Written by Convera’s Market Insights team

Dollar swings with Powell and JOLTs

George Vessey – Lead FX Strategist

The US dollar initially weakened after Federal Reserve (Fed) chair Jerome Powell said that disinflation appears to be resuming, ending a two-day selloff in the bond market and putting downward pressure on US yields and the dollar. However, the US JOLTs report hinted the labour market may be strengthening with job openings and hiring rising – a bearish factor for bonds and a bullish one for the dollar ahead of Friday’s jobs data. The US dollar index still ended the day slightly in the red though, with a large tail to the upside, highlighting bullish fatigue.

Jerome Powell warned maintaining a restrictive stance for too long risks unnecessary economic pain but that cutting rates too soon risks undoing much of the progress made in bringing inflation toward the 2% target. The US 2-year yield dropped back under its 200-day moving average on those comments, but although the Fed chair also acknowledged the labour market is coming into better balance, lowering the risk of another surge in inflation, the JOLTS job openings, released shortly afterwards, surprised to the upside, rising by 221k to 8.140mnl in May, beating the forecast of 7.9mln. This halted a decline in the ratio of job openings versus unemployed persons, one of the Fed’s favoured labour market indicators. Still, the trend is softening with the US economy moving towards pre-pandemic levels and keeping the door open for rate cuts later this year.

We think the macro backdrop is currently bad enough to continue supporting the call for a Fed cut in September. There are mounting signs of the US economy losing steam and the incoming macro data surprised to the downside on all occasions last week. All eyes are on the jobs report on Friday and ISM services PMI as well as the Fed’s meeting minutes today, but until the Fed starts easing and political risks evaporate, the high yield and safe haven appeal of the US dollar might keep it strong for longer.

Euro dips after post-election rebound

Ruta Prieskienyte – Lead FX Strategist

The euro retreated after a three-day advance, in line with the performance of most G10 currencies, after ECB policymakers indicated they need more evidence that price pressures are under control. European stocks dropped, wiping out over half of the prior day’s gains, as French political uncertainty lingers ahead of the final round of voting on Sunday. European government bond yields also fell, but the OAT-Bund 10-year yield spread, a proxy for the French elections’ premium, further narrowed to 72 bps (-6 bps versus Monday), the lowest in almost three weeks.

The preliminary annual inflation rate in the Eurozone eased to 2.5% in June, having briefly accelerated to 2.6% in May, and largely in line with market consensus. Core inflation, a measure excluding volatile items such as food and energy, unexpectedly remained unchanged at 2.9%. The services inflation gauge was also stable at 4.1%. Although the headline trend is encouraging, ECB President Lagarde stated at the ECB Forum that the central bank does not yet have sufficient evidence that inflation threats have passed. The region’s resilient labor market gives the ECB the necessary time to assess the appropriate timing and speed of its monetary policy easing cycle but is in itself a contributor to upward wage pressures, especially in the services sector, where labour costs hold greater sway over prices charged than in manufacturing. At the time of writing, money markets are pricing only a 7% probability of a back-to-back July rate cut, in line with the recent ECB communication, and 41 bps worth of additional easing is expected by year-end.

The realized FX volatility across the euro crosses declined once the markets digested the key takeaways from the first round of the French parliamentary elections and we once again entered a wait-and-watch mode. The 1-week implied volatility, an option-implied gauge of short-term expected future volatility, marginally retreated but continues to trade at elevated levels compared to the 2024 average and the near-term market sentiment remains euro bearish.

Pound edges higher as election looms

George Vessey – Lead FX Strategist

This time tomorrow, British voters head to the ballot box with the polls still pointing toward a large Labour victory. They have narrowed ever so slightly recently, but not as much as we expected and it’s still over a 20-point advantage for Keir Starmer’s opposition party. Usually markets are averse to a change in leadership, especially a left leaning Labour Party, but this time – the hope is Starmer’s more centrist, pro-business stance, promising fiscal discipline and improved EU relations, will bring more stability to the UK economy and politics, which is reassuring investors and propping up the pound.

