Written by the Market Insights Team

Thin liquidity, strong price action

Boris Kovacevic – Global Macro Strategist

Recent headlines from the Washington Post and Wall Street Journal, as well as Trump’s call with Xi last week, had suggested that the new administration may take a more gradual approach to tariffs than initially feared. The once promised tariff hikes on day one of his presidency have not materialized. Investors cheered the postponed tariff rollout and while US markets were closed, futures trading and price action in Europe and Asia reflected the welcomed news with higher equity prices.

While uncertainty remains, this stance aligns with our initial presidential preview published in July, where we anticipated that Trump’s approach might not be as aggressive as markets had priced in. With no immediate catalysts to drive a major shift higher in the dollar for now, exhaustion could set in, particularly if Trump’s policy stance and the Fed’s expected pause are already fully priced into the market.

However, Trump made clear that he will not completely abandon his protectionist plans. The president plans to enact a 25% tariff on Canada and Mexico starting on February 1st. How likely this is to be implemented is still up for debate. This statement from Trump was enough for the dollar to recoup some of its earlier Monday losses and for equities to decline. Uncertainty and volatility seem to be the only certainty right now.

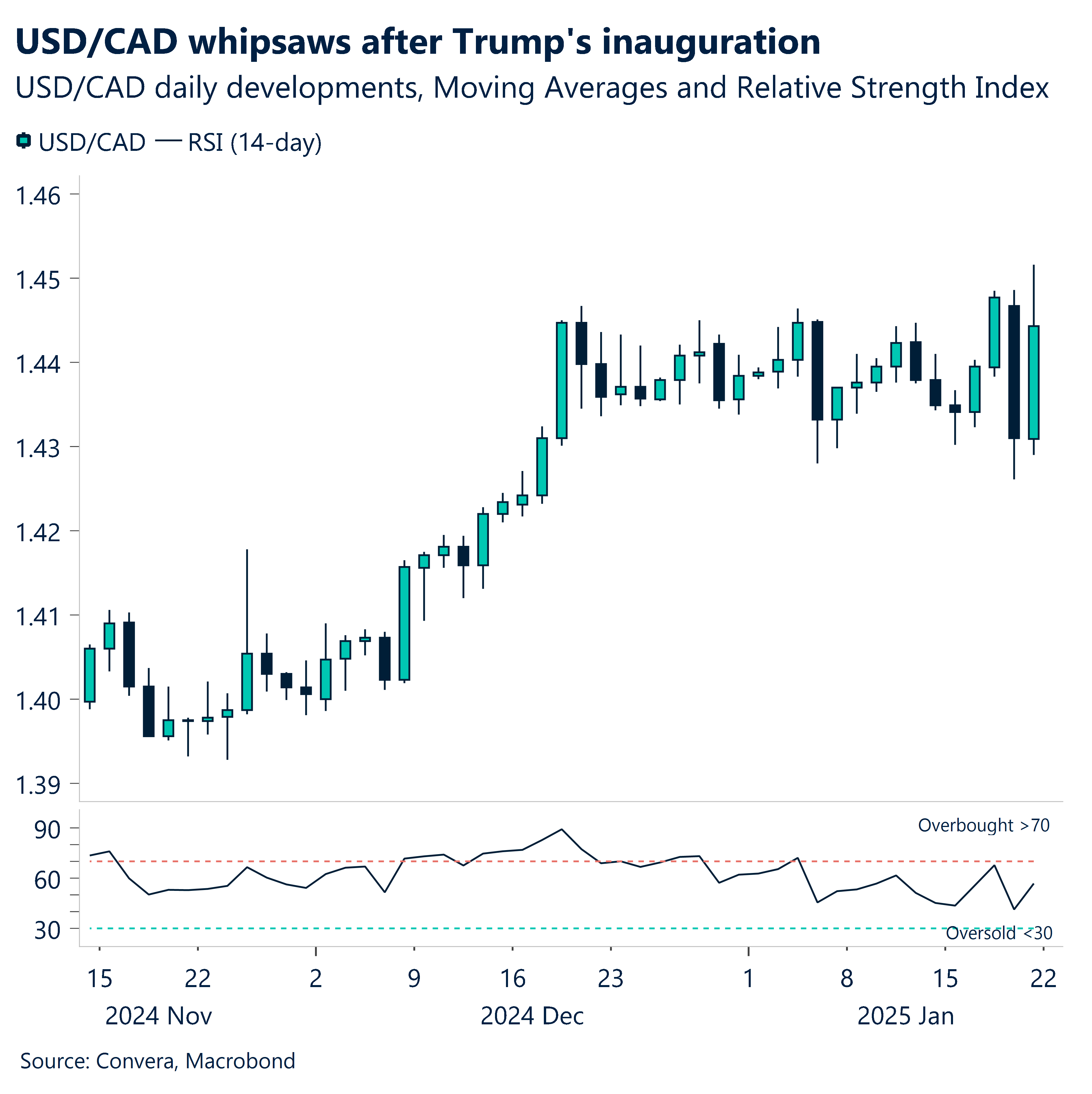

CAD jumps and slumps

Kevin Ford – FX & Marco Strategist

The USD/CAD saw a sharp decline after the WSJ reported, and Trump officials confirmed, that a more gradual approach towards tariffs will be taken. The pair dropped over 1% with the CAD scoring its best day of the year. The move was short-lived though and the CAD reversed course rapidly overnight.

