Global overview

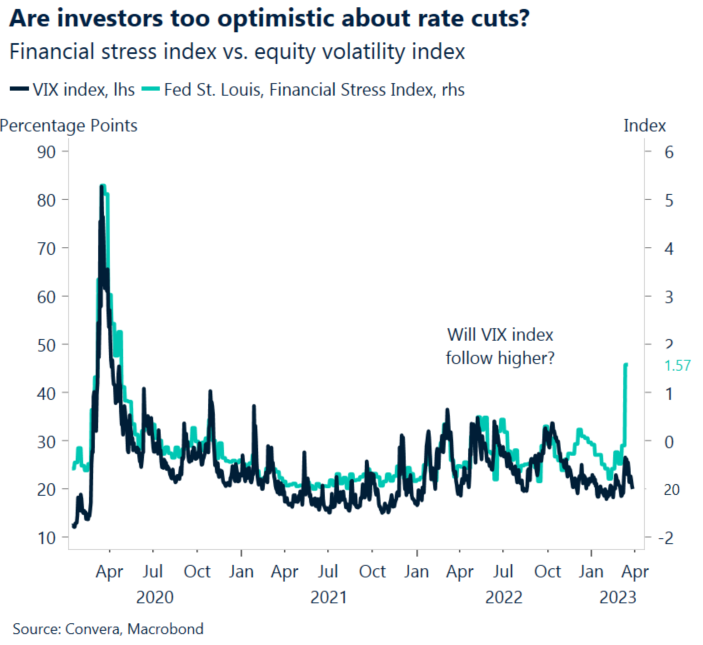

The U.S. dollar steadied after slumping to multiweek lows as global banking instability continued to dominate. The buck was little changed against the euro while it edged off three- and seven-week lows versus counterparts from Canada and the UK, respectively. Markets are yet to signal an all clear yet to the crisis that spurred the second- and third-largest bank collapses in U.S. history. Uncertainty remains high over what’s next for both banks and central banks which is keeping investor conviction low. Add it all up and major currencies are largely adhering to recent ranges. The dollar has found a vulnerability in banking instability as it suggests the Fed is all but done raising interest rates. Moreover, fears of the banking crisis raising the risk of a U.S. recession later this year have markets pulling forward the timeframe for the Fed to cut interest rates, another negative for the buck. Helping to cushion the dollar’s fall, a report this week showed that U.S. consumer confidence unexpectedly brightened in March, a hopeful sign that any economic downturn might materialize later rather than sooner.

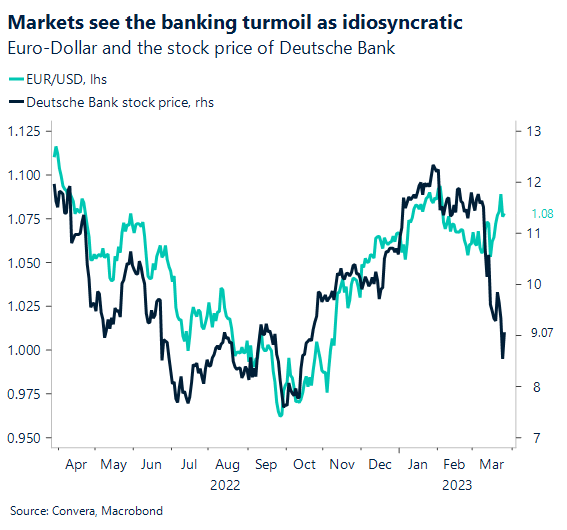

Euro perched near highs

The euro steadied at the top of its range against the dollar as worries about the global banking system diminished, allowing expectations of higher ECB borrowing rates to rise toward the surface. The euro is catching a boost from expectations that the ECB will lift borrowing rates more than the Fed over the balance of the year. And compounding the divergent outlooks for U.S. and European monetary policy is the perception that the Fed may lead major central banks in slashing borrowing rates, should the U.S. economy lose meaningfully momentum.

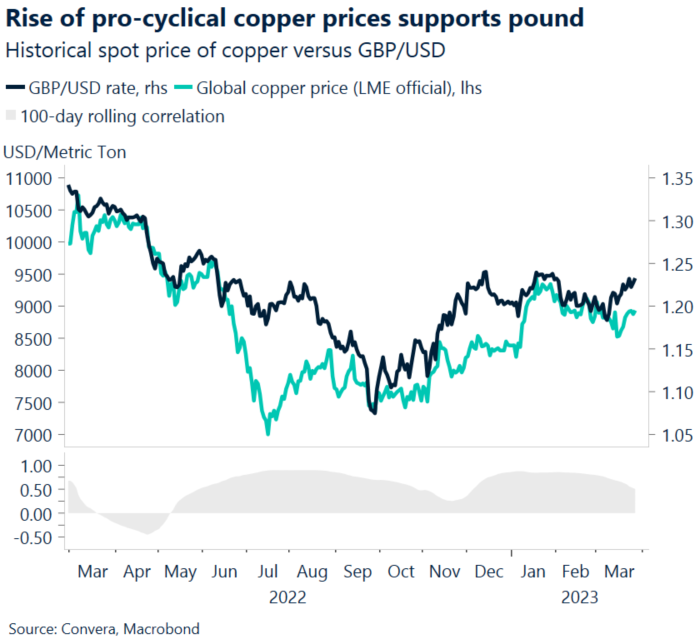

Sterling flirts with 8-week peak

Sterling appreciated to new seven-week highs against its fragile U.S. counterpart. The pound is capitalizing on diminishing worries about the global banking system which is tempering appetite for safety in the U.S. and Japanese currencies. Moreover, the perception that the Bank of England may need to extend its rate hiking campaign in the face of chronically high UK inflation also is proving pound-positive. Britain’s rate debate will look for some stirring from Friday numbers on UK fourth quarter growth that are forecast to confirm the economy stalled.

