Global overview

The broadly weighted U.S. dollar index was on track to eke out a weekly gain, its first in six weeks, as signs of a resilient U.S. economy strengthened conviction in the Federal Reserve raising interest rates. The buck was on pace to post weekly gains against the euro, sterling, and Canadian dollar. The commodity trio from Australia, New Zealand, and Canada were the biggest underperformers as global growth worries flared. While U.S. data has been mixed, inflation continues to run too hot for the Fed’s liking with central bankers this week maintaining hawkish rhetoric on the interest rate outlook. Markets now assign a more than 80% likelihood of the Fed raising rates by another 25 basis points in early May. Several weeks ago, when banking system fears were acute, the odds of the Fed raising rates again were considered a coin toss. The dollar’s reprieve, though, appears to be more of a reduction in downward pressure than a meaningful brightening in sentiment. Consequently, upside for the buck could remain a challenge, particularly if coming data adds to worries about a U.S. economic downturn later this year.

Euro at risk of weekly decline

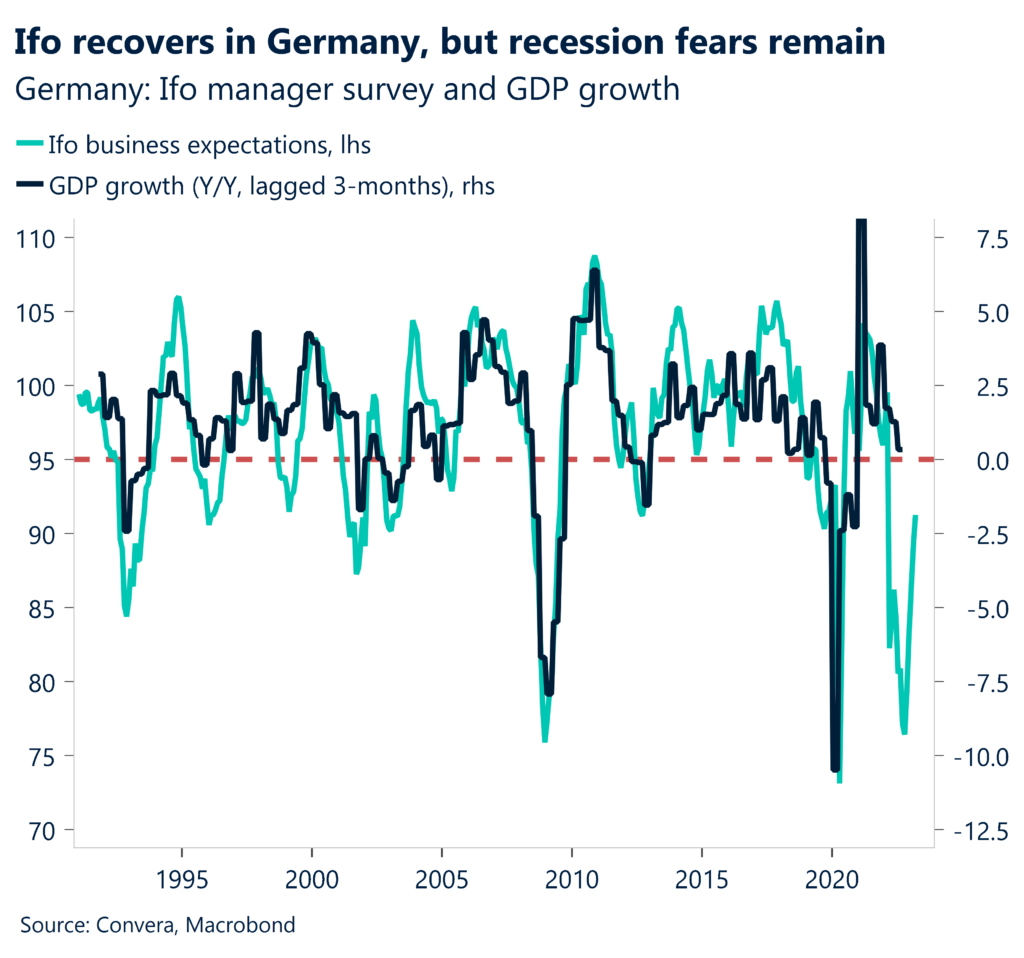

The bullish run that’s propelled the euro to one-year highs was pace to take a breather this week as markets zeroed in on the Fed’s higher for longer interest rate path. Mixed data on the euro zone economy largely offset to leave Europe’s single currency little changed Friday. Manufacturing contracted at a faster pace in April, though services activity expanded more than expected. A number to watch next week is Germany’s influential Ifo survey of business optimism on Monday that’s forecast to brighten for the sixth straight month in April.

