Written by Convera’s Market Insights team

Bonds fall, dollar rises as inflation and Fed due

George Vessey – Lead FX & Macro Strategist

Last Friday’s stronger-than-expected US jobs report saw markets push back expectations of the first rate cut by the Federal Reserve (Fed) to December. The US dollar index extended its reversal from 9-week lows and reclaimed the 105 handle as yields staged a two-standard deviation jump higher on the day, the biggest climb since April’s hot CPI report.

Economic data, particularly US non-farm payrolls prints and CPI prints, remain the biggest market moving events, which have caused volatility in FX to spike over recent months. Thus, this week’s trifecta of US inflation prints, including consumer, producer and exports prices, will be closely monitored. The CPI print falls just ahead of the Fed’s monetary policy decision on Wednesday. Although the US central bank is widely expected to hold borrowing costs steady for a seventh consecutive meeting, there’s less certainty on the updated rate projections. The new dot plot likely will indicate two 25-basis- point cuts this year, compared with three in the March version and versus the market’s current expectation of just one and the rising probability of no rate cut at all.

This Fed meeting could be highly influential for markets as Fed Chair Powell may provide the clearest hint yet to the rate-cut timetable. The US dollar remains supported by its high growth, high yielding and safe haven appeal – the latter all the more important given the rise in political uncertainty across Europe of late, which has rocked risk sentiment and European assets.

A disgruntled European voter

Boris Kovacevic – Global Macro Strategist

Europeans headed to the polls from Thursday to Sunday last week in the worlds second-largest democratic election. The conclusion so far: voters in the continents largest countries have taken the opportunity to voice their dissatisfaction with the ruling governments with the centre-right and far-right parties gaining votes and the greens losing seats.

The parties of French President Emmanuel Macron and German Chancellor Olaf Scholz experienced heavy losses with the former only snatching 15% of the votes while the latter suffered the worst election in history. This could result in a shift of the traditional power balance on a regional basis. Macron already dissolved the lower legislative chamber due to the loss suffered on Sunday with new elections scheduled to take place on June 30. From a European perspective, the status quote remains secured with the centre-left and cent-right parties coming in on top. Still, more spending on defense and caution on the topics of green energy and immigration will likely come out as a result of the election.

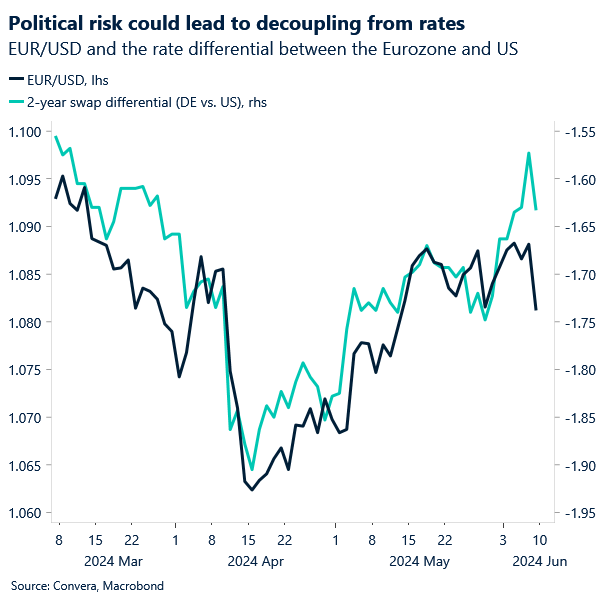

The euro continued its descent that started on Friday after the non-farm payroll surprise. EUR/USD opened the week much lower on heightened political risks coming from the snap election in France and has now fallen from $1.09 to $1.0750 in just two days. Despite the election jitters, the incoming macro data will matter more for the common currency. We will get the Sentix Sentiment, industrial production and some ECB speak on the domestic front. The main risk event will be the Fed decision and US CPI report. Still, should peripheral sovereign yields start rising more than their core peers, optimism surrounding the bottoming European economy might fade. This would come at a time when leveraged funds turned positive on their euro positioning for the first time in August.

Pound pounces on euro weakness

George Vessey – Lead FX & Macro Strategist

The British pound has been sensitive to external events, particular US data, but also the political turmoil across Europe, which has sent GBP/EUR surging through €1.18 to fresh 21-month highs. The upcoming week will feature important domestic economic indicators such as the UK labour market report, monthly GDP figures, industrial production, construction output, and trade balance. One eye will also be on developments in the UK election campaign, with recent polls suggesting a Labour victory would be the best outcome for the pound.

Sterling sits over 3.5% higher, on average, against global peers year-to-date and is the best performing G10 currency against the US dollar so far this year. Market’s expectations of Bank of England (BoE) rate cuts have been slashed following strong activity data and sticky services inflation. The next test will be private sector wage growth figures on Tuesday, another key metric the BoE wants to see more progress in before easing policy. Currently, one full rate cut is being priced in by November, but this could be brought forward to September or August if more progress on services inflation and wage growth is evident.

In terms of FX, the pound has slipped sharply from 3-month highs versus the US dollar following the US jobs report last Friday, and this move lower could extend if US inflation comes in hot or the Fed signals just one rate cut for this year. Against the euro, there is an upside bias for now after stabilising above €1.17 for so long and jumping so sharply today, but domestic pressures such as a potential dovish BoE shift and a narrowing of the UK election polls could weigh heavy on sterling.

Euro crushed after EU election results

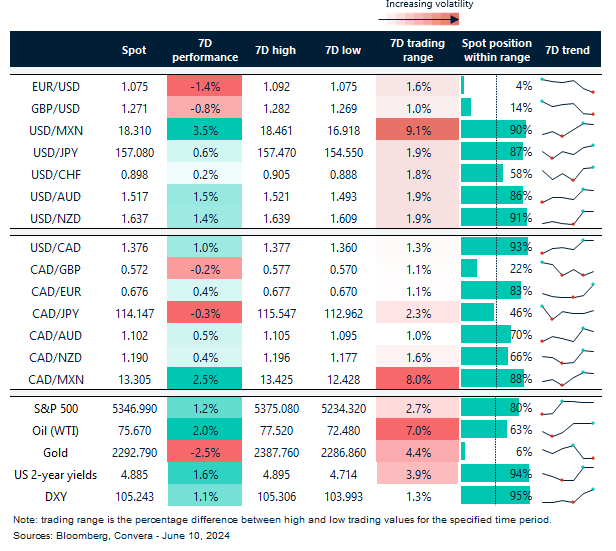

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: June 10-14. All times expressed in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.