Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

Global data slows

The US dollar drifted lower to start the week with markets mostly cautious ahead of Thursday’s Federal Reserve decision.

A sequence of key releases seemed to indicate an ongoing slowdown in global activity with key Chinese releases and global PMI numbers all signalling easing momentum.

From China, while industrial production and fixed asset investment numbers were both in line with expectations, retail sales missed, with a 3.0% annual growth rate versus the 5.0% forecast.

In terms of the purchasing manager index numbers, the most up-to-date reading of the global economy, French, German UK and US manufacturing numbers all missed expectations.

On the other hand, services numbers continued to outperform, which notably outperformed expectations in US services PMI. The Australian services PMI was a rare miss yesterday.

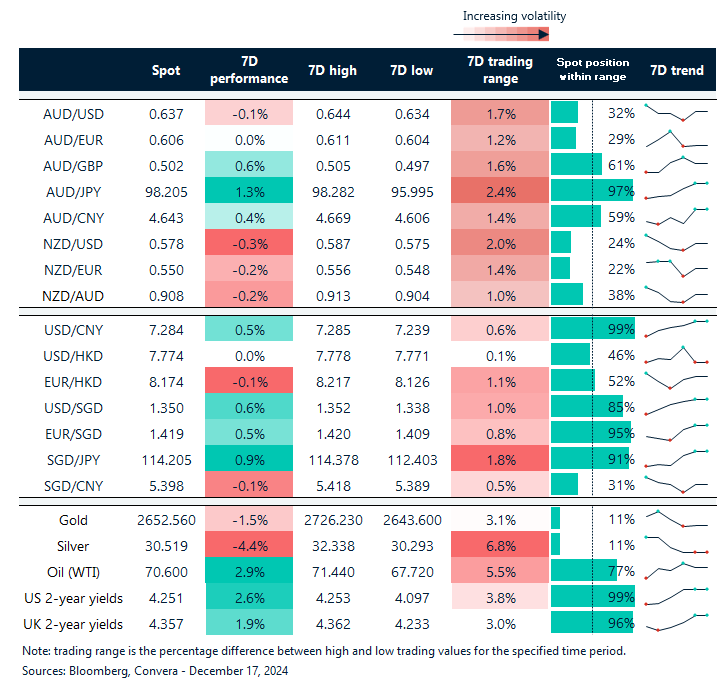

The AUD/USD underperformed with the pair up 0.1% and still close to one-year lows.

The kiwi fared better with the NZD/USD up 0.4%.

The greenback was higher in Asia with USD/SGD and USD/CNH both up 0.1%.

Hawkish tone could limit USD downside

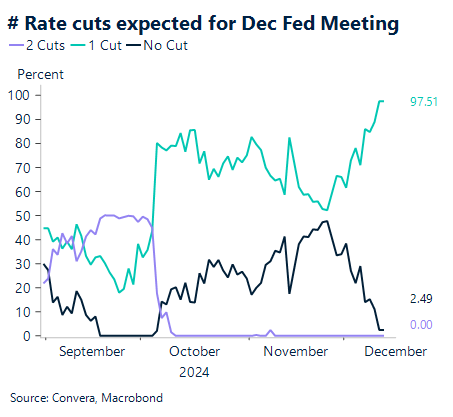

The Fed’s rate announcement looks likely to dominate action this week and is scheduled for this Thursday at 6:00 AEDT.

In accordance with market pricing and mainstream expectations, we anticipate a 25-basis point cut by the FOMC at its December meeting.

The move to cut is expected to face some hardline opposition – governor Michelle Bowman is likely to voice her disapproval once again.

Powell’s press conference and the dot plot are probably going to be hawkish, highlighting the fact that rate cuts are probably going to slow down in 2025.

As such, the risk remains for the USD to potential gain after the Fed announcement, despite any cut.

THB faces pressure from weak domestic demand

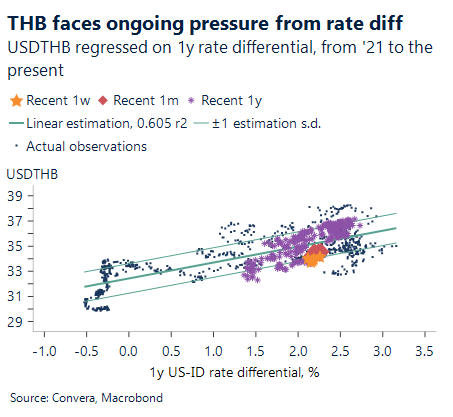

The Bank of Thailand policy meeting is due Wednesday.

Due to tighter financial circumstances, we anticipate that the Bank of Thailand (BOT) would lower its policy rate by 25 basis points to 2.00%.

This might further burden the already feeble economic development and create a vicious cycle.

We think that the fact that personal loan growth went negative in Q3 may allay some of the BOT’s worries on excessive household debt.

We believe that the policy rate of 2.00% is consistent with the BOT’s chosen neutral posture for the time being since it stays within its estimate of the neutral range.

Technically, USD/THB is regaining strength (YTD loss of -1%), with upward momentum more likely while USD/THB stays above the 50-day EMA key support level of 34.10.

Aussie stuck at lows

Table: seven-day rolling currency trends and trading ranges

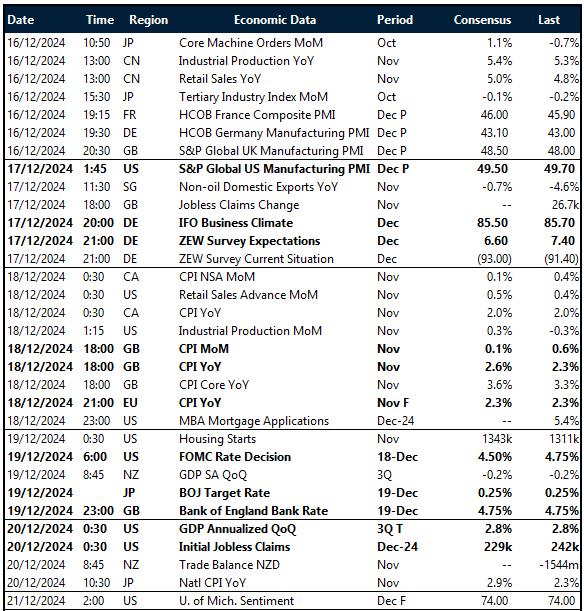

Key global risk events

Calendar: 16 – 21 December

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.