Fed hikes to 5.25%, pushes back on cut hopes

US shares and the greenback both fell overnight after the US Federal Reserve raised official interest rates by 25 basis points and pushed back against the chance of rate cuts this year.

The move brings US rates to a new range between 5.00% to 5.25%.

The Fed did signal that they are prepared to pause their rate-hiking cycle to assess the impact of recent increases but the forceful way in which the Fed rejected rate cuts hit sentiment.

That said, financial markets still believe the Fed will need to cut rates this year, with bond market pricing looking for almost 70 basis points of cuts by the end of 2023 (source: Refinitiv)

The Fed’s decision to hike rates was contested by some observers with worries about the US banking system remaining a major concern in some parts of the market.

Overnight, fears continued to swirl around key smaller US banks, with regional bank PacWest down 59% in last night’s session.

The S&P 500 was down 0.7% while the Nasdaq lost 0.6%.

NZD boosted by jobs

The Australian dollar saw small gains as the US dollar fell.

The AUD/USD gained 0.1%.

The NZD/USD also gained, up 0.3%.

The NZD was initially helped by a stronger than expected employment report yesterday – the March-quarter unemployment rate was steady at 3.4% versus expectations for an increase to 3.5%.

The good news on jobs helped the NZD/AUD climb to three-week highs.

ECB in focus

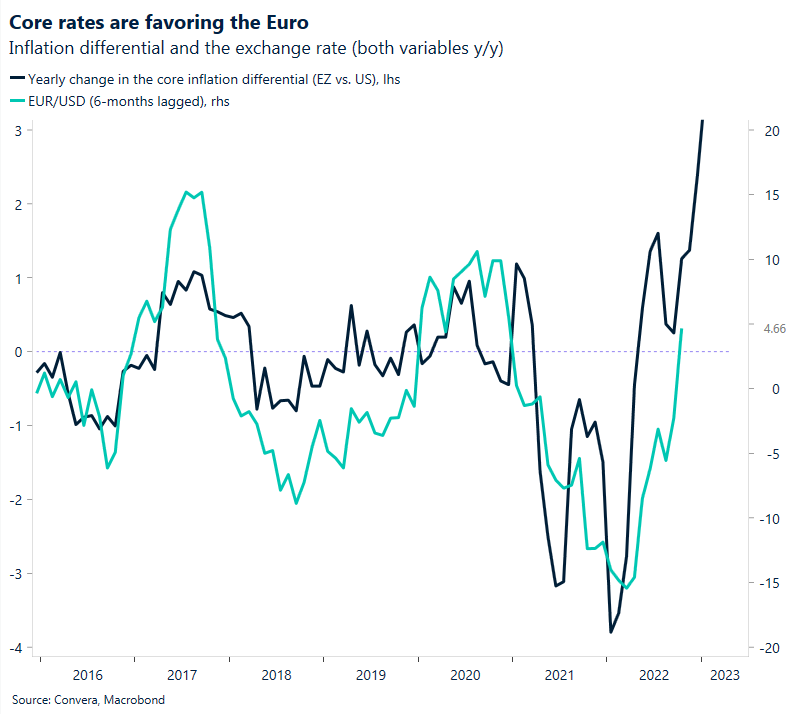

The focus now shifts to tonight’s European Central Bank decision.

While the Fed appears near an end to its rate-hiking cycle, the view in Europe is for more hikes – with 70 basis points of hikes priced in for the next six months.

This divergence in policy is one reason for the euro’s recent strength. The EUR has reached one-year highs versus the US dollar and two-year highs versus the Australian dollar.

The ECB decision is due at 10.15pm AEST.

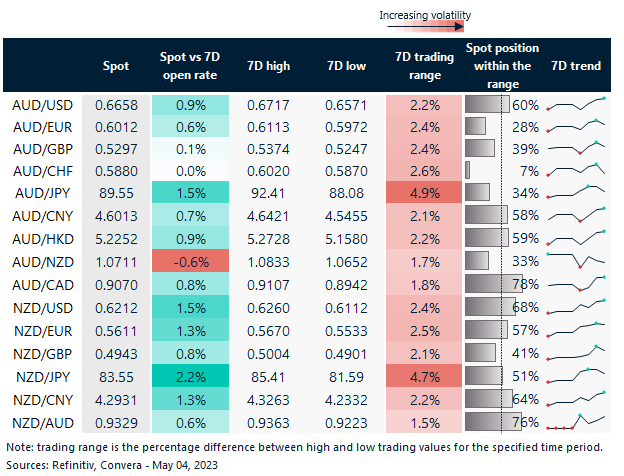

Kiwi outperforms after jobs

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 1 – 5 May

All times AEST

Have a question? [email protected]