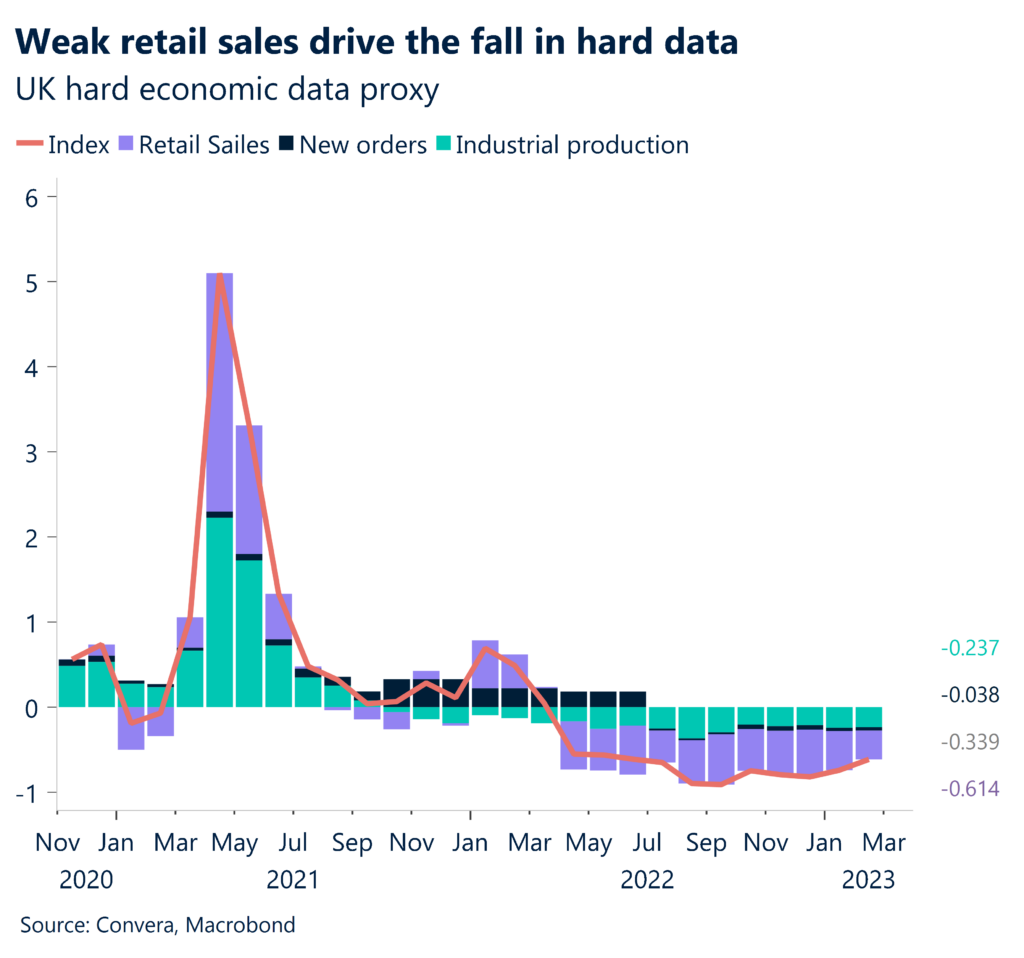

UK consumer squeezed by double-digit inflation

No 10-month highs for sterling this week against the greenback after stubbornly high British inflation weighed heavily on the consumer. British retail sales sank 0.9% in March, a slide nearly double forecasts of 0.5%, while February spending was downgraded. The Bank of England is pitted between a rock and a hard place as area inflation holding tenaciously above 10% green-lights further interest rate hikes that threaten to squeeze household spending and the broader economy.

