Written by Convera’s Market Insights team

Risk aversion supports dollar

George Vessey – Lead FX Strategist

US stock futures are inching lower this morning, whist cryptocurrencies like Bitcoin have slumped up to 6% in a sign of a risk aversion ahead of Nvidia’s earnings to determine if the AI-driven rally has been overdone. The US dollar is ticking higher, with the dollar index already erasing yesterday’s losses.

Although global FX traders are increasing bearish dollar strategies into the September Federal Reserve (Fed) rate decision, recent risk aversion via unease about the strength of the AI sector and rising geopolitical tensions, have triggered safe haven flows into the US currency to cushion its fall of late. Still, despite the recent tepid rebound from 1-year lows, the dollar index is on track to record its worst month of 2024 as signals mount that the Fed will cut rates in September. Meanwhile, US consumer confidence improved in August, with the index rising to 103.3 from 101.9 prior and beating forecasts of 100.7. However, despite being the highest reading in six months, the labour market differential reading fell to its lowest level since March 2021.

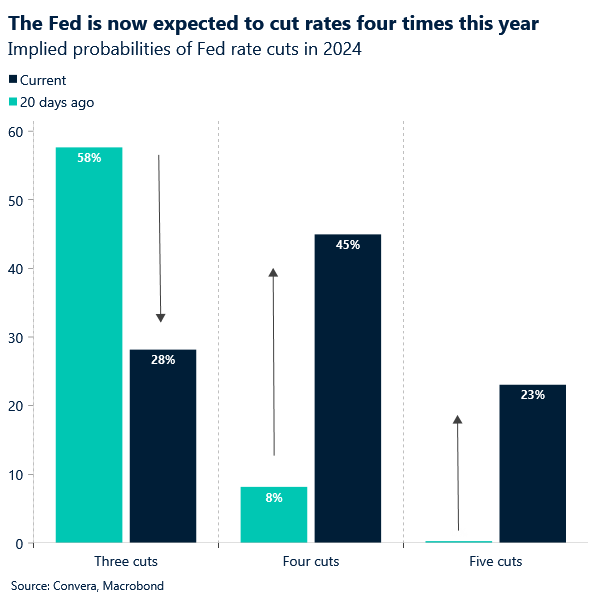

Growing concerns over the US labour market therefore overshadowed, but it hasn’t altered the narrative. Traders are betting on a 25 or 50 basis point rate cut in September and up to four 25 basis point cuts in total by year-end.

Pound scales 2-year peaks

George Vessey – Lead FX Strategist

The pound has extended its gains beyond $1.32 versus the US dollar, reaching its highest in over two years. And in a sign sterling may head even higher, options traders are the most bullish on the currency’s prospects over the next month since 2020, as investors continue to reassess the relative interest-rate path of the Fed and BoE.

Although the Bank of England (BoE) has already cut interest rates this year, from 5.25% to 5.00%, there’s a growing feeling the Fed will move a lot quicker on rate cuts than the BoE going forward. Indeed, markets are pricing in around five basis points of easing from the BoE next month versus about 30 basis points for the Fed. Markets also see fewer than 40 basis points for the rest of the year by the BoE, which is less than half the 100 basis points priced in for the Fed. In line with this pricing, options traders have turned even more bullish on the pound. One-month risk reversals, a period which covers the Fed and BoE decisions next month, show the biggest spread in the pound’s favour since the start of the pandemic.

BoE Governor Andrew Bailey warned markets that policy will need to remain restrictive for sufficiently long and that the easing cycle will therefore be a steady one. His comments keep a wedge between US and UK rates for now, which should continue supporting sterling, all else being equal.

