The benefits of scaling a B2B company of any size can be quite ample. By entering new markets, organizations can grow, diversify risk and increase the pace of innovation. Scaling globally can also bring new efficiencies to production, logistics, marketing and distribution.

However, one area in the modern global economy that has thrown a wrench into many growth plans is cross-border payments. When new countries are brought into the fold, accounts payable teams must determine the appropriate payment methods for each locale to disperse and receive funds efficiently, without higher risks to cover currency conversions and regional compliance issues.

Effective payment processing is crucial for handling multiple currencies and compliance issues, and as cross-border payments systems become more complex, they must link with one another through robust payment infrastructure. To connect cross-border payment systems and facilitate payments, B2B companies often add middleware — software that connects networks to provide an automated yet more complex solution.

However, adding new layers to the tech stack adds more complexities, and such attempts at integration often prove to be clunky, prone to mistakes and ultimately more expensive — the exact opposite of what was intended by growing internationally and achieving economies of scale. So, what’s the best way to scale?

Understanding payment scalability

Payment scalability refers to a payment system’s ability to handle increased transaction volumes without compromising performance, reliability or security. It is a critical aspect of any payment infrastructure, enabling businesses to grow and expand their operations without limitations in their payment processing capabilities. A scalable payment system can adapt to changing demands, whether it’s a sudden surge in transactions or a steady increase in volume over time.

A scalable payment system should be able to process transactions quickly and efficiently, without introducing errors or security vulnerabilities. It should also be able to handle a wide range of payment methods, currencies and geographic locations, making it a flexible and adaptable solution for businesses operating across borders.

Understanding cross-border payment systems

Cross-border payments refer to transactions involving the transfer of funds between two parties in different countries. These payments can be complex, involving multiple currencies, exchange rates and regulatory requirements. For businesses operating globally, cross-border payments are crucial for effectively navigating the intricacies of international trade and commerce — and for scaling effectively.

To establish a successful — and scalable — cross-border payment system, businesses need to consider several critical factors. The price of transactions is a primary concern, as high fees can be detrimental. Speed is another crucial element; delays in payment processing can disrupt cash flow and business operations. Security and compliance are also paramount, as businesses must protect sensitive financial data and adhere to various regulatory standards across different jurisdictions.

Determining the best payment method for specific needs is essential. Traditional banking channels offer reliability but may come with higher costs and slower processing times. Alternatively, businesses can explore modern payment providers that offer faster, more cost-effective solutions. By carefully evaluating these factors, businesses can choose the most suitable payment method to facilitate smooth and efficient cross-border transactions.

The complexities in cross-border payments

Navigating the complexities of cross-border payments can be daunting for businesses. High transaction fees, lengthy processing times and intricate regulatory requirements often pose significant challenges. These issues can lead to increased costs, reduced efficiency and lower customer satisfaction, making it difficult for businesses to thrive in the global market.

To overcome these hurdles, businesses can adopt scalable payment solutions that enable fast, secure and cost-effective cross-border transactions. One effective solution is using application programming interfaces (APIs) and microservices. By integrating these technologies with existing architecture, businesses can streamline processes, reduce complexity and enhance flexibility. This approach not only simplifies cross-border transactions but also ensures that the payment system can accommodate increased demand without requiring significant infrastructure upgrades. Payment automation can also enhance efficiency by reducing manual intervention and errors.

By investing in a scalable payment system, organizations can establish a competitive advantage in the market. They can reduce costs, improve operational efficiency and enhance customer satisfaction. In today’s global economy, where borders are becoming increasingly irrelevant, having a robust and scalable payment system is not just an advantage — it’s a necessity for success.

The importance of scaling payment systems

A scalable payment system enables businesses to process transactions quickly and efficiently, regardless of the location of the parties involved. This efficiency is crucial for maintaining smooth operations and meeting customer expectations in today’s fast-paced and competitive business environment. Scalability also allows businesses to adapt to changing market conditions and customer needs.