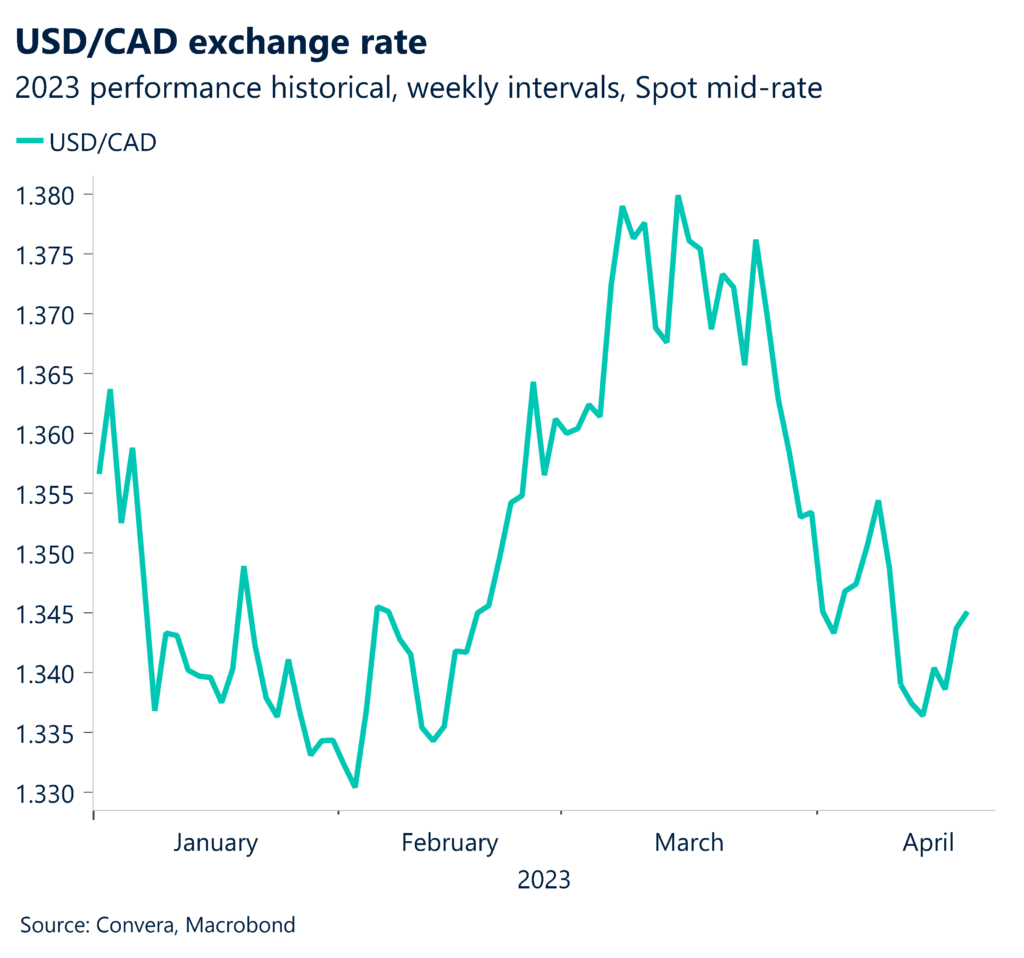

Loonie slumps as consumer spending contracts 0.2%

Canada’s dollar fell to 1 ½ week lows against the U.S. dollar after domestic data added to signs of slowing global growth, a bad thing for commodity-backed currencies. Canadian retail sales fell 0.2% in February which wasn’t as bad as forecasts of a 0.6% fall that followed a burst of spending in January of 1.4%. The loonie has fallen prey to worries about moderating global growth which has weighed on oil markets this week with crude keeping below $80 and near multiweek lows.