The Canadian dollar and Mexican peso dropped sharply after US President Trump said he planned to enact previously threatened tariffs of as much as 25% on Mexico and Canada by Feb. 1. Moreover, Trump emphasized putting America first, especially when it comes to oil production. Will this impact Canadian exports to the US? Crude is Canada’s top export, with nearly 90% sent to the US. The sector, particularly Alberta, will have to wait for more details on policy changes and their effect on trade agreements. As pointed out previously, a sharp tariff on oil exports is unlikely, as it would undermine the USCMA agreement from 2018-2020. Additionally, higher tariffs on crude would immediately affect US consumers—a collateral effect Trump would not welcome, according to his inaugural remarks

During Trump 2.0, market participants should brace for intense volatility and sudden market shifts as we’ve already witnessed. For now, the USD/CAD hovers above the 1.44 level, erasing yesterday’s losses and is back near 5-year highs. Monetary policy divergence is back in focus for today as we’ll see Canadian inflation data for December, with the yearly figure expected at 1.8%.

Fewer reasons to sell the euro

Boris Kovacevic – Global Macro Strategist

The euro made a strong move higher against the US dollar, recording its best day of the year so far. The euro’s rally was fueled by reports that Trump would delay imposing new tariffs on his first day in office. This suggests that tariff hikes may go through Congress rather than executive orders, easing immediate market concerns. With US markets closed for Martin Luther King Jr. Day, thin liquidity amplified the price movements. While we maintain a mildly positive medium-term outlook on the euro, a repeat of its 2016 rally would require a stronger domestic macroeconomic backdrop.

Meanwhile, currencies like the Chinese yuan and Mexican peso remain more vulnerable, given the likelihood of new export controls on China and stricter US immigration policies toward Mexico. The first few months of Trump’s presidency will be critical in shaping market sentiment—if his protectionist bias dominates, volatility will remain high. However, a more pragmatic approach could lead to a repricing of risk across global markets.

Trump is expected to push for trade protectionism and economic nationalism, but the key question is how aggressively he will pursue this agenda. The heightened uncertainty that once justified selling the euro is no longer a given—much of the anxiety has already been priced in over the past four months. Monday’s price action, which saw a weaker dollar, could serve as a preview of what is to come in 2025 if Trump fails to unleash strong hawkish measures soon.

Pound’s rebound could be short-lived

George Vessey – FX Strategist

The pound clocked its best day of the year versus the US dollar yesterday, boosted by the news that Trump was holding off from his grand tariff plan. Higher-beta currencies – those that exhibit a greater sensitivity to changes in the overall market or economic conditions, benefited more than safe havens. This is why the pound appreciated against USD, JPY and CHF but depreciated against SEK, NOK, AUD and NZD. The euro also outperformed sterling, with GBP/EUR sliding to €1.18 – its lowest level since August 2024. Still, the currency pair is in the top third of its 2-year trading range and two cents above its 5-year average.

The positive response to the delayed tariffs news was short-lived though, amidst the update from Trump signalling tariffs on Mexico and Canada by the end of the month. Conflicting signals sent currency markets in particular fluctuating wildly, with GBP/USD trading back under $1.23 this morning. There are simply still too many unknown to call an end of the recent dollar rally and volatility is seen as the only certainty over the coming weeks and months. Aside from these ongoing external drivers, domestic UK data is also in focus this week. This morning’s UK labour market report revealed average weekly earnings for November were lower than expected, at 5.6% compared to 5.7% estimates and 5.2% in the prior period, while the reading excluding bonuses was higher than forecast at 5.6%. The data comes as readings last week raised concerns about the economy stagnating, after inflation eased in line with the Bank of England’s (BoE) estimates, while GDP growth stalled and retail sales disappointed.

Traders favour at least two quarter-point BoE rate cuts this year, but given the recent data, this appears too conservative. Policymaker Alan Taylor most recently suggested the Bank could consider up to 125-150 basis points of cuts if downside risks materialise. This is an obvious headwind for the pound, which could further erode its appeal and keeps the $1.20 handle as a key downside target for FX traders in 2025.

