Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

US bond yields at highs as Fed worries persist

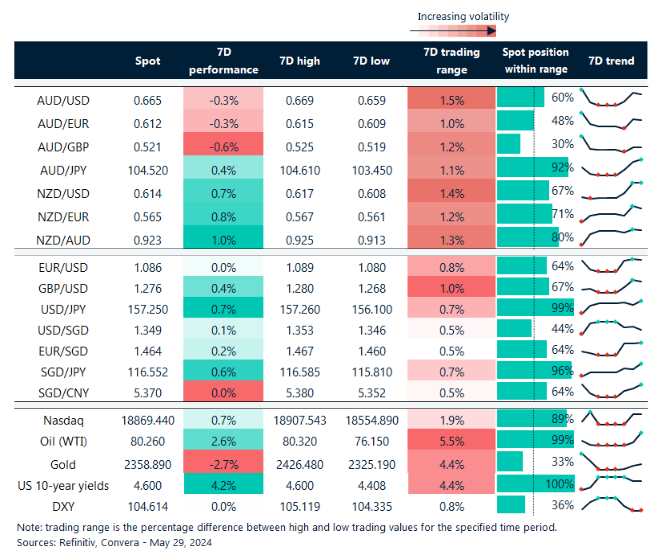

The Australian dollar outperformed overnight ahead of today’s key inflation numbers.

The AUD/USD gained 0.4% as it returned to near four-month highs.

In other markets, the US dollar was mostly higher, as US bond yields climbed. Minneapolis Fed president Neel Kashkari said the central bank had no reason to rush into rate cuts. (Kashkari is not a voting member in 2024, however.)

The US two-year bond yield, a key measure of Fed expectations, climbed to one-month highs at 4.99%.

In other markets, the NZD/USD fell 0.1%, USD/CNH gained 0.1% while USD/SGD was flat.

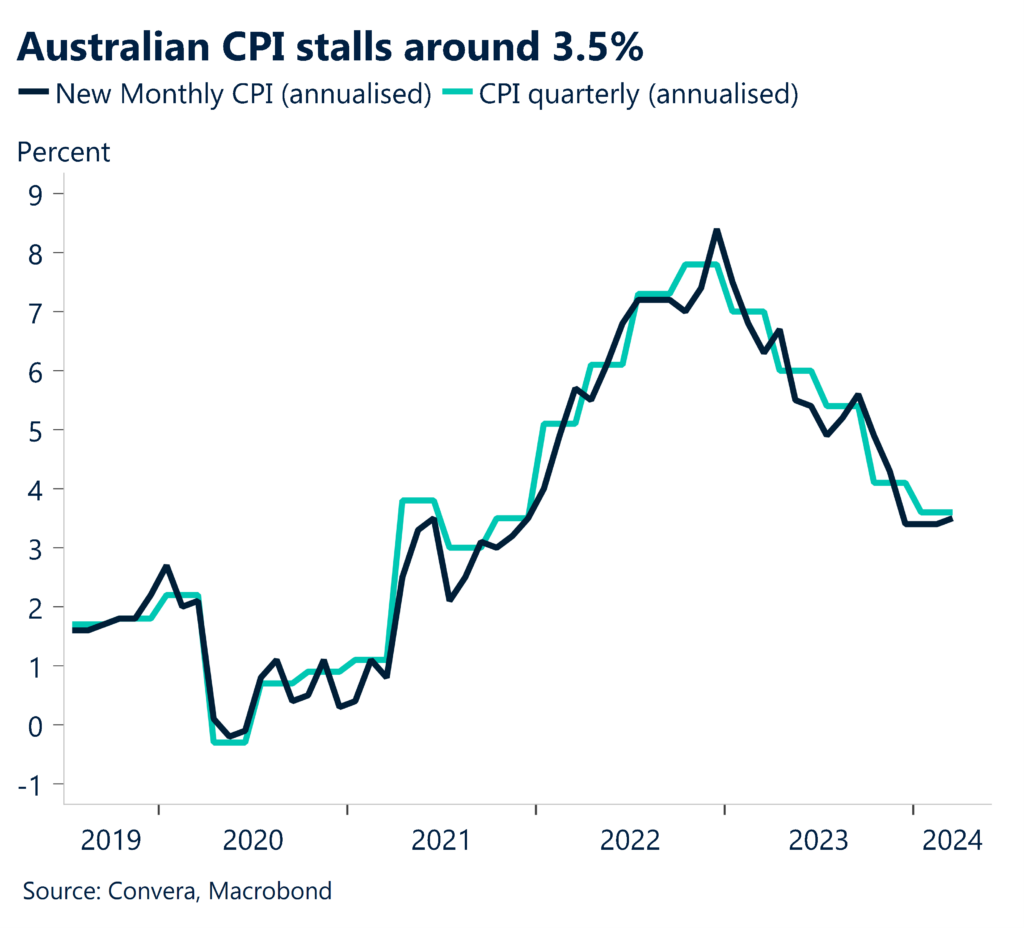

Australian CPI key for RBA’s next move

The main event for the Aussie today is the monthly inflation report. Australian monthly CPI inflation measure is forecast to grow by 0.4% over the month (source: Reuters) but there is a risk of a higher than expected 0.6%.

April is a month with significant seasonal inflation, which could maintain the annual inflation measure around 3.5% year-over-year, above forecasts for 3.3%. April normally sees a spike in clothing prices due to seasonal changes, and domestic travel and lodging costs also tend to increase in light of Easter and school vacations.