C$ rolls to 3-week highs

Higher oil prices and a lower greenback converged to lift the Canadian dollar to three-week highs. Oil’s climb above $73, a two-week high, partly reflects cautious optimism that banking sector woes may not push the world economy into recession. Easing worries about the banking turmoil has been positive for currencies that take their cues from prospects for global growth, like the loonie, while it also tempers demand for safety in the greenback.

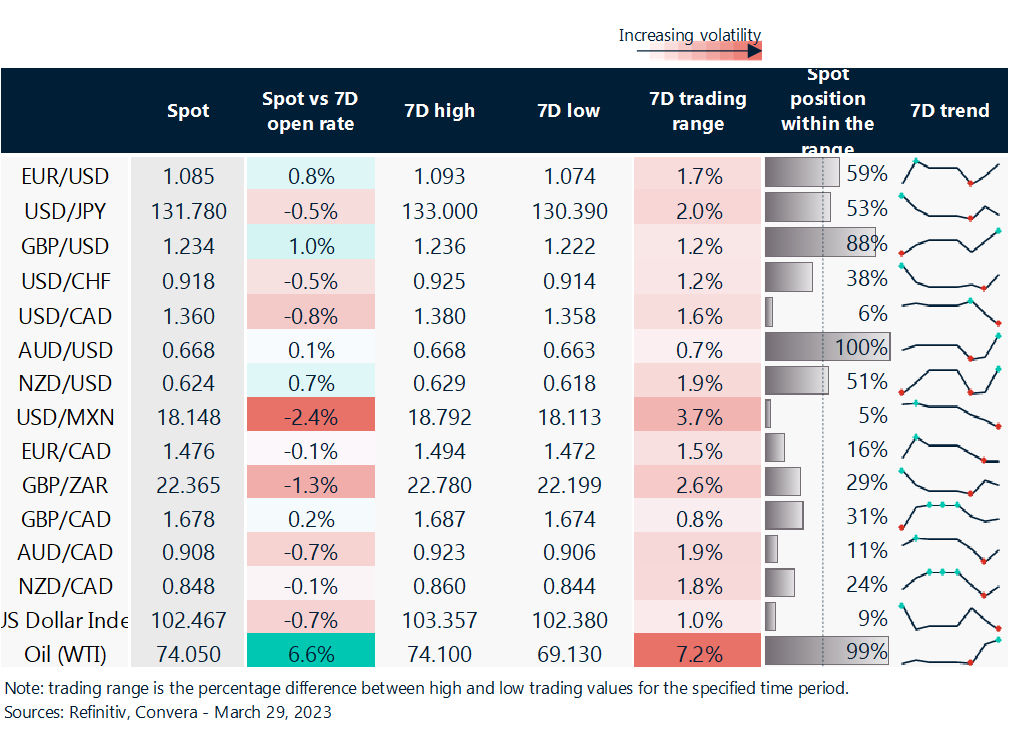

Dollar struggles amid Fed’s less hawkish rate outlook

Table: rolling 7-day currency trends and trading ranges

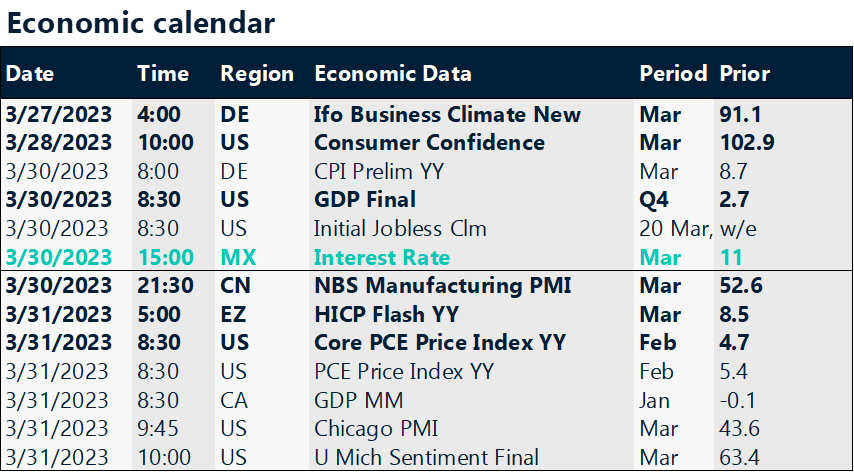

Key global risk events

Calendar: Mar 27-31

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.