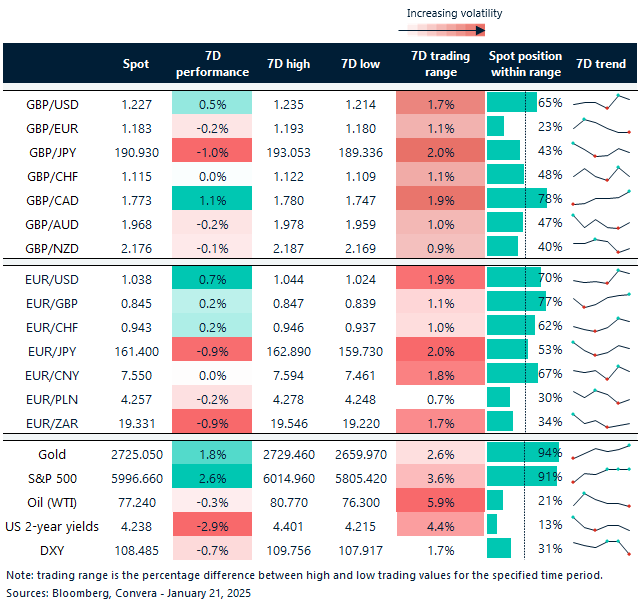

CAD hit hardest on tariff news

Table: 7-day currency trends and trading ranges

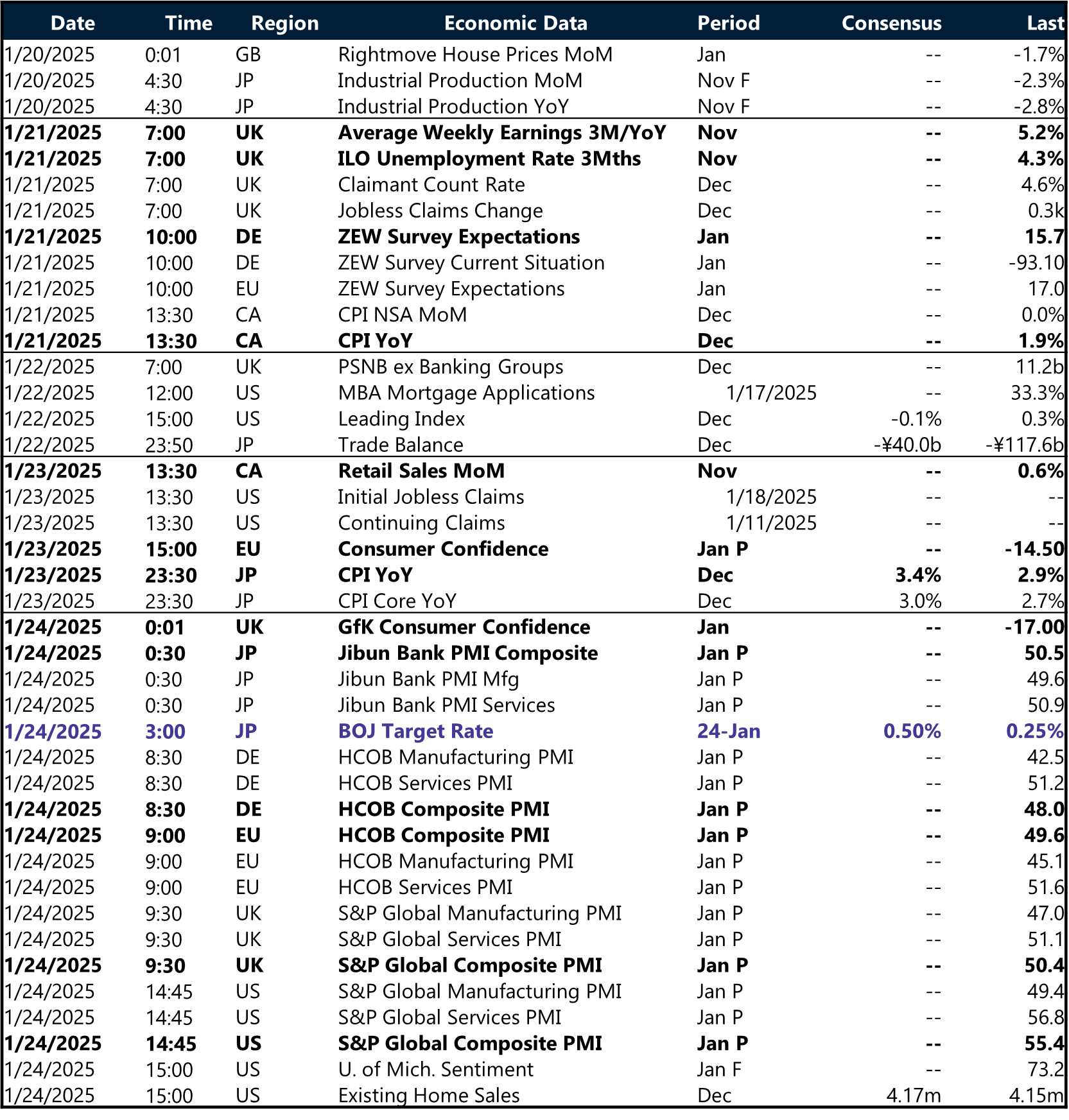

Key global risk events

Calendar: January 20-24

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.