaq index jumped 3.8%, as traders continue to focus on corporate results, while betting the end of the Federal Reserve’s (Fed) interest rate hike campaign is close. Being data dependent though, the Fed as well as market participants, will keep a close eye on today’s ISM manufacturing PMI, which is expected to remain in contraction territory, whilst the important payrolls report is due on Friday. Meanwhile, the Fed’s Senior Loan Officer Opinion Survey (SLOOS) shows banks are being increasingly restrictive in their lending practices while households and businesses are wary of taking on additional borrowing. Although this should help inflation return to target, a credit squeeze also heightens the chances of recession.

As a result, we are still dubious of the “soft landing” call, especially since the Fed has kept the door open to further rate hikes. That said, markets are currently pricing a less than 40% chance of any further rate hikes, and for the Fed to start cutting rates from the second quarter of 2024, supporting a risk-on climate for investors.

UK house prices fall most in 14 years

The British pound recorded a second straight monthly gain and a fourth positive month in five in July against the US dollar. GBP/USD has pulled back sharply from 16-month peaks though as traders look to “Super Thursday” for the Bank of England’s (BoE) next policy decision and Monetary Policy Report. The BoE is widely expected to hike by 25 basis points, although a 50-basis point hike is not out the question.

Money markets are currently assigning around a two-in-three chance of a quarter-point move and one-in-three that the BoE opts for a half-point rate rise, but either way, further tightening could hurt the economy, especially the housing market. This morning, the Nationwide House Price Index in the UK dropped by 3.8% from a year earlier, marking the largest fall in house prices since July 2009. Housing market activity has been subdued in recent months because housing affordability remains stretched for those looking to buy a home with a mortgage, owing to the unprecedented rise in BoE interest rates. Although inflation is showing tentative signs of slowing, which has lessened the likelihood of a jumbo rate rise, consumer prices are still rising at the fastest pace in the G7. Thus, rate differentials should continue to favour the pound, but it also gives rise to the risk of the BoE underdelivering on market expectations, which could hurt the pound further down the line.

Against the euro, the pound has steadily risen for seven consecutive months, from a low of around €1.12, to a high of around €1.1750. UK interest rate and growth differentials relative to the Eurozone will likely continue supporting GBP/EUR, but the 100-month rolling average (currently located at €1.1748) is proving a tough nut to crack.

ECB making slow but steady progress

In what can be described as a small but nonetheless important milestone for the European Central Bank, inflation fell to the lowest level since January 2022. Consumer prices grew by 5.3% in July, marking the ninth yearly fall in the last ten months. The disinflation continues to be primarily driven by dropping energy and goods prices, with services and core inflation remaining at elevated levels.

Overall, the report has not been market moving given the minor deviation from economist’s expectations and the fact that the FX markets are currently more driven by events in the US surrounding inflation and the Fed. The release of GDP numbers for Q2 have been a bit better received by markets as the Eurozone successfully returned to growth, after recording two weak (-0.1% and 0%) quarters in a row. Germany remained the laggard in Europe, underperforming both France and Spain, with no quick recovery in sight. This did not stop the German equity benchmark (DAX) from making a new all-time high on the last trading session of July, reaching 16.540 points for the first time in its history.

The Euro could not profit from its close correlation to risk assets and European stock markets and has once again fallen below the $1.10 mark. Today market movers will come in the form of final PMI reads for all major European economies and the German and Eurozone unemployment rates. We currently see EUR/USD fairly well positioned around the $1.10 mark, moving up and down based on the day’s data releases. A meaningful deviation from this level would have to be accompanied by a serious shift in sentiment or a large data surprise, most likely coming from the US.

Euro on the defensive

Table: 7-day currency trends and trading ranges

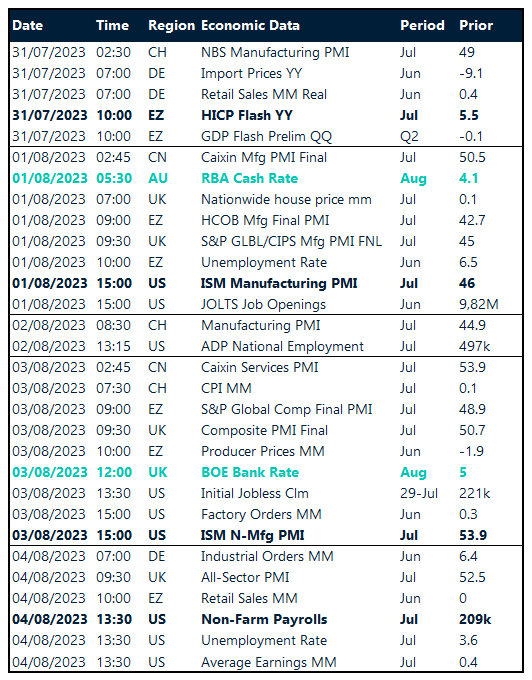

Key global risk events

Calendar: July 31- August 4

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.