Written by Convera’s Market Insights team

Phase one to phase two

George Vessey – Lead FX Strategist

Given the absence of bearish catalysts for the US dollar, its recent revival from over 1-year lows last month looks set to extend further in the short term. The first phase of the dollar recovery was all about the US economy, whereas the second phase could be all about politics. Both are causing bond yields to surge, not just in the US, but across most major economies.

Resilience in the US economy wasn’t just about the blowout jobs report for September and fall in the unemployment rate, but retail sales and the services ISM were both stronger than expected too. In addition, core inflation has picked up steam and gained momentum, which highlights that inflation remains an unresolved problem. As a result, Fed easing expectations have naturally been trimmed, and a yield-driven dollar rally ensued. Beyond the return of US economic exceptionalism though, geopolitics and domestic politics are giving the dollar another layer of support. Gold hit an all-time high on Monday as tensions in the Middle East and the increasingly tight US election race spurred flight to safe haven assets – including the US dollar.

But the result of the election is also critical and improved polling for Trump may add to the upward yield and dollar momentum of the past few weeks via trade, fiscal and monetary policy implications. An election that’s effectively a coin flip makes it difficult for traders to wager on what’s about to happen, which is likely why EUR/USD and GBP/USD are grappling with $1.08 and $1.30 respectively. But a win for Trump could shed a good 5% off these exchange rates before year-end.

Pound stung by rising global yields

George Vessey – Lead FX Strategist

UK bond yields have jumped higher across the curve this morning, in line with yields in major economies across America, Europe and Asia. Traders are trying to second guess the global interest rate trajectory and with less easing priced in over the next 24 months by the G3 central banks, the pound and other pro-cyclical currencies have come under renewed selling pressure versus the USD. This is a pattern we’ve witnessed since the hiking cycle ended back in 2022.

It is mainly a function of what’s going on in the US. The resilience of the US economy has caught market participants and central bank policymakers off guard forcing traders to dial back on aggressive rate cut bets. But in the UK, evidence of moderating inflationary pressures, a gradually loosening labour market, and easing economic momentum, should arguably have added to rate cutting bets. True, a 25bps cut in November is fully priced in, with a 70% chance of another cut in December, but given the surge in bond yields recently, it seems there’s a question mark over back-to-back cuts by bond traders. However, because the Bank of England is no longer seen as the hawkish outlier, coupled with the fact overall G3 easing expectations have fallen, the British pound is on the backfoot against the dollar.

GBP/USD is flirting with $1.30 today, down almost 3% month-to-date , but retaining an almost 3% advantage year-to-date. It is still two cents above its 5-year average of $1.28, which is also currently the 200-day moving average – a level the pair often gravitates back towards as we saw in August. GBP/EUR on the other hand remains above €1.20 – near 2-year highs thanks to widening growth and yield differentials in favour of the pound.

Break of $1.08 coming into play

Boris Kovacevic – Global Macro Strategist

The move higher in US Treasury yields across the curve has dominated the market narrative at the weekly open. The euro was one of many pro risk currencies that have not been able to resist the downward pressure created by falling rate differentials and has once again moved to the lower end of the $1.08 mark. EUR/USD seems to be driven almost primarily by developments in the United States, where the Trump trade is currently in full swing again.

Of course, the negative macro news flow out of Europe has not helped the common currency either. Last week’s commentary from top ECB members like François Villeroy de Galhau expecting inflation to be below 2% early next year has opened the door for more policy easing. We see the central bank cut interest rates in December and to pursue a timetable of implementing quarterly cuts next year. This would put the deposit rate between 1.75% and 2.0% at the end of 2025.

German producer inflation fell more than expected in September as of the report published yesterday. The PPI declined by 1.4% compared to the 0.8% decline expected. Christine Lagarde is scheduled to speak on three occasions during the next two days. However, it is unlikely that the ECB president will be able to change investors mind about the next rate decision.

