US jobs report in focus

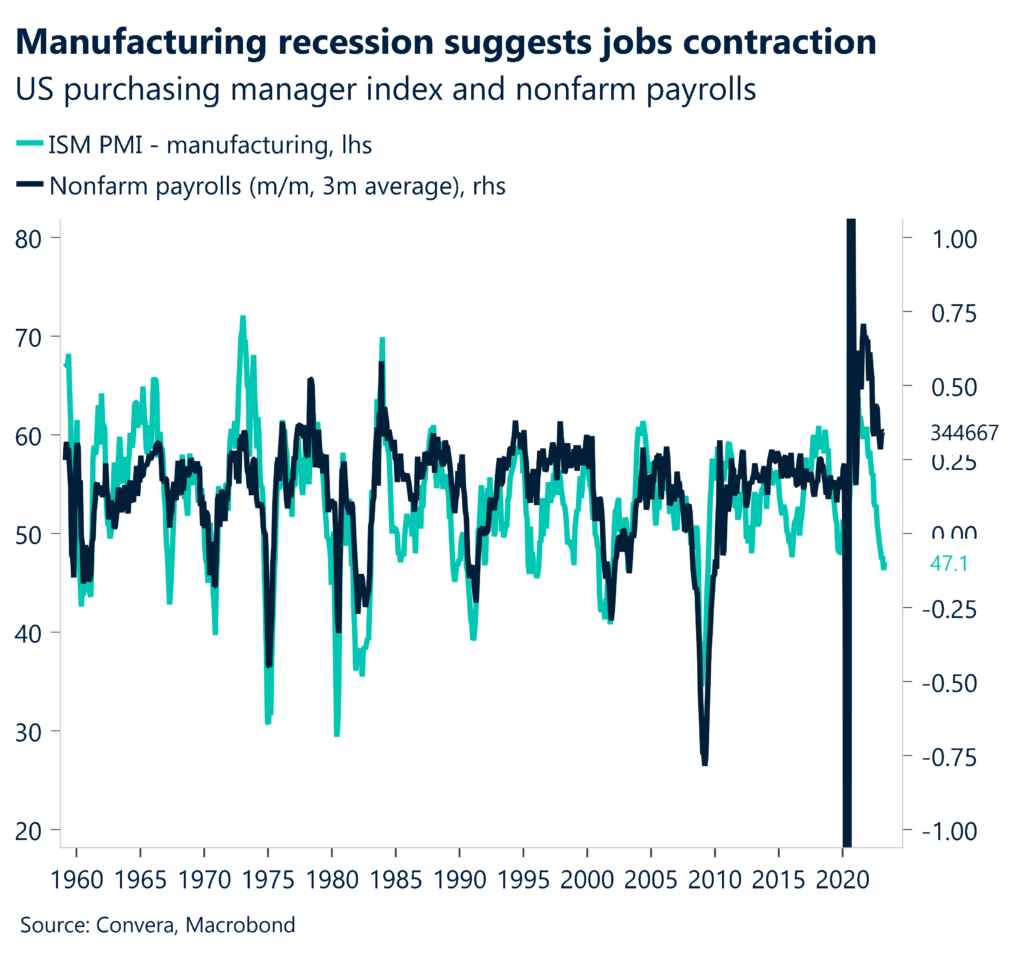

The US dollar continues to slide against its peers as investors weigh the prospect of the Federal Reserve (Fed) reversing its policy-tightening campaign this year amid growing recession risks and US banking turmoil. The US jobs report is in focus today after data yesterday showed applications for US unemployment benefits rose by the most in six weeks and the employment cost index, a broad gauge of wages and benefits, picked up in the first quarter.

Monetary policy divergence remains intact as the Fed signalled its rate hike this week could be the last of its cycle, whilst money markets believe a pivot is more likely before year-end. However, the Fed remains data-dependent, meaning US data will largely govern whether this narrative of policy divergence between the dovish Fed and hawkish ECB and BoE becomes an even sturdier catalyst for both EUR/USD and GBP/USD to continue rising. A stronger-than-expected jobs report today could reduce rate-cutting bets and help the dollar retrace some lost ground, but any signs of a softening labour market could be seen as validating the Fed’s recent decision. Markets are convinced of a pivot though, and this is reflected by 74% of US yield curves being inverted, with the gap between the 3-month and 10-year yield at its highest in 30 years. Will a robust US jobs report today damage this assumption?