Developing a scalable payment system requires a deep understanding of the complexities of cross-border payments. Businesses must develop software that can handle multiple currencies, exchange rates and regulatory requirements.

Top considerations for scaling B2B payments

Scaling cross border B2B payments requires a deep understanding of the complexities of processing payments between businesses. Top considerations for scaling B2B payments include:

- Complexity of payment flows: B2B payments often involve complex payment flows, including multiple parties, currencies, and payment methods. Understanding these complexities is essential for developing a scalable system that can handle diverse transaction scenarios.

- High-value transactions: B2B payments often involve high-value transactions, which require robust security measures to protect against fraud and errors. Ensuring the security and integrity of these transactions is paramount for maintaining trust and compliance.

- Longer payment cycles: B2B payments often have longer payment cycles, which require more sophisticated payment processing capabilities. Efficiently managing these cycles is crucial for maintaining cash flow and operational efficiency.

- Multiple payment methods: B2B payments often involve multiple payment methods, including credit cards, bank transfers and online banking. A scalable system must accommodate various payment methods to meet the diverse needs of business partners.

- Cross-border payments: B2B payments often involve cross-border transactions, which require expertise in navigating complex regulatory requirements and currency exchange rates. Developing a scalable infrastructure that can handle these challenges is essential for successful international operations.

Scalable payments start with building a scalable infrastructure

Building a scalable infrastructure for payment processing requires careful planning, design and implementation. It involves developing a system that can handle increased transaction volumes while maintaining performance, reliability and security.

Modular architecture. A modular architecture allows for easy addition or removal of components as needed, making it easier to scale the system. This flexibility is crucial for adapting to changing business needs and transaction volumes.

Cloud-based infrastructure. Cloud-based infrastructure provides scalability, flexibility and cost-effectiveness, making it ideal for payment processing. It allows businesses to scale resources up or down based on demand, ensuring optimal performance without unnecessary costs.

Distributed systems. Distributed systems allow processing to be distributed across multiple servers, reducing the load on individual servers and improving overall performance. This approach enhances reliability and ensures that the system can handle high transaction volumes without bottlenecks.

Load balancing. Load balancing ensures that incoming traffic is distributed evenly across multiple servers, preventing any one server from becoming overwhelmed. This helps maintain consistent performance and reliability, even during peak transaction periods.

Security. Security is critical for payment processing, and a scalable infrastructure should include robust security measures to protect sensitive data. These measures include encryption, secure authentication, and compliance with global security standards to safeguard against fraud and cyber threats.

A strategic approach to scaling payments

Scaling a payment system for growth involves a series of strategic steps, each requiring careful planning and execution.

Here’s a five-step roadmap to guide the process:

- Define key objectives: Start by identifying the primary goals for scaling the payment system. These could include increasing transaction capacity, reducing latency or enhancing security. Clear objectives provide a focused direction for the scaling efforts.

- Assess current infrastructure: Evaluate the existing payment infrastructure to identify strengths and areas for improvement. This assessment helps in understanding the current capabilities and limitations, forming the basis for the scaling strategy.

- Invest in scalable technologies: Invest in technologies that support scalability, such as cloud-based solutions, APIs and microservices. These technologies offer the flexibility and capacity to handle increased transaction volumes and complexity. Integrating these technologies can enhance payment functionalities, ensuring the system can grow with demand.

- Develop a phased implementation plan: Create a phased implementation plan that aligns with business objectives and minimizes disruption. A step-by-step approach ensures that scaling efforts are manageable and sustainable, allowing for adjustments as needed.

- Adjust and pivot when necessary: Create performance metrics to measure the success of a new scalable system, and be prepared to adjust your strategy if something doesn’t work out.

Key trends in cross-border payments driving the need for scalability

As the landscape of cross-border payments rapidly evolves, the scalability issue has moved front and center. For B2B payments, linking systems across borders can be made seamless and efficient by adopting digital payment solutions that enhance the existing systems, rather than adding new ones. For example, digital payment solutions can streamline processes by offering reusable payment methods and immediate payment notifications, reducing the need for additional steps.