Low yielding yen on the backfoot

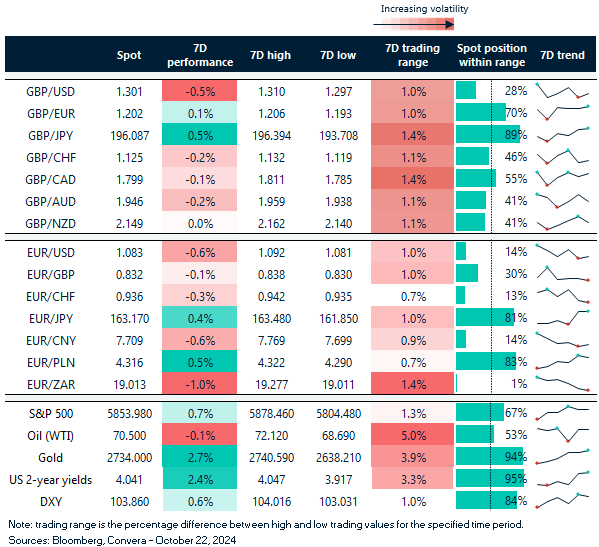

Table: 7-day currency trends and trading ranges

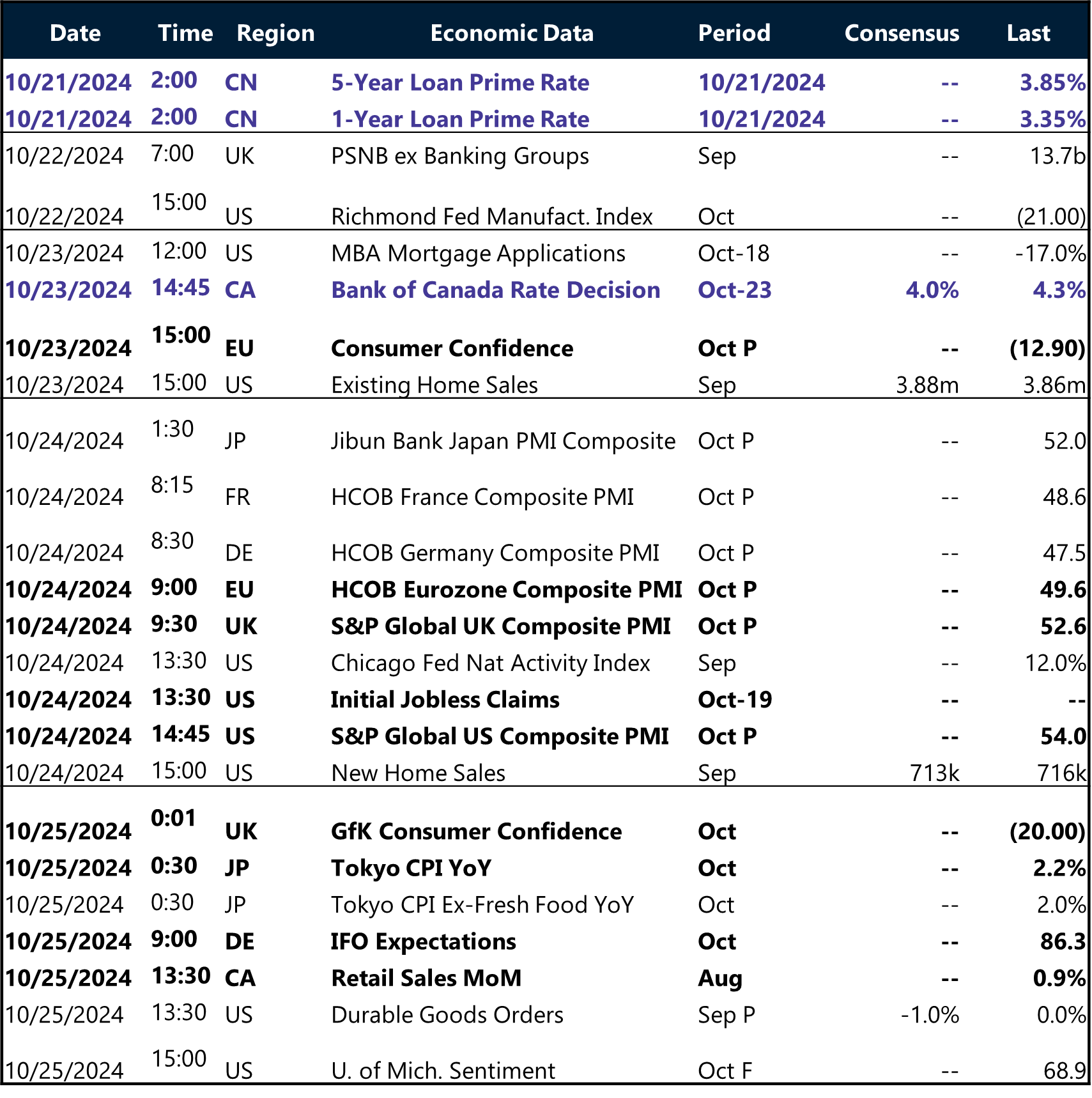

Key global risk events

Calendar: October 21-25

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.