Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

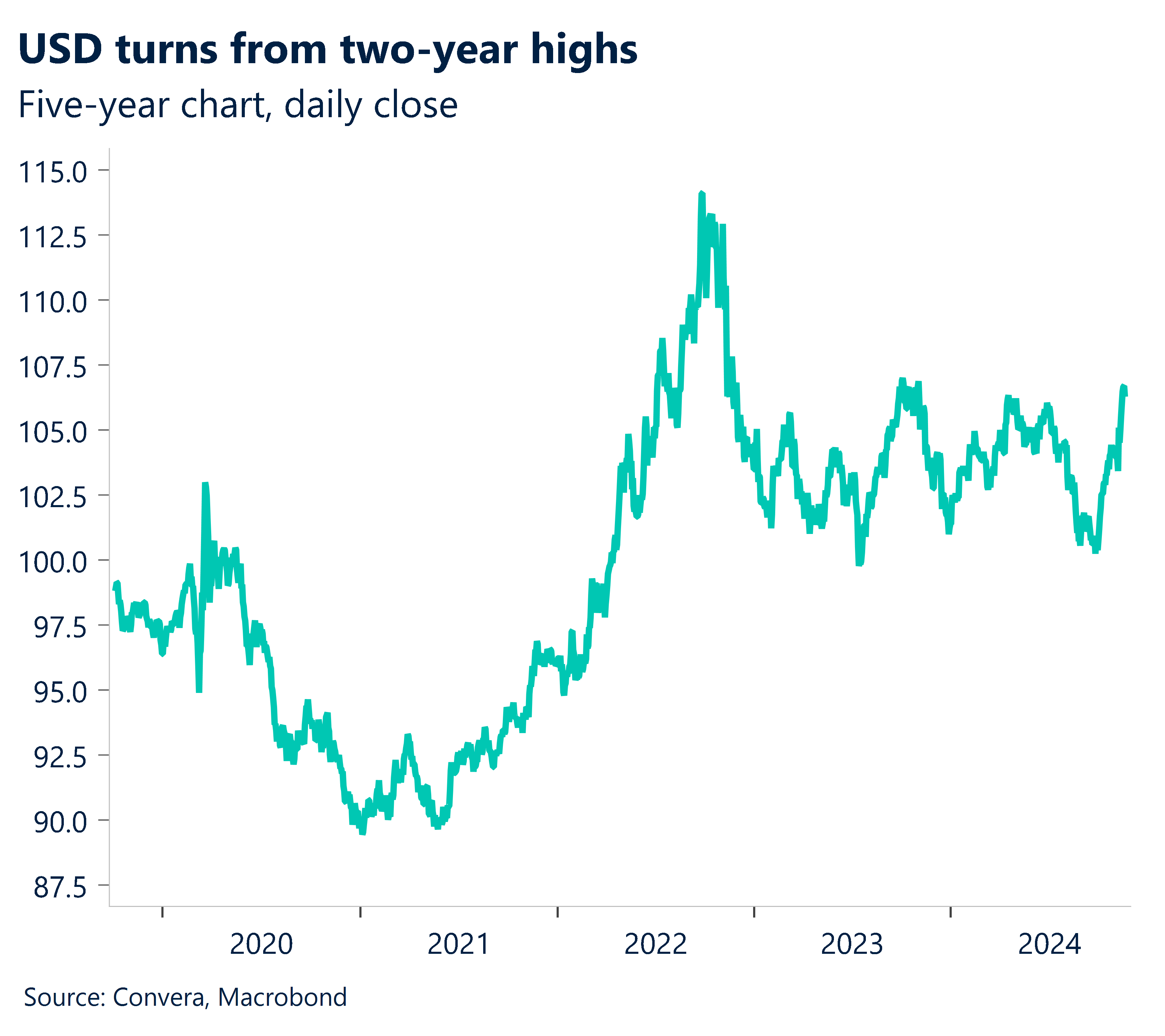

Greenback extends losses from two-year highs

The greenback fell for a third day as the frenetic USD-buying that defined the December quarter so far continued to ease.

The USD index fell 0.2% as the market extended losses from key resistance at the two-year highs.

