USD: Rate differentials pressure the greenback

The Fed’s more dovish lean on Wednesday hinged on a softer labour market, which appeared prioritised over what were framed as more temporary inflation concerns. Breaking down the DXY basket, its largest contributors – the euro and yen – pushed higher against the dollar yesterday, pulling the index down 0.3%. Against the backdrop of this week’s hawkish recalibration worldwide, these two currencies look the most likely candidates to reflect actualised hikes, with the BoJ expected to raise rates later this month, while the ECB remains firmly on hold but with risks skewed toward a hike as the next move. In response, their respective rate differentials vs the US were able to exert notable pressure on the greenback.

The drop appears fragile, however. Looking at the euro – the DXY’s largest contributor – attention turns to Lagarde’s messaging next week (18 Dec). She may tone down the hawkishness conveyed by the ECB’s Schnabel, re‑establishing a more neutral stance that incorporates the dovish voices on the board, equally mindful of inflation undershooting risks. Then, the euro is poised to pare back some gains against the dollar.

EUR: Rosier year‑end risks for EUR/USD

Next week’s ECB meeting is expected to deliver a hold, but last week’s recalibration toward a tighter 2026 policy outlook will either be substantiated or tempered through Lagarde’s messaging. Updated projections for growth and inflation will also help cement whether talk of a hike now is purely speculative or not.

On the projections, Lagarde has already hinted that the ECB will likely present a more optimistic outlook for economic growth, suggesting the possibility of upward revisions.

With the French risk premium still contained – at least until the next vote following this week’s passage of the social security budget – and with December seasonality typically dollar-negative, the balance of risks may be tilting toward a rosier year-end for EUR/USD, barring a significant positive surprise on the US macro front.

Fed Chair Powell stressed that upcoming data releases require careful reading, as they remain distorted both technically and fundamentally by the shutdown. Against this backdrop, should the November NFP print fail to deliver a more uniform soft/tight signal, FX reaction may be contained – tho still leaving EUR/USD to edge higher on negative USD December seasonality and lingering dovish bias tied to a still‑soft US labour market.

GBP: UK GDP falters

GBP has enjoyed several weeks of post-budget relief, with Wednesday’s dovish‑leaning Fed offering GBP/USD the opportunity to reach highs near resistance at 1.3440, after delineating support at 1.33 and then 1.3360.

Sterling itself, however, has failed to provide much of its own merit in justifying the recent ascent – GBP/EUR ticking lower yesterday being the countercase in point. After all, sterling’s relief rally post‑budget may be hitting an exhaustion point, and GBP/EUR best captures that. The pair tested 1.1460 for several days but failed, eventually giving up and falling 0.3% yesterday.

This morning brought further reasons for weakness, with monthly GDP showing a disappointing 0.1% contraction in October, against estimates for a modest 0.1% increase. While monthly figures are often volatile, this print carried a different meaning: September’s contraction was largely attributable to the cyberattack that disrupted motor vehicle manufacturing at Jaguar Land Rover plants, now reopened, so October was expected to deliver a rebound. Instead, the data echoes the broader deterioration in UK macro surprises toward the end of 2025, offering a preview of what is likely to be another year of stagnant growth, further dampened by the 2025 Autumn Budget.

Sterling entered the London trading session on a weaker footing, though the real test of sterling’s fragile ascent comes next week, with labour market and inflation reports preceding the BoE’s final policy meeting of the year, where a cut is expected.

Stocks shrug off Oracle, rally rolls on

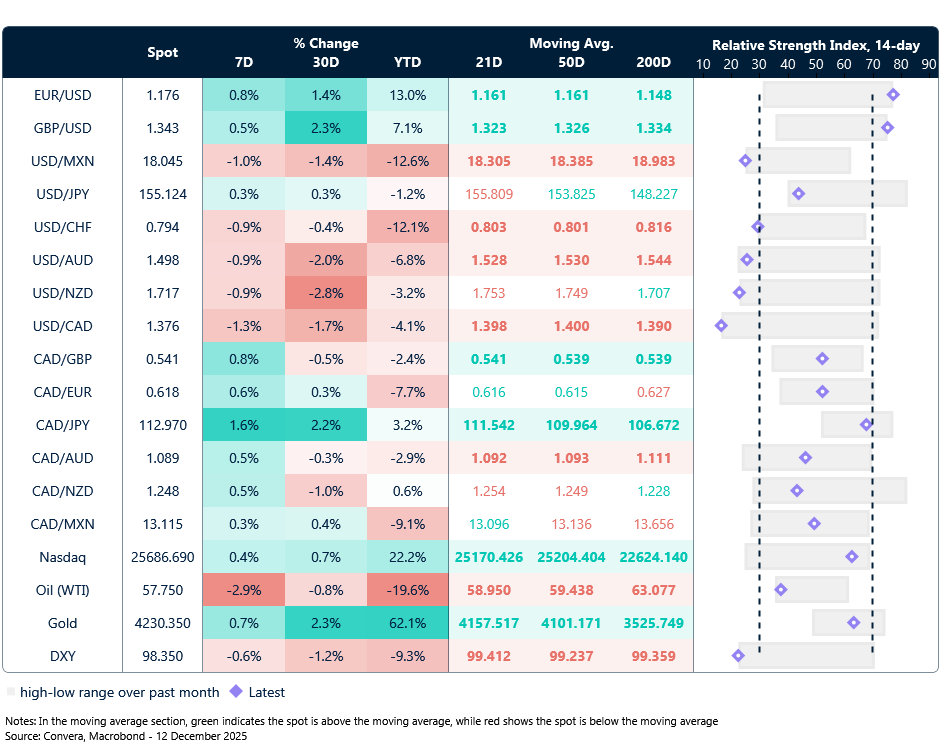

Table: Currency trends, trading ranges and technical indicators

Key global risk events

Calendar: December 8-12

All times are in EST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.