Written by Convera’s Market Insights team

Stocks jump, oil slumps

George Vessey – Lead FX Strategist

US stocks jumped to a fresh peak, with the S&P500 notching its 46th record close of the year, fuelled by a rally in the tech sector as investors look to earnings for vindication of their bets that the US will avoid a recession. The US dollar index continues to press higher, clocking its longest daily winning streak since 2012.

As we’ve seen this month, a measure of underlying US inflation in September came in hotter than expected, while the most recent snapshot of the US labour market showed a drop in unemployment amid solid hiring. This has prompted investors to pull back bets the Fed will again cut its benchmark interest-rate by an outsize 50bps at its upcoming meeting in November. Thus, relative growth and yield differentials remain bullish drivers of the dollar, as does safe haven demand, amidst multiple geopolitical risks. However, Israeli Prime Minister Benjamin Netanyahu agreed to limit retaliation against Iran to military targets, which has triggered a 4% drop in oil prices overnight. Extended declines in oil prices in the short term appear likely amid signs of easing geopolitical risks combined with lingering doubts around the effect of China’s stimulus.

This could cool dollar demand. We are expecting a period of consolidation or a pullback in the dollar index, despite the plethora of bullish drivers, mainly due to it being overbought via the Relative Strength Index on the daily chart, but also because of the lack of fresh positive catalysts.

Pound still soft after mixed jobs data

George Vessey – Lead FX Strategist

The British pound remains on the soft side after a mixed set of data on the UK labour market. The unemployment rate fell to 4% as expected, marking the lowest level since the three months ending in January. Average weekly earnings including bonuses were up 3.8% y/y as expected, but marked a fresh low since November 2020.

The other key takeaways from the jobs report saw payrolled employees decreased slightly by 15,000, more than the 3,000 forecast, but rose by 113,000 y/y. Economic inactivity dropped to 21.8%, whilst vacancies continued to decline for the 27th consecutive quarter, now at 841,000. The vacancies to unemployment ratio remains around one standard deviation higher than the 2000-2019 average. The bottom line is that a cooling UK labour market is bringing down wage growth, which will please Bank of England (BoE) policymakers. The BoE is keeping a close watch on these indicators as it seeks to gauge how far inflationary pressures in the economy are easing and therefore how fast to cut interest rates. Traders are more likely to wait for tomorrow’s CPI data though in assessing whether the BoE delivers a quarter-point interest-rate cut in November.

As such, pricing of BoE rate expectations barely moved after today’s jobs data. UK gilt yields are slightly higher, but GBP/USD remains in the middle of its $1.30-$1.31 range its been stuck within for most of October. GBP/EUR is moving closer to €1.20 though as a result of EUR/USD dropping below $1.10.

Euro trending below $1.09

Boris Kovacevic – Global Macro Strategist

The euro continued to build on its losses from last week and fell to a fresh two-month low at $1.0880. The negative momentum remains the driving force behind the move as investors await crucial US data and the rate decision from the European Central Bank (ECB) later this week for new impetus.

With a depreciation of around 2.2%, October is shaping up to be the worst month for EUR/USD year-to-date. This would be in line with both seasonality trends and previous US election cycles as the euro falls going into Q4 and the election. Former president Donald Trump’s rise in betting markets has been beneficial for the US dollar and stocks of companies that would benefit from a red sweep.

This repricing could continue to pressure pro-risk currencies and EM FX. The results of the ECB’s lending survey and Eurozone industrial production coming up later today could become new catalysts for confirming the weakness in the euro or stopping its fall for now.

GBP/CAD up 1% on oil price drop

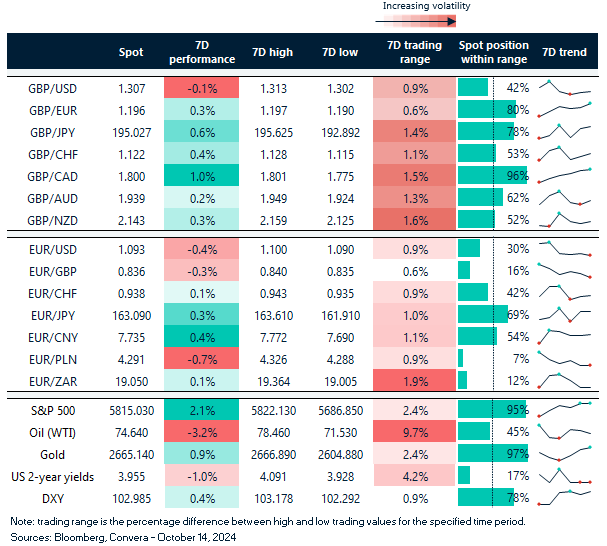

Table: 7-day currency trends and trading ranges

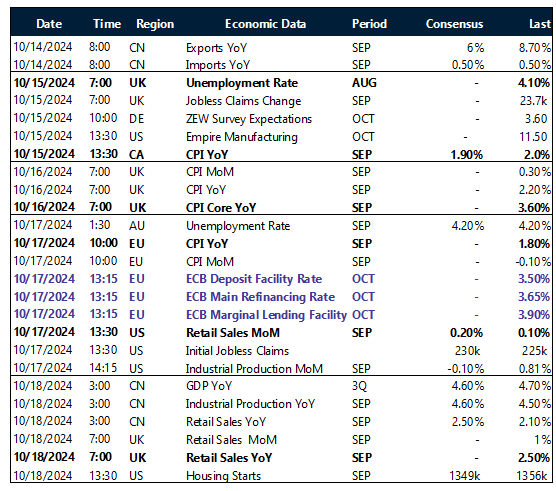

Key global risk events

Calendar: October 14-18

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.