The Aussie was again the main winner, with the AUD/USD up 0.4%, after yesterday’s Reserve Bank of Australia minutes reiterated that inflation was still “too high”.

The NZD/USD gained 0.3% while the USD/CAD fell 0.4% after a higher-than-forecast inflation reading.

In Asia, the USD/JPY and USD/SGD were both flat, while USD/CNH gained 0.1%.

The Chinese yuan will be in focus today with the benchmark loan prime rate release due at 12.00pm AEDT.

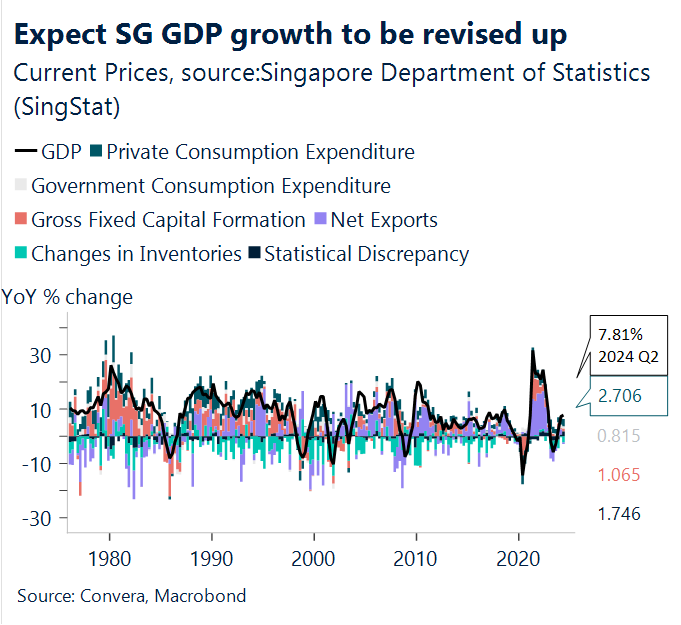

USD/SGD eases ahead of GDP

The USD/SGD surged to three-month highs as the USD gained after Donald Trumnp’s win but, in line with the broader USD pullback, the pair has recently eased.

Looking forward, the SG real GDP will be made public on Friday.

Given the spike in industrial production in September, which was driven mostly by pharmaceutical output, we anticipate that GDP growth will be revised up to 4.8% year over year in its final estimate from 4.1% in the advance estimate.

However, recent data showed Non-Oil Domestic Exports unexpectedly contracted -4.6% y/y in October (vs. consensus: 4.0%) as pharmaceutical exports dipped -40.4% y/y, though electronics exports held up at 2.6% y/y.

MAS policy planning is probably going to stay “old-school,” that is, growth-inflation mix centered, because the S$NEER framework gives it plenty of flexibility.

For now, downside targets for USD/SGD are to the 200-day EMA of 1.3290.

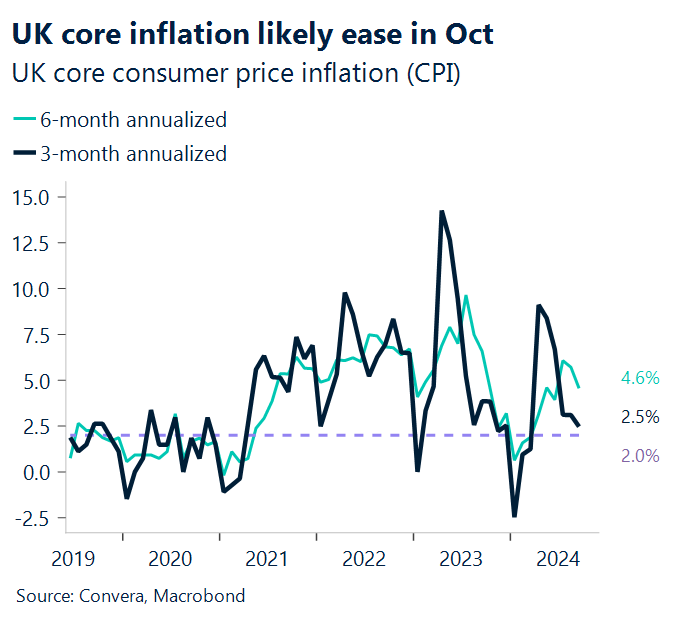

GBP sharp losses pause with CPI due

GBP/USD has lost almost 6.0% so far in the since 1 October and the British pound has weakened in other key markets as well.