Euro’s rally may have run its course

Ruta Prieskienyte – Lead FX Strategist

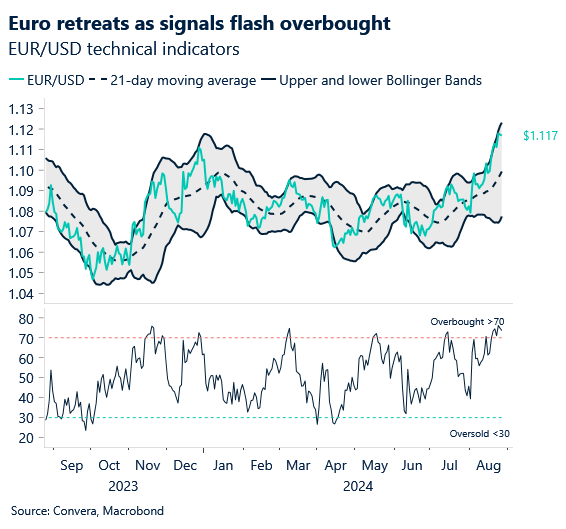

Tuesday was largely uneventful across European markets amid thin trading volumes. Equity markets closed the day mostly unchanged, and bond yields showed little variation. The broader Euro index ended firmly in the red amid increasing signs of weakening domestic fundamentals, while EUR/USD edged down to $1.116 as month-end flows began to dominate the foreign exchange landscape. The euro’s recent rally above $1.12 may have already peaked, with technical indicators suggesting a potential pullback is underway.

Investors are becoming more cautious ahead of the Eurozone’s August inflation data, due this Friday, which could have significant implications for the ECB’s monetary policy. Inflation in Germany and the wider Eurozone is expected to drop to its lowest level in over three years. Despite ECB officials signalling a cautious approach to rate cuts, markets are still pricing in around 65 basis points of cuts by the end of the year.

Meanwhile, EUR/CHF plunged nearly 0.5% on the day, hitting a near three-week low amid safe-haven outflows. Political tensions in France also resurfaced as President Macron faced challenges in forming a new government. After four days of talks with party leaders, Macron ruled out forming a government led by the left-wing Nouveau Front Populaire (NFP) alliance, citing the need for “institutional stability.” If a new government isn’t formed, a budget led by caretaker PM Gabriel Attal could result in €10 billion in cuts, which falls short of Brussels’ expectations. This uncertainty widened the OAT-Bund 10-year spread to 73bps, up 2bps from the previous day, further weighing on the euro.

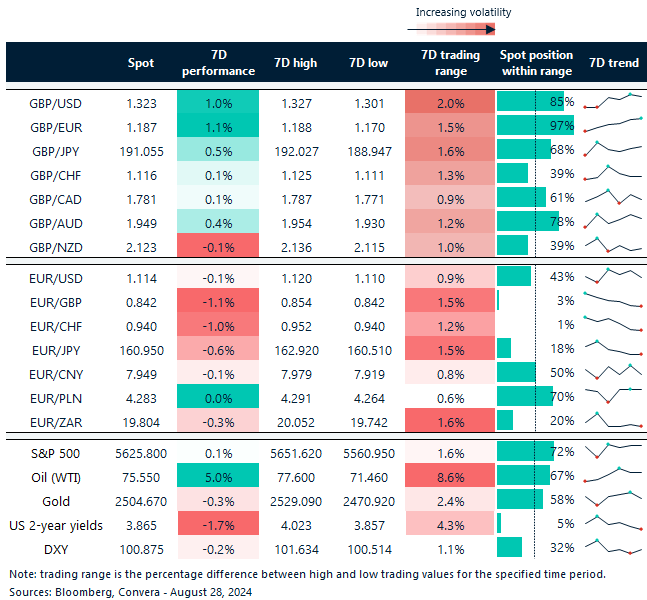

GBP/EUR up 1%, nearing €1.19

Table: 7-day currency trends and trading ranges

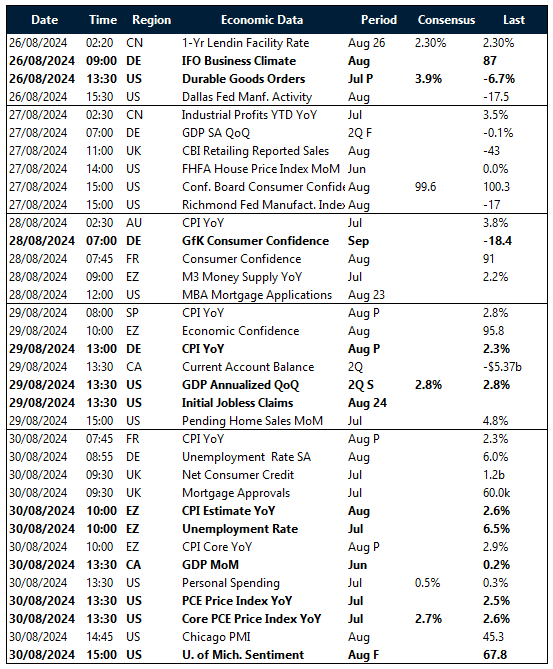

Key global risk events

Calendar: August 26-30

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.