Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

Fed hopes drive market recovery

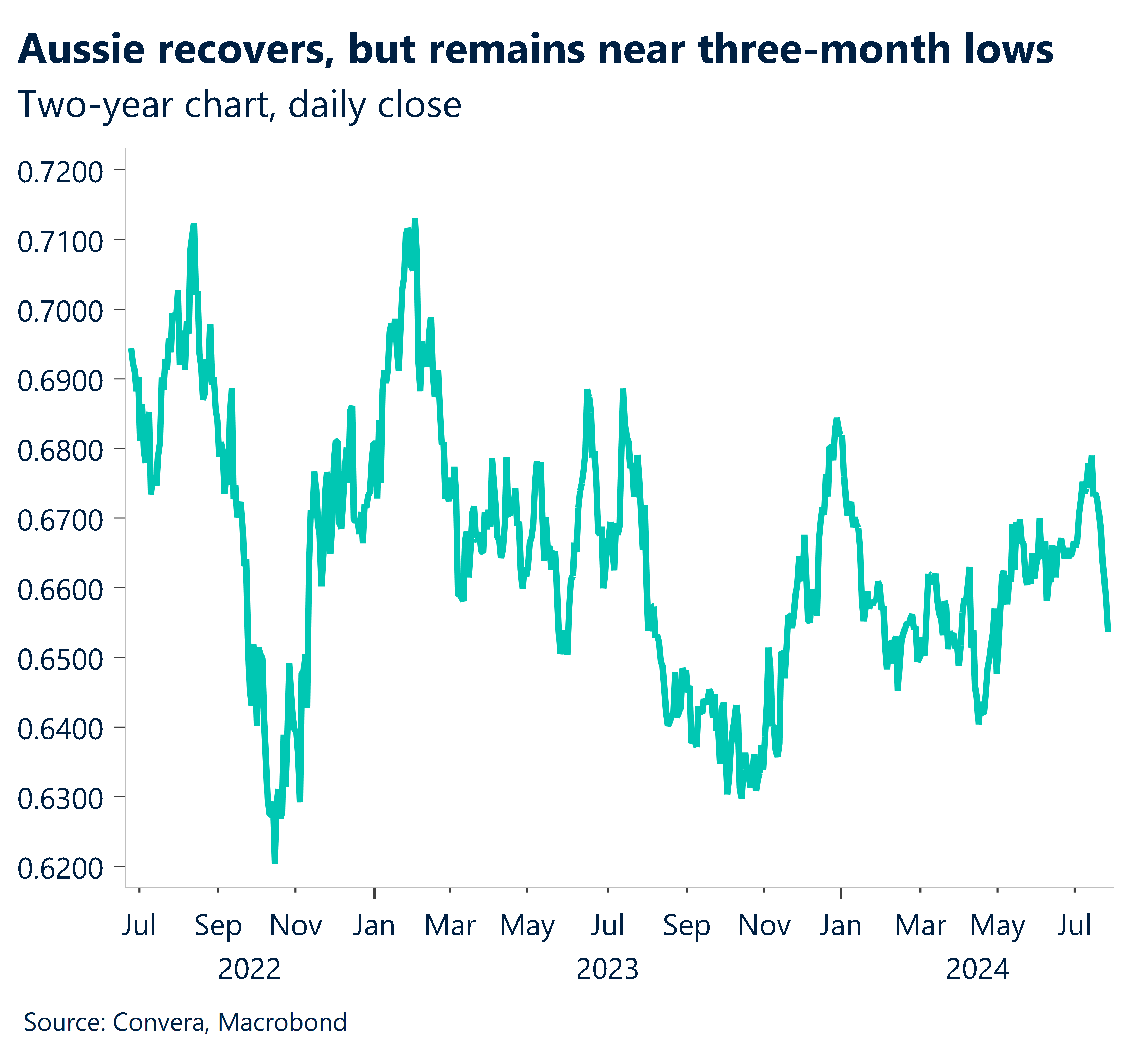

A drop in the closely-watched PCE inflation number on Friday saw most markets shake off last week’s heavy losses helping key FX markets like the Aussie and kiwi to recover.

US shares saw the worst day of trading since 2022 on Wednesday night but by Friday, after the inflation reading, the S&P 500 rebounded 1.0% while the Nasdaq climbed 1.0%.

The personal consumption and expenditure number – the US Federal Reserve’s preferred measure of inflation – fell from 2.6% in May to 2.5% in June while the core number remained steady at 2.6%.

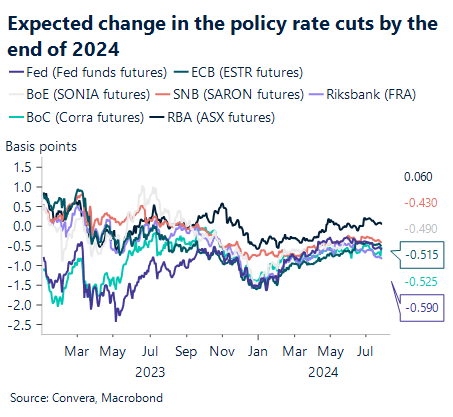

Markets see only a small chance of a cut at Thursday morning’s Fed decision – at less than 5.0% – but a cut at the 18 September meeting is now fully priced in (source: Bloomberg).