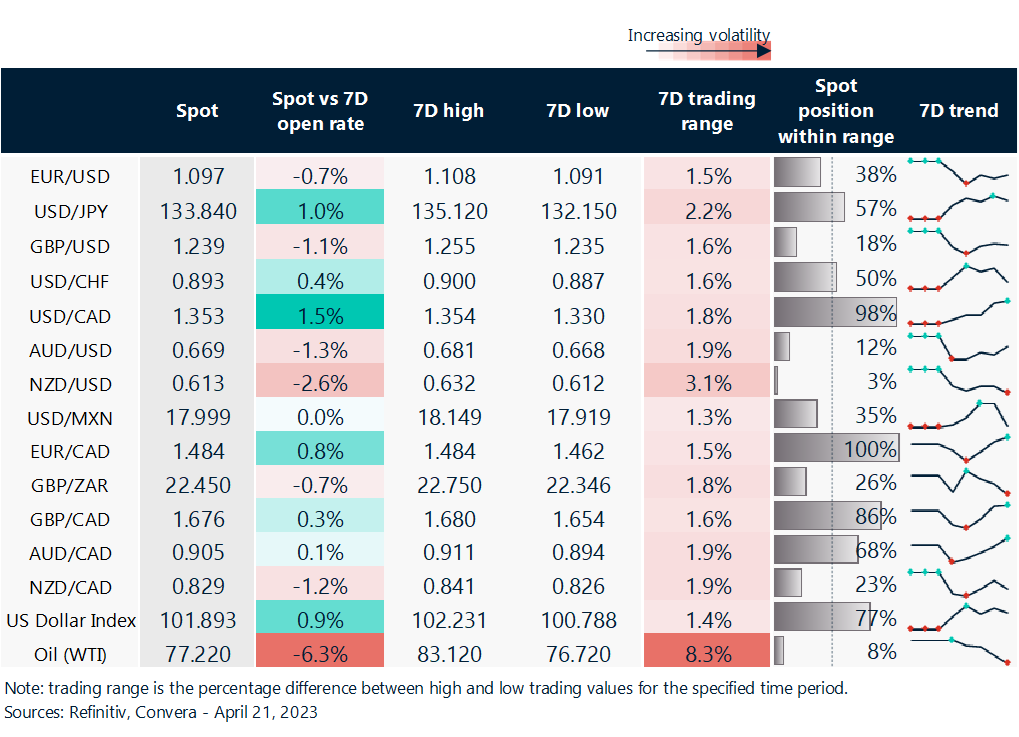

Dollar index on track for first weekly gain in six

Table: rolling 7-day currency trends and trading ranges

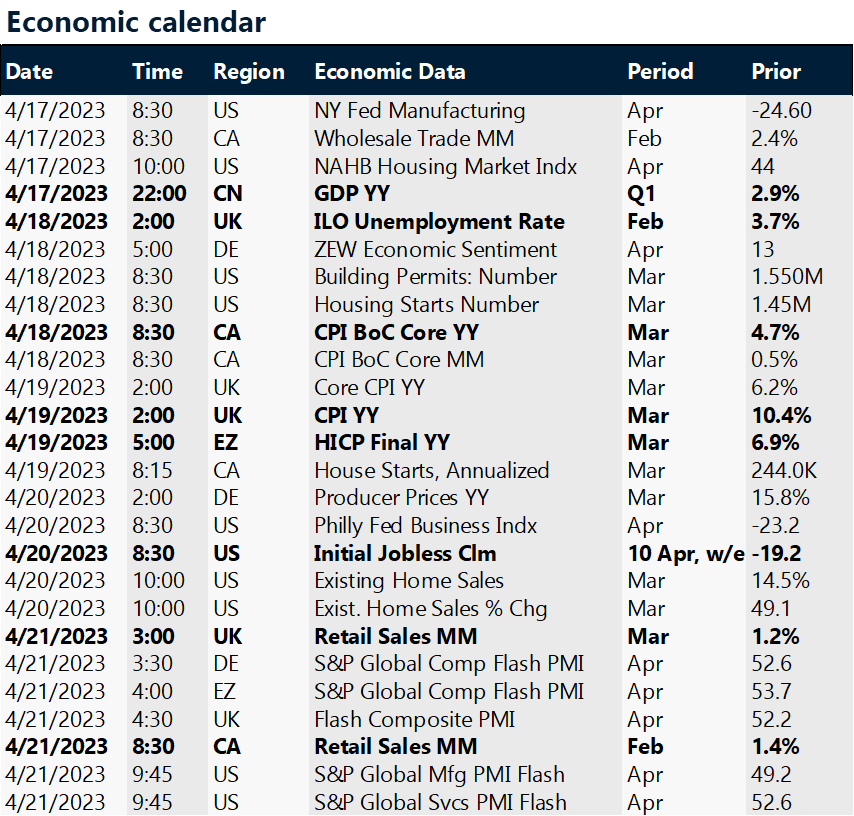

Key global risk events

Calendar: Apr 17-21

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.