Furthermore, fuel prices should have increased by around 2% this month as a result of higher global oil prices, which should decline in May.

Additionally, given the tightness of the rental market, we anticipate an additional significant increase in rent. On the other hand, expenses related to insurance, education, and communication usually remain unchanged in April.

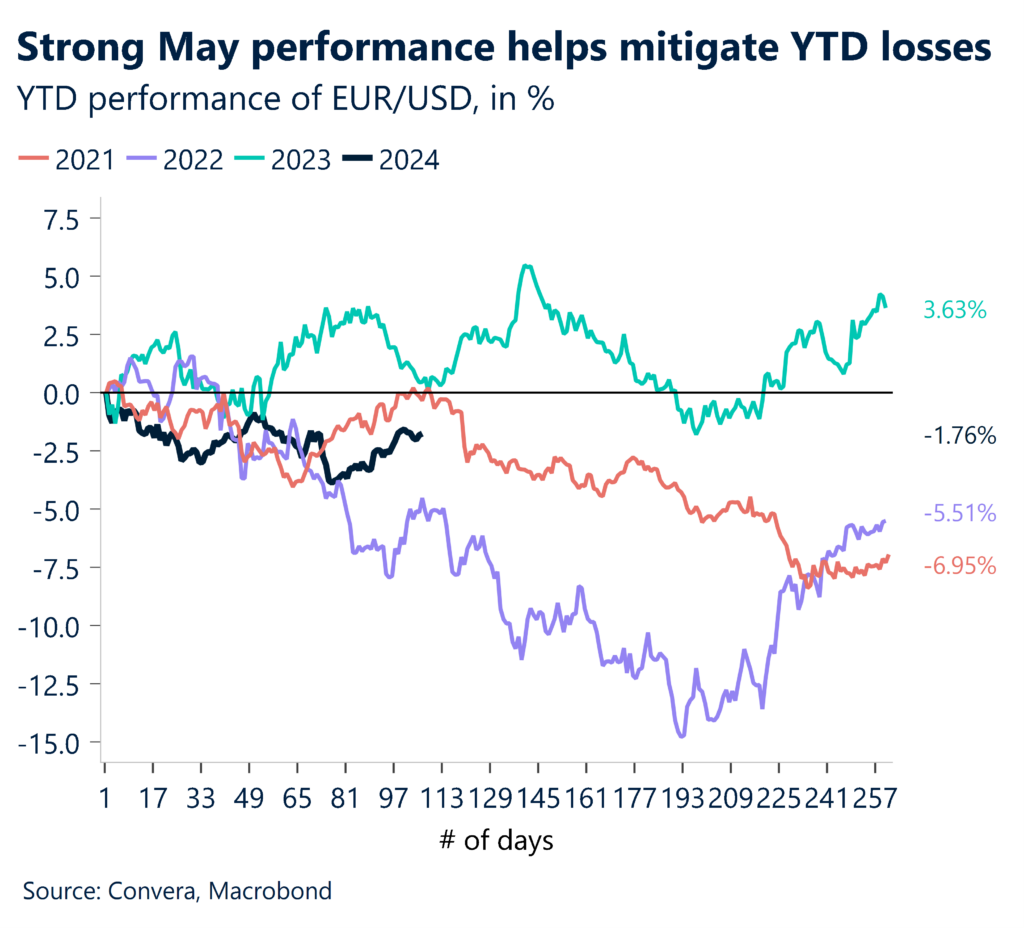

Euro lower as inflation expectations fall

The chances of a European Central Bank rate cut next week continue to climb with a fall in Euro Area inflation expectations overnight.

Since one-year ahead median expectations often closely mirror headline HICP inflation, this was expected to reduce somewhat due to past inflation declines, with some upward pressure coming from HICP inflation failing to decline in April.

One-year expectations fell from 3.0% to 2.9% while the three-year expectations dropped from 2.5% to 2.4%. The ECB was expected to focus on whether the median forecasts for the next three years continue to rise or start to fall.

Financial markets now see a 91% chance of an ECB cut next week (source: Refinitiv).

The EUR/USD turned sharply at two-month highs overnight that could signal potential weakness in the euro. The expected policy divergence as the ECB looks likely to cut interest rates before the Federal Reserve might weigh on the EUR.

Aussie heads toward highs ahead of CPI

Table: seven-day rolling currency trends and trading ranges

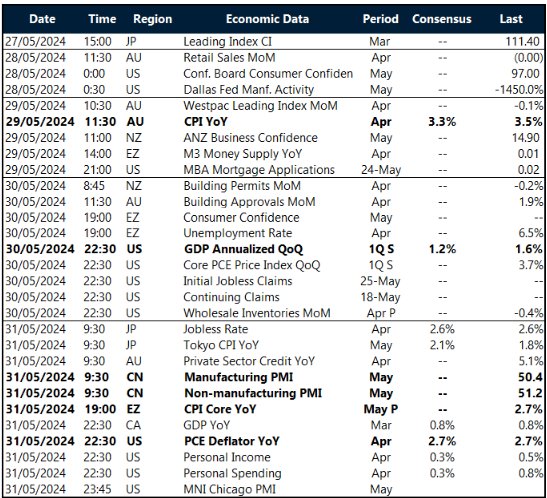

Key global risk events

Calendar: 27 – 31 May

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]