Further complicating the situation is the deepening rout in US regional bank shares after the collapse of a third major regional bank over the weekend keeps investors on tenterhooks. This has boosted safe haven demand for US bonds, sending benchmark 10-year yields and 2-year yields lower, hurting the dollar, whilst the Japanese yen looks poised to snap a 3-week losing streak against the US currency.

ECB hikes, German new orders plunge

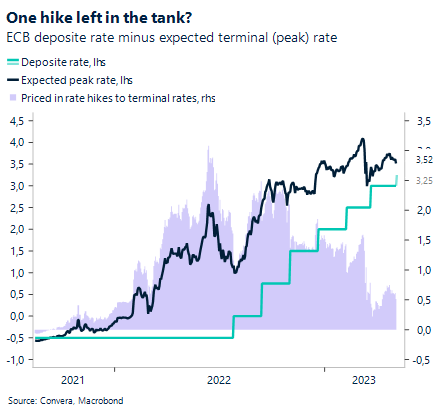

The European Central Bank (ECB) raised its benchmark interest rate by 25 basis points to 3.25% yesterday, meeting market and economists’ expectations. The fastest tightening cycle in the ECB’s history does not seem to be over, as Christine Lagarde has signaled room for one more hike to come.

With unemployment at all-time lows and core inflation rates at record highs, policymakers had little choice but to raise the deposit rate to a fresh 14-year high. The ECB did mention the latest loan officer survey, which suggested that firms demand for credit recorded a sharp drop in the first quarter of 2023. Higher policy rates are being transmitted forcefully to financing and monetary conditions, as mentioned by president Lagarde. This development will most likely be the reason for the ECB to pause and potentially end its tightening cycle after the next policy meeting. At the same time, German factory orders slumped 10.7% amidst a 47.4% contraction in orders for miscellaneous vehicle construction, which include construction of ships. We are now waiting for the release of industrial production to conclude data for Q1, which will give us an answer as to whether Germany grew or contracted during the first three months of the year.

The euro has been largely unaffected by yesterday’s rate decision and is moving incrementally higher on a weekly basis. While EUR/USD is on track to rise the ninth out of the last ten weeks, the total appreciation only sums up to 4.6%. With the Fed officially pausing its tightening cycle and the ECB close to ending rate hikes, the real divergence between the two central banks will mostly come from the pace of their respective rate cuts.