However, the GBP has recently rebounded, and today’s CPI numbers, due at 6.00pm AEDT, could drive further gains.

Energy costs, specifically home energy bills rising 9.5% month-over-month versus last year’s 7% decline, are set to drive headline inflation higher.

While core and services inflation show continued moderation to 3.1% and 4.8% respectively, headline inflation is forecast to rise to 2.2% in October from 1.7%, aligning with Bank of England projections.

The cautious BoE stance and relative growth outperformance continue supporting our slightly bearish GBP outlook.

GBP/USD has recently rebounded from three-month lows with the AUD/GBP still near one-month highs and GBP/SGD near three-month lows.

Aussie extends rebounds from lows

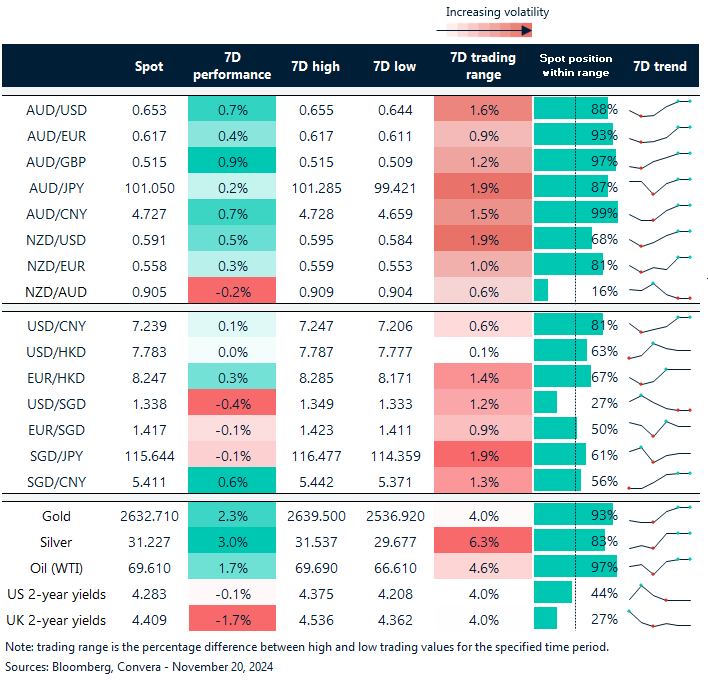

Table: seven-day rolling currency trends and trading ranges

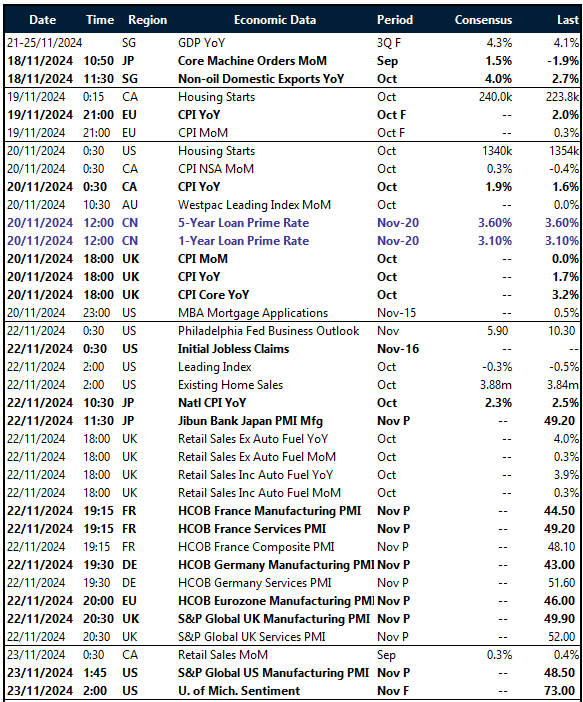

Key global risk events

Calendar: 18 – 23 November

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.