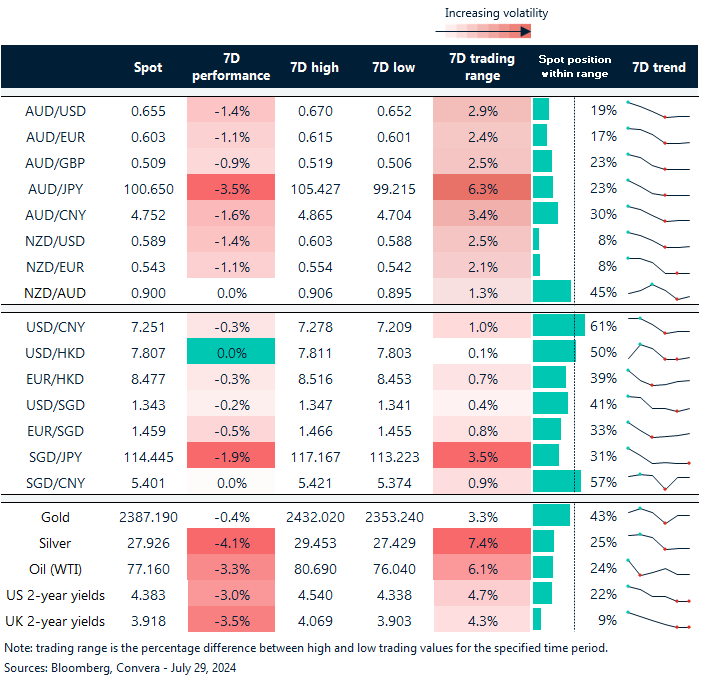

The AUD/USD gained 0.2% on Friday – ending a nine-day losing streak that’s seen the pair fall from 0.6800 to near 0.6500.

The NZD/USD regained 0.1% to end a six-day losing streak. The pair remains close to 18-month lows.

In Asia, the USD/JPY was broadly steady, the USD/CNH recovered recent losses, while the USD/SGD slipped lower as the Monetary Authority of Singapore kept policy steady.

Pound weaker, but euro holds steady

In Europe, the picture was also more mixed, with the British pound weaker but the euro holding steady.

For the GBP/USD, the pair has reversed sharply after hitting a 12-month high at 1.3000 in recent days.

The GBP has been mixed in other markets, falling versus the Singapore dollar but stronger versus the Australian and NZ dollars.

Looking ahead to tonight’s UK lending data, in June, we anticipate a return to net mortgage lending of £2.5 billion, which would be more in line with the current pace of real estate transactions.

For the euro, this month’s reluctance to provide guidance about future rate cuts from the European Central Bank has helped the euro to outperform.

Three big central bank decisions due

FX markets will be driven by central bank decisions this week with policy announcements due from the US Federal Reserve, Bank of Japan and Bank of England.

The Bank of Japan will be closely watched with their Monetary Policy Meeting scheduled for Wednesday. This comes amid signs of increasing price pressures in Japan, which could influence the BoJ’s stance on its current monetary policy.

The Federal Reserve’s FOMC meeting on Wednesday night will be a key focus for markets, potentially impacting the US dollar’s performance.

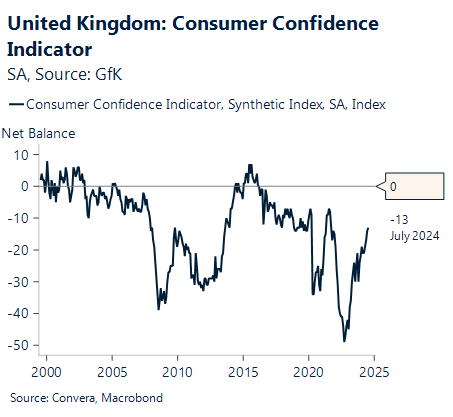

On Thursday, the UK’s Bank of England decision is due – markets see a 60% chance for a 25bps cut (source: Bloomberg).

Around the region, Australia’s June-quarter inflation reading, due Wednesday, will be critical for the Reserve Bank of Australia’s decision next week. Finally, Friday sees the all-important US non-farm employment number released.

Aussie, kiwi off lows

Table: seven-day rolling currency trends and trading ranges

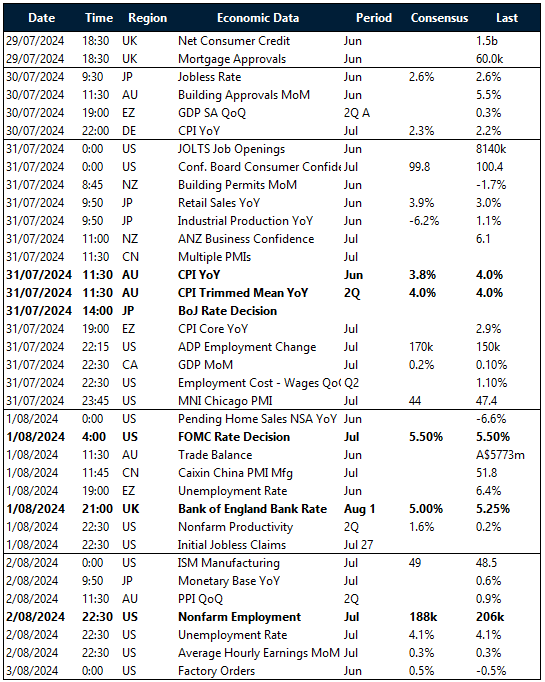

Key global risk events

Calendar: 29 July – 3 August

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]