Written by Convera’s Market Insights team

Bleak US consumer data hits dollar

George Vessey – Lead FX Strategist

Global risk sentiment remains upbeat despite escalating geopolitical tensions, and some disappointing data on US consumer confidence. The S&P 500 posted its 41st record close of 2024, whilst the US dollar index sunk to its lowest level since July 2023 as money markets price in a little over three quarter point rate cuts by the Federal Reserve (Fed) before year-end.

Injecting an adrenaline boost to the recent risk on environment was China’s package of stimulus measures announced on Tuesday, which has seen Chinese equities extend gains overnight. The Chinese yuan has also strengthened with USD/CNY at an over 1-year low, approaching a potential support level around 7.00. More broadly, the US dollar continues to struggle and its index has now broken below its 200-week moving average for the first time since the Fed started tightening monetary policy back in 2022. Adding to the dollar’s woes and Fed easing expectations was the Conference Board’s consumer surveys published on Tuesday, which showed consumer confidence fell well short of expectations, printing 98.7 vs the forecast 104 this month. The labour market differential metric was also in the spotlight – the gap between the percentage of consumers who see jobs as plentiful minus those saying jobs are harder to find, continued to worsen, pointing to a higher US unemployment rate in the September jobs report (due a week on Friday).

Given the Fed said it was only expecting the unemployment rate to rise to 4.4% by year, if it rises even higher, as this data suggests, then perhaps the market is right to expect another 50 basis point cut at either the November or December Fed meetings.

Pound’s momentum could slow

George Vessey – Lead FX Strategist

Sterling’s bullish narrative from the first half of the year has carried through in Q3, aided by positive UK economic data such as this week’s PMIs at a time when expected growth differentials are driving G10 currencies. With an attractive yield appeal, the pound has enjoyed a fresh leg up with elevated risk appetite of late too. GBP/USD has edged above $1.34 and GBP/EUR above €1.20 – putting both pairs at over 2-year highs.

It’s not all smiles for the pound though. Although it has a strong positive correlation with risk sentiment, high beta FX like AUD, NZD, NOK and SEK outperformed GBP yesterday. Meanwhile, despite the UK’s positive cyclical outlook and the Bank of England being the least dovish G3 central bank, there is a chance sterling’s positive impetus could wane from here. The pound has pushed into overbought territory versus the US dollar according to a technical indicator. The 14-day relative strength index is above the 70 level which is a signal that a pullback or period of consolidation beckons.

This doesn’t mean GBP/USD can’t extend towards $1.35, but upside momentum could start fading beforehand, especially if we see FX volatility increase amidst month- and quarter-end flows this week.

Euro benefits from risk on sentiment

Ruta Prieskienyte – Lead FX Strategist

The euro rebounded after a brief dip below $1.11 at the start of the week, supported by improved global sentiment following China’s announcement of an economic stimulus plan aimed at meeting year-end growth targets. European equities rallied, with the French CAC 40 climbing over 1% to a three-week high, driven by gains in the luxury sector, which stands to benefit from China’s recovery measures. European bonds, however, sold off amid this risk-on sentiment.

Despite the market optimism, Eurozone macroeconomic data remains troubling. Germany’s business outlook deteriorated further, with the Ifo institute’s expectations index falling to 86.3 in September, the lowest since February, and the current conditions index dropping to a four-year low of 84.4. These disappointing figures, combined with weak flash PMIs and worsening business and consumer sentiment across the bloc, have raised expectations for an ECB rate cut in October. The probability of a rate cut, as priced into OIS curve, rose from 40% at the start of the week to 63%, despite resistance from some ECB officials. ECB’s Muller acknowledged the possibility of a cut but cautioned that there may not be enough data to make a definitive decision by next month.

Political uncertainty in France also continues to weigh on the euro’s potential. The 10-year OAT-Bund yield spread has widened to 78 basis points, the highest since August, reflecting investor concerns over France’s delayed budget and the potential for a no-confidence vote. Prime Minister Barnier’s government faces an October 1 deadline to present the budget for parliamentary debate, with the possibility of further political turmoil. Additionally, ratings agencies are set to review France’s fiscal health, with Fitch and Moody’s expected to assess the country on October 11 and 25 respectively, following an earlier downgrade by S&P Global. These uncertainties are contributing to a higher risk premium for French debt and may continue to weigh on the euro in the coming weeks.

GBP/USD breaks above $1.34

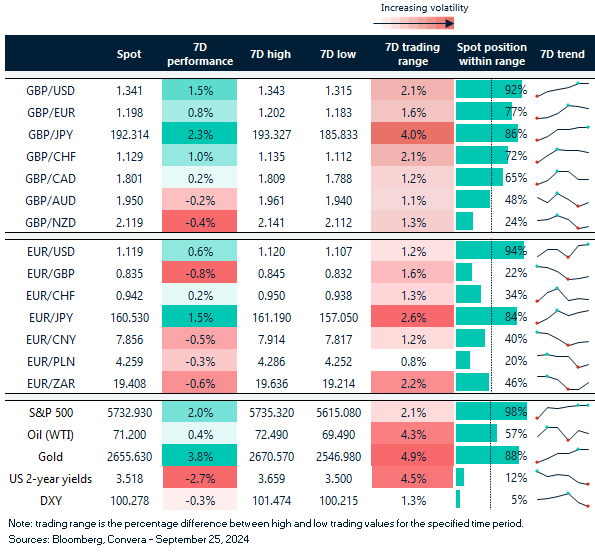

Table: 7-day currency trends and trading ranges

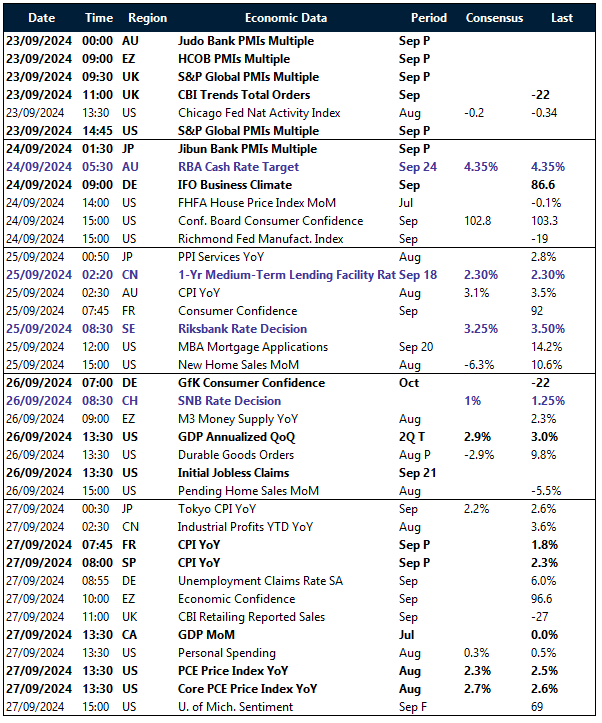

Key global risk events

Calendar: September 23-27

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.