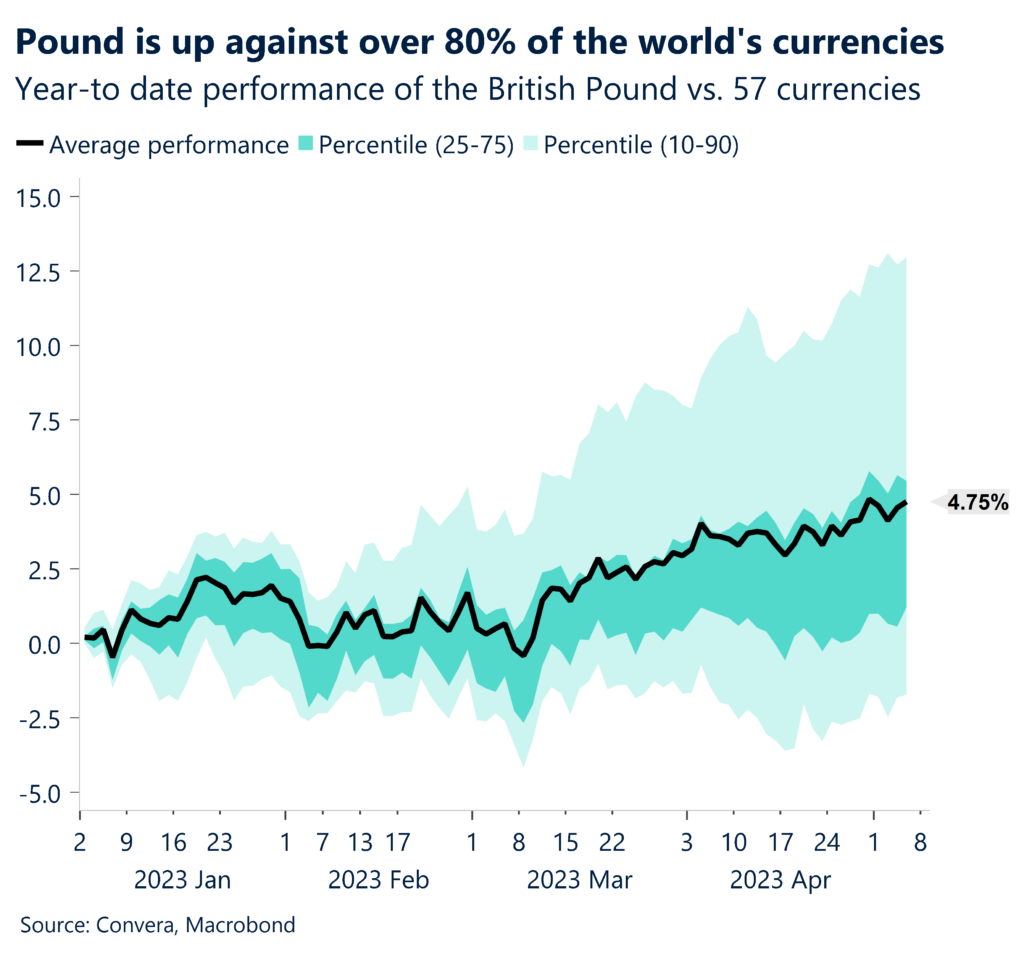

Pound stands tall ahead of BoE

The British pound is up against 80% of the world’s currencies and has, on average, risen by 4.75% this year. GBP/USD has breached the $1.26 mark for the first time since June 2022, whilst GBP/EUR is stretching towards its 200-day moving average at €1.1453. Britain’s economy is showing signs of unexpected resilience, bolstered by a batch of data published yesterday increasing the probability of more BoE rate hikes this year.

Data yesterday showed an upward revision to the closely watched UK composite PMI from 53.9 to 54.9 in April. Growth was solely driven by a resilient services sector growing at its fastest pace in a year, offsetting the ninth consecutive contraction for the manufacturing sector. Moreover, mortgage approvals bounced back to a 5-month high as the housing market continues to surprise to the upside. Consumer credit growth came in above forecasts too and separate figures on inflation expectations also indicated firms expect an even sharper rise in their own prices over the next year. All these hawkish surprises put additional pressure on the BoE to raise rates, with markets pricing a 50% probability of the Bank Rate reaching 5% by August.

Sterling is defying its seasonally weaker historical performance in May, but will the BoE scupper the pound’s gains next week? For now, positive momentum favours sterling and GBP/USD could look to target its 100-week moving average at $1.2725 in the short term, whilst GBP/EUR will need to close above €1.1453 to gain more traction.

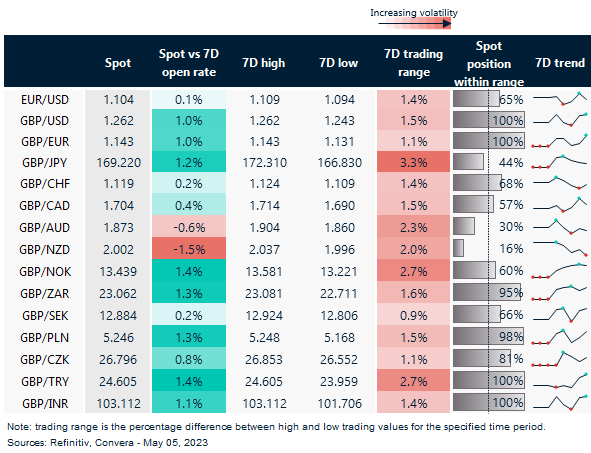

Pound over 1% higher vs. most peers since last week

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: May 1-5

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.