The industry is trending toward smarter, adaptable fintech solutions to enable cross-border payments without increasing the complexity of each B2B transaction.

The following are key trends reshaping international B2B payment systems and driving the need for scalable, adaptable solutions:

Blockchain and stablecoins: Blockchain technology has emerged as a powerful tool for improving cross-border payments by reducing transaction costs and increasing transparency. Stablecoins, a form of cryptocurrency pegged to real-world assets (e.g., US dollars), can offer price stability, making them ideal for international trade. By reducing reliance on traditional banking systems, blockchain can enhance payment speed and lower fees, according to PYMNTS.

Artificial intelligence: AI technologies optimize payment systems by improving fraud detection, streamlining reconciliation and predicting payment flows. AI-driven payment solutions can identify inefficiencies and recommend optimizations, helping businesses save time and money. This is critical for B2B companies looking to expand into new markets, where companies may not be as familiar with the new customs, standards and regulations.

Real-time payments: The demand for real-time payments is rising, particularly in cross-border B2B transactions. While traditional payment systems can take days to settle, real-time payments allow businesses to send and receive funds instantly, improving cash flow and reducing waiting times. Middleware solutions may increase speed, but they’re not always executing in real time, particularly considering the potential risk increase.

API integration: APIs are a key trend to watch as modern payments platforms adopt them to seamlessly integrate payment functionality into existing systems. APIs enable payment automation, facilitate currency conversion, and streamline cross-border transactions without the need to add an intermediary. Essentially, APIs get payment platforms and receiving platforms to talk to each other.

Bridging systems with an API

The trick to capturing B2B payments efficiently while expanding into new countries is to make it as simple as possible to exchange data without major changes in software. According to PYMNTS, “API technology can help enable seamless integration between separate systems and platforms, leading to automated data exchange, streamlined processes and enhanced interoperability without requiring a total revamp of accounting infrastructure.”

A payments API is a set of protocols that enables different software systems to communicate with each other for secure and efficient payment processing. By using an API, businesses can integrate payment functionalities into their internal systems, such as enterprise resource planning (ERP), customer relationship management (CRM) or e-commerce platforms.

