After an upbeat UK GDP surprise raised hopes that the UK economy may avoid a protracted recession this year, supporting the British pound, attention turns to labour market data early tomorrow and the UK Budget on Wednesday. Meanwhile, over the weekend, UK PM Rishi Sunak insisted there is no contagion risk to UK banks after the collapse of Silicon Valley Bank (SVB), which has led bond yields to fall globally.

One of the main stories dominating financial markets is the sudden collapse of SVB late last week, which has led investors to speculate that central banks might be less inclined to keep raising interest rates aggressively, which has weighed heavily on the US dollar over the past few days. UK Chancellor Jeremy Hunt’s budget preparations have thus been upended by the rush to limit the damage from the SVB turmoil as the government and Bank of England facilitate HSBC’s acquisition of the UK arm of SVB. However, Mr Hunt also looks set to keep his grip on UK public finances, refraining from big tax cuts or spending increases for now, resisting giveaways that could destabilise sterling, stocks or gilts as was seen in the mini-budget of September last year.

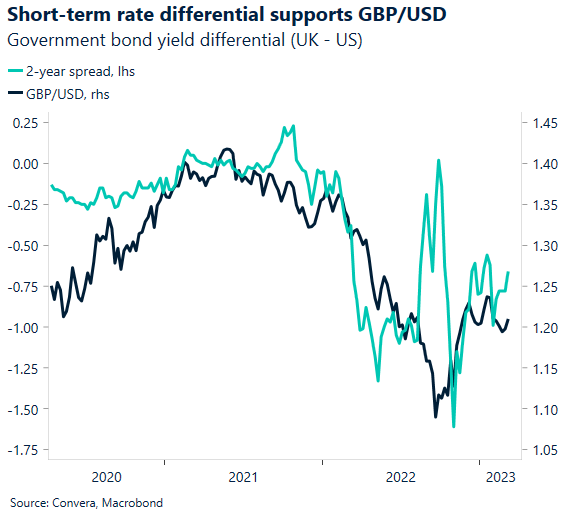

Sterling’s strong end to last week allowed GBP/USD to close above the key $1.20 mark, reducing fears of an extended decline when the currency pair pierced through some key moving averages, which had been offering decent support over the past few weeks. GBP/USD now trades back above $1.21 – 2.6% higher than last week’s low of $1.18.

Dollar drops after jobs report, inflation eyed

The US dollar weakened on Friday after the US labour market report for February was published because the probability of a 50-basis point rate hike by the US Federal Reserve (Fed) dropped backed below 50%. Will a strong US inflation report this week boost expectations for a larger hike once again and strengthen the dollar once more?

Although the US unexpectedly added more than 300,000 jobs in February – well above market forecasts again, slower wage growth and a rise in the unemployment rate prompted financial markets to dial back expectations for a 50-basis point Fed rate hike this month, which reduced the appeal for the US dollar. GBP/USD jumped over 1% last Friday to close the week back above the key $1.20 handle whilst EUR/USD reclaimed $1.07. Attention now turns to Tuesday’s US inflation report, which will be crucial for market participants and policymakers as this will likely dictate the future path for interest rates. The annual inflation rate is seen easing to 6% from 6.4%, while the monthly rate is forecast at 0.4%, down from 0.5%. Also, core consumer prices are forecast to have risen 0.4% over the previous month, resulting in the annual rate easing to 5.5% from 5.6%.US retail sales data will also be released on Wednesday, with forecasts suggesting tighter financial conditions dragged on consumer spending. Other important releases are the preliminary reading for the University of Michigan’s consumer sentiment, industrial production and housing data.

The US dollar has extended its Friday fall this morning after the US government announced several measures to support SVB customers and further fuelling bets of less aggressive US rate hikes in the future. The two-year US Treasury yield, which typically moves in step with interest rate expectations, has suffered its biggest three-day decline since Black Monday in 1987.

ECB hike plus updated projections

The European Central Bank (ECB) will likely hike by 50 basis points on Thursday, so given high market expectations of this, a hike of any other size, larger or smaller, could trigger increased EUR volatility. The more heated debate though will be about the path for monetary policy beyond the March meeting.

The flow of Eurozone data releases has become more mixed lately after a run of positive surprises at the start of the year, mainly in confidence indicators. However, hard economic data like retail sales and GDP figures are anything but rosy. Indeed, because of the poor hard data, EUR/USD’s positive correlation with improving soft data like the ZEW surveys has recently decoupled. Perhaps more importantly from a data perspective is the clear upside surprises in Europe’s February inflation data though, which nearly guarantees further ECB rate hikes beyond this week. Core inflation data, especially in the services sector, has proven sticky and added to this higher nominal wage growth this year and it is easy to understand the ECB’s concern about stubbornly high core inflation. However, the new economic projections by the ECB are expected to show lower inflation in 2024 and 2025, especially since the rapid fall in energy prices and the recovery of the euro since the last projections were published in December.

Markets are currently pricing in 50 basis point hikes in March and May almost fully and a peak ECB rate of around 4.15%, but the tensions in the banking sector could get in the way of an interest rate of over 4%. The ECB may struggle to sound more hawkish than how markets are currently positioned, meaning the risks to the euro are tilted to a somewhat dovish market reaction. EUR/USD could slip back towards $1.05 and GBP/EUR could climb towards €1.14 if this is the case.

CAD over 1% higher versus USD in a week

Table: 7-day currency trends and trading ranges

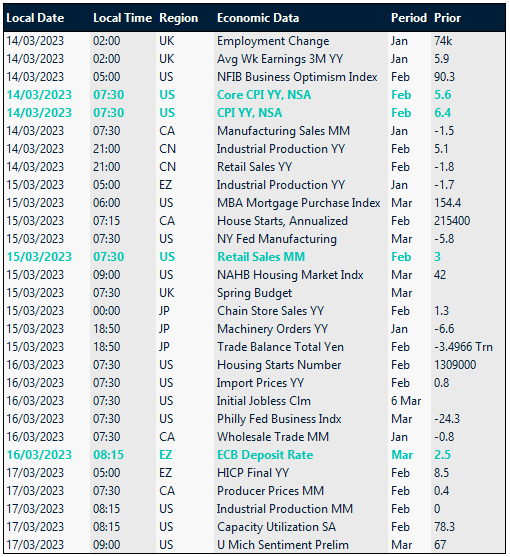

Key global risk events

Calendar: Mar 13 -Mar 17

Have a question? [email protected]