In fact, right now, amidst this potential Labour victory, rather than markets being spooked and UK assets being shunned, British stocks are near a record high, UK bond fluctuations have evaporated, and the pound is the best performing G10 currency year-to-date after the US dollar. Hedging against pound weakness is also at a seven-year low. This is a welcome comfort given how UK assets have been dancing to the tune of political drama for so many years. Some investors are even betting UK assets will provide a refuge in the coming months from political chaos elsewhere, like France and the US. Of course though, you can never say never in politics or markets, so we are wary of surprises triggering increased volatility and unexpected FX moves. The biggest downside tail risk to the pound being a hung-parliament, if no party has a majority of seats. We saw this back in the 2010 & 2017 elections and the pound lost over 4% in value in just over a week. But this is not our base case scenario.

GBP/USD has risen for four days on the bounce, is flirting with its 50- and 100-day moving averages and is in neutral territory according to momentum indicators like the relative strength index. We do need to see a sustained break above $1.27 for a higher chance of fresh 2024 peaks to be reached any time soon though.

Pound on the march higher before election

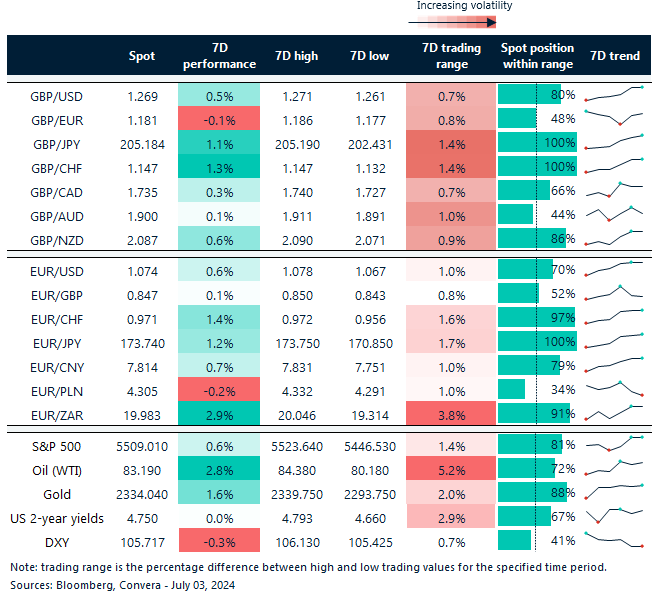

Table: 7-day currency trends and trading ranges

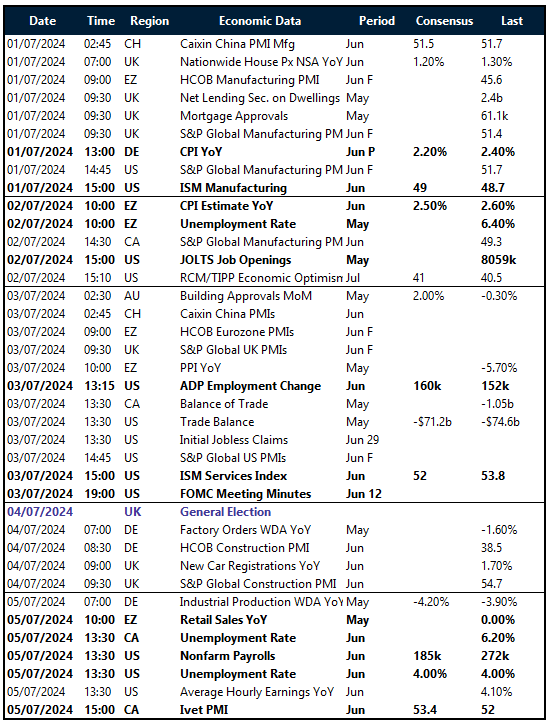

Key global risk events

Calendar: July 01-05

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.