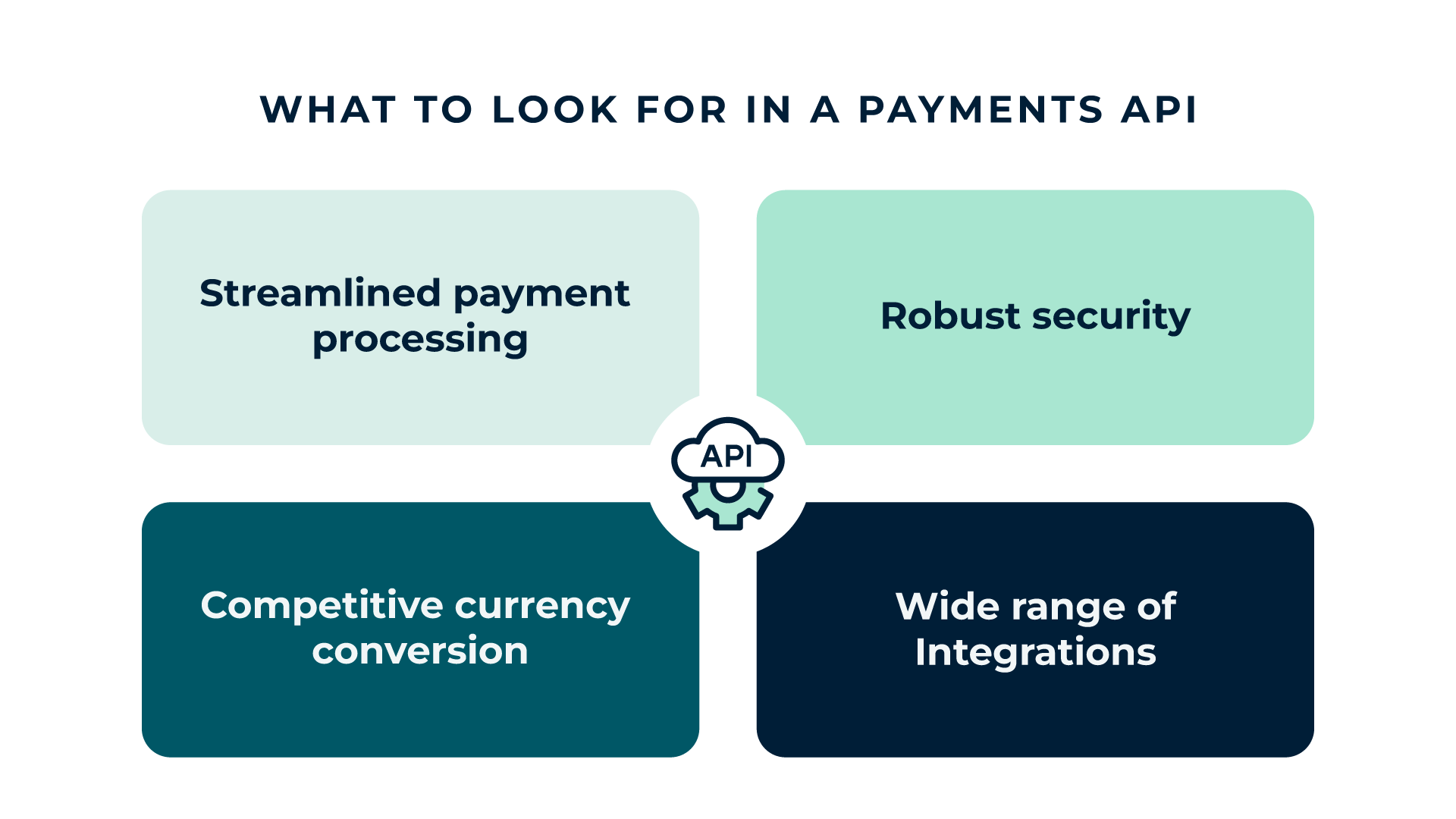

The core features of a payments API include:

- Payment processing: Facilitates authorization and settlement of payments across multiple currencies and regions.

- Currency conversion: Offers real-time exchange rates for seamless international transactions.

- Security: Ensures secure, encrypted transactions that comply with global standards.

- Integration: Enables businesses to connect their payment solutions to existing financial systems and workflows.

Such features are paramount when scaling a B2B company’s cross-border payments. They reduce administrative overhead, eliminate the need for expensive software customization and speed up payment cycles.

Whether supporting a niche payment method or integrating with a specific ERP system, APIs offer flexibility for complex business requirements, including multi-currency support and guidance for navigating compliance hurdles.

When integrating APIs into existing payment systems, businesses should look for a solution that is intuitive, flexible and adaptable to existing workflows, such as accounting, invoicing and inventory management systems.

It’s also advisable to select a platform with a transparent pricing model. Especially when handling high-volume transactions, it’s important to ensure that the fees for cross-border payment support are competitive.

Additionally, businesses should pay acute attention to potential security risks. Though APIs offer enhanced protection from bad actors, the threats to the industry and its financial infrastructure are always changing. API providers must adhere to the highest security standards to protect sensitive financial data.

Selecting the right platform is crucial for businesses looking to scale their international B2B payment systems. The last thing organizations want to do is grow the business to seek economies of scale, only to have them wiped out by non-scalable cross-border payments.

Want more insights on the topics shaping the future of cross-border payments? Tune in to Converge, with new episodes every Wednesday.

Plus, register for the Daily Market Update to get the latest currency news and FX analysis from our experts directly to your inbox.